Press release

Top 30 Indonesian Chemicals Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)The Indonesian chemicals industry spanning petrochemicals, basic chemicals, specialty chemicals, industrial chemical distributors and related manufacturing recorded mixed performances in Q3 2025 amid challenging global markets, domestic demand shifts, and evolving commodity prices. While some petrochemical players saw margin improvements in olefin spreads, smaller specialty and basic chemical firms faced pressure on volumes and pricing.

Polychem Indonesia Tbk (ADMG)

Aneka Gas Industri Tbk (AGII)

Barito Pacific Tbk (BRPT)

Surya Esa Perkasa Tbk (ESSA)

Lotte Chemical Titan Tbk (FPNI)

Intanwijaya Internasional Tbk (INCI)

Lautan Luas Tbk (LTLS)

Emdeki Utama Tbk (MDKI)

Madusari Murni Indah Tbk (MOLI)

Surya Biru Murni Acetylene Tbk (SBMA)

Sinergi Multi Lestarindo Tbk (SMLE)

Indo Acidatama Tbk (SRSN)

Tridomain Performance Materials Tbk (TDPM)

Chandra Asri Petrochemical Tbk (TPIA)

Unggul Indah Cahaya Tbk (UNIC)

Bintang Mitra Semestaraya Tbk (BMSR)

Ancora Indonesia Resources Tbk (OKAS)

Eterindo Wahanatama Tbk (ETWA)

Chemstar Indonesia Tbk (CHEM)

Kusuma Kemindo Sentosa Tbk (KKES)

Delta Giri Wacana Tbk (DGWG)

Nusa Palapa Gemilang Tbk (NPGF)

Saraswanti Anugerah Makmur Tbk (SAMF)

Argha Karya Prima Industry Tbk (AKPI)

Asiaplast Industries Tbk (APLI)

Avia Avian Tbk (AVIA)

Colorpak Indonesia Tbk (CLPI)

Duta Pertiwi Nusantara Tbk (DPNS)

Ekadharma International Tbk (EKAD)

OBM Drilchem Tbk (OBMD

2) Revenue results of major public companies in Indonesia - summarized (per company)

PT Chandra Asri Pacific Tbk (TPIA)

Q3 2025 net profit: ~Rp 21.6 trillion ≈ ~USD 1.30 billion a major turnaround from prior year losses, driven by improved petrochemical margins, higher volumes and strong exports.

PT Barito Pacific Tbk (BRPT)

Q3 2025 net profit: ~Rp 9.71 trillion ≈ ~USD 583.6 million solid earnings supported by petrochemical and energy affiliates within its portfolio.

PT AKR Corporindo Tbk (AKRA)

Q3 2025 net profit: ~Rp 1.65 trillion ≈ ~USD 99.2 million driven by logistics and chemical distribution growth as noted in company filings.

PT Polychem Indonesia Tbk (ADMG) is recognized as a significant specialty/basic chemical producer in Indonesia's industrial chemicals segment.

PT Aneka Gas Industri Tbk (AGII) is a notable industrial gases supplier in the chemicals sector.

PT Unggul Indah Cahaya Tbk (UNIC) is a prominent in chemical product distribution segments.

PT Surya Biru Murni Acetylene Tbk (SBMA) known for industrial gas production and supply chains.

PT Indo Acidatama Tbk (SRSN) categorized among basic chemical producers.

PT Tridomain Performance Materials Tbk (TDPM) a recognized specialty chemical materials company.

PT Lautan Luas Tbk (LTLS) listed among chemicals and industrial supply firms.

3) Key trends & insights from Q3 2025

Petrochemical Margin Recovery

Major players like Chandra Asri and Barito Pacific benefited from improved petrochemical spreads and better global demand for olefins and polyolefins, reversing weaker results seen in prior quarters.

Profit Concentration in Larger Integrators

Earnings were concentrated among the largest integrated chemical producers and distributors, while smaller specialty and basic chemical firms experienced flat to modest profitability due to cost and demand pressures.

Distribution & Logistics as Support

Logistics-focused chemical distributors such as AKR Corporindo saw growth in throughput, hinting at resilience in supply chain-linked earnings even under slower product price growth.

Market Sentiment Mixed

Industry valuation showed short-term market corrections, with some names dropping while others outperformed reflecting investor focus on earnings clarity and cyclical exposure.

