Press release

IoT eSIM Technology Market to Reach US$ 8.9 Billion by 2031, Accelerating Global IoT Connectivity and Remote Network Management | QY Research

Market Summary -The global market for IoT eSIM Technology was estimated to be worth US$ 5,850 million in 2024 and is forecast to reach a readjusted size of US$ 8,913 million by 2031, expanding at a CAGR of 6.2% during the forecast period 2025-2031.

According to QY Research, the newly released report titled "Global IoT eSIM Technology Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031" provides a comprehensive, data-driven assessment of the global IoT eSIM ecosystem. The report is designed to support strategic planning and investment decisions by delivering validated market data, competitive benchmarking, and forward-looking insights into technology evolution, deployment trends, and regional demand dynamics.

Get Full PDF Sample Copy of the Report (Including Full TOC, Tables & Charts):

https://www.qyresearch.in/request-sample/internet-communication-global-iot-esim-technology-market-share-and-ranking-overall-sales-and-demand-forecast-2025-2031

Technology Overview and Market Context -

IoT eSIM (embedded SIM) technology enables secure, remote provisioning and lifecycle management of mobile network profiles for IoT devices-without the need for physical SIM card replacement. Embedded directly onto device hardware and compliant with GSMA standards, eSIMs allow devices to switch carriers over-the-air (OTA), ensuring seamless connectivity across geographies and network operators.

This capability significantly enhances scalability, operational efficiency, and global deployment flexibility, making IoT eSIMs critical for applications requiring long-term, reliable connectivity. Key use cases include connected vehicles, smart meters, industrial sensors, asset tracking systems, and wearable devices, where remote management and uptime are essential.

Market Drivers and Growth Outlook -

Growth in the IoT eSIM Technology market is driven by the rapid expansion of connected devices, increasing adoption of 5G and LPWAN networks, and the need for simplified global IoT deployments. Enterprises and OEMs are increasingly shifting from traditional SIM cards to eSIM solutions to reduce logistics complexity, enable dynamic carrier selection, and improve device lifecycle management.

Additionally, the rise of connected and autonomous vehicles, large-scale smart metering programs, and Industry 4.0 initiatives is accelerating demand for secure, remotely managed connectivity platforms. As IoT deployments scale across borders, eSIM technology is emerging as a foundational enabler for resilient and future-ready IoT infrastructure.

Regional Market Insights -

The report provides detailed regional and country-level analysis highlighting adoption patterns and growth opportunities:

► North America: Driven by early adoption of connected vehicle technologies, industrial IoT deployments, and advanced telecom infrastructure

► Europe: Supported by strong regulatory frameworks, cross-border IoT use cases, and widespread adoption in automotive and utilities sectors

► Asia-Pacific: The fastest-growing region, fueled by large-scale IoT rollouts, smart city initiatives, and expanding telecom ecosystems across China, Japan, South Korea, and India

Competitive Landscape -

The global IoT eSIM Technology market features a mix of telecom operators, connectivity service providers, and secure element technology vendors, competing on network coverage, platform scalability, security, and service flexibility.

Key companies profiled in the report include:

► AT&T

► NTT

► Verizon

► Telekom

► China Mobile

► China Telecom

► China Unicom

► Thales Group

► Giesecke+Devrient

► Wireless Logic

In 2024, the top five players collectively accounted for approximately % of global revenue, supported by extensive carrier partnerships, secure eSIM platforms, and global service reach.

Market Segmentation Highlights -

By Type

► Hardware

► Software and Services

By Application

► In-vehicle Devices

► Smart Meters

► Wearable Devices

► Others

Each segment is analyzed in terms of revenue contribution, growth rate, and adoption trends, enabling stakeholders to identify high-growth areas and prioritize strategic investments.

Reasons to Procure This Report -

► Access reliable global, regional, and country-level revenue forecasts through 2031

► Understand company market share, ranking, and competitive positioning

► Identify high-growth applications and service models in the IoT connectivity ecosystem

► Evaluate technology trends, standards evolution, and deployment strategies

► Support market entry, partnership, and expansion decisions with credible market intelligence

Key Questions Answered in the Report -

► What is the current and projected size of the global IoT eSIM Technology market?

