Press release

Satellite Internet Market to Reach US$ 47.59 Billion by 2032 at 17.67% CAGR; North America Leads with 38% Share - Key Players: SpaceX, Amazon, Viasat

The global Satellite Internet Market reached US$ 13.12 billion in 2024 and is expected to reach US$ 47.59 billion by 2032, growing at a CAGR of 17.67% during the forecast period 2025-2032. The market is expanding rapidly due to increasing demand for high-speed internet connectivity in remote, rural, and underserved regions where terrestrial broadband infrastructure is limited or unavailable.Satellite internet delivers broadband connectivity through satellites in geostationary (GEO), medium Earth orbit (MEO), and low Earth orbit (LEO), enabling wide-area coverage with minimal ground infrastructure. Advancements in LEO satellite constellations, declining launch costs, and improvements in satellite throughput and latency are significantly enhancing service quality. Growing adoption across sectors such as maritime, aviation, defense, disaster recovery, and enterprise connectivity, along with rising investments from major satellite operators and technology companies, is positioning satellite internet as a critical component of the global digital connectivity ecosystem.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/satellite-internet-market?sai-v

The Satellite Internet Market is the sector that provides broadband internet services via satellite networks, enabling connectivity in remote, rural, and underserved regions worldwide.

Key Developments

✅ October 2025: U.S. satellite internet providers expanded low Earth orbit (LEO) satellite deployments to deliver high-speed, low-latency broadband connectivity across rural, remote, and underserved regions.

✅ September 2025: European governments and telecom operators supported satellite broadband initiatives to strengthen digital sovereignty and improve connectivity resilience for critical infrastructure.

✅ August 2025: Asia-Pacific countries accelerated adoption of satellite internet services to support connectivity in geographically challenging regions, including islands, mountainous areas, and disaster-prone zones.

✅ July 2025: Global satellite operators enhanced next-generation satellites with higher throughput, advanced beamforming, and improved ground infrastructure to increase network capacity and reliability.

✅ May 2025: North American enterprises adopted satellite internet solutions to enable connectivity for aviation, maritime, defense, and remote industrial operations.

✅ March 2025: Emerging economies leveraged satellite broadband programs to bridge the digital divide and expand internet access for education, healthcare, and e-governance services.

Mergers & Acquisitions

✅ November 2025: A U.S.-based satellite communications company acquired a satellite networking technology firm to strengthen its broadband constellation management and ground segment capabilities.

✅ August 2025: A European satellite operator partnered with a global telecom provider to expand hybrid satellite-terrestrial internet services across multiple regions.

✅ June 2025: An Asia-Pacific satellite services company was acquired by an international aerospace group to scale next-generation satellite internet infrastructure and coverage.

Key Players

Space Exploration Technologies Corporation (SpaceX) | Amazon.com, Inc. | Viasat, Inc. | SES S.A. | Eutelsat Communications S.A. | Intelsat S.A. | Telesat Canada | Iridium Communications Inc. | AST SpaceMobile, Inc. | Gilat Satellite Networks Ltd.

Key Highlights

Space Exploration Technologies Corporation (SpaceX) - Holds a share of 27.8%: Dominates the satellite broadband market through Starlink, leveraging low Earth orbit (LEO) mega-constellations to deliver high-speed, low-latency global internet connectivity.

Amazon.com, Inc. - Holds a share of 18.6%: Expanding its presence via Project Kuiper, focusing on large-scale LEO satellite networks integrated with AWS cloud infrastructure.

Viasat, Inc. - Holds a share of 12.9%: Strong player in high-capacity geostationary (GEO) satellite broadband, serving aviation, defense, maritime, and remote connectivity markets.

SES S.A. - Holds a share of 10.7%: Operates a hybrid GEO and medium Earth orbit (MEO) satellite fleet, delivering high-performance connectivity for enterprises, governments, and telecom operators.

Eutelsat Communications S.A. - Holds a share of 8.9%: Provides satellite communications across Europe, Africa, and Asia, with growing investments in LEO constellations through strategic partnerships.

Intelsat S.A. - Holds a share of 7.6%: Offers global satellite communications services supporting mobility, media, and government connectivity requirements.

Telesat Canada - Holds a share of 5.4%: Focuses on advanced LEO satellite solutions through its Lightspeed constellation targeting enterprise and government customers.

Iridium Communications Inc. - Holds a share of 4.8%: Specializes in global LEO satellite voice and data services with complete worldwide coverage, including polar regions.

AST SpaceMobile, Inc. - Holds a share of 2.9%: Emerging innovator developing direct-to-smartphone satellite broadband services without the need for specialized terminals.

Gilat Satellite Networks Ltd. - Holds a share of 0.4%: Provides satellite ground equipment, network management solutions, and VSAT technologies supporting global satellite operators.

Purchase this report before year-end and unlock an exclusive 30% discount: https://www.datamintelligence.com/buy-now-page?report=satellite-internet-market?sai-v

(Purchase 2 or more Reports and get 50% Discount)

Market Drivers

- Rising demand for high-speed internet connectivity in underserved, rural, and remote regions where terrestrial broadband infrastructure is limited.

