Press release

Analysis of Segments and Major Growth Areas in the Automotive Usage-Based Insurance Market

The automotive insurance sector is undergoing a transformative phase with new models leveraging technology to tailor coverage based on actual vehicle usage. As innovations such as telematics and AI become more prevalent, the usage-based insurance market is set to experience substantial growth. Below, we explore the market's valuation outlook, the key players, emerging trends, and segmentation insights shaping this evolving industry.Automotive Usage-Based Insurance Market Size and Growth Forecast

The automotive usage-based insurance market is poised for rapid expansion, with its value projected to reach $111.73 billion by 2029. This represents a robust compound annual growth rate (CAGR) of 18.0%. The anticipated surge is driven by several critical factors, including advances in artificial intelligence and machine learning, improved data privacy and security protocols, the fusion of insurance services with smart home technologies, the increasing popularity of subscription-based insurance models, and heightened environmental awareness. Among the leading trends influencing this market are the incorporation of AI and machine learning to better evaluate risks, a shift toward more personalized and adaptable insurance plans, broader use of telematics in electric vehicles, utilization of real-time data from connected and autonomous cars, and the ongoing growth of subscription insurance offerings.

Download a free sample of the automotive usage-based insurance market report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18241&type=smp

Key Players Making an Impact in the Automotive Usage-Based Insurance Market

The market features a range of prominent companies actively shaping its direction. Some of the major players include State Farm, MetLife Services and Solutions LLC, Nationwide Mutual Insurance Company, Allstate Insurance Company, Progressive Casualty Insurance Company, Chubb Limited, The Travelers Indemnity Company, Aviva plc, Government Employees Insurance Company (GEICO), MAPFRE SA, American Family Insurance, Mitsui Sumitomo Insurance Group, Bajaj Finserv Limited, Verisk Analytics Inc., Liberty Mutual Group Inc., Root Insurance Company, The Zebra, Lemonade Inc., Berjaya Sompo Insurance Berhad, Arity LLC, Octo Telematics S.p.A, Insurethebox Limited, Flock Limited, and Mile Auto Inc.

A notable recent development occurred in July 2022 when Lemonade Life Insurance Agency LLC, a US-based insurer, acquired Metromile for $145 million. This strategic move is designed to strengthen Lemonade's vehicle insurance capabilities by utilizing Metromile's extensive data and technology resources. Through integrating Metromile's advanced telematics and data analytics, Lemonade aims to enhance the accuracy and competitiveness of its auto insurance offerings. Metromile is known for its pay-per-mile automobile usage-based insurance solutions in the US market.

View the full automotive usage-based insurance market report:

https://www.thebusinessresearchcompany.com/report/automotive-usage-based-insurance-global-market-report

Latest Trends Driving the Automotive Usage-Based Insurance Sector

Leading companies in the automotive usage-based insurance field are focusing on creating innovative offerings that personalize premiums based on actual vehicle usage. These models rely on data gathered from telematics systems that monitor driving behaviors such as speed, distance traveled, and frequency of trips. This approach enables insurers to tailor premiums more precisely, rewarding safe drivers and improving risk evaluation.

For example, in August 2024, Zuno General Insurance Limited from India rolled out the Pay How You Drive product. This insurance plan incentivizes safe driving by linking premiums to individual driving habits assessed via a mobile app that calculates a Zuno Driving Quotient. It provides customers with control over their insurance costs by offering discounts based on their driving scores and encourages safer driving through rewards and feedback.

Detailed Overview of Automotive Usage-Based Insurance Market Segments

This market is segmented in multiple ways to cover the diversity of offerings and customer needs:

1) By Type:

- Pay-As-You-Drive (PAYD)

- Pay-How-You-Drive (PHYD)

- Manage-How-You-Drive (MHYD)

2) By Vehicle Type:

- Passenger Cars

- Commercial Vehicles

3) By Technology:

- Black Box

- On-Board Diagnostics (OBD)-II

- Embedded

- Smartphone

- Other Technologies

4) By Distribution Channel:

- Insurance Companies

- Aggregator Platforms

5) By End-User:

- Individual Consumers

- Fleet Owners or Managers

Further subcategories include:

- PAYD segmented into Distance-Based, Time-Based, and Geographical insurance.

- PHYD divided into Driving Behavior-Based, Speed and Acceleration-Based, and Risk-Based insurance, such as harsh braking and cornering.

