Press release

Crypto Asset Management Market to Reach US$ 15.87 Billion by 2033 at 26.67% CAGR; North America Leads with 38% Share - Key Players: Coinbase, Fidelity, BitGo

The global crypto asset management market reached US$ 1.74 billion in 2023, increased to US$ 1.89 billion in 2024, and is projected to expand significantly to US$ 15.87 billion by 2033, registering a strong CAGR of 26.67% during the forecast period 2025-2033. This rapid growth is primarily driven by the rising adoption of digital assets across both retail and institutional segments, alongside the growing need for secure custody, portfolio management, and compliance-focused solutions. As cryptocurrencies continue to gain mainstream acceptance, the demand for professional-grade asset management platforms capable of handling complex digital portfolios is accelerating.The market is further strengthened by increasing institutional participation from banks, hedge funds, asset managers, and brokerage firms, which are actively integrating crypto offerings into their investment strategies. Assets such as cryptocurrencies, stablecoins, NFTs, and DeFi tokens are fueling demand for platforms that support real-time portfolio tracking, automated trading, risk analytics, and regulatory reporting. Moreover, improving regulatory clarity in key regions, combined with heightened concerns around cybersecurity and asset protection, is encouraging wider adoption. The integration of blockchain-based transparency and AI-driven analytics is also enhancing operational efficiency, security, and investment decision-making, positioning crypto asset management as a fast-evolving and high-growth segment within the global financial services ecosystem.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/crypto-asset-management-market?sai-v

The Crypto Asset Management Market is the sector that provides platforms, tools, and services for securely managing, trading, storing, and optimizing digital assets such as cryptocurrencies and tokenized assets.

Key Developments

✅ October 2025: On-chain crypto asset management platforms recorded increased assets under management in automated yield strategies and structured digital asset portfolios during 2025.

✅ September 2025: Institutional investors, including hedge funds and asset managers, expanded participation in crypto asset management products such as digital asset funds, trusts, and exchange-traded products.

✅ August 2025: Bitwise Asset Management completed an equity funding round to support the expansion of its crypto asset management services and investment product offerings.

✅ July 2025: State Street launched institutional digital asset custody services to support secure holding, settlement, and management of crypto assets for enterprise clients.

✅ May 2025: WisdomTree reported significant assets under management across its cryptocurrency exchange-traded products, reflecting growing institutional adoption.

✅ March 2025: JPMorgan partnered with a blockchain technology provider to develop institutional-grade digital asset management and custody infrastructure.

Mergers & Acquisitions

✅ November 2025: FalconX acquired 21Shares, a cryptocurrency exchange-traded product issuer, expanding its presence in regulated crypto asset management and investment products.

✅ August 2025: Chainalysis acquired Alterya, an AI-based fraud detection company, to enhance blockchain analytics and compliance capabilities used within crypto asset management workflows.

✅ June 2025: FalconX acquired a majority stake in Monarq Asset Management, strengthening its crypto-native asset management and structured investment strategy offerings.

Key Players

Gemini Trust Company, LLC | Crypto Finance Group | BitGo | Coinbase | FMR LLC (Fidelity) | Bakkt | Paxos Trust Company, LLC | Sygnum | Ledger SAS | Anchorage Digital | Others

Key Highlights

Coinbase holds a share of 26.4 percent, driven by its dominant position in institutional crypto custody, asset management services, strong regulatory compliance, and broad global client base.

FMR LLC (Fidelity) accounts for 18.7 percent, supported by its trusted brand in traditional asset management, expanding digital asset custody services, and growing adoption by institutional investors.

BitGo represents 14.9 percent, benefiting from its secure digital asset custody, insurance-backed services, and widespread use among exchanges, hedge funds, and institutional crypto managers.

Gemini Trust Company, LLC holds 11.8 percent, leveraging its regulated crypto platform, secure custody infrastructure, and strong focus on compliance and transparency.

Anchorage Digital captures 9.6 percent, driven by its status as a federally chartered digital asset bank in the US and growing demand for regulated crypto asset management solutions.

Paxos Trust Company, LLC accounts for 7.2 percent, supported by its blockchain infrastructure, regulated custody services, and strong partnerships with financial institutions.

Crypto Finance Group holds 5.4 percent, focusing on institutional-grade crypto asset management, trading, and custody services, particularly across European markets.

Bakkt represents 3.4 percent, leveraging its digital asset custody platform and enterprise-focused crypto solutions backed by strong financial and technology partnerships.

Sygnum holds 1.6 percent, benefiting from its Swiss-regulated digital asset banking model and tailored crypto asset management services for high-net-worth and institutional clients.

Ledger SAS accounts for 1.0 percent, driven by its secure hardware-based custody solutions and growing adoption among institutions seeking self-custody asset management models.

Purchase this report before year-end and unlock an exclusive 30% discount: https://www.datamintelligence.com/buy-now-page?report=crypto-asset-management-market?sai-v

(Purchase 2 or more Reports and get 50% Discount)

Market Drivers

- Increasing adoption of cryptocurrencies and digital assets by retail and institutional investors driving demand for structured asset management solutions.