► Which regions and applications are driving adoption and revenue growth?

► Who are the leading players, and how competitive is the market structure?

► How will eSIM standards and OTA provisioning shape future IoT deployments?

► What opportunities and challenges will define the market through 2031?

Request for Pre-Order / Enquiry:

https://www.qyresearch.in/pre-order-inquiry/internet-communication-global-iot-esim-technology-market-share-and-ranking-overall-sales-and-demand-forecast-2025-2031

Table of Content:

1 Market Overview

1.1 IoT eSIM Technology Product Introduction

1.2 Global IoT eSIM Technology Market Size Forecast (2020-2031)

1.3 IoT eSIM Technology Market Trends & Drivers

1.3.1 IoT eSIM Technology Industry Trends

1.3.2 IoT eSIM Technology Market Drivers & Opportunity

1.3.3 IoT eSIM Technology Market Challenges

1.3.4 IoT eSIM Technology Market Restraints

1.4 Assumptions and Limitations

1.5 Study Objectives

1.6 Years Considered

2 Competitive Analysis by Company

2.1 Global IoT eSIM Technology Players Revenue Ranking (2024)

2.2 Global IoT eSIM Technology Revenue by Company (2020-2025)

2.3 Key Companies IoT eSIM Technology Manufacturing Base Distribution and Headquarters

2.4 Key Companies IoT eSIM Technology Product Offered

2.5 Key Companies Time to Begin Mass Production of IoT eSIM Technology

2.6 IoT eSIM Technology Market Competitive Analysis

2.6.1 IoT eSIM Technology Market Concentration Rate (2020-2025)

2.6.2 Global 5 and 10 Largest Companies by IoT eSIM Technology Revenue in 2024

2.6.3 Global Top Companies by Company Type (Tier 1, Tier 2, and Tier 3) & (based on the Revenue in IoT eSIM Technology as of 2024)

