Press release

Top 30 Indonesian Forestry Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)The Indonesian forestry sector notably paper, pulp, timber and related products showed mixed performance in Q3 2025. While select public companies delivered improvements in earnings per share and net profits, others reported slower revenue growth or losses. Sector valuations remain relatively low compared to historical averages, signaling cautious investor sentiment despite pockets of operational strength.

PT Indah Kiat Pulp & Paper Tbk (INKP)

PT Pabrik Kertas Tjiwi Kimia Tbk (TKIM)

PT Toba Pulp Lestari Tbk (INRU)

PT Suparma Tbk (SPMA)

PT Indonesia Fibreboard Industry Tbk (IFII)

PT SLJ Global Tbk (SULI)

PT Inter Delta Tbk (INTD)

PT Indo Komoditi Korpora Tbk (INCF)

PT Wijaya Cahaya Timber Tbk (FWCT)

PT Kertas Basuki Rachmat Indonesia Tbk (KBRI)

PT Kedawung Setia Industrial Tbk (KDSI)

PT Sriwahana Adityakarta Tbk (SWAT)

PT Tirta Mahakam Resources Tbk (TIRT) forestry-linked paper/wood operations

PT Integra Indocabinet Tbk (WOOD IJ) IDX listed wood panel & furniture maker

PT Darmi Bersaudara Tbk (KAYU) wood products & export timber

PT Puri Sentul Permai Tbk (KDTN) industrial timber/wood products

PT Kencana Energi Lestari Tbk (KEEN) wood/biomass-linked operations

PT Mulia Boga Raya Tbk (MBRV) forms part of broader wood-related packaging supply

PT Pabrik Kertas Kedawung Tbk (related timber stock)

PT Multi Industry Indonesia Tbk (MIND) associated with wood components Industry observed

PT Asia Pacific Fibers Tbk (APF)* North Asia plywood & timber link

PT Ankha Prima Industri Tbk (APIN)* wood materials processing

PT Wood Manufacturing Tbk (WOOD*)* industry classification: timber processing

PT Fajar Surya Wisesa Tbk (FASW) paper & packaging

PT Alkindo Naratama Tbk (ALDO) paper & packaging (paper sacks)

PT Surya Pertiwi Tbk (SPTV) paper & packaging supplier

PT Sentra Pag... Tbk (paper/packaging exposure)

PT Indosemen Tbk (INDS) paper-related packaging business

PT Tjiwi Kimia subsidiaries or brother firms engaged in forest products

PT Pabrik Kertas Serang Tbk paper mill group

2) Q3 2025 Earnings Call Results of Top 10 Public Forestry Companies Summary & Numbers

1) PT Pabrik Kertas Tjiwi Kimia Tbk (TKIM)

Q3 2025 Performance

Net profit: Rp 3.56 trillion (~USD 214 million) in Q3 2025.

TKIM reported strong net margins largely due to cost controls and operational efficiencies despite some pressure on top-line revenue one of the better results among forestry/paper producers.

Key takeaway: TKIM is typically one of the largest pulp/paper operations in Indonesia and showed solid bottom-line performance in this quarter.

2) PT Indah Kiat Pulp & Paper Tbk (INKP)

Q3 2025 Insight

Detailed Q3 earnings figures (net profit) were not published in free online summaries at time of search, but INKP reported its quarterly earnings release on Dec 10, 2025.

Market data shows historical EPS revisions and performance metrics (e.g., stock EPS and revenue trend) and indicates earnings per share and net sales activity around the Q3 period.

Key takeaway: INKP remains a core forestry/paper company; detailed Q3 numbers often require access to its proprietary quarterly report.

3) PT Suparma Tbk (SPMA)

Q3 2025 Indicator

Earnings per share data shows EPS lower than prior year (e.g., 5.08 vs. 20.88 in 2024), a sign of profit compression for the quarter though exact net profit figure isnt publicly released in free sources.

Key takeaway: Spreads and margins were under pressure compared with prior periods.

4) PT Indonesia Fibreboard Industry Tbk (IFII)

Q3 2025 Indicator

EPS reported improved modestly (e.g., 4.84 vs 4.40 previous year) indicating steady earnings.

Key takeaway: IFII showed incremental year-on-year EPS improvement.

5) PT Toba Pulp Lestari Tbk (INRU)

Q3 2025 Result

Data from industry summaries indicates loss per share (~USD 0.003) in comparable reporting, suggesting an unprofitable quarter.

Key takeaway: INRU continued to face profitability challenges in Q3 2025.

6) PT Wijaya Cahaya Timber Tbk (FWCT)

Q3 2025 Indicator

EPS trend showed lower earnings vs prior year (7.61 vs 14.29), indicating reduced profitability though still profitable.

Key takeaway: Continued positive net earnings but at a compressed level.

7) PT SLJ Global Tbk (SULI)

Q3 2025 Indicator

Available data shows share performance growth and industry presence; profitability metrics specifically for Q3 are not publicly free.

