Press release

Credit Card Market Overview: Major Segments, Strategic Developments, and Leading Companies

The credit card market is on a trajectory of significant growth, reflecting evolving consumer preferences and technological advancements. With innovations in payment methods and security features, the market is adapting swiftly to changing financial behaviors worldwide. Below is an in-depth examination of the market size, key players, influential trends, and detailed segmentation shaping this sector's future.Projected Growth and Market Size of the Credit Card Industry

The credit card market is anticipated to expand substantially, reaching a valuation of $930.03 billion by 2029. This growth will occur at a compound annual growth rate of 8.9%. Several factors contribute to this positive outlook, including the rising adoption of contactless payments, enhanced security and fraud prevention measures, integration with mobile wallets, and the launch of innovative, personalized card designs. Additionally, the increasing popularity of buy now, pay later (BNPL) options plays a crucial role. Key trends projected to influence the market over the coming years include a focus on personalized rewards programs, sustainability initiatives, incorporation of artificial intelligence, flexible payment solutions, and strict regulatory compliance alongside robust data security measures.

Download a free sample of the credit card market report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=3999&type=smp

Prominent Companies Leading the Credit Card Market

Several major players dominate the credit card landscape, including SBI Card and Payment Services Limited, JPMorgan Chase & Co., Bank of America Corporation, Citigroup Inc., Wells Fargo & Company, American Express Company, Capital One Financial Corporation, TD Bank N.A., Barclays plc, U.S. Bancorp, Truist Financial Corporation, The PNC Financial Services Group Inc., HDFC Bank Ltd., ICICI Bank Limited, Synchrony Financial, Discover Financial Services, SunTrust Banks Inc., Axis Bank Limited, Navy Federal Credit Union, BBVA Compass Bancshares Inc., Bank of Baroda, Pentagon Federal Credit Union, First National Bank of Omaha, Credit One Bank, Merrick Bank Corporation, Comenity Capital Bank, First Premier Bank, and Applied Bank.

Strategic Acquisition Enhancing Market Capabilities

In February 2023, Marqeta Inc., a US-based technology firm specializing in card and payment solutions for businesses, acquired Power Finance Corporation Inc. for $223 million. This move aims to broaden and accelerate Marqeta's credit product offerings. By integrating Power Finance's advanced technology and data science tools, Marqeta intends to deliver an expanded array of innovative credit services to its clientele. Power Finance Corporation serves as a credit card program management platform based in the United States.

View the full credit card market report:

https://www.thebusinessresearchcompany.com/report/credit-card-global-market-report

Emerging Trends Influencing the Credit Card Industry

Leading companies in the credit card space are increasingly forming strategic partnerships to boost technology adoption and widen their market presence. Such partnerships involve collaboration between organizations to pool resources and expertise toward shared objectives. For example, in June 2023, Federal Bank Limited, a private sector bank in India, partnered with Scapia Technology Private Limited, a fintech company also based in India, to launch the Federal Scapia Co-branded Credit Card. This card offers lifetime free membership with no initial or annual fees, enhancing affordability for customers. It supports contactless payments via the 'Tap and Pay' feature for smooth transactions and is accepted in over 150 countries at more than one million Visa merchant locations. Additionally, users can earn Scapia Coins with a rewarding 4% rate on travel bookings made through the Scapia app.

Further Innovations and Customer-Centric Features in Credit Cards

This strategic approach reflects a broader industry trend toward delivering convenience and value to cardholders. With features like global usability, rewards tailored to spending behaviors, and seamless payment experiences, credit card providers aim to attract and retain customers in a competitive market. The integration of technology and user-focused benefits continues to shape the credit card landscape.

Detailed Market Segmentation of the Credit Card Industry

This report categorizes the credit card market into several key segments:

1) By Type: Reward Card, Credit Builder Card, Travel Credit Card, Balance Transfer Card, Other Types

2) By Card Type: Base, Signature, Platinum

3) By Service Provider: Visa, Mastercard, Rupay, Other Service Providers

Subcategories under these segments include:

1) Reward Cards: Cashback Cards, Points-based Cards, Miles-based Cards, Category-specific Reward Cards

2) Credit Builder Cards: Secured Credit Cards, Student Credit Cards, Low-limit Credit Cards

3) Travel Credit Cards: Airline-branded Cards, Hotel-branded Cards, General Travel Rewards Cards, Premium Travel Cards

4) Balance Transfer Cards: Low or 0% APR for Balance Transfers, Long-term Balance Transfer Cards, Introductory Offer Balance Transfer Cards

5) Other Types: Business Credit Cards, Prepaid Credit Cards, Store Credit Cards, Co-branded Credit Cards, Corporate Cards

This comprehensive segmentation highlights the diverse range of credit card products available, catering to various consumer needs and preferences across different markets.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Credit Card Market Overview: Major Segments, Strategic Developments, and Leading Companies here

