Press release

Key Trends and Emerging Changes Shaping the Financial Crime and Fraud Management Solutions Market Landscape

The financial crime and fraud management solutions sector is experiencing a surge in growth as organizations worldwide intensify efforts to combat increasingly sophisticated fraudulent activities. With the rise in digital transactions and evolving threats, this market is poised for significant expansion in the coming years. Let's explore the current market size, key players, emerging trends, and major segments shaping the industry's future.Projected Expansion of the Financial Crime and Fraud Management Solutions Market

The market for financial crime and fraud management solutions is set to expand rapidly, reaching a valuation of $36.17 billion by 2029. This growth represents a compound annual growth rate (CAGR) of 13.4%. Several factors are driving this upward trajectory, including a surge in fraud incidents, growing reliance on advanced analytics, increased digital payment activities, strong demand from financial institutions, and the broadening reach of financial services globally. Key trends expected to influence the market include greater adoption of robotic process automation, a transition to integrated fraud management platforms, widespread incorporation of artificial intelligence (AI) and machine learning (ML), increased use of cloud computing services, and the growing application of blockchain technology.

Download a free sample of the financial crime and fraud management solutions market report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18361&type=smp

Leading Companies Dominating the Financial Crime and Fraud Management Solutions Industry

A number of well-established corporations are prominent players in this market. These include Dell Technologies Inc., International Business Machines Corporation (IBM), Oracle Corporation, SAP SE, BAE Systems Applied Intelligence, Capgemini SE, Fiserv Inc., DXC Technology Company, Fidelity National Information Services Inc., LexisNexis Risk Solutions, Thomson Reuters Corporation, Experian Information Solutions Inc., Genpact, SAS Institute Inc., NICE Ltd., ACI Worldwide Inc., Fair Isaac Corporation, Temenos AG, Cloudera Inc., CRISIL Limited, Feedzai Inc., Featurespace Ltd., Securonix Inc., AxiomSL Inc., and Guardian Analytics Inc.

Significant Acquisitions Highlighting Market Development

In a notable move in May 2024, UK-based private equity firm Permira acquired BioCatch for $1.3 billion. This acquisition is strategic, as Permira intends to accelerate global growth and innovation in fraud detection by leveraging BioCatch's advanced behavioral biometric technologies. BioCatch focuses on developing cutting-edge solutions to combat financial crime, and this partnership aims to reinforce leadership in addressing growing fraud threats within the financial sector.

View the full financial crime and fraud management solutions market report:

https://www.thebusinessresearchcompany.com/report/financial-crime-and-fraud-management-solutions-global-market-report

Emerging Trends Unlocking New Opportunities in Financial Crime and Fraud Management

Industry leaders are placing strong emphasis on developing AI-driven solutions to advance fraud detection capabilities and optimize investigative processes. One such innovation is the AI-powered Automated Clearing House (ACH) fraud detection system, which specializes in identifying fraudulent activities related to ACH transactions-electronic payments and transfers processed through the ACH network.

For example, in June 2024, US-based fintech company Oscilar introduced an AI-powered ACH fraud detection platform tailored for fintech firms and financial institutions. This system integrates machine learning, generative AI, and real-time data analysis with transparency features to detect and prevent diverse fraud types, including first-party fraud, account takeovers, stolen credentials, sca*ms, business email compromise (BEC), money mule operations, and ACH check kiting. The technology analyzes banking patterns, verifies transaction intent, identifies emerging fraud methods, and supports risk teams in scaling their review processes efficiently.

Key Segments Driving the Financial Crime and Fraud Management Solutions Market

This market is segmented into several categories to better understand its structure and opportunities:

1) Component Types: Hardware, Software, and Services

2) Deployment Modes: On-Premise and Cloud-Based Systems

3) End Users: Banks, Credit Unions, Specialty Finance Companies, Thrifts, and Other Financial Service Providers

Further breakdowns include:

- Hardware: Security appliances, authentication gadgets, biometric devices, smart cards, and other hardware

- Software: Fraud detection and prevention software, risk management, anti-money laundering (AML) software, authentication and identity management solutions, compliance management, data analytics, and other fraud and crime management applications

- Services: Consulting, implementation and integration, managed services, and support and maintenance offerings

This detailed segmentation provides a comprehensive understanding of the market's diverse components and the various end users driving demand.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Key Trends and Emerging Changes Shaping the Financial Crime and Fraud Management Solutions Market Landscape here