Key takeaway: SULIs market cap and trading performance improved, though exact profit data is not broadly published.

8) PT Inter Delta Tbk (INTD)

Q3 2025 Indicator

Monthly share price and industry listing show active trade; no publicly available Q3 profit figures in open sources.

Key takeaway: Smaller forestry-linked firm; detailed earnings typically reported in IDX filings.

9) PT Indo Komoditi Korpora Tbk (INCF)

Q3 2025 Indicator

Listed in industry tables with share activity, but no free public Q3 profit figures accessible in searches.

Key takeaway: Earnings data is likely available in official company disclosures.

10) PT Kirana Megatara Tbk (KMTR)

Q3 2025 Indicator

Like smaller peers, limited public financial data for Q3 was found; regular share price range and listing are visible.

Key takeaway: Detailed Q3 financials generally reported only in official IDX disclosures and company filings.

3) Key Trends & Insights from Q3 2025

Sector Earnings Patterns

Several major pulp/paper firms reported EPS up despite weak revenue momentum, indicating cost control and operational focus.

Investor Sentiment

Current industry price-to-earnings multiples remain below long-term averages, suggesting markets dont expect rapid growth.

Export & Product Mix Shifts

Though pulp and paper exports maintain volume, signs point to lower softwood demand and price challenges in global supply chains.

Environmental & Regulatory Forces

Intensifying government enforcement (e.g., fines for illegal forest use) may shift operations towards sustainable and certified forestry practices.

4) Outlook for Q4 2025 and Beyond

Near-Term Performance Expectations

Analysts anticipate continued bottom-line resilience for best-in-class pulp/paper firms into Q4 due to operational controls.

Medium players may see margin pressure from raw material costs and currency volatility.

Regulatory Impact

Government crackdowns on illegal forest operations and new FX rules for export receipts could alter cash flow and profit recognition for forestry exporters.

Sustainability & Investment

Stakeholder pressure for sustainable forest finance continues to rise globally, potentially redirecting capital to ESG-compliant firms.

5) Conclusions

Q3 2025 was a pivotal quarter for Indonesian forestry companies:

Mixed earnings with some strong EPS results, but sluggish revenues in parts.

Investors remain cautious as valuations hover below historical norms.

Large pulp/paper producers maintained relative financial strength; smaller timber firms face tighter margins.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 30 Indonesian Forestry Public Companies Q3 2025 Revenue & Performance here

News-ID: 4325280 • Views: …

More Releases from QY Research

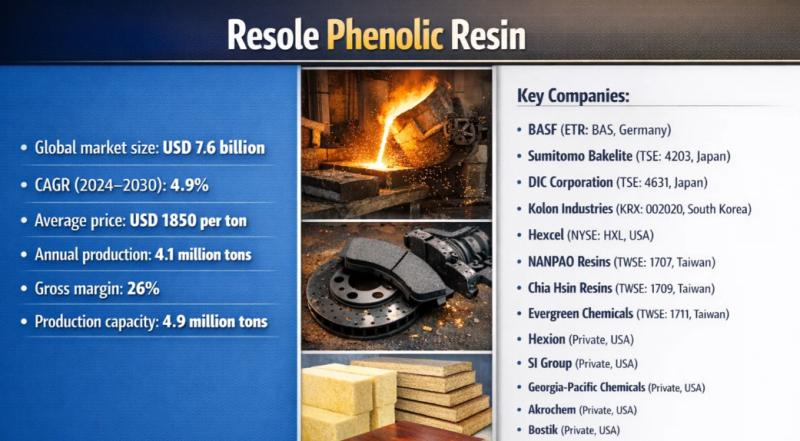

From Slow Cure to High Performance: Weyerhaeuser's Shift to Resole Phenolic Resi …

Problem

Weyerhaeuser Company using conventional thermoplastic binders or novolac-type phenolic systems faced limited heat resistance, slower curing, and additional curing-agent requirements. In applications such as wood panels, insulation, abrasives, refractories, and molded components, these limitations led to longer press cycles, insufficient thermal stability, and inconsistent mechanical performance under high-temperature or fire-exposed conditions.

Solution

Hexion adopted Resole Phenolic Resin, a thermosetting phenolic resin synthesized under alkaline conditions with a formaldehyde-to-phenol ratio greater than 1.…

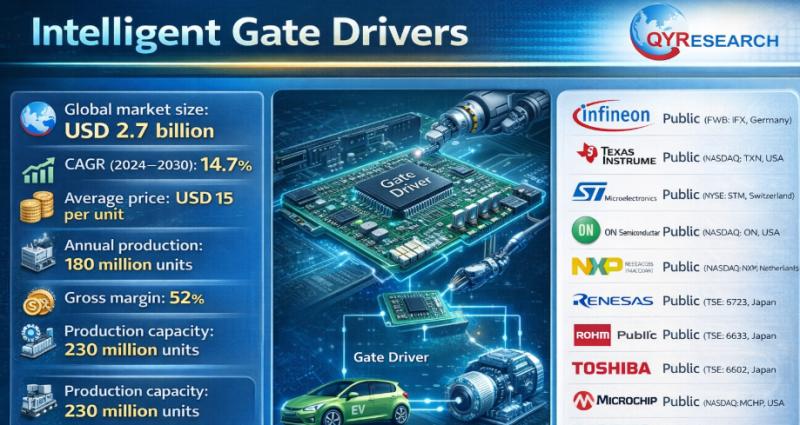

Global and U.S. Intelligent Gate Drivers Market Report, Published by QY Research …