2.7 Mergers & Acquisitions, Expansion

3 Segmentation by Type

3.1 Introduction by Type

3.1.1 Hardware

3.1.2 Software and Services

3.2 Global IoT eSIM Technology Sales Value by Type

3.2.1 Global IoT eSIM Technology Sales Value by Type (2020 VS 2024 VS 2031)

3.2.2 Global IoT eSIM Technology Sales Value, by Type (2020-2031)

3.2.3 Global IoT eSIM Technology Sales Value, by Type (%) (2020-2031)

4 Segmentation by Application

4.1 Introduction by Application

4.1.1 In-vehicle Devices

4.1.2 Smart Meters

4.1.3 Wearable Devices

4.1.4 Others

4.2 Global IoT eSIM Technology Sales Value by Application

4.2.1 Global IoT eSIM Technology Sales Value by Application (2020 VS 2024 VS 2031)

4.2.2 Global IoT eSIM Technology Sales Value, by Application (2020-2031)

4.2.3 Global IoT eSIM Technology Sales Value, by Application (%) (2020-2031)

5 Segmentation by Region

5.1 Global IoT eSIM Technology Sales Value by Region

5.1.1 Global IoT eSIM Technology Sales Value by Region: 2020 VS 2024 VS 2031

5.1.2 Global IoT eSIM Technology Sales Value by Region (2020-2025)

5.1.3 Global IoT eSIM Technology Sales Value by Region (2026-2031)

5.1.4 Global IoT eSIM Technology Sales Value by Region (%), (2020-2031)

5.2 North America

5.2.1 North America IoT eSIM Technology Sales Value, 2020-2031

5.2.2 North America IoT eSIM Technology Sales Value by Country (%), 2024 VS 2031

5.3 Europe

5.3.1 Europe IoT eSIM Technology Sales Value, 2020-2031

5.3.2 Europe IoT eSIM Technology Sales Value by Country (%), 2024 VS 2031

5.4 Asia Pacific

5.4.1 Asia Pacific IoT eSIM Technology Sales Value, 2020-2031

5.4.2 Asia Pacific IoT eSIM Technology Sales Value by Region (%), 2024 VS 2031

5.5 South America

5.5.1 South America IoT eSIM Technology Sales Value, 2020-2031

5.5.2 South America IoT eSIM Technology Sales Value by Country (%), 2024 VS 2031

5.6 Middle East & Africa

5.6.1 Middle East & Africa IoT eSIM Technology Sales Value, 2020-2031

5.6.2 Middle East & Africa IoT eSIM Technology Sales Value by Country (%), 2024 VS 2031

6 Segmentation by Key Countries/Regions

6.1 Key Countries/Regions IoT eSIM Technology Sales Value Growth Trends, 2020 VS 2024 VS 2031

6.2 Key Countries/Regions IoT eSIM Technology Sales Value, 2020-2031

6.3 United States

6.3.1 United States IoT eSIM Technology Sales Value, 2020-2031

6.3.2 United States IoT eSIM Technology Sales Value by Type (%), 2024 VS 2031

6.3.3 United States IoT eSIM Technology Sales Value by Application, 2024 VS 2031

6.4 Europe

6.4.1 Europe IoT eSIM Technology Sales Value, 2020-2031

6.4.2 Europe IoT eSIM Technology Sales Value by Type (%), 2024 VS 2031

6.4.3 Europe IoT eSIM Technology Sales Value by Application, 2024 VS 2031

6.5 China

6.5.1 China IoT eSIM Technology Sales Value, 2020-2031

6.5.2 China IoT eSIM Technology Sales Value by Type (%), 2024 VS 2031

6.5.3 China IoT eSIM Technology Sales Value by Application, 2024 VS 2031

6.6 Japan

6.6.1 Japan IoT eSIM Technology Sales Value, 2020-2031

6.6.2 Japan IoT eSIM Technology Sales Value by Type (%), 2024 VS 2031

6.6.3 Japan IoT eSIM Technology Sales Value by Application, 2024 VS 2031

6.7 South Korea

6.7.1 South Korea IoT eSIM Technology Sales Value, 2020-2031

6.7.2 South Korea IoT eSIM Technology Sales Value by Type (%), 2024 VS 2031

6.7.3 South Korea IoT eSIM Technology Sales Value by Application, 2024 VS 2031

6.8 Southeast Asia

6.8.1 Southeast Asia IoT eSIM Technology Sales Value, 2020-2031

6.8.2 Southeast Asia IoT eSIM Technology Sales Value by Type (%), 2024 VS 2031

6.8.3 Southeast Asia IoT eSIM Technology Sales Value by Application, 2024 VS 2031

6.9 India

6.9.1 India IoT eSIM Technology Sales Value, 2020-2031

6.9.2 India IoT eSIM Technology Sales Value by Type (%), 2024 VS 2031

6.9.3 India IoT eSIM Technology Sales Value by Application, 2024 VS 2031

7 Company Profiles

7.1 AT&T

7.1.1 AT&T Profile

7.1.2 AT&T Main Business

7.1.3 AT&T IoT eSIM Technology Products, Services and Solutions