News-ID: 4324936 • Views: …

More Releases from The Business Research Company

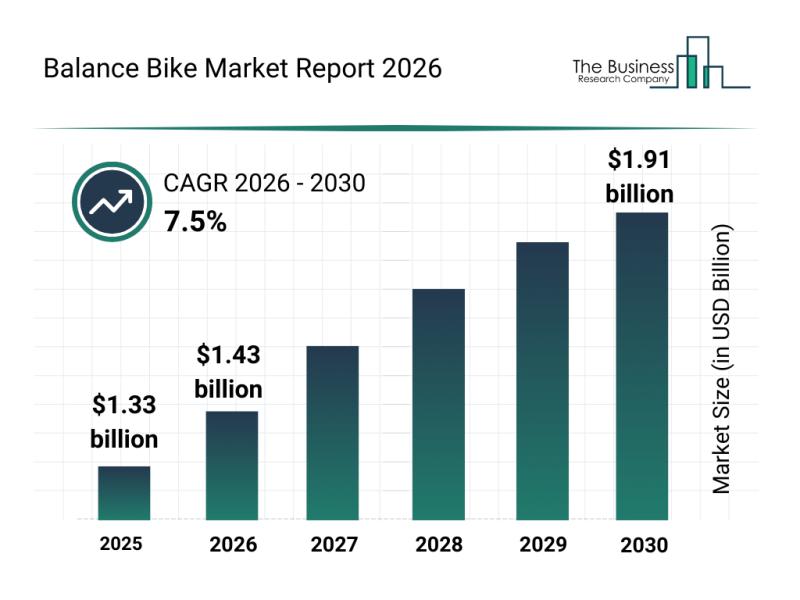

In-Depth Examination of Segments, Industry Trends, and Key Players in the Balanc …

The balance bike market is on track for notable expansion over the coming years, driven by shifting consumer preferences and technological advancements. With increasing focus on child safety and eco-friendly materials, this sector is evolving rapidly to meet the needs of modern families and young riders. Here, we explore the market's size, key players, emerging trends, and the main segments shaping its future.

Projected Growth Trajectory of the Balance Bike Market…

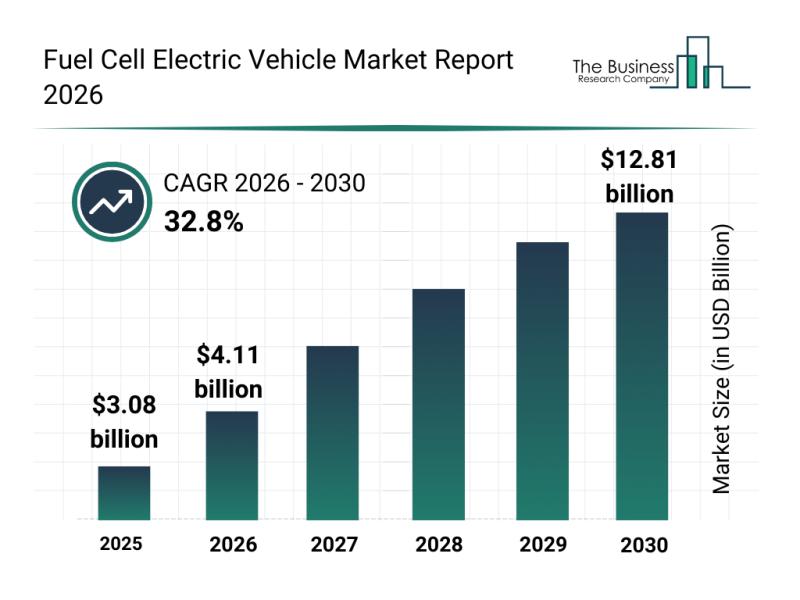

Analysis of Segments and Major Growth Areas in the Fuel Cell Electric Vehicle Ma …

The fuel cell electric vehicle (FCEV) market is on the brink of remarkable expansion as it gains traction globally. Driven by technological progress and growing environmental commitments, this sector is shaping the future of clean transportation. Let's explore the expected market growth, the leading companies involved, emerging trends, and key segments that define this evolving industry.

Projected Expansion and Market Size of the Fuel Cell Electric Vehicle Market

The fuel…

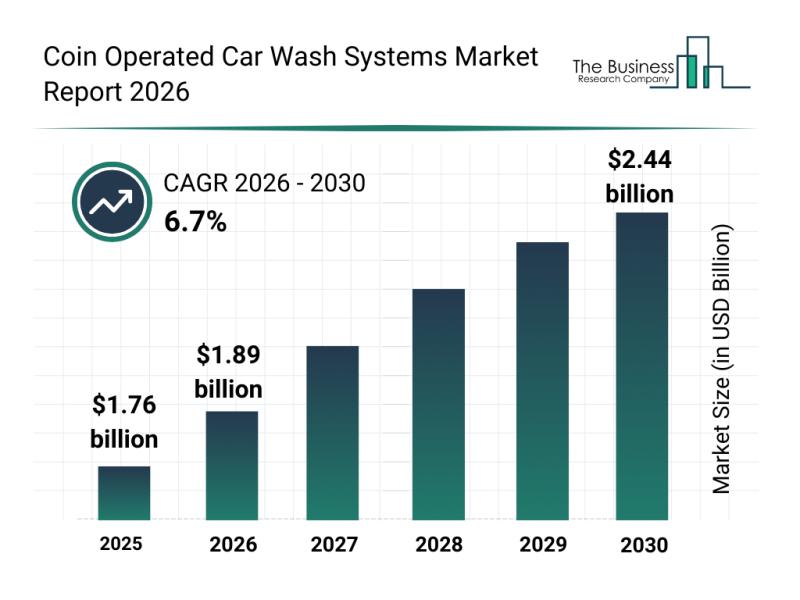

Analysis of Key Market Segments Influencing the Coin Operated Car Wash Systems M …