- MHYD covers Telematics-Driven insurance, Driver Coaching and Feedback-Based insurance, and Risk Reduction and Safety Enhancement insurance.

This comprehensive segmentation underscores the variety of specialized insurance products available to meet diverse customer preferences and evolving market demands.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Analysis of Segments and Major Growth Areas in the Automotive Usage-Based Insurance Market here

News-ID: 4324553 • Views: …

More Releases from The Business Research Company

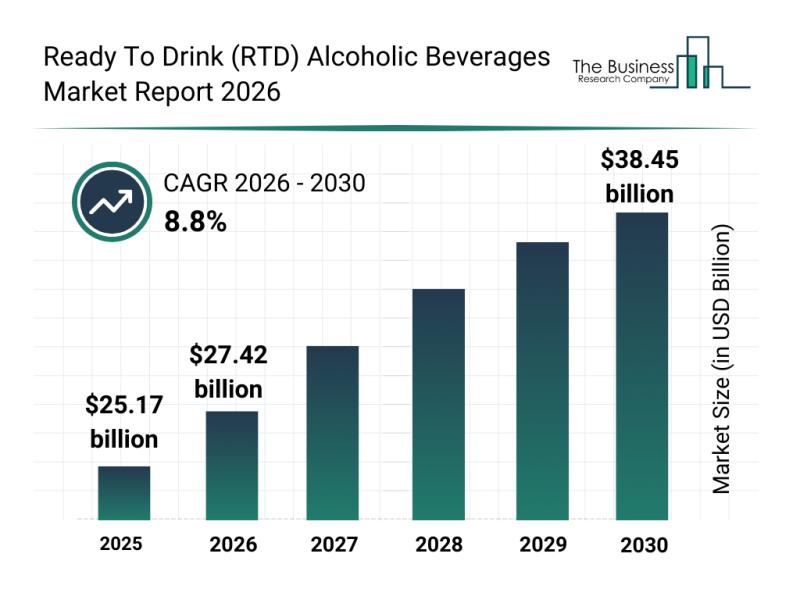

Outlook for the Ready To Drink (RTD) Alcoholic Beverages Market: Major Segments, …

The ready-to-drink (RTD) alcoholic beverages market is on track to experience significant growth over the coming years, driven by evolving consumer preferences and industry innovations. This sector is rapidly expanding as more consumers seek premium, convenient, and sustainable options in their alcoholic beverage choices. Let's explore the market's projected size, key drivers, major players, emerging trends, and segmentation details shaping its future.

Projected Expansion and Market Size of the Ready To…

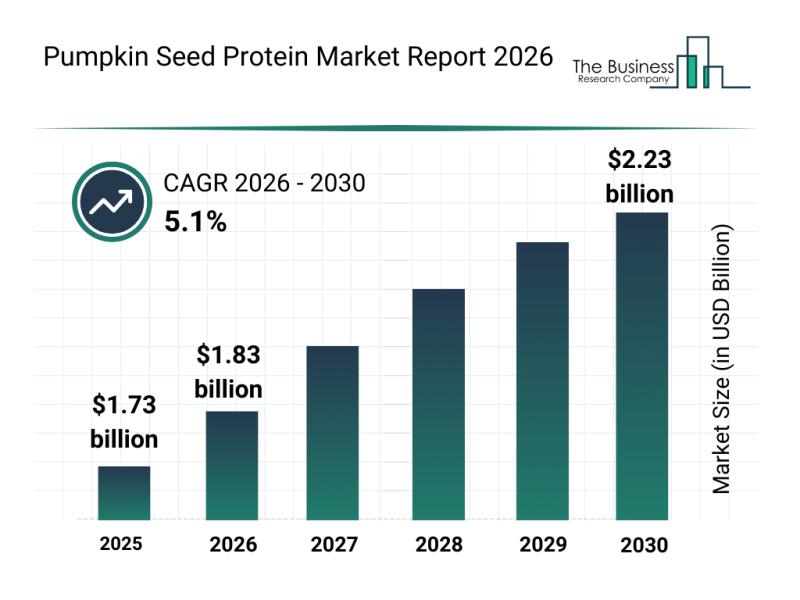

Emerging Sub-Segments Transforming the Pumpkin Seed Protein Market Landscape

The pumpkin seed protein market is emerging as a promising sector within the broader landscape of plant-based proteins. With increasing consumer interest in alternative, allergen-free protein sources and sustainable nutrition, this market is set to witness substantial growth and innovation. Let's explore the market size projections, key players, current trends, and major product segments shaping the future of pumpkin seed protein.