News-ID: 4324502 • Views: …

More Releases from The Business Research Company

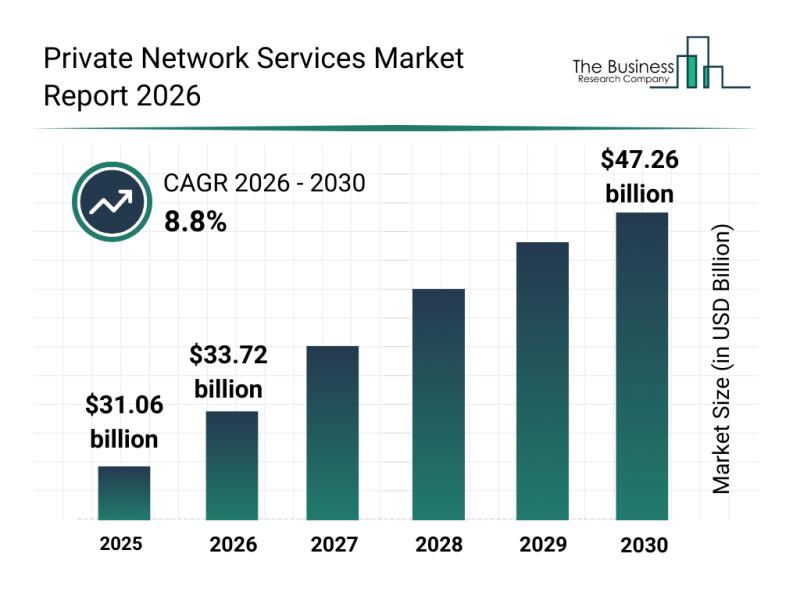

Leading Companies Fueling Innovation and Growth in the Private Network Services …

The private network services sector is set to experience remarkable growth as demand for secure, high-performance connectivity continues to rise across various industries. With advancements in wireless technology and evolving network needs, this market is positioning itself for widespread adoption and innovation over the coming years. Let's explore the market size, key players, driving trends, and segmentation to better understand what lies ahead.

Private Network Services Market Size and Growth Outlook…

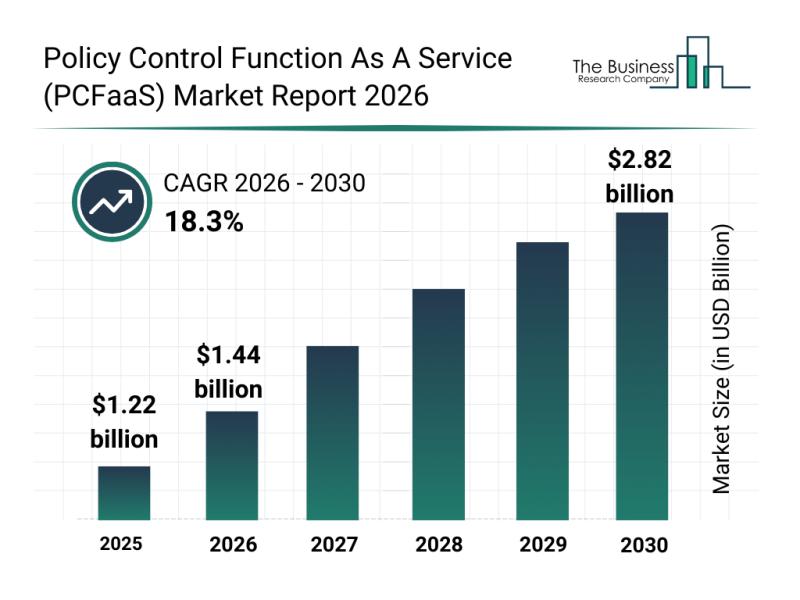

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the Po …

The policy control function as a service (PCFaaS) market is on track for substantial expansion over the coming years, driven by technological advancements and increasing demand in telecommunications. This sector is transforming rapidly as operators adapt to next-generation network requirements and cloud-native approaches. Let's delve into the market's expected valuation, key players, emerging trends, and notable segmentations shaping its future.

