Press release

Liquefied Natural Gas (LNG) Manufacturing Plant: Setup Cost, Capital Investment & ROI Analysis

IntroductionLiquefied Natural Gas (LNG) is natural gas, primarily methane, that has been cooled to around -162°C (-260°F) to convert it into a liquid form for easier storage and transportation. This process reduces its volume by approximately 600 times, making it economically viable to transport over long distances where pipelines are not feasible. LNG is colorless, odorless, and non-toxic, and it serves as a cleaner alternative to other fossil fuels due to its lower carbon emissions. It is widely used in power generation, industrial applications, and residential energy supply. With growing energy demands and global efforts to transition to cleaner fuels, LNG has become a critical component of the global energy landscape.

Request for a Sample Report: https://www.imarcgroup.com/liquefied-natural-gas-manufacturing-plant-project-report/requestsample

Market Drivers and Outlook

The global LNG market is experiencing rapid growth, driven by increasing energy demand, particularly in Asia-Pacific economies like China, India, and Japan, where natural gas is preferred for power generation and industrial use due to its lower environmental impact. Rising efforts to reduce carbon emissions and shift from coal and oil to cleaner energy sources are boosting LNG adoption. Technological advancements in liquefaction, storage, and shipping infrastructure are improving supply chain efficiency, enabling LNG to reach new markets. Additionally, long-term supply contracts, strategic government policies, and investments in LNG terminals and import/export facilities are further supporting market expansion. The market outlook remains positive, with anticipated growth in small-scale LNG projects, floating storage units, and the use of LNG in transportation, including shipping and heavy-duty vehicles, which is expected to diversify demand and enhance the sector's long-term sustainability.

Liquified Natural Gas (LNG) Manufacturing Plant Report Overview:

IMARC's new report titled "Liquified Natural Gas (LNG) Manufacturing Plant Project Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," provides a complete roadmap for setting up a liquified natural gas (LNG) manufacturing plant. The study covers all the requisite aspects that one needs to know while entering the liquified natural gas (LNG) industry. It provides a comprehensive breakdown of the liquified natural gas (LNG) manufacturing plant setup cost, offering detailed insights into initial capital requirements and infrastructure planning. This report is a must-read for entrepreneurs, investors, researchers, consultants, business strategists, and all those who have any kind of stake in the liquified natural gas (LNG) industry. Additionally, the report analyzes the liquified natural gas (LNG) manufacturing plant cost, helping stakeholders evaluate the overall financial feasibility and long-term profitability.

Key Steps:

Manufacturing Process and Technical Workflow

This report offers detailed information related to the process flow and the unit operations involved in a liquified natural gas (LNG) manufacturing plant project. Moreover, information related to raw material requirements and mass balance has further been provided in the report with a list of necessary technical tests as well as quality assurance criteria.

Aspects Covered

• Product Overview

• Unit Operations Involved

• Mass Balance and Raw Material Requirements

• Quality Assurance Criteria

• Technical Tests

Infrastructure and Setup Requirements

This section presents a comprehensive analysis of key considerations involved in establishing a liquified natural gas (LNG) manufacturing plant. It covers critical aspects such as land location, selection criteria, strategic significance of the site, environmental impact, and associated land acquisition costs. In addition, the report outlines the proposed plant layout along with the primary factors influencing its design. Furthermore, it provides detailed insights into various operational requirements and expenditures, including those related to packaging, utilities, machinery, transportation, raw materials, and human resources.

• Land, Location and Site Development

• Plant Layout

• Machinery Requirements and Costs

• Raw Material Requirements and Costs

• Packaging Requirements and Costs

• Transportation Requirements and Costs

• Utility Requirements and Costs

• Human Resource Requirements and Costs

Buy Full Report: https://www.imarcgroup.com/checkout?id=23297&method=2142

Financial Projections and Economic Viability

This section provides a comprehensive economic analysis for establishing a liquified natural gas (LNG) manufacturing plant. It encompasses a detailed evaluation of capital expenditure (CapEx), operating expenditure (OpEx), taxation, and depreciation. Additionally, the report includes profitability analysis, payback period estimation, net present value (NPV), projected income statements, liquidity assessment, and in-depth examinations of financial uncertainty and sensitivity parameters.

• Capital Investments

• Operating Costs

• Expenditure Projections

• Revenue Projections

• Taxation and Depreciation

• Profit Projections

• Financial Analysis

Key Considerations for Plant Design and Operations:

• Production Capacity: The selection of machinery and the design of the plant layout should be aligned with the intended scale of production, which may vary from small-scale operations to large industrial facilities. This alignment ensures optimal utilization of space, resources, and production capabilities.

• Automation Levels: The degree of automation should be adjusted based on factors such as labor availability, budget constraints, and the level of technical expertise. Options may range from semi-automated systems to fully automated solutions, allowing for flexibility in capital investment and operational efficiency.

• Location Adaptation: Plant location should be strategically selected to align with local market demand, ensure proximity to raw material sources, leverage available labor, and comply with regional regulatory requirements. These factors collectively contribute to improved operational efficiency and cost optimization.

• Product Flexibility: The plant should be equipped with processes and machinery capable of accommodating a variety of product specifications. This flexibility enables manufacturers to respond to diverse and evolving market demands effectively.

• Sustainability Features: Incorporating sustainable practices is essential. This includes the integration of renewable energy sources, implementation of efficient waste management systems, and use of energy-efficient machinery to meet environmental standards and long-term sustainability objectives.