- Growing need for secure, compliant, and transparent platforms to store, track, and manage diverse crypto portfolios.

- Rising interest in digital financial products such as Bitcoin ETFs, staking, yield farming, and decentralized finance (DeFi) services.

- Development of regulatory frameworks and clearer guidance in key markets encouraging institutional participation.

- Expansion of blockchain infrastructure and custody solutions reducing security risks and enhancing investor confidence.

- Integration of analytics, risk management, and portfolio optimization tools tailored to crypto asset classes.

- Increasing demand for automated, AI-driven, and algorithmic investment strategies in crypto markets.

Industry Developments

- Launch of institutional-grade crypto asset management platforms offering custody, trading, reporting, and compliance.

- Introduction of diversified crypto funds, index products, and tokenized asset offerings to broaden investor access.

- Partnerships between traditional asset managers, fintech firms, and blockchain technology providers.

- Growth of decentralized autonomous organization (DAO)-managed funds and community-governed investment vehicles.

- Expansion of staking, yield-generation, and liquidity provisioning services as part of asset management offerings.

- Strategic acquisitions and investments in crypto asset management startups and technology enablers.

- Enhanced focus on regulatory compliance tools, tax reporting, and anti-money-laundering (AML)/know-your-customer (KYC) integrations.

Regional Insights

North America - 38% share: "Driven by high institutional investment activity, mature financial markets, supportive crypto infrastructure, and growing regulatory clarity."

Europe - 28% share: "Supported by progressive digital asset regulation, strong fintech ecosystems, and rising adoption of crypto investment products."

Asia Pacific - 26% share: "Fueled by rapid digital finance adoption, large retail investor base, expanding blockchain innovation hubs, and growing interest in crypto services."

Latin America - 4% share: "Boosted by increased crypto adoption as a hedge against local currency volatility, growing fintech usage, and expanding investment solutions."

Middle East & Africa - 2% share: "Driven by emerging digital asset frameworks, sovereign investment interests, and increasing demand for alternative financial products."

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/crypto-asset-management-market?sai-v

Key Segments

By Type

Cryptocurrencies dominate the market due to their widespread adoption as digital investment assets and mediums of exchange, supported by high liquidity and strong retail and institutional interest. Stablecoins hold a significant share as they provide price stability and are increasingly used for trading, payments, and remittances within digital asset ecosystems. Tokenized assets are gaining strong momentum as they enable fractional ownership and improved liquidity for real-world assets such as real estate, equities, and commodities. NFTs continue to expand beyond collectibles into areas such as gaming, digital art, and intellectual property management. DeFi assets are witnessing rapid growth, driven by increasing adoption of decentralized financial services including lending, borrowing, and yield generation.

By Solutions

Custodial solutions account for a major share as institutional investors and enterprises prioritize secure storage, compliance, and risk management of digital assets. Wallet management solutions are widely adopted by individual and retail investors for secure access, transaction management, and asset tracking. Portfolio management is gaining traction as investors seek consolidated views, performance analytics, and risk assessment across diverse digital asset holdings. Fund management solutions are expanding steadily, particularly among institutional investors, to support structured investment vehicles and regulatory reporting.

By Deployment

Cloud-based deployment dominates the market owing to its scalability, flexibility, and lower infrastructure costs, enabling rapid implementation and easy integration with trading platforms and blockchain networks. On-premises deployment remains relevant for institutions with stringent security, compliance, and data sovereignty requirements that demand greater control over asset management infrastructure.

By Application

Web-based applications hold a significant share as they provide broad accessibility, advanced analytics, and integration with multiple digital asset platforms. Mobile-based applications are experiencing strong growth, driven by increasing smartphone penetration and demand for real-time asset monitoring, trading, and management on the go.

By End-User

Individual users represent a large segment, supported by growing retail participation in digital asset trading and investment. Retail investors continue to expand their presence as user-friendly platforms and educational resources lower entry barriers. Institutional investors are one of the fastest-growing segments, driven by increasing regulatory clarity, demand for secure custody solutions, and portfolio diversification strategies. Enterprises are increasingly adopting digital asset management solutions for treasury management, payments, and blockchain-based business models.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Crypto Asset Management Market to Reach US$ 15.87 Billion by 2033 at 26.67% CAGR; North America Leads with 38% Share - Key Players: Coinbase, Fidelity, BitGo here

News-ID: 4327812 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

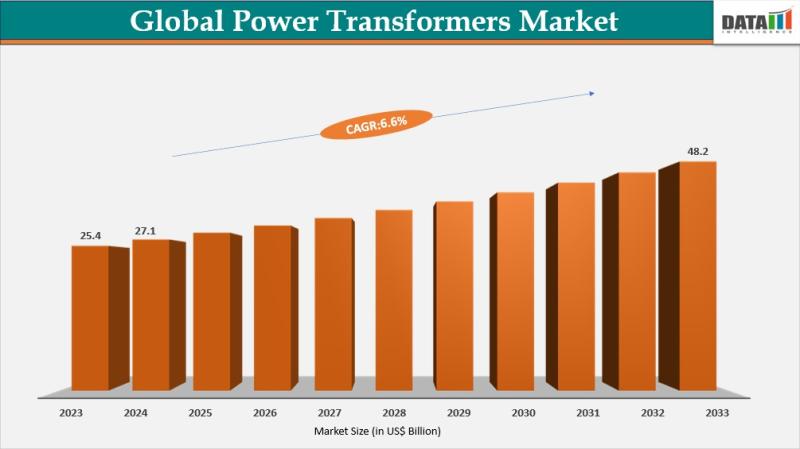

Power Transformers Market to Reach US$ 45.2 Billion by 2032 | CAGR 6.6% | Asia P …

