Press release

UAE Data Center Market Set for Strong Growth to Reach US$ 1,992.69 million by 2031: Hyperscale Investment & Opportunities in Tier III & Tier IV Facilities

UAE data center market was US$ 740.53 million in 2023 and is expected to reach US$ 1,992.69 million by 2031, growing with a CAGR of 13.3% between 2024 and 2031.Request Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://datamintelligence.com/download-sample/uae-data-center-market?kb

Latest Investments in UAE:

✅ Khazna Data Centers secured US$2.62 billion in financing to scale operations in Abu Dhabi and Dubai and develop the UAE's first AI-enabled data center in Ajman.

✅ Microsoft and G42 announced plans to add 200 MW of new data center capacity in the UAE as part of a wider US$15.2 billion digital infrastructure push.

✅ G42's Stargate UAE project, a 5-GW AI data center campus, is progressing in Abu Dhabi with participation from global technology partners.

✅ Equinix launched its third Dubai facility (DX3), strengthening colocation capacity and connectivity in the UAE market.

✅ Gulf Data Hub is building multiple data centers at its KIZAD campus in Abu Dhabi, with further expansion phases planned.

✅ The UAE's total data center capacity is expected to approach 950 MW by 2028, marking roughly 165% growth from current levels.

✅ Oracle Cloud, in partnership with e& enterprise, introduced UAE OneCloud to support sovereign cloud and secure data services.

✅ KKR is backing Gulf Data Hub with investments that support more than US$5 billion in regional data center development.

✅ du increased investments by AED 545 million to expand data center and digital infrastructure supporting cloud and sovereign services.

✅ Moro Hub continues to expand solar-powered data centers at Dubai Solar Park, aligning digital growth with sustainability goals.

Key Major Players:

Dcvaults, Etisalat, Gulf Data Hub, Khazna Data Center, and datamena.

Key Industry Developments:

Capacity additions and key projects

• Existing UAE data center power capacity is about 414-500 MW, with almost 250 MW of new capacity expected to go live by the end of 2025; the total upcoming pipeline exceeds 1.4 GW, implying more than a 3× increase in coming years.

• Abu Dhabi dominates upcoming capacity with roughly 40% of planned MW, while Dubai remains the largest cluster by number of facilities; other locations like Sharjah, Al Ain, Ajman and Fujairah are also seeing new builds.

A flagship 100 MW Khazna AI Data Center in Ajman is scheduled to be operational by Q3 2025, dedicated to AI and other data‐intensive applications.

Investors and ecosystem

• Major operators include Khazna, Equinix, Etisalat, Group 42 (G42), Injazat, Gulf Data Hub, DEWA Moro Hub, DIFC and Datacenter Vaults, alongside global cloud providers like Microsoft and AWS that rely on local facilities.

• Microsoft and G42 announced a 200 MW capacity expansion in the UAE in 2025 (beyond your specified window but confirming trajectory), underlining how sovereign‐cloud, AI and hyperscale workloads are concentrating in the country.

Regulation, data residency and "local first" hosting

• The UAE Data Protection Law (Federal Decree‐Law No. 45 of 2021) and related sector rules increasingly require that certain personal and sensitive data be stored and processed in UAE‐approved data centers, pushing demand for local infrastructure.

• 2025 cybersecurity updates expand obligations around consent, cookie use, server/API security and on‐shore storage for personal data, making local data centers central to compliance strategies for banks, government, healthcare and digital businesses.

Strategic themes 2025

• The UAE is consistently ranked among the top emerging global data center markets, with Dubai and Abu Dhabi both identified as leading "up‐and‐coming" hubs in 2025 comparative rankings.

• Key themes: AI‐optimized and green data centers (including solar‐powered facilities in Dubai), strong incentives for digital infrastructure investment, and a clear policy push for data sovereignty and cyber resilience anchored in domestic data‐center capacity.

Forecast Projection:

The UAE Data Center Market is anticipated to rise at a considerable rate during the forecast period, between 2025 and 2032. In 2024, the market is growing at a steady rate, and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

Research Process:

Both primary and secondary data sources have been used in the UAE Data Center Market research report. During the research process, a wide range of industry-affecting factors are examined, including governmental regulations, market conditions, competitive levels, historical data, market situation, technological advancements, upcoming developments, in related businesses, as well as market volatility, prospects, potential barriers, and challenges.

Buy Now & Get 30% OFF - Grab 50% OFF on 2+ reports: https://www.datamintelligence.com/buy-now-page?report=uae-data-center-market?kb

Key Growth Segmentation:

By Enterprise Size: (IT & Telecom, BFSI, Healthcare, Retail, Others)

Benefits of the Report:

Chapter 1: Lays the foundation by defining the scope of the report, highlighting core market segments across regions, product types, and applications. It delivers a clear snapshot of current market size, growth potential, and how the industry is expected to evolve in both the near and long term.

Chapter 2: Spotlights the most impactful market insights, unveiling the transformative trends and forces shaping the future of the industry.

