Press release

CMOS Image Sensor Market to Reach US$ 53.10 Billion by 2033 at 9.10% CAGR; Asia Pacific and North America Lead Demand - Key Players: Sony, Samsung, STMicroelectronics

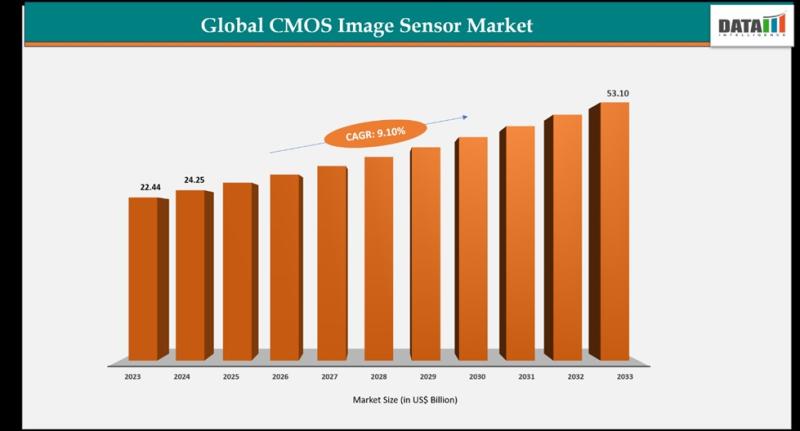

The Global CMOS Image Sensor Market reached US$ 22.44 billion in 2023, increased to US$ 24.25 billion in 2024, and is expected to reach US$ 53.10 billion by 2033, growing at a CAGR of 9.10% during the forecast period 2025-2033. The market is witnessing steady expansion driven by rising demand for high-performance imaging solutions across industrial, defense, automotive, consumer electronics, and scientific research applications.Growth in the CMOS image sensor market is further supported by increasing adoption in defense, offshore energy, oceanographic research, and environmental monitoring, where advanced imaging is critical for navigation, surveillance, and inspection. CMOS image sensors are increasingly integrated into Unmanned Underwater Vehicles (UUVs) and related systems used for naval surveillance, subsea infrastructure inspection, and maritime security. Technological advancements in sensor miniaturization, low-light performance, AI-enabled image processing, and energy-efficient designs-along with rising investments in maritime robotics and strategic defense collaborations-are reshaping industry dynamics and supporting long-term market growth.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/cmos-image-sensor-market?sai-v

The CMOS Image Sensor Market encompasses the global development, manufacturing, and adoption of complementary metal-oxide-semiconductor (CMOS) image sensors used to capture visual information across consumer electronics, automotive, industrial, medical, and security applications.

Key Developments

✅ December 2025: Major semiconductor manufacturers unveiled next-generation CMOS image sensors featuring enhanced low-light performance, higher dynamic range, and AI-optimized on-chip processing for advanced imaging applications.

✅ October 2025: Automotive OEMs accelerated adoption of advanced CMOS image sensors for autonomous driving systems, surround-view cameras, and enhanced driver-assistance features in new vehicle models.

✅ September 2025: Smartphone makers incorporated high-resolution, multi-spectral CMOS sensors with improved computational photography capabilities into flagship and mid-range devices.

✅ July 2025: Industrial automation and robotics sectors increased integration of CMOS image sensors for machine vision systems used in quality inspection, safety monitoring, and process control.

✅ May 2025: Healthcare imaging equipment manufacturers expanded use of CMOS sensors in digital X-ray detectors, endoscopes, and surgical imaging systems for better image clarity and faster capture speeds.

✅ March 2025: Startups and research groups showcased prototype CMOS sensors with novel materials (e.g., stacked sensors, organic photodiodes) aimed at next-generation imaging performance.

Mergers & Acquisitions

✅ November 2025: A global semiconductor leader acquired a specialized CMOS image sensor design firm to strengthen its portfolio in automotive and industrial imaging solutions.

✅ August 2025: A technology conglomerate partnered with an AI vision startup to integrate advanced machine learning features directly into CMOS sensor chips for edge processing.