The Global Power Transformers Market reached US$ 27.1 billion in 2024 and is expected to reach US$ 45.2 billion by 2032, growing at a CAGR of 6.6% during the forecast period 2025-2032. Market growth is driven by rising electricity demand, rapid urbanization, and the accelerating integration of renewable energy sources into national power grids. Asia Pacific accounted for 38.1% of the global market share in 2024 and is expected to…

United States Specialty Silica Market Intelligence 2025 | Global Scope, Industry …

Specialty Silica Market report analyzes the global market size, shares, recent trends, competitive intelligence, and future market outlook during the forecast period 2024-2031

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://datamintelligence.com/download-sample/specialty-silica-market?kb

United States: Recent Industry Developments

✅ December 2025: U.S. silica producers expanded high-performance specialty silica lines to support growing EV tire and lightweight composite demand.

✅ November 2025: Innovation increased in engineered silica grades tailored…

Aircraft Insulation Market Set for Steady Growth at 8.1% CAGR Through 2034, Led …

The Global Aircraft Insulation Market reached USD 7.3 billion in 2024 and is expected to grow steadily through 2034, expanding at a CAGR of 8.1% during the forecast period 2025-2034.

Market growth stems from advances in lightweight materials like aerogels and advanced foams, which enhance thermal and acoustic insulation while cutting aircraft weight to boost fuel efficiency and reduce emissions. Rising demand for these solutions in new aircraft designs aligns with…

Onshore Wind Turbine Market to Reach US$ 72.6 Billion by 2030 | CAGR 4.9% | Asia …

The Global Onshore Wind Turbine Market reached US$ 51.9 billion in 2022 and is expected to reach US$ 72.6 billion by 2030, growing at a CAGR of 4.9% during the forecast period 2024-2031. Market growth is driven by the increasing demand for renewable energy, supportive government policies and incentives, and global efforts to reduce carbon emissions and transition toward sustainable power generation.

Onshore wind turbines are widely adopted due to their…

More Releases for Data

Data Catalog Market: Serving Data Consumers

Data Catalog Market size was valued at US$ 801.10 Mn. in 2022 and the total revenue is expected to grow at a CAGR of 23.2% from 2023 to 2029, reaching nearly US$ 3451.16 Mn.

Data Catalog Market Report Scope and Research Methodology

The Data Catalog Market is poised to reach a valuation of US$ 3451.16 million by 2029. A data catalog serves as an organized inventory of an organization's data assets, leveraging…

Big Data Security: Increasing Data Volume and Data Velocity

Big data security is a term used to describe the security of data that is too large or complex to be managed using traditional security methods. Big data security is a growing concern for organizations as the amount of data generated continues to increase. There are a number of challenges associated with securing big data, including the need to store and process data in a secure manner, the need to…

HOW TO TRANSFORM BIG DATA TO SMART DATA USING DATA ENGINEERING?

We are at the cross-roads of a universe that is composed of actors, entities and use-cases; along with the associated data relationships across zillions of business scenarios. Organizations must derive the most out of data, and modern AI platforms can help businesses in this direction. These help ideally turn Big Data into plug-and-play pieces of information that are being widely known as Smart Data.

Specialized components backed up by AI and…

Test Data Management (TDM) Market - test data profiling, test data planning, tes …

The report categorizes the global Test Data Management (TDM) market by top players/brands, region, type, end user, market status, competition landscape, market share, growth rate, future trends, market drivers, opportunities and challenges, sales channels and distributors.

This report studies the global market size of Test Data Management (TDM) in key regions like North America, Europe, Asia Pacific, Central & South America and Middle East & Africa, focuses on the consumption…

Data Prep Market Report 2018: Segmentation by Platform (Self-Service Data Prep, …

Global Data Prep market research report provides company profile for Alteryx, Inc. (U.S.), Informatica (U.S.), International Business Corporation (U.S.), TIBCO Software, Inc. (U.S.), Microsoft Corporation (U.S.), SAS Institute (U.S.), Datawatch Corporation (U.S.), Tableau Software, Inc. (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY…

Long Term Data Retention Solutions Market - The Increasing Demand For Big Data W …

Data retention is a technique to store the database of the organization for the future. An organization may retain data for several different reasons. One of the reasons is to act in accordance with state and federal regulations, i.e. information that may be considered old or irrelevant for internal use may need to be retained to comply with the laws of a particular jurisdiction or industry. Another reason is to…