Chapter 3: Provides a deep dive into the competitive landscape of , covering revenue shares, strategic initiatives, and notable mergers & acquisitions that are reshaping the market.

Chapter 4: Presents detailed company profiles of leading players featuring financial performance, product portfolios, profit margins, and key milestones that set them apart in the industry.

Chapters 5 & 6: Break down revenue analysis at both regional and country levels, offering precise data on market size, growth drivers, and expansion opportunities across global markets.

Chapter 7: Analyzes the market by product type, spotlighting segment-specific opportunities and helping stakeholders identify untapped, high-growth areas.

Chapter 8: Explores the market through application-based segmentation, assessing demand across industries and pinpointing downstream sectors with the strongest potential for growth.

Chapter 9: Maps the industry's supply chain in detail, tracing upstream and downstream activities to provide clarity on value creation across the ecosystem.

Chapter 10: Wraps up with a concise summary of the report's key insights distilling the most critical findings and strategic takeaways for decision-makers and stakeholders.

Get Customization in the report as per your requirements: https://datamintelligence.com/customize/uae-data-center-market?kb

Key companies and projects

Khazna Data Centers (G42 group)

• Announced and promoted the UAE's first AI‐optimized data center in Ajman (QAJ1), a 100 MW facility designed specifically for high‐density AI compute, with an AI‐efficient modular design and advanced cooling; it is due to be operational in Q3 2025.

• Confirmed in April 2025 that it had broken ground on two new Abu Dhabi facilities - AUH4 in Mafraq and AUH8 in Masdar City - as part of a wider UAE expansion funded by a USD 2.6 billion financing package for multiple domestic data‐center projects.

Moro Hub (Digital DEWA / Dubai Electricity and Water Authority)

• Together with Huawei, continued construction of a 100 MW solar‐powered Tier III data center at the Mohammed bin Rashid Al Maktoum Solar Park near Dubai, promoted as the largest solar‐powered data center in the Middle East and Africa.

• In March-April 2025, Moro Hub was highlighted again as Emirates Group's future co‐location provider, with the airline group set to migrate its data centers to this green facility from mid‐2026, reinforcing the project's role in UAE digital infrastructure.

Other notable capacity‐expansion signals

Microsoft and G42 / Khazna

• In November 2025 (just outside your Sep 2025 cut‐off but relevant directionally), Microsoft and G42 announced a plan to expand UAE data‐center capacity by 200 MW, with capacity to be delivered through Khazna Data Centers, confirming sustained hyperscale and AI‐driven build‐out beyond the projects above.

• Across this period, Khazna and Moro Hub are the primary named entities publicly announcing new UAE data‐center builds or breaking ground on specific facilities, especially AI‐optimized and solar‐powered sites in Ajman, Abu Dhabi and Dubai.

Unlock Free 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release UAE Data Center Market Set for Strong Growth to Reach US$ 1,992.69 million by 2031: Hyperscale Investment & Opportunities in Tier III & Tier IV Facilities here

News-ID: 4323989 • Views: …

More Releases from DataM Intelligence 4 Market Research LLP

Artificial Intelligence (AI) Chip Market (2026-2033) | UAE's 4 Trillion Transist …

DataM Intelligence has published a new research report on "Artificial Intelligence (AI) Chip Market Size 2025". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status of Top Key Players and Drivers. The purpose of this report is to provide a telescopic view of the current market size by value and volume, opportunities, and development status.

Latest M & A

• Intel moves…

Japan Nurse Call Systems Market (2025-2033) | Opportunities in Hospitals and Sen …

DataM Intelligence has published a new research report on "Japan Nurse Call Systems Market Size 2025". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status of Top Key Players and Drivers. The purpose of this report is to provide a telescopic view of the current market size by value and volume, opportunities, and development status.

Get a Sample PDF Of This…

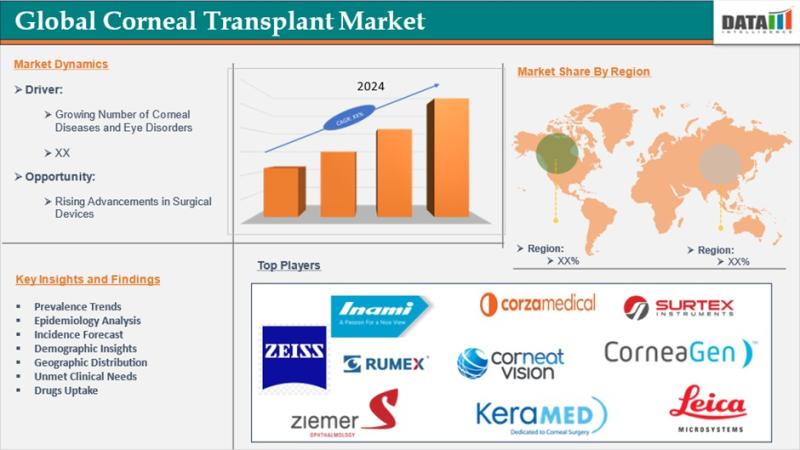

Corneal Transplant Market to Reach US$ 1,006.95 Million by 2033 at 7.59% CAGR | …

Corneal Transplant Market reached US$ 523.88 million in 2024 and is expected to reach US$ 1,006.95 million by 2033, growing at a CAGR of 7.59% during the forecast period 2025 to 2033.