- Rapid deployment of low Earth orbit (LEO) satellite constellations enabling lower latency and wider coverage compared to traditional geostationary satellites.

- Increasing reliance on satellite internet for commercial applications such as maritime, aviation, enterprise connectivity, and mobile backhaul.

- Growth in remote work, e-learning, telemedicine, IoT, and digital services requiring reliable broadband access.

- Government initiatives and public-private partnerships aimed at bridging the digital divide and expanding national broadband coverage.

- Technological advancements in satellite payloads, beamforming, adaptive modulation, and network management improving service quality.

- Rising investments by major technology and aerospace companies accelerating innovation and market competition.

Industry Developments

- Expansion of LEO satellite constellations to improve global coverage and reduce latency.

- Strategic partnerships between satellite internet providers and telecom operators to expand regional connectivity.

- Deployment of high-throughput satellites using advanced frequency bands such as Ku-band and Ka-band.

- Integration of satellite internet with IoT networks for applications in agriculture, energy, logistics, and defense.

- Launch of mobility-focused satellite internet services for aviation, maritime, and land transportation.

- Increased government-backed programs using satellite broadband to serve remote households and enterprises.

- Growing competition among new and established players leading to improved affordability and service innovation.

Regional Insights

North America - 38% share: Driven by strong presence of satellite internet providers, high rural broadband demand, and supportive government connectivity programs.

Europe - 29% share: Supported by digital inclusion initiatives, rural connectivity projects, and investments in satellite infrastructure.

Asia Pacific - 25% share: Fueled by government-led digital transformation programs, rising internet demand, and expansion into remote and island regions.

Latin America - 4% share: Boosted by efforts to bridge connectivity gaps in rural and hard-to-reach areas through satellite-based solutions.

Middle East & Africa - 3% share: Driven by growing investments in digital infrastructure and increasing adoption of satellite connectivity in remote locations.

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/satellite-internet-market?sai-v

Key Segments

By Orbit Type

Low Earth Orbit (LEO) dominates the market as it enables low-latency communication, higher bandwidth, and improved coverage, making it ideal for broadband connectivity, mobility services, and real-time applications. The rapid deployment of large LEO satellite constellations supports widespread adoption across commercial and defense sectors. Medium Earth Orbit (MEO) continues to hold a notable share, particularly for navigation, communication, and specialized data services that require broader coverage with fewer satellites compared to LEO systems.

By Frequency Band

Ku band holds a significant share due to its wide use in satellite broadband, television broadcasting, and maritime and aviation connectivity. Ka band is one of the fastest-growing segments, driven by its ability to deliver higher data throughput and support next-generation high-speed satellite internet services. L band maintains steady demand for mobile satellite services and navigation applications due to its reliability and resistance to signal degradation. C band continues to be used for broadcasting and enterprise communication, offering stable performance over large geographic areas. X band remains a niche but critical segment, primarily adopted for military, defense, and secure communication applications.

By Download Speed

Medium-speed connections (25-100 MBPS) dominate the market as they meet the requirements of most residential, enterprise, and mobility users for streaming, browsing, and business applications. High-speed connections (>100 MBPS) are witnessing rapid growth, driven by increasing demand for ultra-fast internet, cloud applications, video conferencing, and data-intensive services. Low-speed connections.

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Satellite Internet Market to Reach US$ 47.59 Billion by 2032 at 17.67% CAGR; North America Leads with 38% Share - Key Players: SpaceX, Amazon, Viasat here

News-ID: 4324073 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

United States Power Transistor Market (2026-2033)., North America's Hold 32% Mar …

Market Size and Growth

Global power transistor market grows with rising demand in EVs, industrial electronics, and renewable energy (2026-2033)

United States: Recent Industry Developments

✅ February 2026: Infineon Technologies (U.S. operations) introduced next-generation silicon carbide (SiC) power transistors for EV and renewable energy applications.

✅ January 2026: ON Semiconductor launched high-efficiency gallium nitride (GaN) power transistors for data centers and industrial automation.

✅ December 2025: Texas Instruments released new automotive-grade MOSFETs to enhance power…

United States International Express Delivery Market (2026-2033)., North America …

Market Size and Growth

Market expansion outlook: The International Express Delivery Market was hit huge Growth (2026-2033)

United States: Recent Industry Developments

✅ February 2026: FedEx expanded its global express delivery network, introducing faster cross-border services for e-commerce shipments.

✅ January 2026: UPS launched AI-enabled route optimization to improve delivery speed and reduce operational costs.

✅ December 2025: DHL implemented sustainable delivery solutions using electric cargo vehicles for urban international shipments.