7.1.4 AT&T IoT eSIM Technology Revenue (US$ Million) & (2020-2025)

7.1.5 AT&T Recent Developments

7.2 NTT

7.2.1 NTT Profile

7.2.2 NTT Main Business

7.2.3 NTT IoT eSIM Technology Products, Services and Solutions

7.2.4 NTT IoT eSIM Technology Revenue (US$ Million) & (2020-2025)

7.2.5 NTT Recent Developments

7.3 Verizon

7.3.1 Verizon Profile

7.3.2 Verizon Main Business

7.3.3 Verizon IoT eSIM Technology Products, Services and Solutions

7.3.4 Verizon IoT eSIM Technology Revenue (US$ Million) & (2020-2025)

7.3.5 Verizon Recent Developments

7.4 Telekom

7.4.1 Telekom Profile

7.4.2 Telekom Main Business

7.4.3 Telekom IoT eSIM Technology Products, Services and Solutions

7.4.4 Telekom IoT eSIM Technology Revenue (US$ Million) & (2020-2025)

7.4.5 Telekom Recent Developments

7.5 China Mobile

7.5.1 China Mobile Profile

7.5.2 China Mobile Main Business

7.5.3 China Mobile IoT eSIM Technology Products, Services and Solutions

7.5.4 China Mobile IoT eSIM Technology Revenue (US$ Million) & (2020-2025)

7.5.5 China Mobile Recent Developments

7.6 China Telecom

7.6.1 China Telecom Profile

7.6.2 China Telecom Main Business

7.6.3 China Telecom IoT eSIM Technology Products, Services and Solutions

7.6.4 China Telecom IoT eSIM Technology Revenue (US$ Million) & (2020-2025)

7.6.5 China Telecom Recent Developments

7.7 China Unicom

7.7.1 China Unicom Profile

7.7.2 China Unicom Main Business

7.7.3 China Unicom IoT eSIM Technology Products, Services and Solutions

7.7.4 China Unicom IoT eSIM Technology Revenue (US$ Million) & (2020-2025)

7.7.5 China Unicom Recent Developments

7.8 Thales Group

7.8.1 Thales Group Profile

7.8.2 Thales Group Main Business

7.8.3 Thales Group IoT eSIM Technology Products, Services and Solutions

7.8.4 Thales Group IoT eSIM Technology Revenue (US$ Million) & (2020-2025)

7.8.5 Thales Group Recent Developments

7.9 Giesecke+Devrient

7.9.1 Giesecke+Devrient Profile

7.9.2 Giesecke+Devrient Main Business

7.9.3 Giesecke+Devrient IoT eSIM Technology Products, Services and Solutions

7.9.4 Giesecke+Devrient IoT eSIM Technology Revenue (US$ Million) & (2020-2025)

7.9.5 Giesecke+Devrient Recent Developments

7.10 Wireless Logic

7.10.1 Wireless Logic Profile

7.10.2 Wireless Logic Main Business

7.10.3 Wireless Logic IoT eSIM Technology Products, Services and Solutions

7.10.4 Wireless Logic IoT eSIM Technology Revenue (US$ Million) & (2020-2025)

7.10.5 Wireless Logic Recent Developments

7.11 Truphone

7.11.1 Truphone Profile

7.11.2 Truphone Main Business

7.11.3 Truphone IoT eSIM Technology Products, Services and Solutions

7.11.4 Truphone IoT eSIM Technology Revenue (US$ Million) & (2020-2025)

7.11.5 Truphone Recent Developments

7.12 Kigen

7.12.1 Kigen Profile

7.12.2 Kigen Main Business

7.12.3 Kigen IoT eSIM Technology Products, Services and Solutions

7.12.4 Kigen IoT eSIM Technology Revenue (US$ Million) & (2020-2025)

7.12.5 Kigen Recent Developments

7.13 Infineon

7.13.1 Infineon Profile

7.13.2 Infineon Main Business

7.13.3 Infineon IoT eSIM Technology Products, Services and Solutions

7.13.4 Infineon IoT eSIM Technology Revenue (US$ Million) & (2020-2025)

7.13.5 Infineon Recent Developments

7.14 Vodafone

7.14.1 Vodafone Profile

7.14.2 Vodafone Main Business

7.14.3 Vodafone IoT eSIM Technology Products, Services and Solutions

7.14.4 Vodafone IoT eSIM Technology Revenue (US$ Million) & (2020-2025)

7.14.5 Vodafone Recent Developments

7.15 KORE Wireless

7.15.1 KORE Wireless Profile

7.15.2 KORE Wireless Main Business

7.15.3 KORE Wireless IoT eSIM Technology Products, Services and Solutions

7.15.4 KORE Wireless IoT eSIM Technology Revenue (US$ Million) & (2020-2025)

7.15.5 KORE Wireless Recent Developments

7.16 1NCE

7.16.1 1NCE Profile

7.16.2 1NCE Main Business

7.16.3 1NCE IoT eSIM Technology Products, Services and Solutions

7.16.4 1NCE IoT eSIM Technology Revenue (US$ Million) & (2020-2025)

