Press release

Japan Poised to Lead Blockchain in Insurance Innovation as Global Market Surges at 34.5% CAGR, Driving Transparency, Fraud Prevention, and Operational Efficiency.

Tokyo-Japan- The Blockchain in Insurance Market reached US$ 1.4 Billion in 2023 and is expected to reach US$ 15.0 Billion by 2031, growing with a CAGR of 34.5% during the forecast period 2024-2031.Market is growing due to strong government support for digital transformation, rising demand for fraud reduction and claims transparency, increasing adoption of smart contracts for faster payouts, secure data sharing across insurers and healthcare providers, and the push for cost efficiency, customer trust, nationwide modernization drive.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/blockchain-in-insurance-market?pratik

Japan: Key Industry Developments

1. Blockchain-based Health Insurance Claims System Launch:

A major Japanese insurer officially launched a blockchain-based health insurance claims system in September 2025 to streamline processing and improve transparency by recording patient treatment and billing data on a distributed ledger accessible to providers and policyholders, aiming to cut settlement times and reduce errors.

2. Policyholder Rewards Program Using Blockchain:

In 2025, a leading life insurance firm introduced a blockchain-powered rewards program that lets policyholders earn, view, and redeem digital rewards (like premium discounts or wellness benefits) securely on a transparent ledger tied to behaviors such as on-time payments and healthy actions.

3. Pilot of Tokenized Life Insurance Contracts:

A mega Japanese insurer began a pilot for tokenized life insurance contracts in 2025, issuing policies as digital tokens on a private blockchain to enhance transparency, reduce administrative costs, and give real-time policy access via mobile apps.

4. Sompo's Blockchain Test for MaaS Delay Insurance:

Sompo Japan Insurance continued blockchain testing for automated claims tied to train delays under its Mobility-as-a-Service (MaaS) insurance offering, using distributed ledger tech to trigger payouts when defined transport delays occur.

5. Embedded Insurance via Fintech Partnership (Related Digital Experience):

While not purely blockchain, Smartpay's embedded insurance service launch in Japan in summer 2025 integrates digital customer journeys and advanced fintech platforms that often leverage secure ledger-based identity and transaction infrastructure - signaling movement toward more digitally native insurance offerings.

Key players:-

Mapfre, Max Life Insurance, Auxesis Group, KM Business Information US, Inc, Bitfury, IBM, SAP oracle, MetLife and Consensys.

Market Segmentation Analysis:-

By Component (Solutions & Services)

In Japan, blockchain solutions dominate the insurance market as insurers deploy platforms for smart contracts, fraud detection, and automated claims processing. Services such as system integration, consulting, and compliance support are growing steadily, driven by Japan's strict regulatory framework and insurers' focus on secure, scalable digital transformation.

By Application (Claims, Underwriting, Fraud, Payments)

Claims management leads blockchain adoption in Japan, enabling faster settlements and improved transparency. Fraud detection is another key application, helping insurers reduce false claims. Underwriting and premium payments are gaining traction as blockchain enhances data accuracy, risk assessment, and transaction security.

By Insurance Type (Life, Health, Property & Casualty)

Life and health insurance segments are increasingly using blockchain in Japan to manage policy records, customer data, and claim histories securely. Property and casualty insurers are adopting blockchain to streamline claims verification, disaster-related payouts, and cross-company data sharing, improving operational efficiency.

By End User (Insurers, Reinsurers, Intermediaries)

Japanese insurers are the primary adopters of blockchain, focusing on operational efficiency and customer trust. Reinsurers are leveraging blockchain for transparent risk-sharing and faster settlements. Intermediaries, including brokers and agents, are gradually adopting blockchain to improve policy administration and data accuracy.

Purchase this report before year-end and unlock an exclusive 30% discount:https://www.datamintelligence.com/buy-now-page?report=blockchain-in-insurance-market?pratik (Purchase 2 or more Reports and get 50% Discount)

Growth Drivers:

1. Rising Demand for Transparency & Trust

Consumers and businesses in Japan increasingly prefer transparent, traceable insurance records.

Blockchain's immutable ledger meets this need, boosting adoption.

