Press release

In-Depth Examination of Segments, Industry Trends, and Key Players in the Merchant Cash Advance Market

The merchant cash advance market is gaining significant traction as businesses seek more flexible financing options. With the rise of e-commerce and digital financial services, this sector is set for notable expansion. Below is an insightful overview of the market's size, key players, driving factors, trends, and segment dynamics that shape its future outlook.Expected Growth Trajectory of the Merchant Cash Advance Market

The merchant cash advance market is projected to experience substantial growth over the next several years. By 2029, its market size is anticipated to reach $25.38 billion, growing at a compound annual growth rate (CAGR) of 6.6%. This expansion is largely driven by factors such as expanding e-commerce activities, higher internet penetration, evolving consumer spending habits, regulatory changes, and broader acceptance of merchant cash advances. Key trends expected to influence the market include widespread adoption of digital payments, continuous technological advancements, progress in data analytics, innovations in financial technology, and a focus on tailored and personalized financing solutions.

Download a free sample of the merchant cash advance market report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=17201&type=smp

Prominent Players Leading the Merchant Cash Advance Industry

Several influential companies play a major role in the merchant cash advance sector. These include American Express Company, PayPal Holdings Inc., Stripe Capital Inc., Lendio Inc., Kabbage Inc., Square Capital LLC, CAN Capital Inc., OnDeck Capital Inc., National Funding, YouLend, Rapid Finance, Fora Financial LLC, Reliant Funding, Fundbox Inc., Credibly Holdings LLC, National Business Capital & Services, BFS Capital Inc., biz2credit Inc., Par Funding, Libertas Funding LLC, Greenbox Capital LLC, Kalamata Capital Group LLC, Perfect Alliance Capital LLC, Advance America Capital Corp, and Swift Capital.

Notably, in December 2022, South African digital bank TymeBank Holdings Limited acquired fintech company Retail Capital for R1.5 billion ($82.16 million). This deal enables TymeBank to broaden its product offerings by adding working capital financing solutions tailored for small and medium-sized enterprises (SMEs), building on Retail Capital's expertise in merchant cash advance services.

View the full merchant cash advance market report:

https://www.thebusinessresearchcompany.com/report/merchant-cash-advance-global-market-report

Key Drivers Accelerating Momentum in the Merchant Cash Advance Market

Innovation in payment flexibility is a major force propelling growth in this market. Companies are focusing on introducing flexible payment solutions that allow customers to select from various options such as installment payments, subscription models, or deferred repayments. This adaptability improves convenience and meets diverse financial requirements.

For example, in November 2022, Amazon Inc. launched a merchant cash advance program for U.S. sellers in collaboration with Parafin, a software firm. This initiative provides sellers with quick access to capital without interest or collateral, with repayments based on gross merchandise sales. Such programs demonstrate how market players are enhancing financing accessibility to support business growth.

Emerging Trends Creating New Prospects in the Merchant Cash Advance Market

Technological innovation continues to shape the merchant cash advance ecosystem. Enhanced data analytics and fintech advancements are enabling smarter underwriting and personalized loan offers, which improve the customer experience and reduce risk for lenders.

Additionally, the growing acceptance of digital payments and integration with e-commerce platforms are expanding the reach of merchant cash advances. This ongoing digital transformation is expected to unlock further opportunities for both providers and small business borrowers.

Detailed Segmentation of the Merchant Cash Advance Market

The merchant cash advance market is categorized into specific segments based on type, repayment method, and application sector:

1) By Type:

- $5,000-250,000 (Small-Scale Merchant Cash Advances, Short-Term Cash Advances)

- $250,000-500,000 (Medium-Scale Merchant Cash Advances, Mid-Term Cash Advances)

- More than $500,000 (Large-Scale Merchant Cash Advances, Long-Term Cash Advances)

2) By Repayment Method:

- MCA Split

- Automated Clearing House (ACH)

- MCA Lockbox

3) By Application:

- Healthcare

- Manufacturing

- Retail and E-commerce

- Travel and Hospitality

- Energy and Utilities

- Information Technology (IT) and Telecom

- Other Applications

These segments provide a comprehensive framework for understanding the diverse needs and financing structures in the merchant cash advance market.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release In-Depth Examination of Segments, Industry Trends, and Key Players in the Merchant Cash Advance Market here