7.16.5 1NCE Recent Developments

7.17 BICS

7.17.1 BICS Profile

7.17.2 BICS Main Business

7.17.3 BICS IoT eSIM Technology Products, Services and Solutions

7.17.4 BICS IoT eSIM Technology Revenue (US$ Million) & (2020-2025)

7.17.5 BICS Recent Developments

7.18 Telit Cinterion

7.18.1 Telit Cinterion Profile

7.18.2 Telit Cinterion Main Business

7.18.3 Telit Cinterion IoT eSIM Technology Products, Services and Solutions

7.18.4 Telit Cinterion IoT eSIM Technology Revenue (US$ Million) & (2020-2025)

7.18.5 Telit Cinterion Recent Developments

7.19 Eseye

7.19.1 Eseye Profile

7.19.2 Eseye Main Business

7.19.3 Eseye IoT eSIM Technology Products, Services and Solutions

7.19.4 Eseye IoT eSIM Technology Revenue (US$ Million) & (2020-2025)

7.19.5 Eseye Recent Developments

7.20 SIMCom

7.20.1 SIMCom Profile

7.20.2 SIMCom Main Business

7.20.3 SIMCom IoT eSIM Technology Products, Services and Solutions

7.20.4 SIMCom IoT eSIM Technology Revenue (US$ Million) & (2020-2025)

7.20.5 SIMCom Recent Developments

8 Industry Chain Analysis

8.1 IoT eSIM Technology Industrial Chain

8.2 IoT eSIM Technology Upstream Analysis

8.2.1 Key Raw Materials

8.2.2 Raw Materials Key Suppliers

8.2.3 Manufacturing Cost Structure

8.3 Midstream Analysis

8.4 Downstream Analysis (Customers Analysis)

8.5 Sales Model and Sales Channels

8.5.1 IoT eSIM Technology Sales Model

8.5.2 Sales Channel

8.5.3 IoT eSIM Technology Distributors

9 Research Findings and Conclusion

10 Appendix

10.1 Research Methodology

10.1.1 Methodology/Research Approach

10.1.1.1 Research Programs/Design

10.1.1.2 Market Size Estimation

10.1.1.3 Market Breakdown and Data Triangulation

10.1.2 Data Source

10.1.2.1 Secondary Sources

10.1.2.2 Primary Sources

10.2 Author Details

10.3 Disclaimer

QY Research PVT. LTD.

315 Work Avenue,

Raheja Woods,

6th Floor, Kalyani Nagar,

Yervada, Pune - 411060,

Maharashtra, India

India: (O) +91 866 998 6909

USA: (O) +1 626 295 2442

Email: hitesh@qyresearch.com

Web: www.qyresearch.in

About Us -

QY Research, established in 2007, is a globally recognized market research and consulting firm delivering syndicated and customized research solutions across ICT, automotive, industrial IoT, healthcare, and advanced technology sectors. With over 50,000 clients across more than 80 countries, QY Research combines rigorous research methodologies, deep domain expertise, and actionable insights to support data-driven decision-making and sustainable business growth.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release IoT eSIM Technology Market to Reach US$ 8.9 Billion by 2031, Accelerating Global IoT Connectivity and Remote Network Management | QY Research here

News-ID: 4332620 • Views: …

More Releases from QY Research, Inc.

Global Semiconductor Silicon Wafer Market to Reach US$ 29.08 Billion by 2032, Dr …

Market Summary -

The global Semiconductor Silicon Wafer market was valued at US$ 17,020 million in 2025 and is projected to reach US$ 29,080 million by 2032, growing at a CAGR of 8.1% during the forecast period 2026-2032.