2. Smart Contract Adoption

Smart contracts automate claims and payouts, reducing manual intervention.

This improves processing speed, efficiency, and customer experience.

3. Enhanced Security & Data Privacy

Blockchain offers robust cryptographic protection for sensitive insurance data.

Growing cybersecurity concerns push insurers toward secure distributed ledgers.

4. Supportive Regulations

Japanese regulators are developing frameworks that encourage blockchain experimentation and pilots.

Regulatory clarity fosters insurer investment and innovation.

5. Cost Efficiency via Automation

Blockchain can significantly cut administrative costs by removing intermediaries and streamlining processes.

Some estimates show up to 30% savings in backend operations.

Speak to Our Analyst and Get Customization in the report as per your requirements:https://www.datamintelligence.com/customize/blockchain-in-insurance-market?pratik

Regional Insights:

North America - 38% Share

North America leads with 38%, driven by early blockchain adoption in insurance, strong InsurTech funding, widespread use of smart contracts for claims automation, and supportive regulatory sandboxes in the U.S. and Canada.

Europe - 27% Share

Europe holds 27%, supported by digital insurance transformation, GDPR-compliant blockchain frameworks, cross-border insurance use cases, and active pilots in fraud detection and policy administration across the U.K., Germany, and France.

Asia-Pacific - 25% Share

Asia-Pacific accounts for 25%, fueled by rapid digitalization of insurers, government-backed blockchain initiatives, and rising demand for transparent claims processing. Japan plays a key role through insurer-led pilots, partnerships with blockchain startups, and focus on cybersecurity and data integrity.

South America - 5% Share

South America represents 5%, supported by gradual blockchain adoption in insurance, growing InsurTech ecosystems, and early-stage use cases in claims verification and microinsurance, mainly in Brazil and Argentina.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription?pratik

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Japan Poised to Lead Blockchain in Insurance Innovation as Global Market Surges at 34.5% CAGR, Driving Transparency, Fraud Prevention, and Operational Efficiency. here

News-ID: 4328860 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

Restaurant POS Software Market to Reach US$ 14.76 Billion by 2033 at 12.6% CAGR …

Restaurant POS Software Market reached US$ 5.15 billion in 2024 and is expected to reach US$ 14.76 billion by 2033, growing at a CAGR of 12.6% during the forecast period of 2025 to 2033.

The market is experiencing robust growth as increasing demand for efficient, integrated, and cloud-based point-of-sale solutions drives adoption across restaurants, cafes, quick service outlets, and hospitality chains. Restaurant POS software enhances order management, payment processing, inventory tracking,…

Natural Gas Storage Market Trends: Strategic Insights for Energy Companies and I …

DataM Intelligence released its latest game-changing report "Natural Gas Storage Market Size 2025" Packed with actionable insights for decision-makers, this report goes beyond numbers to decode regional growth hotspots, high-potential market segments, CAGR forecasts, revenue performance of leading players, and the real drivers steering the industry forward. Whether you're an investor, manufacturer, distributor, or technology strategist, this report delivers a crystal-clear, telescopic outlook on market size (value & volume), Growth…

Mobile Threat Defence Market to Reach US$ 12.85 Billion by 2033 at 13.5% CAGR | …

Mobile Threat Defence Market reached US$ 4.12 billion in 2024 and is expected to reach US$ 12.85 billion by 2033, growing at a CAGR of 13.5% during the forecast period of 2025 to 2033.

The market is gaining strong momentum as rising adoption of mobile devices, increasing occurrence of sophisticated cyberattacks, and growing enterprise focus on securing mobile endpoints drive demand for advanced threat defence solutions. Mobile threat defence (MTD) technologies…

