Press release

Top Players and Industry Competition in the Livestock Insurance Market

The livestock insurance market is gaining significant attention as various factors come into play that impact the agricultural and farming sectors worldwide. With increasing risks associated with changes in the environment and animal health, this market is set to expand considerably over the coming years. Here is a detailed overview of the market's size, key players, emerging trends, and segmentation.Livestock Insurance Market Size and Growth Projections

The livestock insurance market is projected to reach a valuation of $5.34 billion by 2029, growing at a compound annual growth rate (CAGR) of 7.9%. This steady increase is driven by several factors including the effects of climate change on disease outbreaks among animals, stricter regulations surrounding globalization and animal transport, rising awareness and use of insurance policies, economic uncertainties, and government incentives. Additionally, advancements in technology, the use of data analytics, blockchain for enhanced transparency, remote monitoring solutions, and strategic partnerships are expected to shape the market's trajectory in the forecast period.

Download a free sample of the livestock insurance market report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=16466&type=smp

Key Players Leading the Livestock Insurance Industry

A number of prominent companies dominate the livestock insurance landscape, playing pivotal roles in market development. Some of the leading firms include Allianz SE, Munich Reinsurance Company, Nationwide Mutual Insurance Company, Liberty Mutual Insurance Company, Swiss Reinsurance Company Ltd, Zurich Insurance Group Ltd., Chubb Limited, Sompo Holdings Inc., The Hartford Financial Services Group Inc., AXA XL, American Family Insurance, QBE Insurance Group Ltd., Shelter Insurance Companies, Lloyd's of London, ICICI Lombard General Insurance Company Limited, Howden Insurance & Reinsurance Brokers (Philippines) Inc., HDFC ERGO General Insurance Company Limited, Farm Bureau Financial Services, Future Generali India Insurance Company Ltd., FBL Financial Group Inc., Rural Mutual Insurance Company, The Accel Group, Farmers Mutual Hail Insurance Company of Iowa, GramCover, and The Bath State Bank.

Strategic Moves in the Livestock Insurance Sector

In a recent development from October 2024, Specialist Risk Group (SRG), a UK-based firm specializing in insurance and risk management, acquired Stonehatch Risk Solutions Limited. Although the financial details were not disclosed, this acquisition is intended to strengthen SRG's expertise in bloodstock and livestock insurance by incorporating Stonehatch's specialized knowledge and expanding its equine insurance portfolio. Stonehatch Risk Solutions Limited is recognized for its focus on livestock insurance in the UK market.

View the full livestock insurance market report:

https://www.thebusinessresearchcompany.com/report/livestock-insurance-global-market-report

Emerging Trends Shaping the Livestock Insurance Market

Companies within the livestock insurance sector are actively innovating products that offer enhanced benefits. One notable trend is the introduction of parametric heat-stress insurance, designed to deliver more accurate and timely coverage. This type of insurance pays out when certain weather conditions indicating heat stress occur, rather than based on actual losses suffered by farmers. For example, in May 2023, NFU Mutual, a UK rural insurer, partnered with Skyline Partners, Markel Group, and Arthur J. Gallagher & Co. to launch a pioneering parametric heat-stress insurance product targeted at UK dairy farmers. This innovative policy uses an index-based system that triggers payouts based on satellite and weather station data, helping to mitigate financial losses due to heat stress in cattle.

Breakdown of Livestock Insurance Market Segments

The livestock insurance market is categorized into several key segments to address different coverage needs and customer profiles. These include:

Coverage Type

- Mortality

- Revenue

- Other Coverage

Animal Type

- Bovine

- Swine

- Sheep and Goats

- Poultry

- Other Animals

Distribution Channels

- Direct

- Agency or Broker

- Bancassurance

- Other Channels

End Users

- Commercial

- Individuals

Further subdivisions include:

Mortality Coverage by accidental mortality, disease-related mortality, and natural disaster-related mortality;

Revenue coverage by market price coverage, income loss coverage, and price guarantee coverage;

Other coverage options such as theft, transit, and emergency surgery coverage.

