Press release

Beyond PPPs: How Infrastructure Leasing Delivers Speed, Control, and Capital

Infrastructure Asset Leasing Emerges as a Global Alternative to Public Debt FinancingImage: https://www.abnewswire.com/upload/2025/12/09068b06c107e70c7300936ccc99bab9.jpg

Governments around the world are confronting a widening infrastructure funding gap as demand accelerates across healthcare systems, social housing, transportation networks, energy grids, and AI-driven digital infrastructure. Traditional public funding models reliant on sovereign debt, bonds, and taxpayer capital are increasingly constrained by fiscal pressure, rising interest rates, and credit rating sensitivity.

As a result, infrastructure asset leasing is gaining momentum as a viable, scalable alternative to public funding and conventional public-private partnership (PPP) structures.

Rethinking How Infrastructure Is Financed

Historically, governments have financed infrastructure through direct capital expenditure and long-term public debt. While effective in earlier decades, this approach now presents growing challenges:

* Rising sovereign debt levels impacting national credit ratings

* Large upfront capital requirements stressing government budgets

* Long-term balance sheet liabilities limiting fiscal flexibility

* Slower project delivery timelines

In contrast, infrastructure leasing allows governments to deploy essential assets without issuing public debt or bonds, significantly reducing balance sheet pressure while accelerating project execution.

"Infrastructure leasing allows governments to think like operators rather than borrowers," said Russell Duke, CEO of National Standard Finance LLC [http://www.natstandard.com/]. "You maintain full operational control of the asset while avoiding the long-term debt burden that ultimately falls on taxpayers."

Infrastructure Assets Often Decline in Value

Unlike traditional financial assets, most infrastructure assets-such as social infrastructure, transportation networks, power networks, and digital platforms-depreciate in value over time due to:

* Asset life cycles

* Maintenance and upgrade requirements

* Rapid technology advancement

* Regulatory and operational complexity

From a financial perspective, these assets often function more like long-term liabilities than appreciating investments. Yet governments frequently finance them as if they were balance sheet assets, carrying decades of debt for infrastructure that requires continuous reinvestment.

Leasing aligns the financing structure with the economic reality of infrastructure use and depreciation.

Image: https://www.abnewswire.com/upload/2025/12/6486574c151c0490177e40214e6c4828.jpg

Balance Sheet and Accounting Advantages

Infrastructure asset leasing offers several financial and accounting benefits compared to traditional debt financing:

* Reduced upfront capital expenditure

* No increase in sovereign debt metrics

* More balance-sheet-friendly treatment than bonds

* Predictable long-term payment obligations

* Improved fiscal planning and transparency

Critically, governments retain full control over asset operations, standards, and public use, achieving functional ownership without transferring authority to private concession operators.

Institutional Private Capital Driving the Model

Global institutional investors-including pension funds, insurance companies, and fixed-income asset managers-are actively seeking long-duration, predictable income streams backed by high-quality counterparties.

Long-term infrastructure leases are particularly attractive because they provide:

* Stable cash flows

* Long-term contractual certainty

* Alignment with institutional liability structures

* Exposure to essential public infrastructure

Image: https://www.abnewswire.com/upload/2025/12/e24ab022d80c8b906e7db9cc4fe545c8.jpg

"From an institutional investor standpoint, infrastructure leases backed by government entities represent one of the most compelling risk-adjusted opportunities in fixed income today," said Robert Lavin, CFO of National Standard Finance LLC and a former Wall Street executive. "They deliver predictability for investors while preserving flexibility for governments."

A New Hybrid Beyond Traditional PPPs

While PPPs and concession models have mobilized private capital, they often involve:

* Lengthy procurement timelines

* Reduced government control over assets

* Political and public resistance

Infrastructure leasing introduces a hybrid financing model that preserves government authority while accessing institutional capital. Compared to traditional PPPs, leasing structures typically enable faster delivery timelines, clearer governance, and stronger public accountability.

The Role of Specialized Infrastructure Finance Firms

Executing large-scale infrastructure leasing programs requires deep expertise across government finance, institutional capital markets, and asset structuring. National Standard Finance LLC, a long standing globally recognized U.S. based global infrastructure investment and comprehensive advisory firm brings robust experience and skill in:

* Government infrastructure financing solutions

* Institutional lease finance

* Healthcare, social infrastructure, transportation, energy, and digital assets

* Structuring long-term leases for creditworthy public entities

As governments reassess how infrastructure is financed in a constrained fiscal environment, specialized firms are playing an increasingly strategic role in bridging public needs with private capital. The Principal's at National Standard Finance have been active players in the lease finance niche market for more than 20 years across various types of asset types.

Image: https://www.abnewswire.com/upload/2025/12/28b869a067ca4e3ac3769a4ca0647546.jpg

The Future of Infrastructure Finance

As infrastructure demand continues to rise globally, the limitations of debt-funded public ownership are becoming more pronounced. Infrastructure asset leasing offers a disciplined, scalable alternative-one that reduces fiscal strain, protects sovereign credit profiles, and accelerates delivery of essential public assets.

