Press release

Payment Processing Solutions Market Set for Strong Growth to USD 209.61 Billion by 2032, Led by North America's Over 35% Global Market Share | DataM Intelligence

The Global Payment Processing Solutions Market is valued at approximately USD 92.62 billion in 2025 and is projected to reach USD 209.61 billion by 2032, growing at a robust CAGR of 11.9% during the forecast period 2025-2032.Market growth is driven by the rapid expansion of digital payments, increasing adoption of e-commerce and mobile wallets, and rising demand for secure, real-time transaction processing. Additionally, growth in contactless payments, fintech innovations, and the integration of AI and fraud detection technologies are further accelerating market expansion.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/payment-processing-solutions-market?ram

United States: Key Industry Developments

✅ October 2025: BHMI was named by Banking CIO Outlook as the Top Electronic Payment Transaction Solution for 2025, highlighting its unified software for managing debit, credit, ATM, POS, mobile, P2P, and real-time payments in a scalable system.

✅ September 2025: Reports detailed the regional size and structure of the payment processing market, emphasizing growth in U.S. digital transactions and the need for advanced solutions amid evolving consumer behaviors.

✅ August 2025: Top payments stories featured Klarna's $26bn BNPL loans sale to Nelnet for U.S. expansion, alongside SoftBank's prep for PayPay's U.S. listing to boost payment app capabilities.

Asia Pacific / Japan: Key Industry Developments

✅ October 2025: Link Processing expanded its "Anywhere" platform in Japan, integrating credit cards, electronic money, code payments, and direct debits for versatile cashless solutions across business formats.

✅ September 2025: Japan's Payment Services Act amendment was approved, easing fintech regulations to spur innovation in payment processing while enhancing fraud prevention and stablecoin adoption.

✅ August 2025: Nuvei launched direct acquiring in Japan via Paywiser acquisition, enabling major card schemes and alternative payment methods to support eCommerce scaling for local and global businesses.

Key Merges and Acquisitions(2025):

✅ Leading firms in the payment processing solutions market pursued major consolidations through high-value acquisitions, enhancing merchant services and global transaction capabilities.

✅ Companies expanded into specialized verticals like e-commerce and B2B payments via strategic asset swaps and issuer solutions divestitures, streamlining operations for focused growth.

✅ Providers integrated HR, payroll, and payment platforms through multibillion-dollar deals, while targeting European and Asian markets with complementary technology acquisitions.

Market Segmentation Analysis:

-By Payment Method: Credit Card Leads with Dominant Share

Credit Card holds 47% market share as of 2025 projections, favored for universal acceptance in stores, online, and apps due to familiarity and rewards.

Debit Card follows at around 25%, enabling direct account debits for everyday transactions with lower fraud risks.

E-wallet captures 20%, surging via mobile convenience like Apple Pay, while Others (e.g., ACH) take 8% for niche transfers.

-By Verticals: BFSI Commands Largest Portion

Retail leads with 28% share, powered by high-volume e-commerce and POS integrations for seamless checkouts.

BFSI secures 25%, driven by secure transaction needs in banking amid regulatory compliance.

Hospitality holds 15% for contactless bookings, Utilities & Telecommunication 12% for bill payments, Maritime 5% for logistics fees, and Others 15% across media and healthcare.

Purchase this report before year-end and unlock an exclusive 30% discount: https://www.datamintelligence.com/buy-now-page?report=payment-processing-solutions-market?ram (Purchase 2 or more Reports and get 50% Discount)

Why is the Payment Processing Solutions Market Growing?

The rapid expansion of the Payment Processing Solutions market in 2025 is fueled by several critical factors:

-Booming E-commerce and Digital Payments: The surge in online shopping and consumer preference for mobile wallets, contactless payments, and instant transfers is accelerating demand for scalable processing platforms.

-Rise of Omnichannel and Real-Time Systems: Businesses seek seamless integration across online, in-store, and mobile channels, with real-time payment infrastructures enabling faster transactions and global cashless economies.

-AI-Driven Fraud Prevention and Innovations: Advancements in AI, machine learning, blockchain, and Buy Now Pay Later (BNPL) options enhance security, support recurring billing, and handle complex cross-border transactions.

-Regional Digital Adoption: Strong growth in Asia-Pacific, driven by rising internet penetration, favorable regulations in markets like India, and increased bank account holders, boosts infrastructure investments.

Regional Insights:

-North America leads the Payment Processing Solutions Market with the highest regional share, exceeding 35% in 2024 and maintaining dominance into 2025 due to advanced digital infrastructure, high credit card penetration, and rapid adoption of online payments in the U.S. and Canada.

-Asia Pacific follows as the second-largest market, capturing around 28.6% share in 2025, driven by rapid urbanization, surging internet penetration, and explosive growth in mobile wallets and digital payments in countries like China and India.

-Europe ranks third with approximately 20.2% market share in 2025, fueled by diverse payment preferences, stringent regulations, and ongoing technological innovations across the region.