This detailed segmentation allows for tailored insurance solutions that meet the diverse and evolving needs of livestock owners across the globe.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top Players and Industry Competition in the Livestock Insurance Market here

News-ID: 4324512 • Views: …

More Releases from The Business Research Company

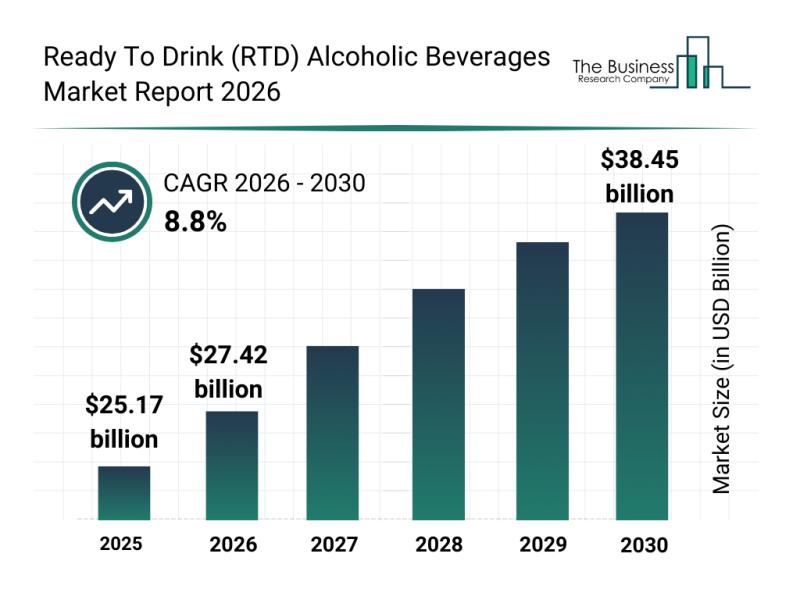

Outlook for the Ready To Drink (RTD) Alcoholic Beverages Market: Major Segments, …

The ready-to-drink (RTD) alcoholic beverages market is on track to experience significant growth over the coming years, driven by evolving consumer preferences and industry innovations. This sector is rapidly expanding as more consumers seek premium, convenient, and sustainable options in their alcoholic beverage choices. Let's explore the market's projected size, key drivers, major players, emerging trends, and segmentation details shaping its future.

Projected Expansion and Market Size of the Ready To…

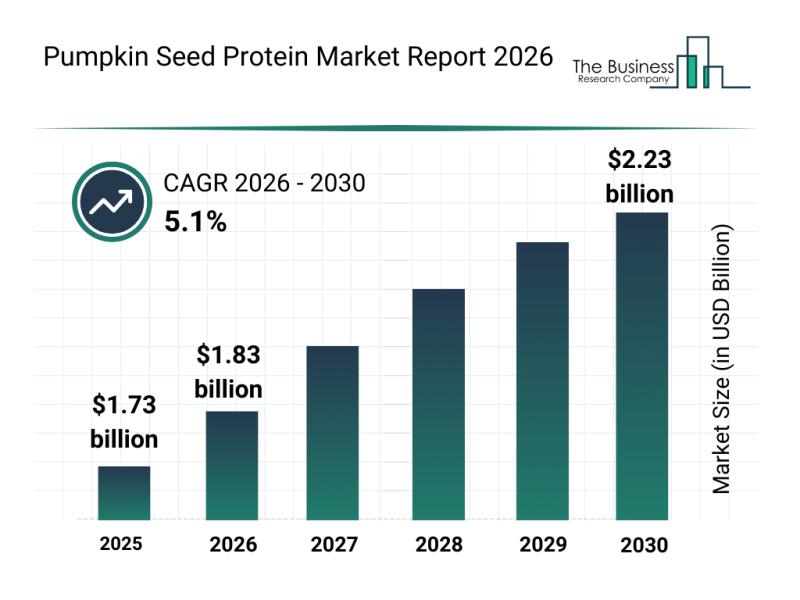

Emerging Sub-Segments Transforming the Pumpkin Seed Protein Market Landscape

The pumpkin seed protein market is emerging as a promising sector within the broader landscape of plant-based proteins. With increasing consumer interest in alternative, allergen-free protein sources and sustainable nutrition, this market is set to witness substantial growth and innovation. Let's explore the market size projections, key players, current trends, and major product segments shaping the future of pumpkin seed protein.