Projected Market Valuation and Growth Expectations for Pumpkin Seed Protein…

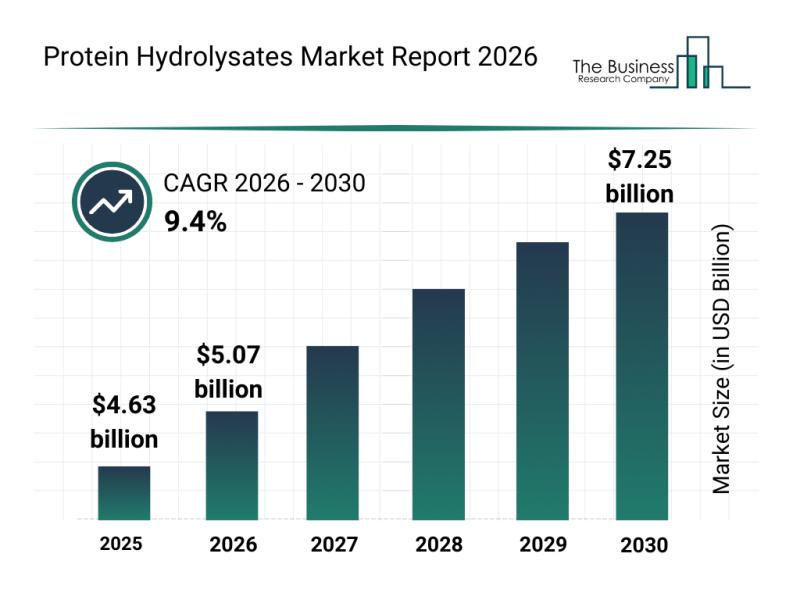

Top Players and Market Competition in the Protein Hydrolysates Industry

The protein hydrolysates market is positioned for significant expansion in the coming years as consumer preferences and nutritional science continue to evolve. With increasing attention on tailored nutrition solutions and the rise of plant-based options, this market is gearing up for robust growth and innovation.

Protein Hydrolysates Market Size Projections Through 2030

The protein hydrolysates market is forecasted to grow substantially, reaching a value of $7.25 billion by 2030. This…

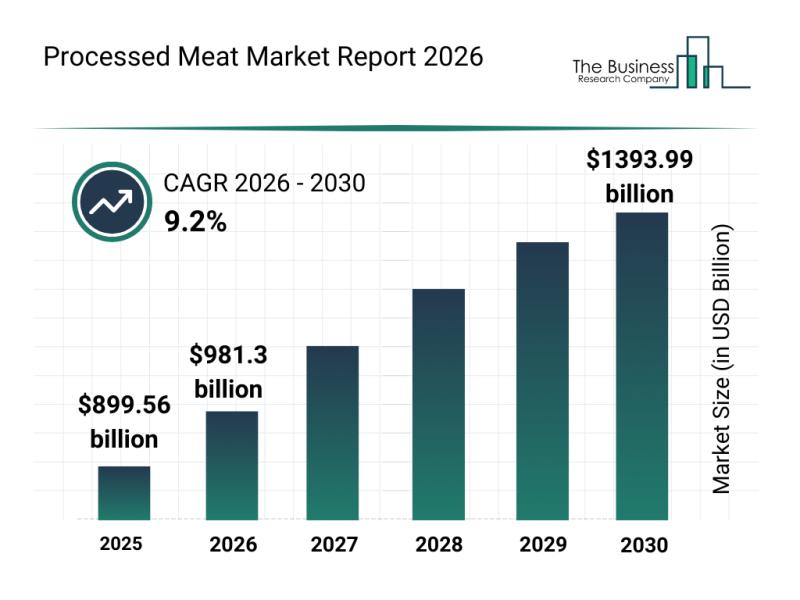

Processed Meat Market Overview: Major Segments, Strategic Developments, and Lead …

The processed meat industry is positioned for substantial expansion over the coming years, driven by evolving consumer preferences and technological advancements. As the market adapts to changing demands and regulatory landscapes, it is expected to reach impressive valuation milestones. Let's explore the current market size, key players, emerging trends, and detailed segment analyses shaping this sector's future.

Forecasted Market Size and Growth Trajectory of the Processed Meat Market

The processed…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…