4) Outlook for Q4 2025 and beyond

Demand Stabilization

Petrochemical demand is expected to stabilize toward Q4 2025 as global supply chains adjust to price cycles, potentially supporting continued margin improvements for takers of olefins and derivatives.

Expansion & Investment

Major Indonesian chemical producers are pursuing capacity expansions and strategic investments (e.g., new downstream plants regional construction trends), which can support longer-term growth and value creation.

Commodity Price Risks

Volatility in feedstock and energy prices remains a key risk for Q4 2025, potentially compressing margins for smaller chemical producers.

ESG and Sustainability Focus

Sustainability practices and carbon emission initiatives (notably among large petrochemical firms) are gaining prominence, aligning with broader industrial policy trends in Indonesia.

5) Conclusion

The Indonesian public chemicals sector in Q3 2025 displayed a bifurcated performance: large integrated petrochemical producers like Chandra Asri Pacific and Barito Pacific delivered strong profits and market resilience, while smaller and specialty chemical firms reported more modest or limited public disclosure results. Logistics and distribution entities such as AKR Corporindo contributed to overall industry earnings, highlighting the sectors dependence on both production and chemical handling infrastructure. Going into Q4 2025, stabilization in demand, strategic investments, and feedstock pricing will be critical drivers shaping performance trajectories.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 30 Indonesian Chemicals Public Companies Q3 2025 Revenue & Performance here

News-ID: 4331482 • Views: …

More Releases from QY Research

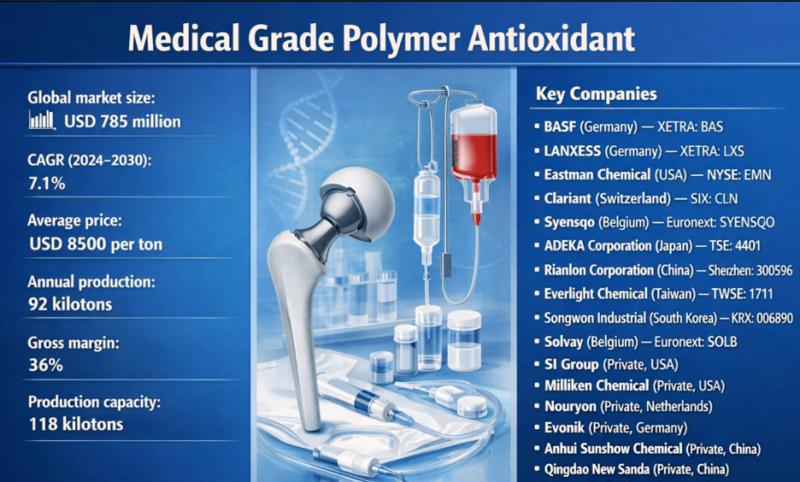

From Degradation to Durability: How Medical-Grade Polymer Antioxidants Transform …

Problem

Abbott Laboratories faced oxidative degradation and material aging during processing, sterilization, and long-term use. High-temperature molding, gamma irradiation, ethylene oxide (EtO), and autoclave sterilization often caused polymer chain scission, discoloration, loss of mechanical strength, and reduced biocompatibility. These issues increased rejection rates, limited device lifespan, and created regulatory challenges for implantable and patient-contact medical products.

Solution

BASF adopted Medical Grade Polymer Antioxidants, highly purified stabilization additives specifically engineered for healthcare applications. These…

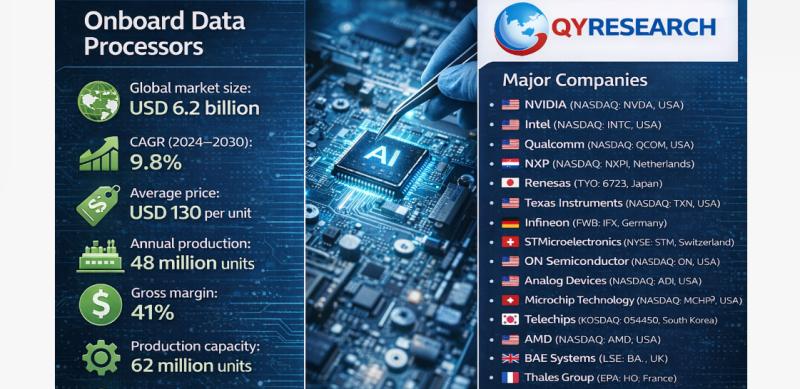

Global and U.S. Onboard Data Processors Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Onboard Data Processors, high-reliability computing units embedded within vehicles, aircraft, spacecraft, industrial machines, and autonomous systems to collect, process, and act on sensor data in real time. Onboard data processors integrate CPUs/GPUs/AI accelerators, memory, interfaces, and ruggedized power management to enable mission-critical decision-making at the edge-reducing latency, bandwidth consumption, and dependence on remote cloud resources. As autonomy, AI, and edge…

