Press release

Emerging Sub-Segments Transforming the Burial Insurance Market Landscape

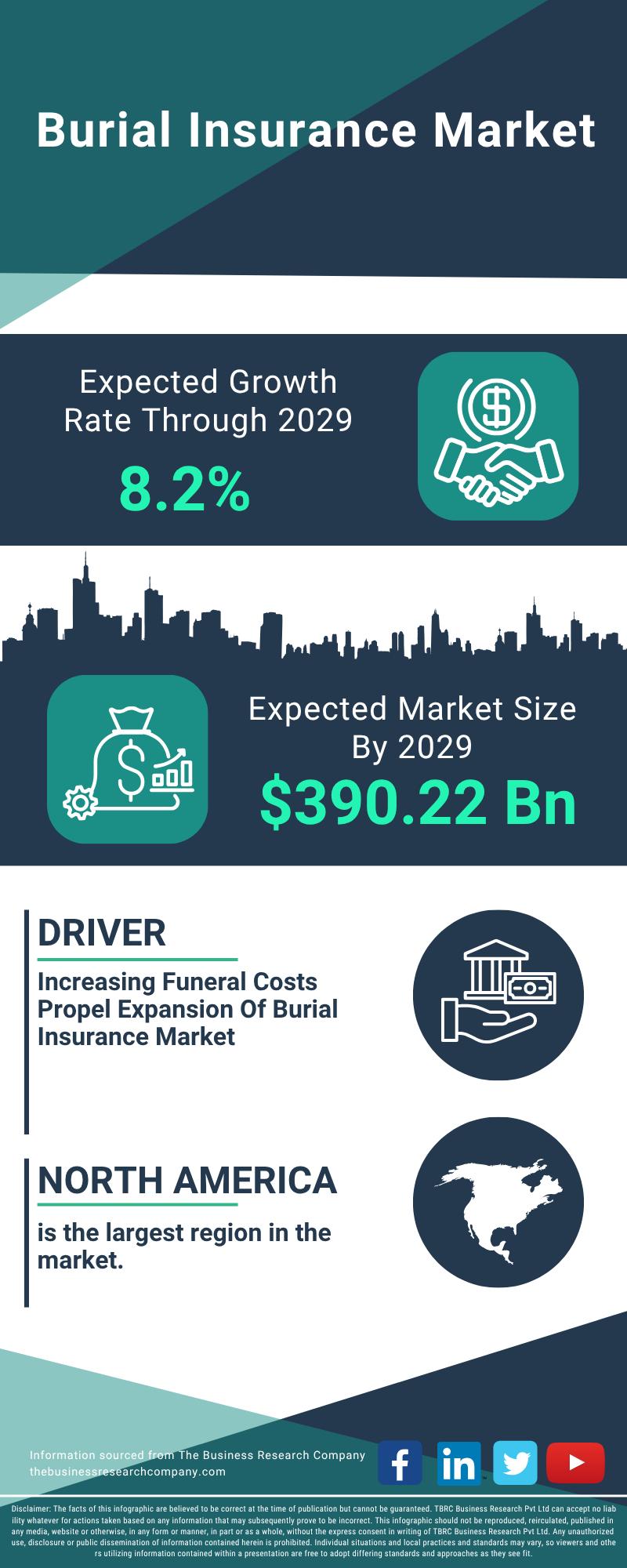

The burial insurance sector is poised for notable expansion in the coming years, driven by demographic shifts and technological advancements. This report delves into the market's size, key players, emerging trends, and important segments shaping the industry's future trajectory.Projected Growth and Market Size of the Burial Insurance Industry

The burial insurance market is forecasted to experience significant growth, reaching a value of $390.22 billion by 2029. This expansion corresponds to a compound annual growth rate (CAGR) of 8.2%. Several factors contribute to this promising outlook, including increased internet penetration, a rise in elderly populations, the prevalence of nuclear families, heightened competition alongside strategic partnerships, and a boost in disposable income. Additionally, the market is expected to evolve through advancements in insurance products, integration of value-added services, application of artificial intelligence (AI) and machine learning in underwriting, digital platform innovations, and ongoing technological progress.

Download a free sample of the burial insurance market report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18273&type=smp

Prominent Companies Driving the Burial Insurance Market

The burial insurance landscape is shaped by several leading organizations, including Cigna Group, Zurich Insurance Group Ltd., Prudential Financial Inc., Aviva PLC, New York Life Insurance Co., Hannover Ruck SE, The Massachusetts Mutual Life Insurance Company, Sun Life Financial Inc., The Hartford Financial Services Group Inc., Manulife Financial Corporation, Assurant Inc., Allianz SE, Globe Life Inc., Legal & General Group, Sentinel Security Life Insurance Company, Colonial Penn Life Insurance Company, The Baltimore Life Insurance Company, Dignity Memorial, Choice Mutual, Fidelity Life Assurance Company Limited, Titan Casket, and Sagicor Life Insurance Company.

