Press release

Competitive Landscape: Key Market Leaders and Emerging Participants in the Bancassurance Sector

The bancassurance sector is on track for significant growth in the coming years, driven by various market forces and evolving industry practices. This overview explores the expected market size, influential players, current trends, and key segments shaping the future of bancassurance globally.Projected Growth and Market Size of the Bancassurance Market

The bancassurance market is forecasted to expand impressively, reaching a valuation of $237.7 billion by 2029. This growth corresponds to a compound annual growth rate (CAGR) of 7.7% throughout the forecast period. Factors contributing to this expansion include ongoing regulatory reforms, demographic changes, evolving customer demands, globalization, and continued regulatory developments. Key trends expected to influence this market are digital transformation, increasing product personalization, closer integration with financial services, ongoing product innovation, and enhanced use of data analytics.

Download a free sample of the bancassurance market report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=16354&type=smp

Leading Players Driving the Bancassurance Industry

The bancassurance landscape features numerous prominent companies, including Allianz SE, AXA Group (AXA SA), Wells Fargo & Company, HSBC Holdings plc, Citigroup Inc., MetLife Inc., Assicurazioni Generali S.p.A., Prudential Financial Inc., American Express Company, BNP Paribas SA, ING Groep N.V., Mitsubishi UFJ Financial Group Inc. (MUFG), Crédit Mutuel, Barclays PLC, Crédit Agricole SA, Intesa Sanpaolo S.p.A., Banco Bradesco S.A., Standard Chartered PLC, Nordea Bank Abp, Australia and New Zealand Banking Group Limited (ANZ), CNA Financial Corporation, Lloyds Banking Group plc, Bank of Nova Scotia (Scotiabank), ABN AMRO Group N.V., and Yes Bank Ltd.

Significant Acquisition Expanding Bancassurance Reach

In February 2022, HSBC Holdings plc, a UK-based banking and financial services firm, completed the acquisition of AXA Singapore for $575 million. This strategic move is anticipated to generate synergies and broaden the portfolio of financial products and services available to customers within Singapore. AXA Group is a notable provider of life, health, and general insurance solutions based in Singapore.

View the full bancassurance market report:

https://www.thebusinessresearchcompany.com/report/bancassurance-global-market-report

Technological Advances Shaping Bancassurance Trends

Bancassurance companies are increasingly adopting technological innovations such as digital insurance platforms to improve customer engagement, streamline processes, and customize insurance offerings. Digital insurance platforms utilize technology to simplify and automate the entire insurance experience - from purchasing to policy management and claims processing. For example, in October 2023, NCBA Bancassurance Intermediary LTD from Kenya launched a digital insurance portal designed to facilitate insurance management. This platform offers secure, self-service tools including quote comparisons, instant portfolio access, real-time claim submission and tracking, and easy premium payments.

Detailed Segmentation of the Bancassurance Market

The bancassurance market is segmented into various categories in this report:

1) Insurance Type: Life Insurance and Non-Life Insurance

2) Model Type: Pure Distributor Model, Strategic Alliance Model, Joint Venture Model, Financial Holding, and Other Model Types

3) End User: Personal and Business

Further breakdowns include:

- Life Insurance: Term Life Insurance, Whole Life Insurance, Endowment Policies, Universal Life Insurance, Unit-Linked Insurance Plans (Ulips), Pension Plans, Critical Illness Insurance, Annuities

- Non-Life Insurance: Health Insurance, Motor Insurance, Property Insurance, Travel Insurance, Homeowners Insurance, Liability Insurance, Personal Accident Insurance, Commercial Insurance (including Business Insurance), Marine and Aviation Insurance

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email us at info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Competitive Landscape: Key Market Leaders and Emerging Participants in the Bancassurance Sector here