Corneal transplantation, also known as keratoplasty, is a surgical procedure in which a damaged or diseased cornea is replaced with healthy donor tissue to restore vision and maintain ocular integrity. The cornea serves as the transparent outer layer of…

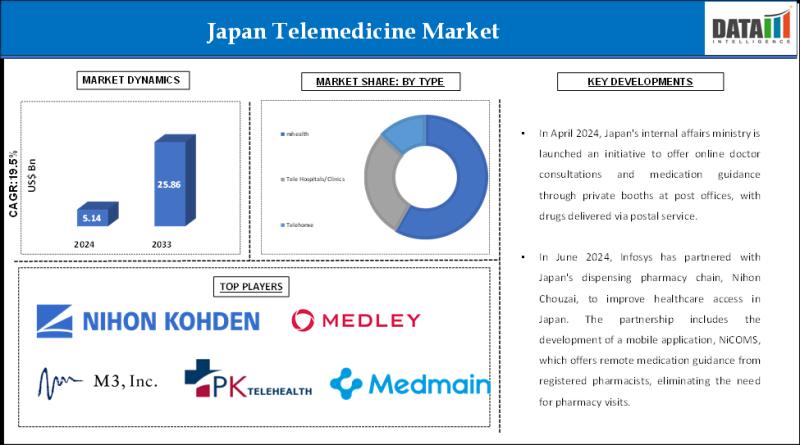

Japan Telemedicine Industry (2025-2033) | Technology Advancements and Market Pen …

DataM Intelligence has published a new research report on "Japan Telemedicine Market Size 2025". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status of Top Key Players and Drivers. The purpose of this report is to provide a telescopic view of the current market size by value and volume, opportunities, and development status.

Get a Sample PDF Of This Report (Get…

More Releases for UAE

Introduces "E-Invoicing UAE" - Simplifying Digital Compliance for UAE Businesses

KGRN Chartered Accountants, a leading name in financial and compliance consulting, has officially introduced its new service, "E-Invoicing UAE," to help organizations across the United Arab Emirates achieve effortless compliance with the Federal Tax Authority (FTA)'s digital invoicing regulations.

The E-Invoicing UAE platform by KGRN enables businesses to streamline their billing operations, automate tax compliance, and transition to the UAE's paperless invoicing system with confidence. The service is tailored for both…

Ashish Jain, a Renowned Fund Manager Expands into UAE Real Estate in UAE

Dubai - Ashish Jain, a world-renowned fund manager and CEO of Fortune Capital, Fortune Wealth, and the newly launched Alieus Hedge Fund, is stepping into the UAE real estate market as part of his latest strategic expansion. This move marks Jain's entry into the thriving property market, further cementing his reputation as a leader in global finance and innovation.

Image: https://www.getnews.info/uploads/9b42e4a62bfaef7aaf02043c03240d75.jpg

A Visionary Leader in Finance

With over 15 years of experience in…

Fitness Equipment Market UAE | UAE Fitness Market Revenue | Member Penetration U …

The fitness services means any service treatment, diagnosis, advice or instruction concerning to the physical fitness, comprising but not restricted to diet, body building, cardio-vascular fitness, or physical training programs and which you function as or on behalf of the named insured. The fitness services market is commonly propelled by the increasing concerns over the healthy lifestyles around the populace throughout the UAE. Growing health awareness concerning the advantages of…

UAE Fitness Services Market, UAE Fitness Services Industry, Covid-19 Impact UAE …

A strong growth has been witnessed with a considerable expansion in the number of boutique and budget fitness centers directly contributing to the economy.

High Obese and Obesity Rate: Increase in membership rate in UAE fitness centers due to the prevalence of high obese population and obesity rate (Adult obesity in the UAE stood at 27.8% in 2019) has positively affected the market.

Growth of Ladies Fitness Center: Opening up…

wifi solution in uae

Welcome to MAK, Wifi solutions provider in UAE. We bring everything that you would expect from an internet service provider – a highly professional installation and setup, high internet speed, a reliable network, great technical support and customer service to create a remarkable experience for the users, thereby remaining the most trusted WiFi Solutions provider in Dubai and across UAE.

Designing Efficient and Cost Effective Home Wifi Networks

Keep the connections to…

UAE Nuclear Power Sector UAE Nuclear Power Sales Report

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. UAE Power Sector Scenario

1.1 Existing Power Generation Outlook

1.2 Current & Projected Power Demand

2. Why UAE Energy Policy beyond Oil & Gas?

3. UAE Nuclear Power Sector Overview

3.1 UAE Entering into Nuclear Power Sector

3.2 Nuclear Policy Overview

4. UAE Nuclear Power Sector Dynamics

4.1 Favorable Parameters

4.2 Nuclear Power Sector…