Downlaod Free Custom Research: https://www.datamintelligence.com/custom-research?kb=ied

Japan:…

United States Fibrin Sealants Market Witness high Growth (2026-2033)., North Ame …

Market Size and Growth

Fibrin Sealants Market to hit at a high CAGR during the forecast period (2026-2033)

United States: Recent Industry Developments

✅ February 2026: Baxter International launched a next-generation fibrin sealant with enhanced adhesive strength for surgical applications.

✅ January 2026: Medtronic expanded distribution of its fibrin sealant portfolio to support minimally invasive and robotic surgeries.

✅ December 2025: Integra LifeSciences introduced a fast-acting fibrin sealant optimized for wound closure in cardiovascular procedures.

Download…

United States Commercial Juicer Market (2026-2033) | Global Market Growth Projec …

Market Size and Growth

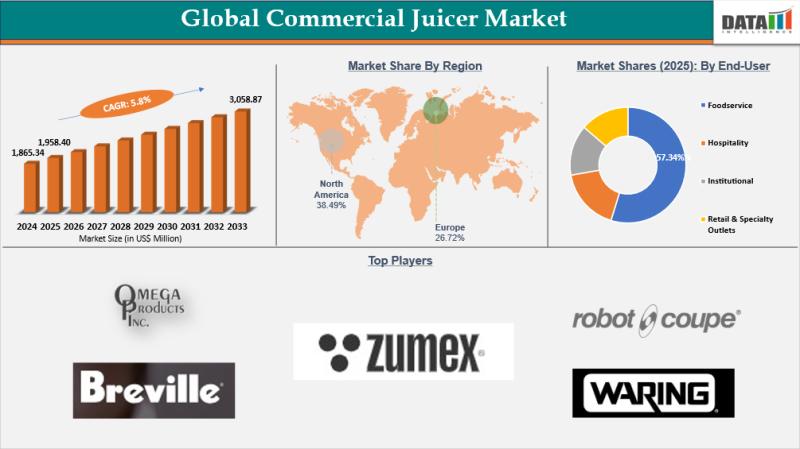

commercial juicer market reached US$ 1,865.34 Million in 2024, rising to US$ 1,958.40 Million in 2025 and is expected to reach US$ 3,058.87 Million by 2033, growing at a strong CAGR of 5.8% during the forecast period from 2026 to 2033.

demand is driven by investments in modern processing technologies, such as the US$ 6.3 million funding provided by the government to Greenhouse Juice Company in Mississauga, Canada.

United…

More Releases for LEO

"LEO Satellites: Revolutionizing Space Communication and Observation"

The LEO Satellite Market is expected to register a CAGR of 11.5% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

Growing Demand for Global Connectivity: The increasing need for ubiquitous, high-speed internet access, particularly in remote and underserved regions, is a key driver for the LEO satellite market. LEO satellites, with their low latency and ability to provide…

LEO Antenna Market Size 2024 to 2031.

Market Overview and Report Coverage

A LEO antenna is a low earth orbit satellite antenna designed to communicate with satellites that operate in low earth orbit. These antennas are essential for various applications such as communication, navigation, and earth observation.

The LEO antenna market is expected to witness significant growth in the coming years, with a projected CAGR of 10.70% during the forecasted period. The increasing demand for satellite communication…

LEO Satellite Antenna Manufacturers in Korea | GTL

GTL is the best LEO satellite antenna manufacturers in Korea, with unique technology that allows an antenna to automatically track satellite signals.

The industry's accelerating rate of LEO launches is based on the low costs of developing and launching LEO satellites. And ground infrastructure is essential for the new generation of LEO satellite constellations. As such, GTL provides a cutting-edge infrastructure to support the expanding space industry.

GTL LEO satellite

A LEO satellite…

LEO Satellite Antenna Products | GTL

GTL provides LEO satellite antenna to enable the real-time and online checking of antenna status in a low-cost maintenance in Korea.

The industry's accelerating rate of LEO launches is based on the low costs of developing and launching LEO satellites. And ground infrastructure is essential for the new generation of LEO satellite constellations. As such, GTL provides a cutting-edge infrastructure to support the expanding space industry.

GTL LEO satellite Satellites need to…

LEO Satellite Market Size - Forecasts to 2027

According to a new market research report published by Global Market Estimates, the Global LEO Satellite Market is projected to grow from USD 9.8 Billion in 2022 to USD 20.1 billion in 2027 at a CAGR value of 15.8% from 2022 to 2027.

Browse 151 Market Data Tables and 111 Figures spread through 181 Pages and in-depth TOC on "Global LEO Satellite Market - Forecast to 2027" https://www.globalmarketestimates.com/market-report/leo-satellite-market-3743

By Satellite Type…

Leo Pharma - Cancer Drugs Clinical Pipeline Insight

“Leo Pharma - Cancer Drugs Clinical Pipeline Insight” offers in depth insight on ongoing clinical trials for the cancer drugs developed by Leo Pharma. This report highlights various clinical and non-clinical parameters involved in the development of cancer drugs in clinical pipeline. Currently there are “3” cancer drugs in clinical pipeline.

The report includes all the relevant information with respect to development of cancer drugs in the clinical pipeline. Report helps…