Press release

Saudi Arabia Structural Steel Market Expanding at a CAGR of 4.33% during 2026-2034

Saudi Arabia Structural Steel Market OverviewMarket Size in 2025: USD 683.3 Million

Market Size in 2034: USD 1,000.8 Million

Market Growth Rate 2026-2034: 4.33%

According to IMARC Group's latest research publication, "Saudi Arabia Structural Steel Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia structural steel market size reached USD 683.3 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,000.8 Million by 2034, exhibiting a CAGR of 4.33% during 2026-2034.

How AI is Reshaping the Future of Saudi Arabia Structural Steel Market

● AI-powered design optimization algorithms enable engineers in Saudi Arabia to create efficient structural steel configurations, reducing material waste while maintaining strength and safety standards across construction projects.

● Machine learning systems analyze historical performance data from sensors, predicting equipment failures in fabrication facilities and enabling proactive maintenance that minimizes costly production downtime.

● AI-driven Building Information Modeling systems automate structural analysis and steel layout planning, accelerating design cycles and improving accuracy for complex megaprojects like NEOM and Red Sea developments.

● Smart quality control systems using computer vision detect defects in steel components during fabrication, ensuring consistent product quality and compliance with international structural engineering standards.

● Predictive analytics platforms optimize supply chain operations and material procurement, enabling Saudi fabricators to manage inventory efficiently and reduce costs in volatile construction markets.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-structural-steel-market/requestsample

How Vision 2030 is Transforming Saudi Arabia Structural Steel Industry

Saudi Arabia's Vision 2030 is revolutionizing the structural steel industry by prioritizing infrastructure development, economic diversification, and sustainable construction practices amid rapid urbanization. The initiative drives demand for high-quality steel beams, columns, and prefabricated components, integrating advanced fabrication technologies to support megaprojects like NEOM, the Red Sea Project, Qiddiya, and New Murabba. This transformation aligns with construction efficiency goals, promoting modular building techniques and rapid assembly methods across residential, commercial, and industrial sectors. Local manufacturing incentives under Vision 2030 spur innovation and reduce import dependence, while international steel fabricators introduce advanced welding and cutting technologies that enhance structural integrity. Government investments in transportation infrastructure, smart cities, and entertainment complexes create continuous demand for structural steel components across construction, power generation, and manufacturing sectors. The emphasis on sustainable building practices and recyclable materials positions structural steel as a cornerstone of green construction, meeting both environmental targets and engineering excellence. Ultimately, Vision 2030 elevates the structural steel sector as a vital enabler of Saudi Arabia's ambitious infrastructure goals, boosting construction capabilities and positioning the Kingdom as a regional hub for advanced steel fabrication and engineering innovation.

Saudi Arabia Structural Steel Market Trends & Drivers:

Saudi Arabia's structural steel market is experiencing robust growth, driven by rapid urbanization trends and massive infrastructure development under Vision 2030 megaprojects. The market is fueled by large-scale construction initiatives including NEOM requiring approximately two million tons of structural steel trusses for The Line's interconnected skysc cores standing 500 meters tall, while the Red Sea Project, Qiddiya entertainment city, and New Murabba development in Riyadh collectively form the largest construction program ever undertaken in the Kingdom. These ambitious schemes demand marine-grade plate structures, corrosion-resistant tubular foundations, and ultra-long beams shipped in modular pods to remote desert and coastal sites, driving continuous demand for advanced structural steel components.

The increasing emphasis on sustainable construction practices is significantly boosting market demand. Structural steel's high recyclability and low environmental impact align perfectly with Saudi Arabia's green building initiatives and sustainability targets under Vision 2030. In 2025, China Harbour Engineering Company commenced operations at its 200,000 square meter modular production facility in Riyadh to support the Sedra housing project by Roshn, a significant initiative within Saudi Vision 2030, utilizing robotics and digital technologies for enhanced precision. The construction of multi-story buildings, shopping malls, business centers, and smart cities requires advanced structural steel systems including H-type beams, I-type beams, columns, and angles to ensure structural integrity and comply with modern building standards. Additionally, Saudi Arabia's goal of deriving 50% of electricity from renewables by 2030 is spurring orders for solar, wind, and grid infrastructure steelwork, while the oil and gas sector continues to require specialized structural components for refineries, petrochemical plants, and offshore platforms across the Eastern Region.