News-ID: 4324825 • Views: …

More Releases from The Business Research Company

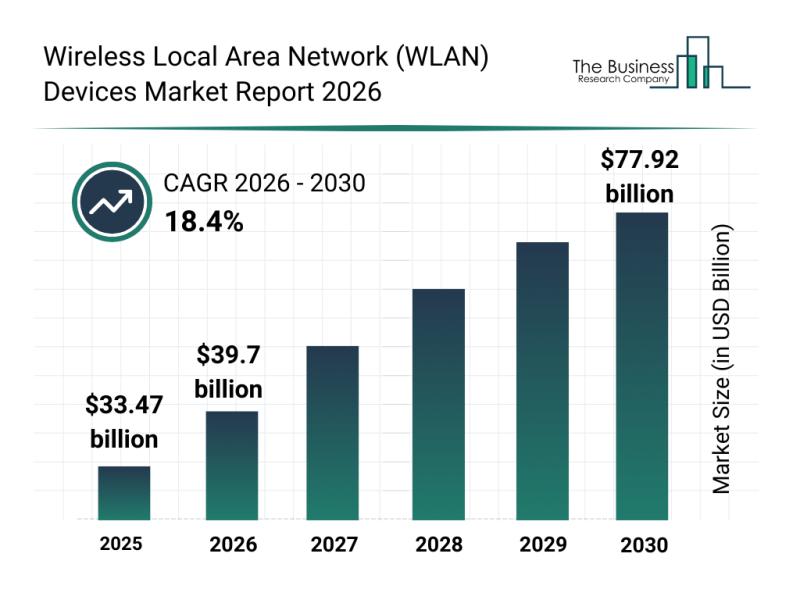

Key Strategic Developments and Emerging Changes Shaping the Wireless Local Area …

The Wireless Local Area Network (WLAN) devices market is positioned for impressive growth driven by technological advancements and increasing adoption across various sectors. With continuous innovation and expanding applications, this market is set to experience significant developments through 2030 and beyond. Let's explore the current market size, key players, emerging trends, and segmentation within this dynamic industry.

Projected Growth and Market Size of the Wireless Local Area Network Devices Market

The…

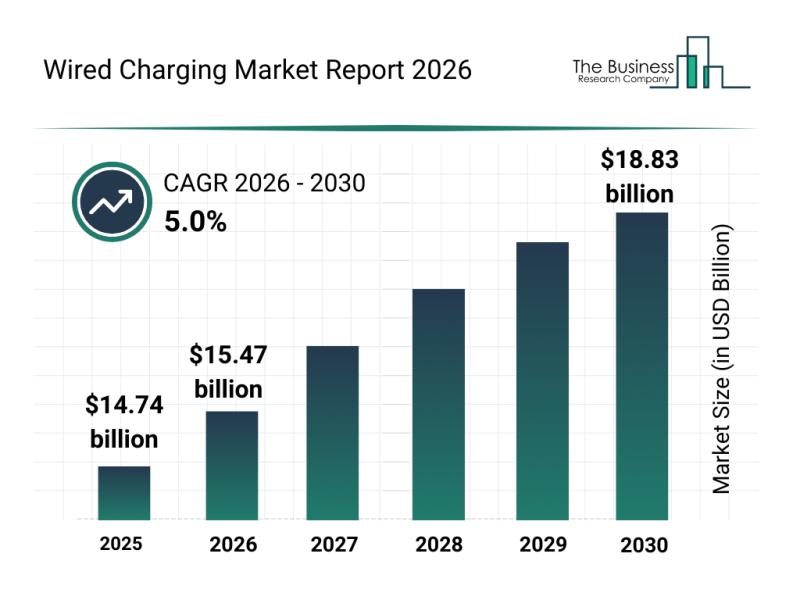

Segmentation, Major Trends, and Competitive Overview of the Wired Charging Marke …

The wired charging market is poised for significant expansion in the coming years, driven by technological advancements and increasing demand across various sectors. As devices and electric vehicles continue to evolve, the need for efficient and reliable wired charging solutions becomes more critical, shaping the future landscape of this market.