In a notable move reflecting market consolidation, December 2022 saw Octopus Group, a UK-based holding company active in real estate, energy, venture capital, and investment management, acquire Guardian Angel for an undisclosed amount. Guardian Angel, also based in the UK, specializes in end-of-life planning services, including funeral and insurance offerings. This acquisition aims to broaden Octopus Group's portfolio in end-of-life financial and planning services.

Emerging Trends Highlighting New Opportunities in Burial Insurance

Leading players in the burial insurance market are increasingly focusing on funeral cash plans that offer quick financial assistance to cover funeral costs. These plans provide beneficiaries with lump sum payments, reducing the financial burden during difficult times. For example, in March 2024, Diaspora Insurance, a UK-based insurance and risk management firm, introduced an innovative group funeral insurance plan. This product targets diaspora communities with comprehensive and affordable coverage, including life, health, and group funeral insurance. It features fast payouts, flexible premiums, and a simplified claims process designed to meet the specific financial needs of these groups efficiently.

View the full burial insurance market report:

https://www.thebusinessresearchcompany.com/report/burial-insurance-global-market-report

Additional Market Drivers Supporting Burial Insurance Expansion

The growing elderly population is a major factor fueling the demand for burial insurance. As people age, the need for financial products that cover end-of-life expenses becomes increasingly important, encouraging more consumers to seek burial insurance solutions.

Moreover, the rising use of digital tools and the internet facilitates easier access to insurance products. This digital transformation allows insurance providers to reach wider customer bases and deliver tailored offerings through online platforms, supporting the market's robust growth.

Breakdown of Burial Insurance Market Segments

This report segments the burial insurance market into several key categories:

1) By Type: Simplified Issue, Guaranteed Issue, and Pre-Need Insurance

2) By Age of End-User: Over 50, Over 60, Over 70, Over 80

3) By Target Demographic: Seniors, Low-Income Individuals, Middle-Income Individuals

4) By Distribution Channel: Insurance Agents, Direct Sales, and Online Channels

Further sub-segments include:

- Simplified Issue: Simplified Issue Whole Life Insurance, Simplified Issue Term Life Insurance, Simplified Issue Burial Plans

- Guaranteed Issue: Guaranteed Issue Whole Life Insurance, Guaranteed Issue Final Expense Insurance

- Pre-Need Insurance: Pre-Need Burial Insurance Plans, Pre-Need Funeral Insurance

These classifications help provide a clearer understanding of the market landscape and consumer preferences across different groups and distribution methods.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Emerging Sub-Segments Transforming the Burial Insurance Market Landscape here

News-ID: 4324637 • Views: …

More Releases from The Business Research Company

Key Strategic Developments and Emerging Changes Shaping the Manual Paint Spray M …

The manual paint spray machine market is positioned for consistent advancement over the coming years, driven by evolving industrial needs and consumer preferences. This sector is influenced by several key factors that are shaping its growth trajectory and innovation landscape. Let's explore the current market size, the main companies involved, emerging trends, and how the market segments are structured.

Forecasted Market Size and Growth Outlook for Manual Paint Spray Machines

The…

Segmenting the Market, Identifying Key Trends, and Analyzing the Competitive Lan …

The machine tools market is poised for significant expansion over the coming years, fueled by advancements in technology and increasing industrial demands. As industries continue to modernize and automate, the need for more precise, efficient, and versatile machine tools becomes paramount. This overview delves into the projected market size, influential players, emerging trends, and key market segments shaping the future of this sector.

Forecasted Growth and Size of the Machine Tools…

Top Players and Competitive Dynamics in the Lithium-Ion Cell Post Processing Equ …

The lithium-ion cell post processing equipment sector is set for remarkable expansion as demand for electric vehicles and energy storage solutions accelerates worldwide. Innovations in battery manufacturing and automation are playing a crucial role in driving this market forward. Below, we explore the market's size trajectory, leading companies, emerging trends, and its segmentation for a comprehensive view of this evolving industry.

Projected Market Growth and Size of the Lithium-Ion Cell Post…

Segmentation, Major Trends, and Competitive Overview of the Linear Actuator Mark …

The linear actuator sector is on track for significant expansion as advancements in technology and industrial demands continue to rise. With applications growing across various industries, this market is set to experience substantial growth over the next several years. Below is a detailed look at the market size, leading players, influential trends, and segment breakdowns shaping the future of linear actuators.

Forecasted Size and Growth Prospects of the Linear Actuator Market…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…