Significant Growth Forecast for the Policy Control Function As A Service…

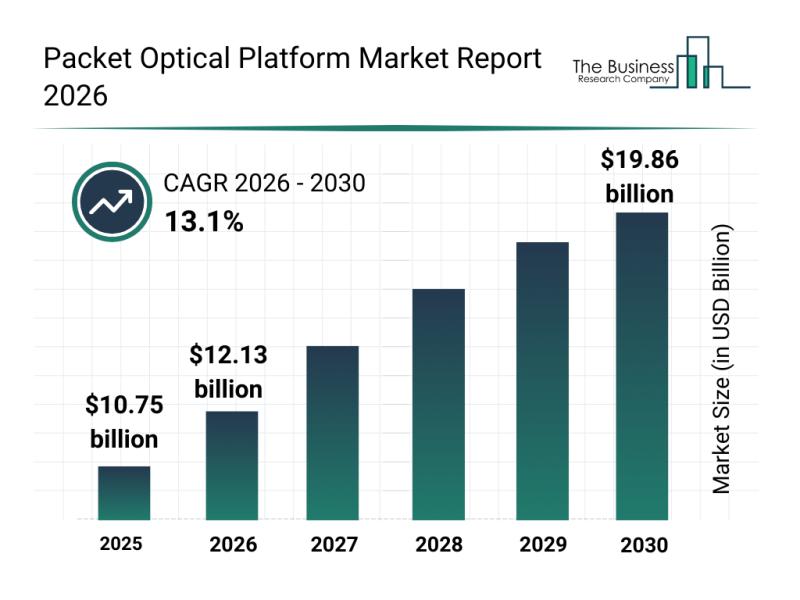

Top Players and Competitive Dynamics in the Packet Optical Platform Market

The packet optical platform market is positioned for significant expansion in the coming years, driven by advances in network technology and increasing demand for high-capacity data transmission. As digital infrastructure evolves, this sector is set to play a crucial role in supporting the growing needs of data centers, telecom providers, and cloud services. Let's explore the market's projected size, key players, emerging trends, and the segments contributing to its growth.

Forecasted…

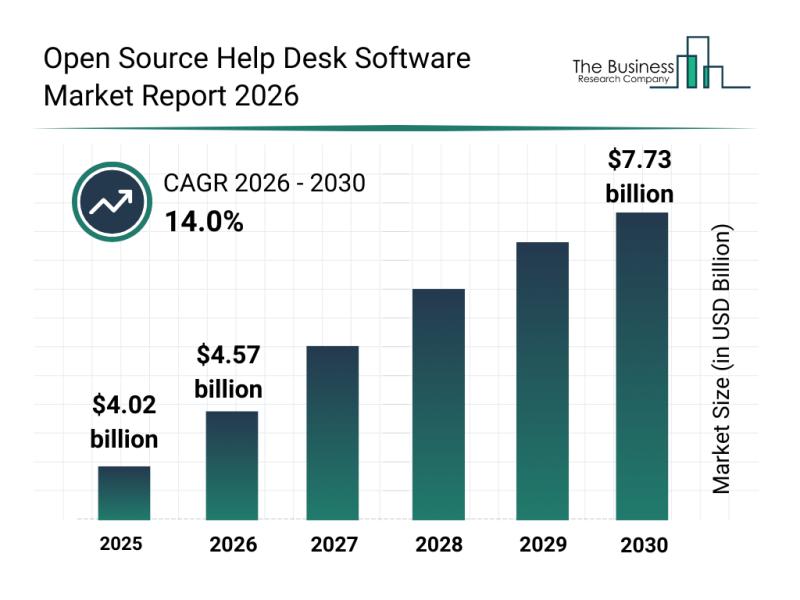

Analysis of Segmentation, Market Trends, and Competitive Landscape in the Open S …

The open source help desk software market is set to experience significant expansion in the coming years, driven by technological advancements and evolving business needs. As organizations increasingly embrace digital customer support, this market is positioned for notable growth through 2030. Below is an in-depth exploration of the market size, leading players, key trends, and segmentation insights.

Projected Market Size and Growth Rate of the Open Source Help Desk Software Market…

More Releases for Card

Gift Card and Incentive Card Market Set for Explosive Growth | National Gift Car …

A new business intelligence report released by AMA with title "Gift Card and Incentive Card Market" has abilities to raise as the most significant market worldwide as it has remained playing a remarkable role in establishing progressive impacts on the universal economy. The Global Gift Card and Incentive Card Market Report offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through…

IC Card/Smart Card Market 2022 | Detailed Report

The IC Card/Smart Card research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the IC Card/Smart Card research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope, market overview, and driving force.

Download FREE Sample Report…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future.

A new report published by Allied Market Research, titled, Prepaid Card Market…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future

Prepaid Card Market is projected to grow at a CAGR of 22.7%…

Card Intelligent Lock Market Report 2018: Segmentation by Type (Magnetic card Lo …

Global Card Intelligent Lock market research report provides company profile for Tri-circle, Dessmann, Royalwand, Bangpai, ZKTeco, Schlage, KEYLOCK, Yale, Tenon, KAADAS, BE-TECH and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also…

Prepaid Card Market Report 2018: Segmentation by Card Type (Single-purpose prepa …

Global Prepaid Card market research report provides company profile for Green Dot Corporation, NetSpend Holdings, Inc., H&R Block Inc., American Express Company, JPMorgan Chase & Co., PayPal Holdings, Inc., BBVA Compass Bancshares, Inc. and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and…