✅ June 2025: A contract semiconductor manufacturer acquired imaging IP assets to expand its CMOS image sensor design and production capabilities.

Key Players

Sony Semiconductor Solutions Corporation | ams-OSRAM AG | STMicroelectronics | Samsung | Tokyo Electron Limited | OMNIVISION | Semiconductor Components Industries, LLC | Canon U.S.A., Inc. | Panasonic Corporation of North America | Hamamatsu Photonics K.K. | Others

Key Highlights

Sony Semiconductor Solutions Corporation - Holds a 41.2% share, driven by its global leadership in CMOS image sensor technology, superior low-light performance, stacked sensor innovation, and dominant adoption across smartphones, automotive, and industrial imaging.

Samsung - Holds a 18.6% share, supported by advanced semiconductor manufacturing capabilities, aggressive innovation in high-resolution sensors, and strong integration with consumer electronics ecosystems.

STMicroelectronics - Holds a 9.8% share, leveraging its strength in automotive-grade CMOS sensors, ADAS applications, and growing demand for industrial and machine vision solutions.

OMNIVISION - Holds a 8.7% share, recognized for cost-effective CMOS sensors, strong presence in mobile, IoT, and security camera applications, and wide OEM adoption.

ams-OSRAM AG - Holds a 6.9% share, benefiting from expertise in optical sensing, 3D sensing technologies, and integration of emitters and sensors for advanced imaging applications.

Semiconductor Components Industries, LLC (onsemi) - Holds a 5.8% share, driven by its focus on automotive and industrial CMOS sensors, power-efficient designs, and long-term supply agreements.

Canon U.S.A., Inc. - Holds a 3.9% share, contributing through high-performance imaging sensors for professional cameras, medical imaging, and industrial inspection systems.

Panasonic Corporation of North America - Holds a 2.7% share, supported by its imaging solutions for industrial, security, and automotive markets with emphasis on reliability and precision.

Hamamatsu Photonics K.K. - Holds a 1.6% share, specializing in high-sensitivity and scientific-grade image sensors for medical, analytical, and research applications.

Tokyo Electron Limited - Holds a 0.8% share, primarily contributing through advanced semiconductor manufacturing equipment and process technologies supporting CMOS sensor fabrication.

Purchase this report before year-end and unlock an exclusive 30% discount: https://www.datamintelligence.com/buy-now-page?report=cmos-image-sensor-market?sai-v

(Purchase 2 or more Reports and get 50% Discount)

Market Drivers

- Rising demand for high-resolution and low-power imaging solutions across consumer electronics such as smartphones, tablets, and laptops.

- Growing adoption of advanced driver assistance systems (ADAS), autonomous vehicles, and in-vehicle camera systems requiring sophisticated imaging capabilities.

- Expansion of security and surveillance infrastructure driving installation of CMOS image sensors in CCTV, smart cameras, and monitoring systems.

- Increasing use of CMOS sensors in medical imaging equipment, industrial inspection, robotics, and machine vision applications.

- Technological advancements in pixel architecture, enhanced dynamic range, back-side illumination (BSI), and stacked sensor designs improving image quality and performance.

- Rising demand for compact, cost-effective imaging solutions in IoT, AR/VR, drones, and wearable devices.

- Integration of artificial intelligence (AI) and on-sensor processing to enable smarter imaging, edge analytics, and real-time object detection.

- Growing investments by key manufacturers in R&D to develop next-generation sensor technologies with enhanced sensitivity and low light performance.

Industry Developments

- Launch of next-generation CMOS image sensors featuring higher pixel counts, improved noise reduction, and advanced color accuracy.

- Development of stacked and back-side illuminated (BSI) sensors that offer enhanced light sensitivity and better performance in low light conditions.

- Strategic collaborations between imaging technology companies and consumer electronics OEMs to integrate custom sensor solutions.

- Expansion of CMOS image sensor applications into automotive LiDAR, time-of-flight (ToF), and 3D sensing markets.

- Increased investments and acquisitions to strengthen product portfolios and expand global manufacturing capacities.

- Integration of AI-enabled on-chip processing and neural processing units to accelerate image analytics and reduce reliance on external processors.