News-ID: 4325040 • Views: …

More Releases from The Business Research Company

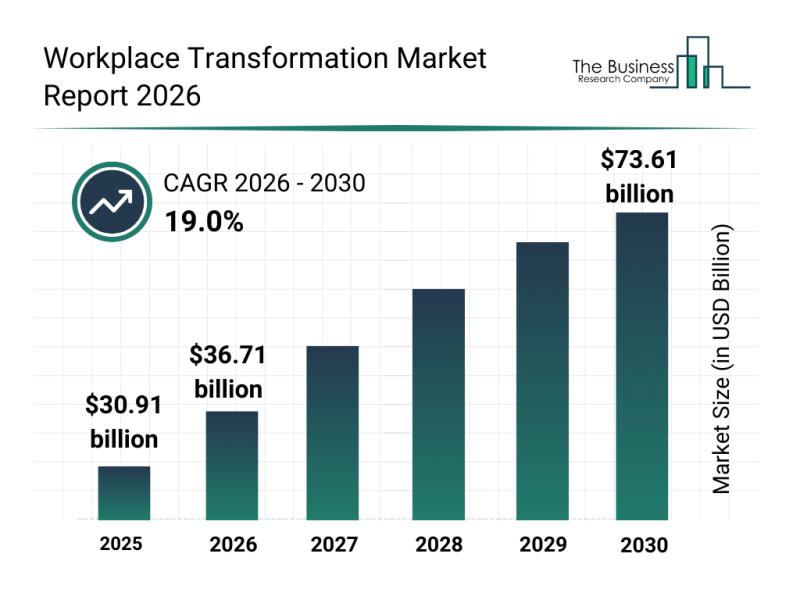

Emerging Sub-Segments Driving Change in the Workplace Transformation Market

The workplace transformation market is undergoing a significant evolution as organizations adapt to changing work environments and technology advancements. With the rise of hybrid models and digital tools, this market is set to experience rapid expansion in the coming years. Below, we explore its projected growth, key players, emerging trends, and detailed segmentation to provide a comprehensive overview of the sector's future direction.

Projected Market Size and Growth Trajectory of the…

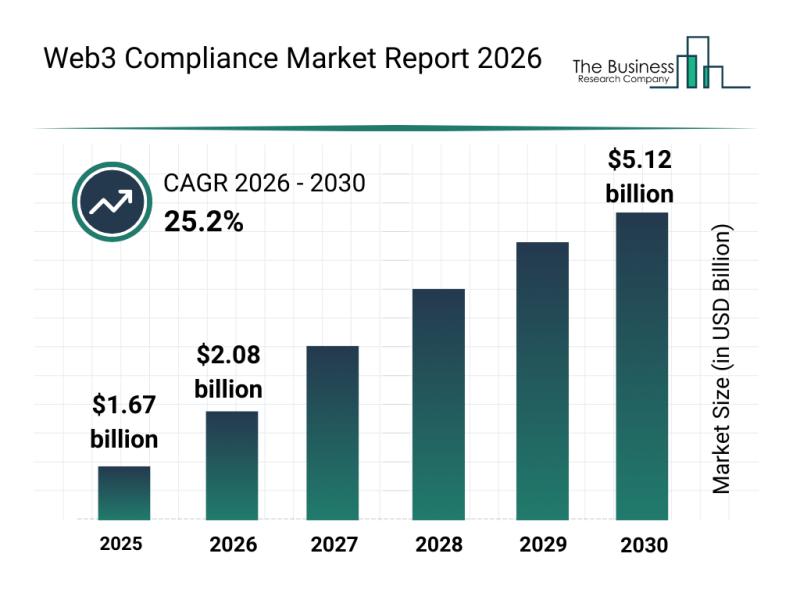

Analysis of Segmentation, Market Dynamics, and Competitive Landscape in the Web3 …

Exploring the promising future of the Web3 compliance sector reveals a landscape set for rapid expansion driven by technological advancements and increasing institutional interest. As blockchain technology and digital assets become more deeply embedded in global finance and governance, the demand for robust compliance solutions is soaring. Below is a detailed overview of the Web3 compliance market's current trajectory, key players, evolving trends, and primary segments shaping its growth.

Projected Market…

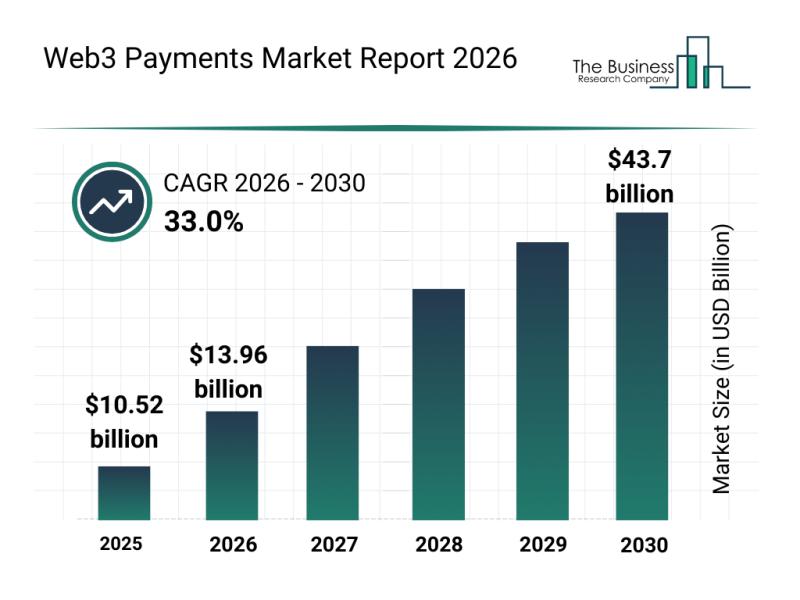

Top Companies and Market Competition in the Web3 Payments Sector

The Web3 payments market is on the brink of remarkable expansion as digital finance continues to evolve. This sector is experiencing rapid innovation driven by the increasing adoption of blockchain technologies and the growing demand for secure, efficient, and decentralized payment solutions. Let's explore the current market size, key drivers, prominent companies, trends, and growth opportunities shaping the future of Web3 payments.

