Press release

Leading Firms Advancing Innovation and Growth in the Fixed Income Asset Management Market

The fixed income asset management market is on track for robust expansion in the coming years, driven by a variety of economic and regulatory factors. This segment is evolving rapidly as investors increasingly seek stable and diverse income-generating assets amidst fluctuating market conditions. Let's delve into the market's size, key players, emerging trends, and segmentation to better understand its future direction.Projected Growth and Market Size of the Fixed Income Asset Management Market

The fixed income asset management market is forecasted to reach an impressive $113,391.7 billion by 2029, growing at a compound annual growth rate (CAGR) of 9.8%. Several key elements contribute to this anticipated growth, including fluctuations in interest rates, shifts in credit spreads, changes in the yield curve's configuration, expectations around inflation, and regulatory reforms. Additionally, important trends such as a rising demand for sustainable fixed income products, increased interest in alternative fixed income assets, widespread adoption of technology for data analytics and automation, heightened focus on liquidity management in volatile markets, and greater emphasis on environmental, social, and governance (ESG) considerations are shaping the landscape of this market.

Download a free sample of the fixed income asset management market report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=14714&type=smp

Key Factors Encouraging Growth in the Fixed Income Asset Management Market

Investor appetite for sustainable fixed income investments has been steadily increasing, reflecting a broader shift towards responsible investing. This trend is motivating asset managers to develop products that integrate ESG factors while still offering attractive returns.

Alongside this, the growing interest in alternative fixed income assets is expanding the market's scope. Investors are exploring various non-traditional fixed income instruments to diversify their portfolios and manage risk more effectively in uncertain economic climates.

Prominent Companies Driving the Fixed Income Asset Management Market

Several leading firms dominate the fixed income asset management sector, including JPMorgan Chase and Co., International Business Machines Corporation (IBM), Goldman Sachs Group Inc., Oracle Corporation, State Bank of India (SBI), ABB Ltd., Fidelity Investments, BlackRock Inc., Adobe Inc., Housing Development Finance Corporation Ltd., State Street Global Advisors, Franklin Resources Inc., Axis Bank Ltd., The Vanguard Group, T. Rowe Price Group Inc., Invesco Ltd., Synaptics Inc., Wellington Management Company LLP, Oppenheimer Holdings Inc., Pacific Investment Management Company LLC (PIMCO), IDFC Ltd., and Evergreen Investments LLC.

View the full fixed income asset management market report:

https://www.thebusinessresearchcompany.com/report/fixed-income-asset-management-global-market-report

Significant Developments and Acquisitions Among Market Leaders

In an important move in April 2022, Goldman Sachs Group Inc., a US-based investment bank, acquired NN Investment Partners for $1.88 billion (€1.7 billion). This acquisition strengthened Goldman Sachs' foothold among European clients, enhanced its leadership in insurance asset management, and reinforced its commitment to sustainable investing. NN Investment Partners, headquartered in the Netherlands, is recognized for its fixed income asset management expertise, making this a strategic addition to Goldman Sachs' investment offerings.

Innovations and Trends Shaping the Fixed Income Asset Management Market

Industry players are focused on innovation to stay competitive. For example, JPMorgan Asset Management launched the JPMorgan Active Bond ETF (JBND) in October 2023 on the NYSE Arca. This actively managed fixed-income exchange-traded fund employs a bottom-up, value-driven approach, prioritizing security selection. It aims to optimize total returns by investing in a diverse mix of intermediate- and long-term debt securities, with a special emphasis on securitized debt. The goal of JBND is to outperform the Bloomberg US Aggregate Bond Index over a market cycle spanning three to five years.

The rise of ETFs like JBND reflects a broader trend where asset managers leverage technology and data analytics to deliver tailored investment solutions that cater to evolving investor preferences and market conditions.

Detailed Breakdown of Fixed Income Asset Management Market Segments

The fixed income asset management market is categorized into several key segments:

1) Asset Class: Government Bonds, Corporate Bonds, Municipal Bonds, Mortgage-Backed Securities, Asset-Backed Securities, High-Yield Bonds, and Other Asset Classes.

2) Investment Strategy: Core Fixed Income, Active Fixed Income, Passive Fixed Income.