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/payment-processing-solutions-market?ram

Key Players:

ShipMoney | PayPal | Stripe | Adyen | Wirecard | PayU | CCBill | First Data | OceanPay | Equian | MarTrust Corporation Ltd. | TridentTrust | Sea Alliance Ltd. | Wilhelmsen | Riga Accounting Hub | BachmannHR Group

Key Highlights (Top 5 Key Players) for Payment Processing Solutions Market:

-PayPal provides comprehensive digital payment solutions, enabling online merchants, consumers, and businesses to send, receive, and manage payments globally through its integrated platform and mobile app.

-Stripe offers developer-friendly APIs for seamless payment processing, supporting e-commerce, subscriptions, and marketplaces with tools for fraud prevention and international payouts.

-Adyen delivers an end-to-end payment platform for enterprises, unifying online, in-store, and mobile transactions while optimizing for omnichannel commerce and revenue recovery.

-PayU specializes in emerging market payment gateways, processing high-volume transactions for e-commerce platforms with local payment methods, installment plans, and risk management services.

-First Data (now part of Fiserv) handles merchant acquiring and processing for card-based payments, powering retail POS systems, online gateways, and enterprise-scale transaction routing worldwide.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription?ram

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payment Processing Solutions Market Set for Strong Growth to USD 209.61 Billion by 2032, Led by North America's Over 35% Global Market Share | DataM Intelligence here

News-ID: 4333368 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

United States Plant-Based Protein Supplements Market Growth 2032 | Growth Driver …

Market Size and Growth

Plant-Based Protein Supplements Market size reached US$ 3.61 billion in 2024 and is expected to reach US$ 6.79 billion by 2032, growing with a CAGR of 8.21% during the forecast period 2024-2032

Download Free Sample PDF Report (Get Higher Priority for Corporate Email ID):- https://datamintelligence.com/download-sample/plant-based-protein-supplements-market?kb

plant-based protein supplements market that's exploding as more people embrace vegan vibes, flexitarian lifestyles, and eco-friendly eats. From pea protein powders to hemp-infused bars

United…

Anaesthesia Vaporizer Market Size, Share, Growth report | North America leads wi …

As per DataM intelligence research report "Anaesthesia Vaporizer Market is anticipated to grow at a CAGR during the forecast period 2024-2031."

The market is growing due to rising surgical procedures and healthcare infrastructure expansion. Vaporizers ensure precise delivery of anesthetic agents during surgeries. Technological advancements and patient safety focus drive demand.

Download your exclusive sample report today: (corporate email gets priority access):

https://www.datamintelligence.com/download-sample/anaesthesia-vaporizer-market?prasad

DataM Intelligence unveils exclusive insights into the Anaesthesia Vaporizer Market…

Flight Simulator Market Poised for Strong Growth to USD 11.6 Billion by 2030, An …

The Global Flight Simulator Market reached USD 6.8 billion in 2022 and is expected to reach USD 11.6 billion by 2030, growing with a CAGR of 7.0% during the forecast period 2024-2031.The flight simulator market is growing due to rising air passenger traffic, increasing demand for trained pilots, expanding commercial and military aircraft fleets, and advancements in virtual reality and simulation technologies that enhance cost-effective, safe, and realistic pilot training…

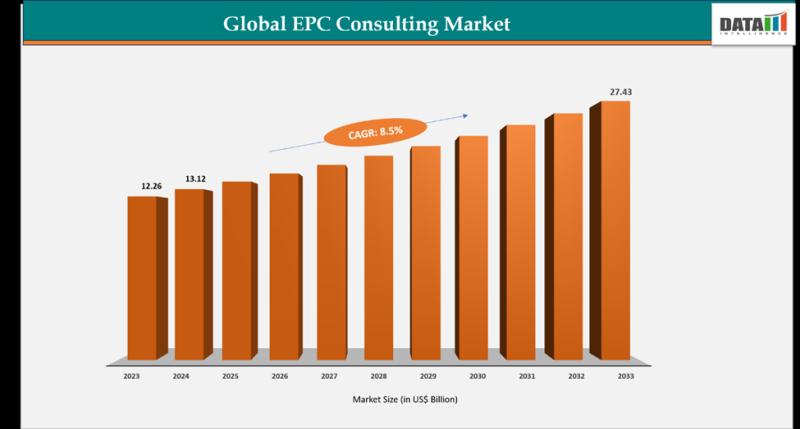

EPC Consulting Market to Reach US$ 27.43 Billion by 2033 | North America leads w …

As per DataM intelligence research report "The global EPC consulting market reached US$ 12.26 billion in 2023, with a rise to US$ 13.12 billion in 2024, and is expected to reach US$ 27.43 billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025-2033."

The market is driven by increasing infrastructure and industrial project development globally. EPC consulting ensures efficient project planning, execution, and cost management. Rising investments…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…