QY Research has released a comprehensive new market report on Intelligent Gate Drivers, advanced semiconductor control components that integrate gate-driving, protection, sensing, and communication functions to manage power transistors such as IGBTs, MOSFETs, SiC MOSFETs, and GaN HEMTs. Unlike conventional gate drivers, intelligent gate drivers embed real-time monitoring, fault protection, and adaptive control, enabling higher efficiency, reliability, and safety in modern power electronic systems. As electrification accelerates across EVs, renewable…

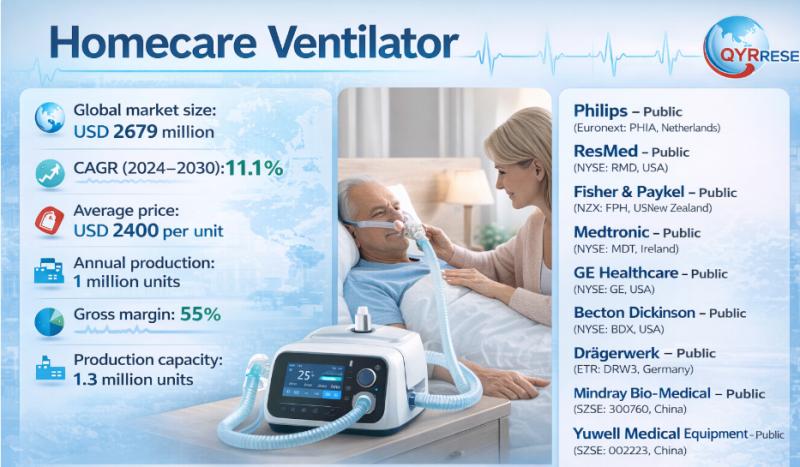

Global and U.S. Homecare Ventilator Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Homecare Ventilator, a medical device that assists or takes over a person's breathing outside of a hospital setting. Designed for long‐term respiratory support, these ventilators are used by people with chronic respiratory conditions such as COPD, neuromuscular disease, spinal injuries, or sleep‐related breathing disorders. Homecare ventilators are typically portable, quieter, and easier to operate than ICU ventilators.

Core Market Data

Global market…

Top 30 Indonesian Battery Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Aneka Tambang Tbk (ANTM) diversified metals (nickel & battery feedstock)

Bayan Resources Tbk (BYAN) large mining & metal revenue

AlamTri Resources / Adaro Energy Tbk (ADRO) diversified mining & metals

Indo Tambangraya Megah Tbk (ITMG) mining including metals exposure

PT Bukit Asam Tbk (PTBA) minerals/coal & metals linkage

Vale Indonesia Tbk (INCO) nickel & concentrates

PT Timah…

More Releases for Tbk

Indonesia Textile Industry Market Valuation Expected to Hit USD 28.57 billion by …

USA, New Jersey: According to Verified Market Research analysis, the global Indonesia Textile Industry Market size was valued at USD 21.7 Billion in 2023 and is projected to reach USD 28.57 Billion by 2031, growing at a CAGR of 3.50% from 2024 to 2031

How AI and Machine Learning Are Redefining the future of Indonesia Textile Industry Market?

AI-powered production planning systems optimize yarn selection, fabric blends, and loom utilization, improving output…

Infrastructure Market 2021 Strategic Assessments - PT. Acset Indonusa Tbk.., Pt. …

The Infrastructure Market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The Infrastructure sector in Indonesia is…

Indonesia Telecom Tower Market Demand, Size, Share, Scope & Forecast To 2025 |To …

The Indonesia telecom tower market accounted to US$ 557.9 Mn in 2017 and is expected to grow at a CAGR of 27.1% during the forecast period 2018 – 2025, to account to US$ 3,695.5 Mn by 2025.

Get Sample Copy of this Indonesia Telecom Tower Market research report at - https://www.businessmarketinsights.com/sample/TIPRE00004113

The Business Market Insights provides you regional research analysis on “Indonesia Telecom Tower Market” and forecast to 2025. The research report…

Coal Mining in Indonesia Market 2022| PT Bumi Resources Tbk, PT Adaro Energy Tbk …

Researchmoz added Most up-to-date research on "Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption" to its huge collection of research reports.

Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption

Summary

GlobalData's "Coal Mining in Indonesia to 2022", provides a comprehensive coverage on Indonesias coal industry. It provides historical and forecast data on coal production by grade, reserves, consumption and exports by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes

Summary

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by type; exports, exports by type and exports by country. Detailed analysis of the…