The future of infrastructure may depend less on expanding public debt and more on innovative financing structures that reflect how infrastructure is actually used, maintained, and evolved over time.

Media Contact

Company Name: National Standard Finance LLC

Contact Person: Russell Duke

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=beyond-ppps-how-infrastructure-leasing-delivers-speed-control-and-capital]

Country: United States

Website: http://www.natstandard.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Beyond PPPs: How Infrastructure Leasing Delivers Speed, Control, and Capital here

News-ID: 4327034 • Views: …

More Releases from ABNewswire

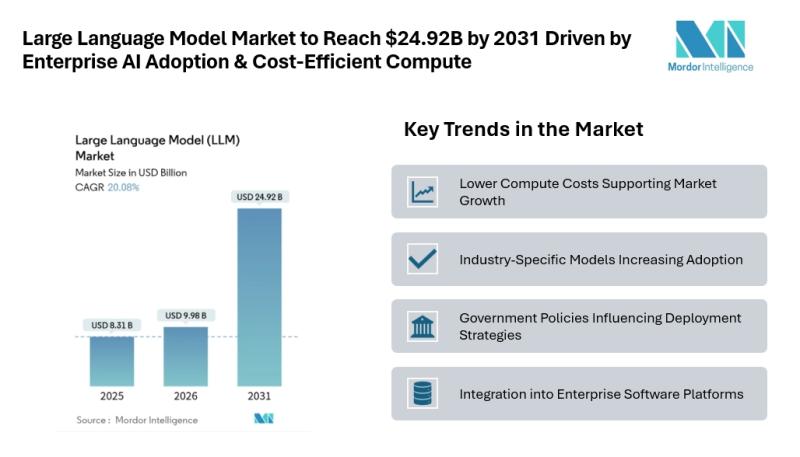

Large Language Model Market to Reach $24.92B by 2031 Driven by Enterprise AI Ado …

Mordor Intelligence has published a new report on the large language model market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Large Language Model Market Outlook

According to Mordor Intelligence, the LLM market size [https://www.mordorintelligence.com/industry-reports/large-language-model-llm-market?utm_source=abnewswire] was valued at USD 8.31 billion in 2025 and is estimated to grow to USD 9.98 billion in 2026, reaching USD 24.92 billion by 2031 at a CAGR of 20.08% during the forecast period.…

Self Employed Tax Software UK: Why Freelancers and Sole Traders Are Switching to …

With Many individuals are seeking software that simplifies tax filing while ensuring full compliance with HMRC requirements. Manual spreadsheets and paper-based calculations are being replaced by real-time, automated systems that give users visibility over their tax position throughout the year. Among the platforms gaining traction is Pie, a UK-based digital tax app built specifically to support self-employed individuals with modern income needs.

LONDON, United Kingdom - February 19, 2026 - Demand…

CivicMail.org Reinvents Postcard Campaigns for Grassroots Advocacy

CivicMail.org aims to bring civic engagement back to basics through the power of pen, paper, and postage.

Image: https://www.abnewswire.com/upload/2026/02/2addd1e9e0381d7e2262e1edbb064123.jpg

CivicMail.org [https://civicmail.org/] has announced its launch to help Americans send real, physical postcards to their elected officials with just a few clicks, delivering personalized messages directly to the desks of decision-makers at the local, state, and federal levels.

Research shows [https://www.concordia.ca/news/stories/2021/09/24/personalized-messages-are-more-likely-to-get-a-response-from-politicians-new-research-finds.html] that physical mail carries more weight with elected officials than petitions, emails, or…