Saudi Arabia Structural Steel Industry Segmentation:

The report has segmented the market into the following categories:

Product Type Insights:

● H-Type Beam

● I-Type Beam

● Columns

● Angles

● Others

End Use Insights:

● Residential

● Institutional

● Commercial

● Manufacturing

Usage Insights:

● Direct End-User

● EPC-Contractor

● Others

Breakup by Region:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Buy the Latest 2026 Edition: https://www.imarcgroup.com/checkout?id=20966&method=1315

Recent News and Developments in Saudi Arabia Structural Steel Market

● January 2025: China Harbour Engineering Company commenced operations at its 200,000 square meter modular building factory in Riyadh supporting the Sedra housing project by Roshn, utilizing robotics and digital technologies to enhance precision in structural steel fabrication for Vision 2030 initiatives.

● July 2025: New Murabba Company signed an agreement with Korea-based Heerim Architects & Planners to collaborate on innovative architectural overlays for its 19 sq km mixed-use urban development in Riyadh, seeking leading contractors for large-scale structural steel works and critical infrastructure developments.

● October 2025: Engineers unveiled construction plans for NEOM's The Line revealing forty cores standing 500 meters tall will be interconnected by approximately two million tons of structural steel trusses prefabricated in controlled environments before being lifted into position.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Structural Steel Market Expanding at a CAGR of 4.33% during 2026-2034 here

News-ID: 4322408 • Views: …

More Releases from IMARC Group

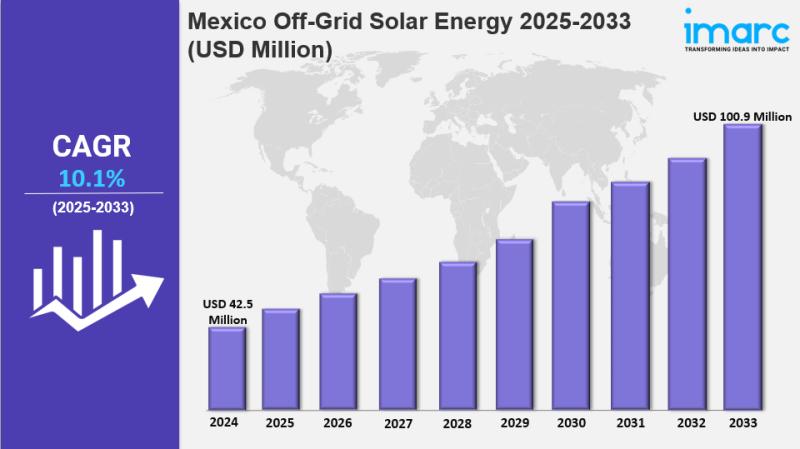

Mexico Off-Grid Solar Energy 2025: Size, Trends, Growth, Latest Insights and For …

IMARC Group has recently released a new research study titled "Mexico Off-Grid Solar Energy Market Size, Share, Trends and Forecast by End User and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico off-grid solar energy market size reached USD 42.5 Million in 2024 and is forecast to grow to USD 100.9…

India Structured Cabling Market to Reach $1,764.72 M by 2034 | CAGR 8.57% Growth

According to IMARC Group's report titled "India Structured Cabling Market Size, Share, Trends and Forecast by Product Type, Wire Category, Application, Vertical, and Region, 2026-2034", the report offers a comprehensive analysis of the industry, including India structured cabling market trends, share, growth, and regional insights.

How Big is the India Structured Cabling Industry?

The structured cabling market size in India was USD 841.76 Million in 2025. Looking forward, IMARC Group estimates the…

India ICT Market to Reach $1,95,431.59 M by 2034 | CAGR 7.82% Growth

According to IMARC Group's report titled "India ICT Market Size, Share, Trends and Forecast by Spending, Technology, and Region, 2026-2034", the report offers a comprehensive analysis of the industry, including India ICT market trends, share, growth, and regional insights.

How Big is the India ICT Industry?

The ICT market size in India was USD 99,210.08 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,95,431.59 Million by 2034,…

Peanut Processing Plant DPR - 2026: Business Opportunities, Machinery Cost, and …

The global food processing industry is experiencing remarkable growth, with peanut processing emerging as a significant sector driven by increasing consumer demand for nutritious snacks, peanut butter, oil, and protein-rich products. As health-conscious consumers seek plant-based proteins and sustainable food options, establishing a peanut processing plant presents a strategically compelling business opportunity for entrepreneurs and food industry investors.

Market Overview and Growth Potential

The global peanut processing market demonstrates robust growth trajectory,…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…