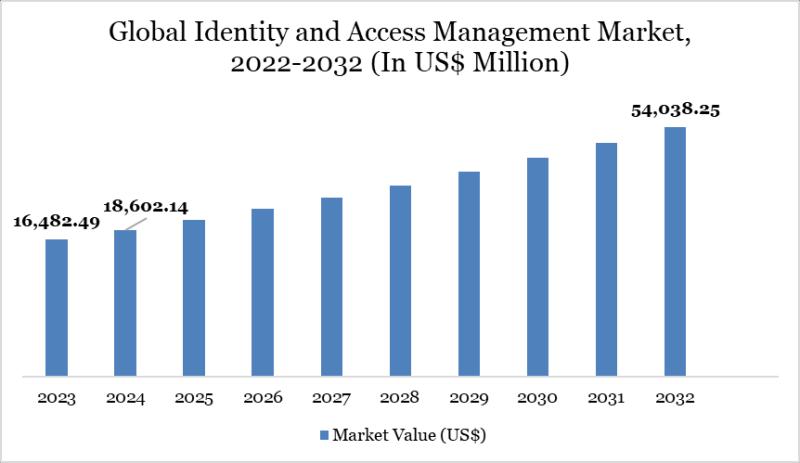

Identity and Access Management Market Set for Explosive Growth to US$ 54.04 Bill …

The Global Identity and Access Management Market was US$18,602.14 million in 2024 and is expected to reach US$54,038.25 million in 2032, growing at a CAGR of 14.4% during the forecast period (2025-2032).

Market growth is driven by escalating cybersecurity threats, rising adoption of cloud and hybrid IT environments, and stringent regulatory compliance needs like GDPR and CCPA. Advancements in AI-powered authentication, zero-trust architectures, and the surge in remote work are further…

More Releases for Japan

Vision Guided Robotic Systems Market Size 2022 - FANUC(Japan), KUKA(Germany), AB …

The Vision Guided Robotic Systems Market research report also provides an in-depth analysis of key players in the market, including their company profiles, business offerings, recent development, market strategies, and critical observation related to the product. The research study provides extensive coverage of the Vision Guided Robotic Systems Market size across all industries and businesses. In addition, it offers detailed insights into market size and growth depending upon various segments…

Japan Agriculture Market, Japan Agriculture Industry, Japan Agriculture Livestoc …

The agriculture sector is a very significant sector in Japan. Agriculture sector exists in every part of country, but is especially essential on the northern island of Hokkaido that accounts for approximately 10% of national production. Modern methods such as commercial fertilizers, hybrid seeds, insecticides, and machinery, have been used so efficiently in farming. Japan is the second major agricultural product importer in the world (after the U.S.). Almost all…

Car Navigation ECU Market 2019: Top Key Players are AW Software (Japan), Contine …

Car Navigation ECU Market 2019 Report analyses the industry status, size, share, trends, growth opportunity, competition landscape and forecast to 2025. This report also provides data on patterns, improvements, target business sectors, limits and advancements. Furthermore, this research report categorizes the market by companies, region, type and end-use industry.

Get Sample Copy of this Report@ https://www.researchreportsworld.com/enquiry/request-sample/13844912

Global Car Navigation ECU market 2019 research provides a basic overview of the industry…

Global Car Navigation ECU Market Outlook to 2023 – AW Software (Japan), Contin …

An automotive navigation system is part of the automobile controls or a third party add-on used to find direction in an automobile and the ECU is the core part control it.

Car Navigation typically uses a satellite navigation device to get its position data which is then correlated to a position on a road. According to this study, over the next five years the Car Navigation ECU market will register a…

Global Car Navigation Parts Market Research Report 2019-2025 | Global Key Play …

This research report titled “Global Car Navigation Parts Market” Insights, Forecast to 2025 has been added to the wide online database managed by Market Research Hub (MRH). The study discusses the prime market growth factors along with future projections expected to impact the Car Navigation Parts Market during the period between 2018 and 2025. The concerned sector is analyzed based on different market factors including drivers, restraints and opportunities in…

Global Automotive 3D Scanning Laser Radar (3D-LiDAR) Market 2019-2025 | Velodyne …

Researchmoz added Most up-to-date research on "Global Automotive 3D Scanning Laser Radar (3D-LiDAR) Market Insights,Forecast to 2025" to its huge collection of research reports.

3D LiDAR uses a pulsed laser to detect distance, velocity and angle with high precision. LiDAR can classify objects, detect lane markings, and may also be used to accurately position an autonomous vehicle relative to a high definition map.

3D LiDAR is prominent, as it is a key…