- Partnerships with industrial automation and healthcare technology firms to tailor sensors for machine vision, medical imaging, and diagnostic devices.

- Regulatory approvals and compliance updates related to safety and performance standards in automotive and medical imaging applications.

Regional Insights

North America - 38% share: "Driven by strong presence of key semiconductor and imaging technology companies, high adoption of advanced imaging in consumer electronics and automotive sectors, and robust R&D ecosystem."

Europe - 26% share: "Supported by growing industrial automation demand, increasing use of machine vision systems, strong automotive manufacturing base, and investments in imaging innovations."

Asia Pacific - 28% share: "Fueled by rapid expansion of smartphone manufacturing, rising adoption of CMOS sensors in consumer electronics, surveillance, and automotive applications, and increasing semiconductor production capacity."

Latin America - 5% share: "Boosted by gradual uptake of surveillance technologies, improving industrial infrastructure, and rising demand for advanced imaging solutions."

Middle East & Africa - 3% share: "Driven by expanding investments in technology infrastructure, emerging adoption of digital imaging in security and industrial applications, and increasing focus on technological modernization."

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/cmos-image-sensor-market?sai-v

Key Segments

By Technology

Front-Illuminated (FI-CMOS) sensors hold a significant share, driven by their cost-effectiveness, mature manufacturing processes, and widespread use in entry- and mid-range imaging applications. Backside-Illuminated (BSI-CMOS) sensors are witnessing strong growth due to their superior light sensitivity, improved low-light performance, and increasing adoption in smartphones and advanced imaging devices. Stacked CMOS sensors represent a high-growth segment, supported by advanced architectures that enable faster readout speeds, higher frame rates, enhanced processing capabilities, and improved overall image quality.

By Resolution

Sensors with up to 5 MP account for a substantial share, driven by their extensive use in basic imaging applications such as security cameras and entry-level consumer electronics. The 5 MP to 16 MP segment holds a major portion of the market, supported by widespread adoption in smartphones, automotive cameras, and industrial inspection systems. Sensors with resolutions above 16 MP are experiencing rapid growth, driven by demand for high-definition imaging in premium smartphones, medical imaging, aerospace & defense, and professional photography applications.

By Application

Consumer electronics dominate the market, driven by high demand for smartphones, tablets, and wearable devices incorporating advanced camera systems. Aerospace & defense applications hold a significant share, supported by the need for high-performance imaging in surveillance, navigation, and reconnaissance systems. Automotive applications are growing rapidly, driven by increasing integration of cameras in advanced driver-assistance systems (ADAS) and autonomous vehicles. Industrial applications contribute steadily through use in machine vision, quality inspection, and automation. Healthcare applications are expanding due to growing adoption of CMOS sensors in medical imaging, diagnostics, and endoscopy. Other applications, including security and scientific research, further support overall market growth.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release CMOS Image Sensor Market to Reach US$ 53.10 Billion by 2033 at 9.10% CAGR; Asia Pacific and North America Lead Demand - Key Players: Sony, Samsung, STMicroelectronics here

News-ID: 4333104 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

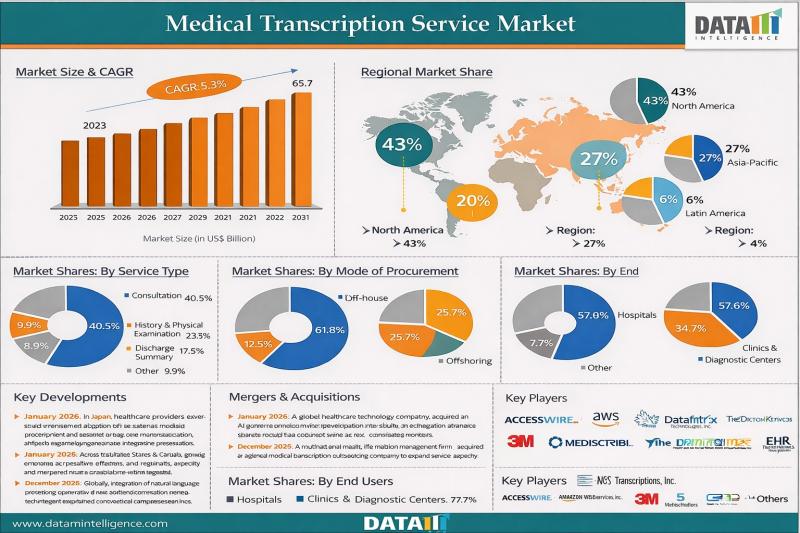

Medical Transcription Service Market to Reach US$ 65.70 Billion by 2031 at 5.3% …