Projected Market Valuation and Growth Expectations for Pumpkin Seed Protein…

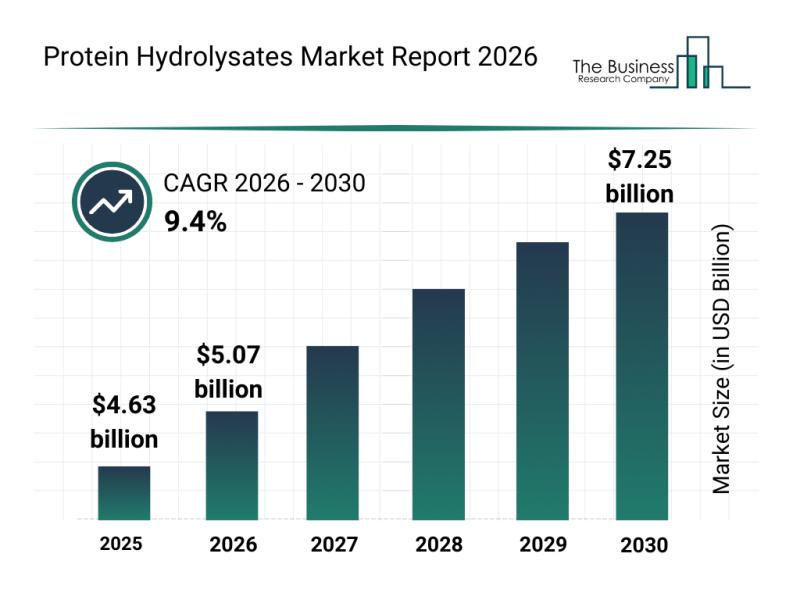

Top Players and Market Competition in the Protein Hydrolysates Industry

The protein hydrolysates market is positioned for significant expansion in the coming years as consumer preferences and nutritional science continue to evolve. With increasing attention on tailored nutrition solutions and the rise of plant-based options, this market is gearing up for robust growth and innovation.

Protein Hydrolysates Market Size Projections Through 2030

The protein hydrolysates market is forecasted to grow substantially, reaching a value of $7.25 billion by 2030. This…

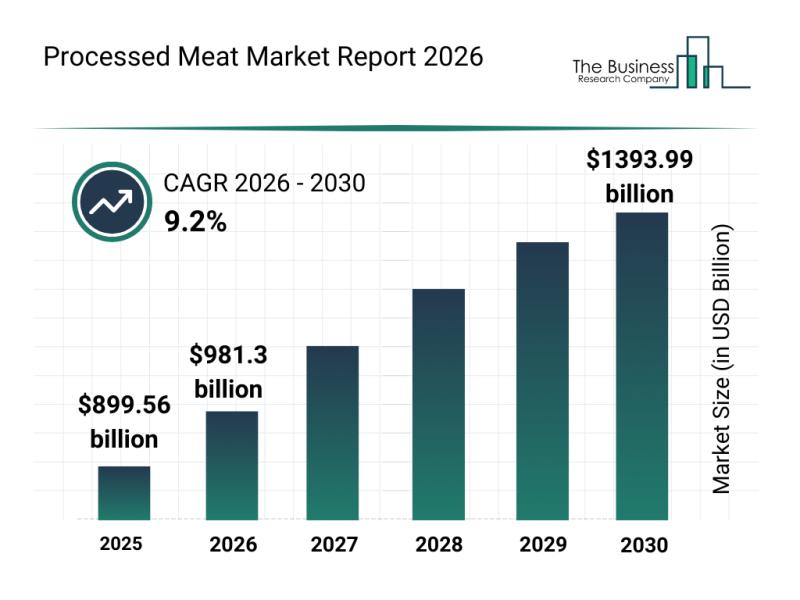

Processed Meat Market Overview: Major Segments, Strategic Developments, and Lead …

The processed meat industry is positioned for substantial expansion over the coming years, driven by evolving consumer preferences and technological advancements. As the market adapts to changing demands and regulatory landscapes, it is expected to reach impressive valuation milestones. Let's explore the current market size, key players, emerging trends, and detailed segment analyses shaping this sector's future.

Forecasted Market Size and Growth Trajectory of the Processed Meat Market

The processed…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…