Forecasted Growth and Market Size of the Web3 Payments…

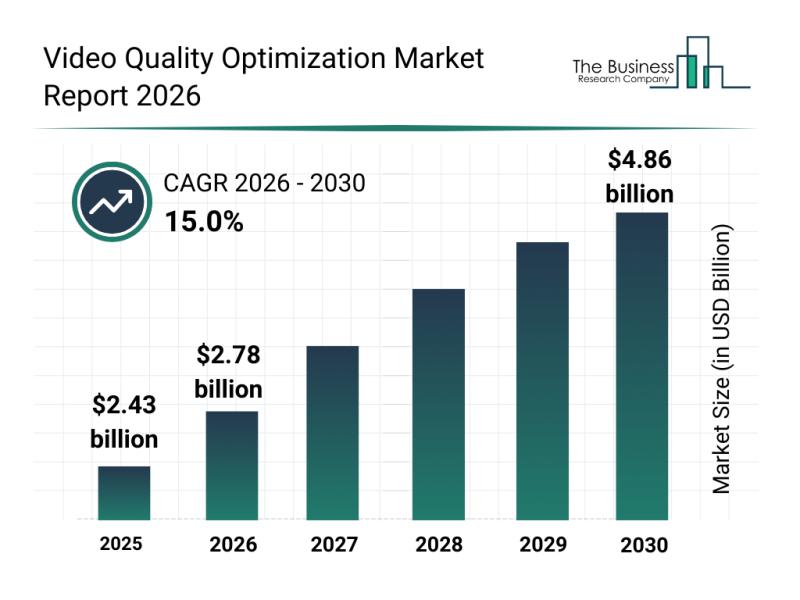

Analysis of Segments and Major Growth Areas in the Video Quality Optimization Ma …

The video quality optimization market is positioned for significant expansion as demand for high-resolution content and advanced streaming technologies increases. This sector is evolving rapidly, propelled by innovations that enhance video delivery and user experience across multiple platforms. Below, we explore the market size, leading players, influential trends, and detailed segment breakdowns shaping this dynamic industry.

Market Growth Outlook for the Video Quality Optimization Market by 2030

The video quality…

More Releases for Capital

Venture Capital Investment Market Is Booming Worldwide | Accel, Benchmark Cap …

Venture Capital Investment Market: The extensive research on Venture Capital Investment Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Venture Capital Investment Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the market, such as…

Venture Capital & Private Equity Firms Market is Going to Boom | TPG Capital, GG …

The latest independent research document on Venture Capital & Private Equity Firms examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Venture Capital & Private Equity Firms study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth,…

Venture Capital Investment Market 2021 Is Booming Worldwide | Accel, Benchmark C …

Venture Capital Investment Market describes an in-depth evaluation and Covid19 Outbreak study on the present and future state of the Venture Capital Investment market across the globe, including valuable facts and figures. Venture Capital Investment Market provides information regarding the emerging opportunities in the market & the market drivers, trends & upcoming technologies that will boost these growth trends. The report provides a comprehensive overview including Definitions, Scope, Application, Production…

Risk Capital Investment Market Business Development Strategies 2020-2026 by Majo …

Risk Capital Investment Market - Global Analysis is an expert compiled study which provides a holistic view of the market covering current trends and future scope with respect to product/service, the report also covers competitive analysis to understand the presence of key vendors in the companies by analyzing their product/services, key financial facts, details SWOT analysis and key development in last three years. Further chapter such as industry landscape and…

Global Venture Capital Investment Market, Top key players are Accel, Benchmark C …

Global Venture Capital Investment Market Report 2019 - History, Present and Future

The global market size of Venture Capital Investment is $XX million in 2018 with XX CAGR from 2014 to 2018, and it is expected to reach $XX million by the end of 2024 with a CAGR of XX% from 2019 to 2024.

Global Venture Capital Investment Market Report 2019 - Market Size, Share, Price, Trend and Forecast is a professional…

Venture Capital Investment Market 2019 Trending Technologies, Developments, Key …

Fintech solutions provide alternative finance firms with a platform for investors to directly come across companies and individuals looking for equity financing and debt. The technology has enabled new players to take faster decisions, engage with customers more precisely, and run operations at low cost-to-income ratios compared with traditional banks

This report studies the Venture Capital Investment market status and outlook of Global and major regions, from angles of players,…