Medical Transcription Service Market reached US$ 43.46 billion in 2023 and is expected to reach US$ 65.70 billion by 2031, growing at a CAGR of 5.3% during the forecast period 2024-2031.

Medical transcription (MT) involves the accurate conversion of diverse healthcare audio recordings into structured written documentation, including clinical reports, consultation notes, discharge summaries, psychiatric evaluations, referrals, interviews, and patient medical histories dictated by healthcare professionals. These transcription outputs form a…

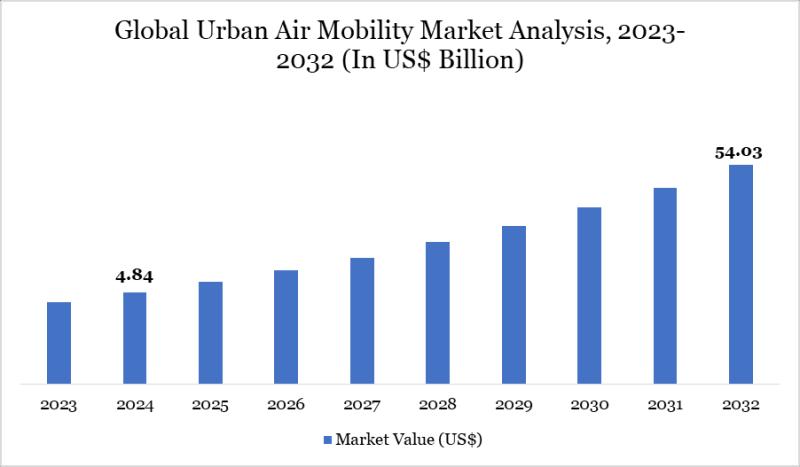

Urban Air Mobility Market Set for Explosive Growth to USD 54.03 Billion by 2032, …

The Global Urban Air Mobility Market reached USD 4.84 billion in 2024 and is expected to reach USD 54.03 billion by 2032, growing with a robust CAGR of 35.20% during the forecast period 2025-2032.

Market growth is driven by rapid urbanization, surging demand for efficient short-distance transportation, and advancements in electric vertical takeoff and landing (eVTOL) aircraft. Supportive government regulations, substantial investments from aerospace giants like Joby Aviation and Lilium, expanding…

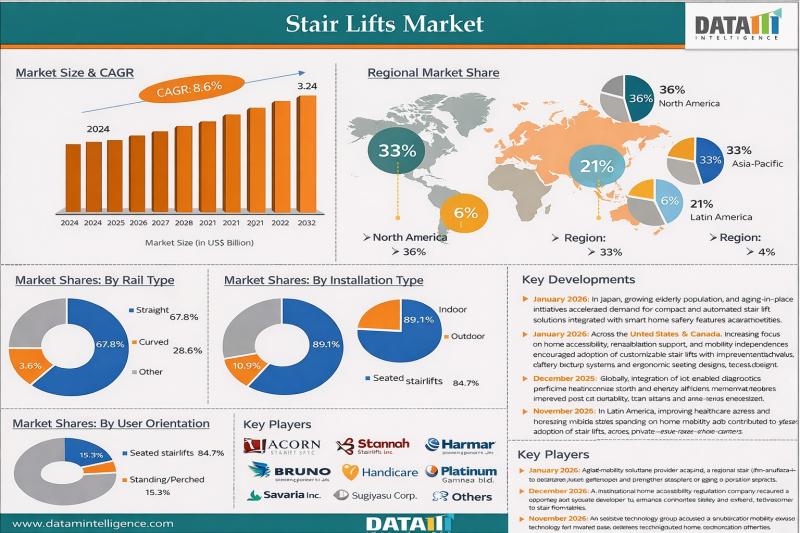

Stair Lifts Market to Reach USD 3.24 Billion by 2032 at 8.6% CAGR | North Americ …

Stair Lifts Market reached USD 1.36 billion in 2024 and is expected to reach USD 3.24 billion by 2032, growing at a CAGR of 8.6% during the forecast period 2025-2032.