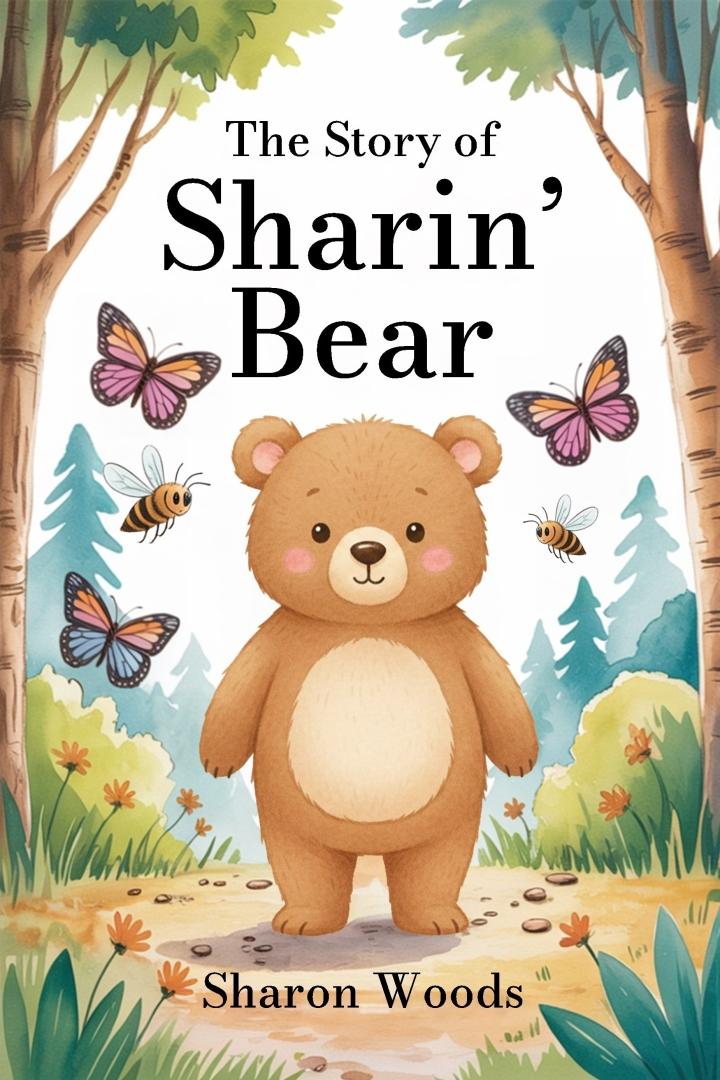

New Children's Story: The Story of Sharin' Bear

A Heartfelt Message Of Courage, Kindness, And The True Meaning Of Giving

A pleasant new story for children, The Story of Sharin' Bear by Sharon Woods , introduces families to a lovable little cub whose journey of bravery and compassion changes him into a representation of sharing for children globally.

Entrenched in adventure, innocence, and emotional growth, this uplifting tale offers an unforgettable reminder that even the smallest acts of kindness can…

More Releases for Infrastructure

The Rise & Rise Of Asian Infrastructure With Talisman Infrastructure Partners

The results are in, and during the first quarter of the 21st century the biggest beneficiary has easily been the Asia-Pacific region. Growing dramatically in head count and economic might, with huge upgrades in infrastructure, urbanization and a burgeoning middle class, this step-change has lifted an astounding 1.1 billion people out of poverty, arguably the greatest human achievement in recorded history.

Image: https://www.abnewswire.com/upload/2025/05/5c4342b0cf37947e4ab427efc61e2562.jpg

China has been the primary driver of Asia's economic…

Communication Infrastructure: The Backbone of 5G's Infrastructure Market Transfo …

The 5G infrastructure market is experiencing a period of explosive growth, driven by the promise of ultra-fast speeds, low latency, and massive connectivity. At the heart of this revolution lies the communication infrastructure segment, a critical area offering immense opportunities for innovation and expansion.

Market Dynamics and Growth Drivers

Communication infrastructure, encompassing the hardware and software that enable 5G networks, is the bedrock upon which the 5G ecosystem is built. From small…

Talisman Infrastructure Partners Cements Infrastructure Expansion in Henan Joint …

As the Spring breeze gently sways Ginkgo trees in the afternoon sun of China's Henan province, CEO of Hong Kong-based Talisman Infrastructure Partners [https://www.talismaninfrastructure.com], Mr. Christian Lindberg, lays out his firms latest mainland joint-venture partnership in collaboration with Cement producer, Henan Cement Stone Group, to develop and operate a mid-sized limestone quarry project in H2 2025.

Image: https://www.abnewswire.com/upload/2025/02/21711bb9a3a64ba252da643be0cd786d.jpg

"The ADB (Asian Development Bank) says Asia-Pacific requires an annual investment of US$1.7 trillion…

Hyper-Converged Infrastructure Market: A Revolution in IT Infrastructure

The hyper-converged infrastructure (HCI) market has witnessed significant growth in recent years, driven by advancements in technology, increasing data volumes, and the need for IT infrastructure that can scale efficiently and cost-effectively. This post will delve into the market, exploring its size, share, opportunities, challenges, demand, and trends.

Market Size and Share

The HCI market is a substantial segment of the global IT infrastructure market. While precise figures can vary depending on…

Infrastructure Construction Market Is Booming Worldwide | Gammon, GMR Infrastruc …

HTF MI broadcasted a new title “Infrastructure Construction Market in India 2017” with 59 pages and in-depth assessment including key market trends, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players such as Gammon India Limited, GMR Infrastructure Limited, Hindustan Construction Company Limited, IRB Infrastructure Developers Limited, Jaiprakash Associates Limited, Lanco Infratech Limited, Larsen & Toubro Limited, MEP Infrastructure Developers Limited, NCC…

Infrastructure Construction Market to Witness Huge Growth by 2015-2020 | Include …

HTF Market Intelligence released a new research report of 59 pages on title 'Infrastructure Construction Market in India 2017' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, Europe or Asia and important players such as Gammon India, GMR Infrastructure, Hindustan Construction, IRB Infrastructure, Jaiprakash Associates, Lanco Infratech, Larsen & Toubro, MEP Infrastructure Developers, NCC Ltd

Request a sample report @ https://www.htfmarketreport.com/sample-report/1304472-infrastructure-construction-market

Summary

HTF’S latest…