Global and U.S. Soil Testers Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Soil Testers, devices used to devices used to measure and analyze soil properties to assess soil health, fertility, and suitability for agriculture, landscaping, construction, or environmental studies. They evaluate parameters such as soil moisture, pH, nutrient levels (N-P-K), salinity, temperature, and electrical conductivity, helping users make informed decisions about irrigation, fertilization, crop selection, and land management.

Core Market Data

Global market size:…

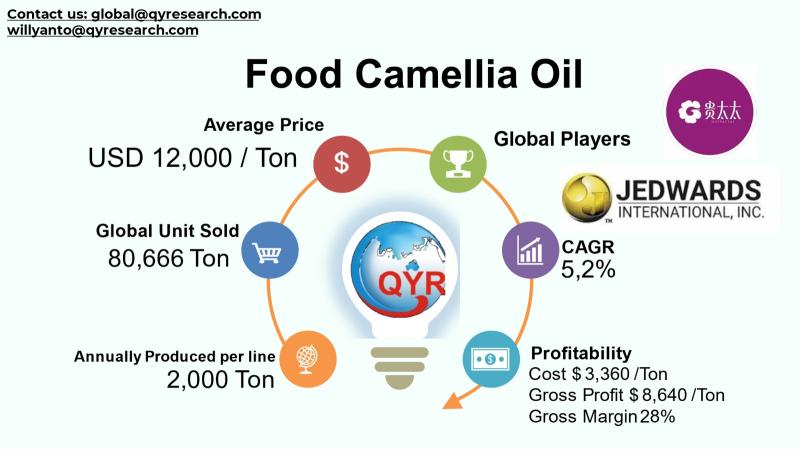

Premium Edible Oils in Focus: Inside the Global Food Camellia Oil Market

The global Food Camellia Oil industry encompasses the production, distribution, and consumption of an edible oil extracted primarily from the seeds of Camellia oleifera and related Camellia species. Traditionally valued in East Asia for its light flavor, high heat tolerance, and health benefits similar to olive oil, camellia oil is increasingly positioned as a premium, health-forward alternative in both culinary and food-processing applications. Although niche in scale compared to mainstream…

More Releases for Tbk

Indonesia Textile Industry Market Valuation Expected to Hit USD 28.57 billion by …

USA, New Jersey: According to Verified Market Research analysis, the global Indonesia Textile Industry Market size was valued at USD 21.7 Billion in 2023 and is projected to reach USD 28.57 Billion by 2031, growing at a CAGR of 3.50% from 2024 to 2031

How AI and Machine Learning Are Redefining the future of Indonesia Textile Industry Market?

AI-powered production planning systems optimize yarn selection, fabric blends, and loom utilization, improving output…

Infrastructure Market 2021 Strategic Assessments - PT. Acset Indonusa Tbk.., Pt. …

The Infrastructure Market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The Infrastructure sector in Indonesia is…

Indonesia Telecom Tower Market Demand, Size, Share, Scope & Forecast To 2025 |To …

The Indonesia telecom tower market accounted to US$ 557.9 Mn in 2017 and is expected to grow at a CAGR of 27.1% during the forecast period 2018 – 2025, to account to US$ 3,695.5 Mn by 2025.

Get Sample Copy of this Indonesia Telecom Tower Market research report at - https://www.businessmarketinsights.com/sample/TIPRE00004113

The Business Market Insights provides you regional research analysis on “Indonesia Telecom Tower Market” and forecast to 2025. The research report…

Coal Mining in Indonesia Market 2022| PT Bumi Resources Tbk, PT Adaro Energy Tbk …

Researchmoz added Most up-to-date research on "Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption" to its huge collection of research reports.

Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption

Summary

GlobalData's "Coal Mining in Indonesia to 2022", provides a comprehensive coverage on Indonesias coal industry. It provides historical and forecast data on coal production by grade, reserves, consumption and exports by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes

Summary

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by type; exports, exports by type and exports by country. Detailed analysis of the…