3) End User: Institutional Investors and Retail Investors.

Further subcategories include:

- Government Bonds: Treasury Bonds, Sovereign Bonds, Inflation-Protected Bonds, Foreign Government Bonds.

- Corporate Bonds: Investment-Grade Bonds, Non-Investment-Grade Bonds (High-Yield), Convertible Bonds, Callable Bonds.

- Municipal Bonds: General Obligation Bonds, Revenue Bonds, Taxable Municipal Bonds, Municipal Bond Funds.

- Mortgage-Backed Securities (MBS): Residential Mortgage-Backed Securities (RMBS), Commercial Mortgage-Backed Securities (CMBS), Collateralized Mortgage Obligations (CMOs).

- Asset-Backed Securities (ABS): Auto Loan-Backed Securities, Credit Card Receivables-Backed Securities, Student Loan-Backed Securities, Other Consumer Loan-Backed Securities.

- High-Yield Bonds: Junk Bonds, Emerging Market Bonds, Distressed Debt.

- Other Asset Classes: Treasury Inflation-Protected Securities (TIPS), Foreign Currency Bonds, Structured Notes, Hybrid Securities.

This comprehensive segmentation enables market participants to tailor their investment strategies and target specific niches within the fixed income space, aligning with diverse investor needs and risk appetites.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Leading Firms Advancing Innovation and Growth in the Fixed Income Asset Management Market here

News-ID: 4328054 • Views: …

More Releases from The Business Research Company

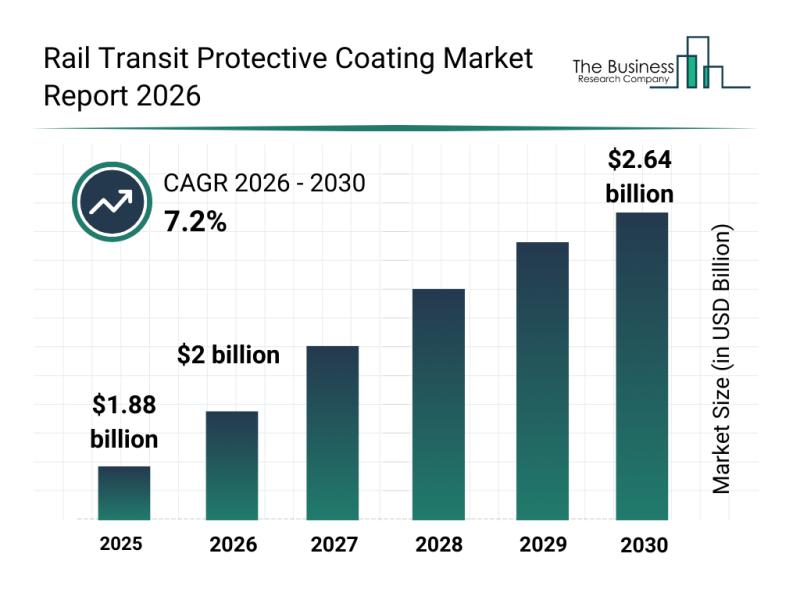

Rail Transit Protective Coating Market Overview: Major Segments, Strategic Devel …

The rail transit protective coating sector is positioned for significant expansion in the coming years, driven by technological advancements and increasing infrastructure investments. This market is evolving rapidly as stakeholders prioritize durability, sustainability, and efficiency in rail transit systems. Let's explore the market's valuation projections, leading companies, emerging trends, and detailed segment analysis to get a clearer understanding of its future trajectory.