The coin operated car wash systems market is set to experience significant growth as it adapts to evolving technologies and customer preferences. With increasing emphasis on water conservation and automation, this sector is on track to expand steadily over the coming years. Let's explore the market size projections, major players, driving trends, and the segmentation that defines this industry.

Projected Expansion of the Coin Operated Car Wash Systems Market by 2030…

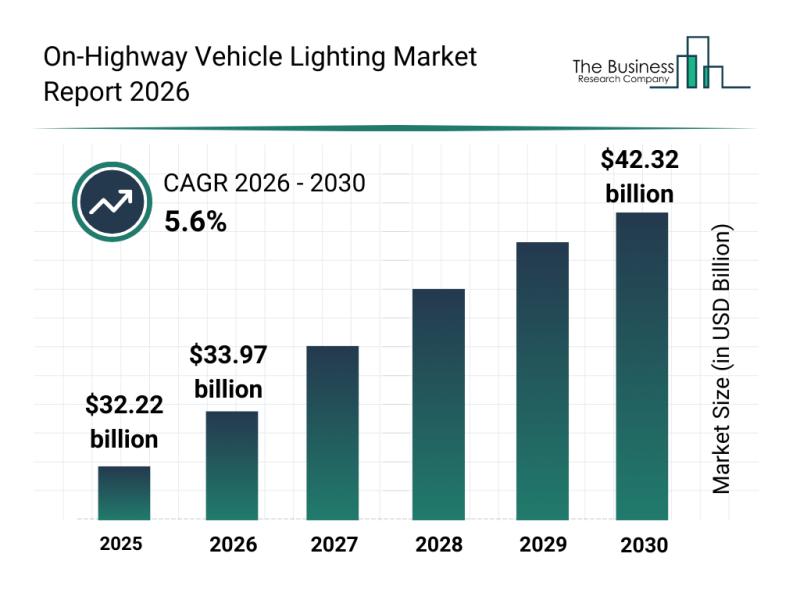

Key Strategic Developments and Emerging Changes Shaping the On-Highway Vehicle L …

The on-highway vehicle lighting market is positioned for notable expansion as technological advancements and evolving vehicle requirements continue to shape the industry. Innovations in lighting solutions aligned with increasing safety standards and the rise of smart vehicle systems are driving significant interest and investment in this sector. Below is an overview of the market size, leading companies, emerging trends, and segment dynamics that are defining the future of on-highway vehicle…

More Releases for Financial

Financial Leasing Services Market Share, Size, Financial Summaries Analysis from …

Infinity Business Insights has recently released a comprehensive research report titled "Financial Leasing Services Market Insights, Extending to 2031." This publication spans over 110+ pages and offers an engaging presentation with visually appealing tables and charts that are self-explanatory. The worldwide Financial Leasing Services market is expected to grow at a booming CAGR of 6.3% during 2024-2031. It also shows the importance of the Financial Leasing Services market main players…

Global Financial Aid Management Software Market Streamlining Financial Assistanc …

Overview for the report "Financial Aid Management Software Market" Helps in providing scope and definations, Key Findings, Growth Drivers, and Various Dynamics by Infinitybusinessinsights.com. This report will help the viewer in Better Decision Making.

At a predicted CAGR of 10.9% from 2023 to 2028, The Market for Financial Assistance Management Software will increase from USD 1.07 billion in 2022 to USD X.XX billion by 2030. The market's expansion can be attributed…

What will be Driving Growth Financial Leasing Market 2027 | Bank Financial Leasi …

Financial Leasing Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report analysis.

Ask for…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Is Booming | KLC Financial, SMFL Leasing, GM Financial, …

HTF MI recently introduced Global Financial Leasing Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Sumitomo Mitsui Finance and Leasing, Maldives, HNA Capital, KUKE S.A., KLC…

Financial Analytics Market: Banking & financial sector expected to make most of …

The Financial Analytics Market deals with the development, manufacture and distribution of financial analytics tools for enterprises of all kinds and sizes. Financial data analytics can be described as a set of tools, techniques and processes used to find out answers for various business questions as well as to forecast future scenarios regarding finance and the economy.

The services provided by the Financial Analytics Market are used for analyzing the equity…