The stair lifts market is being driven by the rapidly ageing global population, increasing prevalence of mobility-related disabilities, and a growing preference for ageing-in-place solutions that enhance independence and quality of life for seniors and individuals with physical limitations. Stair lifts…

United States Injection Molding Market Insights 2033 | Growth in Key Industries, …

Injection Molding Market reached US$ 295 billion in 2024 and is expected to reach US$ 451.83 billion by 2033, growing at a CAGR of 5% during the forecast period 2025-2033

Get a Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/injection-molding-market?kb

Injection Molding Market: Trends, Services, and Innovations Shaping the Industry

The Injection Molding Market continues to evolve rapidly, driven by advancements in materials, technologies, and customized manufacturing solutions.…

More Releases for CMOS

Industrial CMOS Image Sensor Market

Industrial CMOS Image Sensor Market Overview

In industrial applications, one of the very important applications of CMOS image sensors is Automatic Optical Inspection (AOI, Automated Optical Inspection). In many applications such as display panel inspection, printed board inspection, etc, manual inspection is no longer competent, only relying on automatic optics.At the same time, new imaging architectures and new software algorithms are improving recognition speed and making the system more cost-effective.

This report…

X-ray CMOS Flat Panel Detector Market

The "X-ray CMOS Flat Panel Detector Market" is expected to reach USD xx.x billion by 2031, indicating a compound annual growth rate (CAGR) of xx.x percent from 2024 to 2031. The market was valued at USD xx.x billion In 2023.

Growing Demand and Growth Potential in the Global X-ray CMOS Flat Panel Detector Market, 2024-2031

Verified Market Research's most recent report, "X-ray CMOS Flat Panel Detector Market: Global Industry Trends, Share, Size,…

How Startups are Scaling Without Hiring CMOs

As investor funding becomes more elusive in today's competitive startup landscape, entrepreneurs are turning to innovative solutions to optimize their budgets and fuel growth. One such approach gaining traction is partnering with specialized marketing agencies like GrowthExpertz, a San Francisco-based remote growth agency that was founded in 2016 by serial growth hacker Andrew Lee Miller after he hacked his third startup exit. According to PayScale the average salary in…

CMOS and sCMOS Image Sensors CMOS and sCMOS Image Sensors

The latest CMOS and sCMOS Image Sensors market study offers an all-inclusive analysis of the major strategies, corporate models, and market shares of the most noticeable players in this market. The study offers a thorough analysis of the key persuading factors, market figures in terms of revenues, segmental data, regional data, and country-wise data.

Request a sample on this latest research report @ https://www.reportsnreports.com/contacts/requestsample.aspx?name=5096977

Top Key Players are covered in this report:…

Global In-vehicle Camera CMOS Market

Global In-vehicle Camera CMOS Market Overview:

The latest report published by QY Research demonstrates that the global In-vehicle Camera CMOS market will showcase a steady CAGR in the coming years. The research report includes a thorough analysis of the market drivers, restraints, threats, and opportunities. It addresses the lucrative investment options for the players in the coming years. Analysts have offered market estimates at a global and a regional level. The research…

Global CMOS Sensor Market Insights, Forecast

The CMOS Sensor market was valued at Million US$ in 2017 and is projected to reach Million US$ by 2025, at a CAGR of during the forecast period. In this study, 2017 has been considered as the base year and 2018 to 2025 as the forecast period to estimate the market size for CMOS Sensor

Get sample copy of the report:

https://www.marketdensity.com/contact?ref=Sample&reportid=49874

Table of Contents:

Table of Contents

1 Study Coverage

1.1…