Expected Market Size and Growth Outlook for Rail Transit…

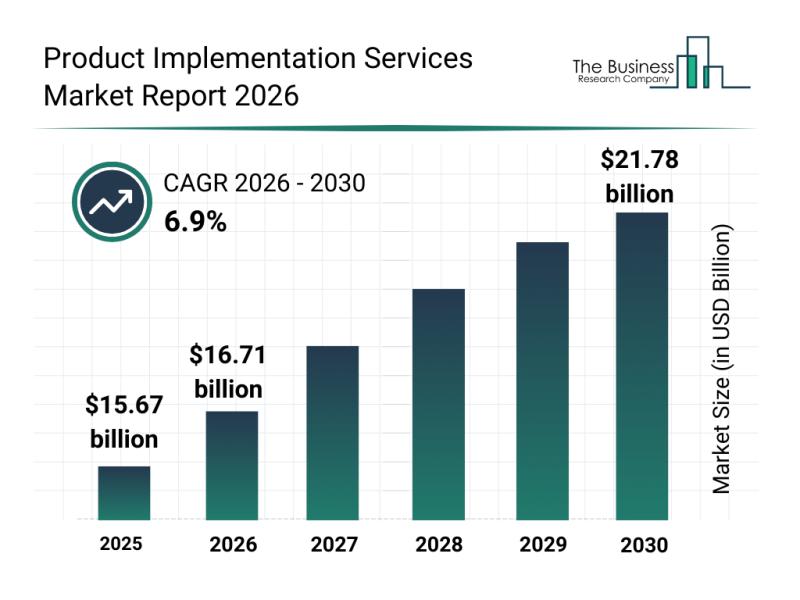

Analysis of Segments and Major Growth Areas in the Product Implementation Servic …

The product implementation services sector is on the verge of significant expansion, driven by evolving technology needs and increasing enterprise adoption of sophisticated systems. Understanding the current market size, key contributors, emerging trends, and segment breakdowns offers valuable insights into what lies ahead for this dynamic industry.

Market Size and Expected Growth Trajectory in the Product Implementation Services Market

The product implementation services market is projected to experience strong growth…

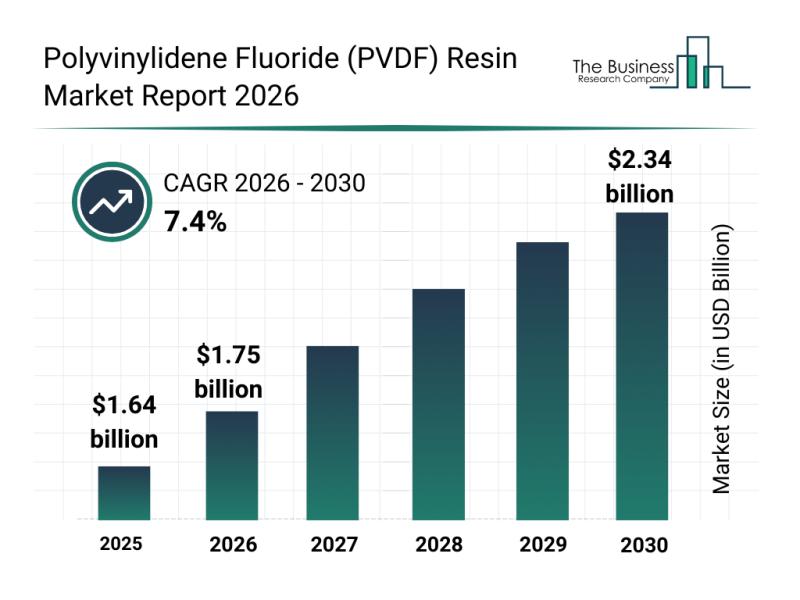

Key Strategic Developments and Emerging Changes Shaping the Polyvinylidene Fluor …

The polyvinylidene fluoride (PVDF) resin market is on track for significant expansion over the coming years. Driven by various technological advances and rising demands across multiple industries, this sector is expected to evolve rapidly. Let's explore the anticipated market growth, influential players, key trends, and detailed segmentation shaping the future of PVDF resin.