According to QY Research, the newly released report titled "Global Semiconductor Silicon Wafer Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" delivers a comprehensive, data-driven assessment of the global silicon wafer…

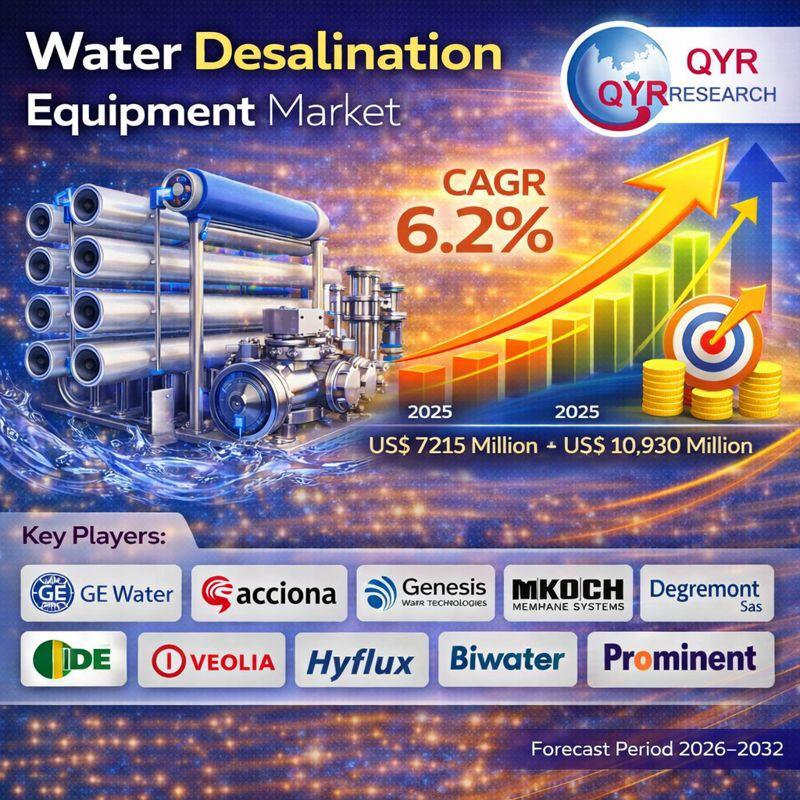

Global Water Desalination Equipment Market to Reach US$ 10.93 Billion by 2032, D …

Market Summary -

The global Water Desalination Equipment market was valued at US$ 7,215 million in 2025 and is projected to reach US$ 10,930 million by 2032, growing at a CAGR of 6.2% during the forecast period 2026-2032.

According to QY Research, the newly published report titled "Global Water Desalination Equipment Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" provides a comprehensive, data-driven evaluation of the global desalination equipment…

Global Syndiotactic Polystyrene Market to Reach US$ 162 Million by 2032, Driven …

Market Summary -

The global Syndiotactic Polystyrene (SPS) market was valued at US$ 111 million in 2025 and is projected to reach US$ 162 million by 2032, expanding at a CAGR of 5.6% during the forecast period 2026-2032.

According to QY Research, the newly released report titled "Global Syndiotactic Polystyrene Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" provides a comprehensive, data-driven assessment of the global SPS market. The…