Projected Growth and Size of the Wired Charging Market by 2030

The wired charging market is anticipated to reach a value…

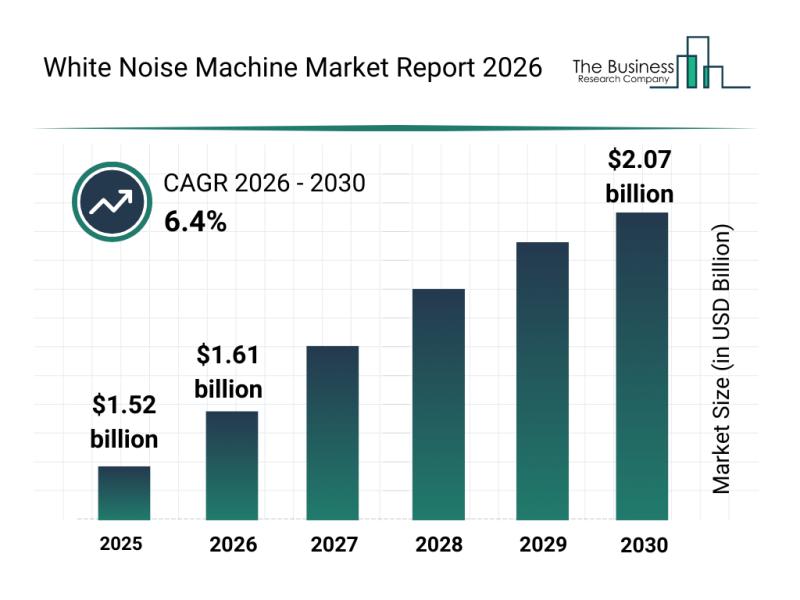

Top Players and Competitive Dynamics in the White Noise Machine Market

The white noise machine market is on track for substantial growth as consumer interest in wellness technology and sound therapy continues to rise. Increasingly, people are seeking devices that enhance sleep quality and relaxation, driving innovations and adoption across various user groups and applications. Let's explore the market's size projections, key players, emerging trends, and segmentation details that define this evolving industry.

Forecasted Expansion of the White Noise Machine Market by…

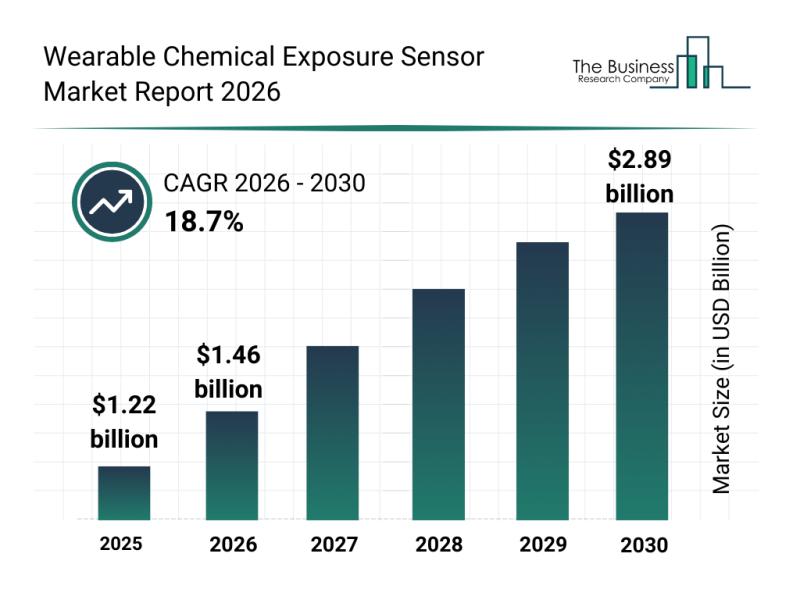

Market Segmentation, Major Trends, and Competitive Overview of the Wearable Chem …

The wearable chemical exposure sensor industry is rapidly emerging as a critical segment within safety and environmental monitoring markets. With increasing awareness about hazardous chemical exposure and advancements in sensor technology, the landscape is evolving quickly. Let's explore the market's size, major players, driving forces, key trends, and segmentation details to better understand its growth trajectory and future potential.

Projected Market Value and Growth Trajectory of the Wearable Chemical Exposure Sensor…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…