Projected Growth and Market Size of the Polyvinylidene Fluoride Resin Market

The PVDF resin market is forecasted…

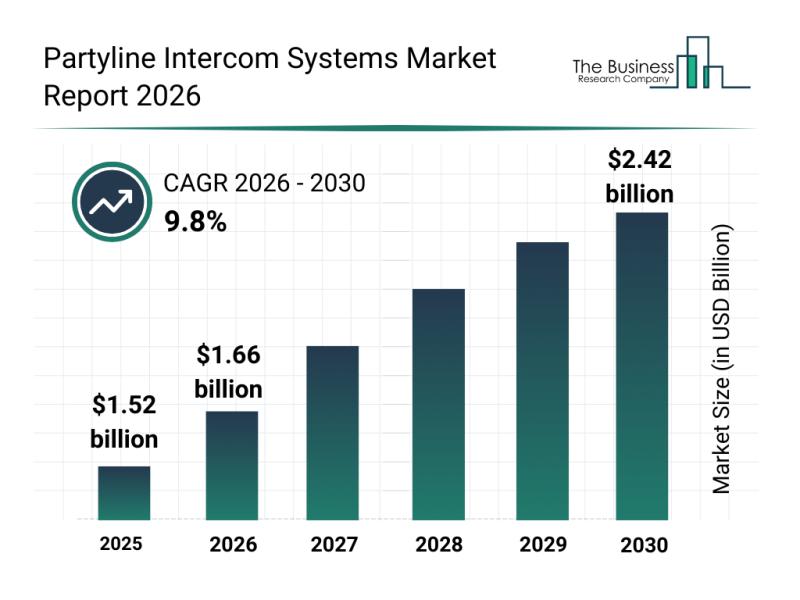

Leading Companies Fueling Innovation and Growth in the Partyline Intercom System …

The partyline intercom systems market is gearing up for significant expansion as communication needs evolve across various industries. With increasing demand for more versatile and efficient communication tools, this sector is set to witness rapid advancements and growing adoption over the coming years. Let's explore the market size projections, key drivers, major players, emerging trends, and important segments shaping this dynamic industry.

Projected Market Size and Growth Trajectory of the Partyline…

More Releases for Bond

Multi-Parameter Bond Screener: Enhanced Bond Search by Cbonds

The constantly growing flow of information on the debt instruments available on the market compels businesses and private investors to search for effective ways to systematize and filter out only relevant data. Although many companies offer pools of information regarding the bonds issued on the specific local market or stock exchange, this data is often limited and fragmented. Moreover, awkward interface further delays the search process. Thus, finding a flexible…

Bond Market Set for Explosive Growth

The latest 115+ page survey report on Global Bond Market is released by HTF MI covering various players of the industry selected from global geographies like North America (Covered in Chapter 6 and 13), United States, Canada, Mexico, Europe (Covered in Chapter 7 and 13), Germany, UK, France, Italy, Spain, Russia, Others, Asia-Pacific (Covered in Chapter 8 and 13), China, Japan, South Korea, Australia, India, Southeast Asia, Others, Middle East…

Corporate Bond Market, Top key players are HDFC Corporate Bond Fund ,Aditya Birl …

Corporate Bond Market

The report begins with a brief introduction on the various segments of the bond market in Global followed by a further split of corporate bond segments. Evolution of the corporate bond market in Global entails a brief description of the major events that have taken place since its inception. The market overview section provides an overview of the global corporate bond market in terms of issuance of corporate…

Welsh Forestry Investment Bond Launched

Seattle, WA, September 03, 2011 -- An innovative Wales-based forestry investment firm has started up and has attracted support from Forestry Research Associates (FRA).

Woodland Bond is a concept launched by managing director John Tunnicliffe, who wanted to offer people the chance to invest in Welsh woodland, while helping to manage the woodland in the country sustainably.

FRA has spoken out in support of the idea, which is similar to the successful…

James Bond Test™ MK III Developed for Adhesion, Bond and Other Tensile Strengt …

James Instruments Inc. manufacturer of the world's most advanced Non Destructive Test Equipment for construction materials has developed the James Bond Test MK III for measuring the bond strength/tensile strength/adhesion strength of concrete, asphalt, tile, concrete repair, or other overlay material by the direct tension or pull off method. It uses disc attached to the material under test to,

1.

Measure the…

First Bond Sale: Greece by Barvetii

Greece has successfully sold government bonds in its first attempt since the huge EU-IMF loan bail-out was launched in early May.

Analysts at Barvetii International Wealth Consultants the international wealth consultants believe this first bond sale will test investors’ appetites after a recent downgrade by the credit rating agencies, which cut the country’s rating to "junk". The benchmark Greek 10-year bond yield trades at 10%, almost twice as much as Spain’s,…