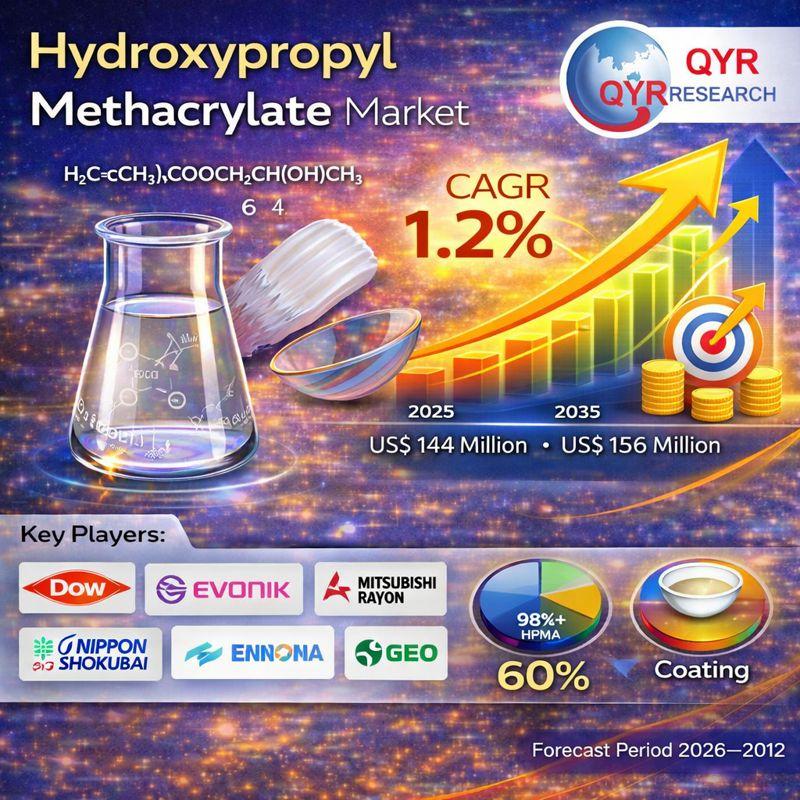

Global Hydroxypropyl Methacrylate Market to Reach US$ 156 Million by 2032, Suppo …

Market Summary -

The global Hydroxypropyl Methacrylate (HPMA) market was valued at US$ 144 million in 2025 and is projected to reach US$ 156 million by 2032, expanding at a CAGR of 1.2% during the forecast period 2026-2032.

According to QY Research, the newly released report titled "Global Hydroxypropyl Methacrylate Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" provides a comprehensive, data-driven evaluation of the global HPMA market.…

More Releases for SIM

TM SIM Registration 2026 - Register Your TM SIM Online

TM SIM registration is mandatory in the Philippines under the SIM Registration Act. If your TM SIM is not registered, it may get deactivated, which means no calls, no texts, and no mobile data. Many users face issues during registration because they don't understand the process properly or miss small requirements.

I've personally gone through the SIM registration TM https://tmsimsregister.com/ process, checked official portals, and reviewed common user problems.…

Embedded SIM IC Market

Embedded SIM IC Market Overview

Embedded SIM chip refers to embedding the SIM card into the device and updating its configuration through wireless remote download. Compared with the traditional pluggable SIM card, the embedded SIM card greatly reduces the card space on the device, and its volume is reduced to 10% of the traditional SIM card. In addition, it is directly embedded in the device in form, realizing the card-free nature…

E-SIM Card (Embedded SIM) Market Size, Share, Growth & Trends, Analysis by 2029

This comprehensive report thoroughly assesses various regions, estimating the volume of the global E-SIM Card (Embedded SIM) market within each region during the projected timeframe. The report is meticulously crafted and includes valuable information on the current market status, historical data, and projected outlook. Furthermore, it presents a detailed market analysis, segmenting it based on regions, types, and applications. The report closely monitors key trends that play a crucial role…

E-Sim Market

According to the Market Statsville Group, the global e-sim market size is expected to grow from USD 702.2 million in 2021 to USD 6673.8 million by 2030, at a CAGR of 32.5% from 2022 to 2030. Embedded Subscriber Identity Module (eSIM) or Embedded Universal Integrated Circuit Card (eUICC) is a reprogrammable chip that can be soldered or removed. It's a small chip that the user uses to verify their identity…

MRRSE : Current Market Scenario of E-SIM Card Market |Key Players - Apple Inc., …

An insightful study, titled “E-SIM Card Market” has been freshly broadcasted to the vast research repository of Market Research Reports Search Engine (MRRSE). The research study provides detailed comprehensions and forecasts future growth of the global market with an in-depth study of the factors impacting revenue growth throughout the mentioned forecast period. Further, a deep analysis on the major players from diverse regions is also present in the report.

Get Report…

E-SIM Card Market |Key Players - Apple Inc., Samsung, Gemalto NV, Giesecke & Dev …

An insightful study, titled “E-SIM Card Market” has been freshly broadcasted to the vast research repository of Market Research Reports Search Engine (MRRSE). The research study provides detailed comprehensions and forecasts future growth of the global market with an in-depth study of the factors impacting revenue growth throughout the mentioned forecast period. Further, a deep analysis on the major players from diverse regions is also present in the report.

Get Free…