• Raw Material Sourcing: The supply chain strategy should be customized to ensure reliable and cost-effective sourcing of raw materials. This approach should consider client-specific requirements and regional supply dynamics to maintain consistent production and manage input costs.

About Us:

IMARC Group is a leading global market research and management consulting firm. We specialize in helping organizations identify opportunities, mitigate risks, and create impactful business strategies.

Our expertise includes:

• Market Entry and Expansion Strategy

• Feasibility Studies and Business Planning

• Company Incorporation and Factory Setup Support

• Regulatory and Licensing Navigation

• Competitive Analysis and Benchmarking

• Procurement and Supply Chain Research

• Branding, Marketing, and Sales Strategy

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Liquefied Natural Gas (LNG) Manufacturing Plant: Setup Cost, Capital Investment & ROI Analysis here

News-ID: 4319344 • Views: …

More Releases from IMARC Group

Dog Food Manufacturing Plant Project Report: Setup, Machinery & Investment Insig …

Dog food is a formulated pet nutrition product designed to meet the dietary needs of dogs at various life stages. It includes dry kibble, wet food, semi-moist food, and specialized formulations enriched with proteins, vitamins, minerals, and functional ingredients. With rising pet ownership, premiumization trends, and increasing awareness of pet health and nutrition, dog food has become a fast-growing segment within the global pet care industry.

Setting up a dog food…

South Korea Meat Market Size, Share, Industry Overview, Trends and Forecast 2033

IMARC Group has recently released a new research study titled "South Korea Meat Market Report by Product (Chicken, Beef, Pork, Mutton, and Others), Type (Raw, Processed), Distribution Channel (Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores, and Others), and Region 2025-2033" This report offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

South Korea Meat Market…

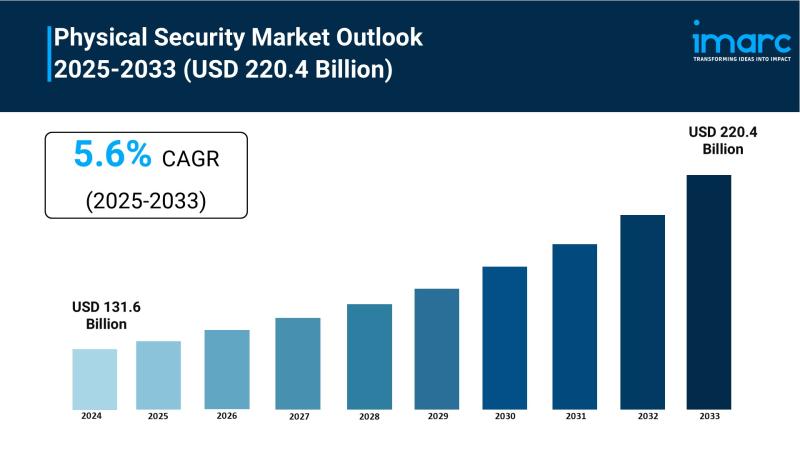

Physical Security Market to Reach USD 220.4 Billion by 2033, Growing at a CAGR o …

Market Overview:

The Physical Security Market is experiencing robust expansion, driven by Escalating Global Security Threats and Asset Protection Requirements, Proliferation of Smart Infrastructure and IoT-Connected Environments and Strategic Modernization of Global Retail and Commercial Footprints. According to IMARC Group's latest research publication, "Physical Security Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global physical security market size reached USD 131.6 Billion in 2024. Looking forward, IMARC…

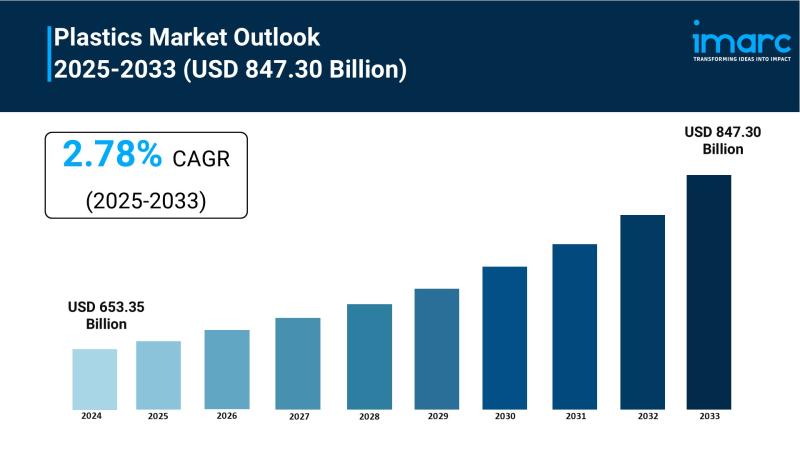

Plastics Market to Reach USD 847.30 Billion by 2033, Growing at a CAGR of 2.78%

Market Overview:

The Plastics Market is experiencing rapid growth, driven by Expanding Demand for High-Performance Engineering Thermoplastics, Rapid Proliferation of Advanced Polymer Recycling Technologies and Global Surge in Medical-Grade Resin Requirements. According to IMARC Group's latest research publication, "Plastics Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global plastics market size was valued at USD 653.35 Billion in 2024. Looking forward, IMARC Group estimates the market…

More Releases for LNG

LNG Bunkering Market Growth, Trends & Opportunities 2025 | Top key players - Tre …

LNG Bunkering Market, as analyzed in the study by DataM Intelligence, presents a detailed overview of the industry with in-depth insights, historical data, and key statistics. The report thoroughly examines market dynamics, competitive strategies, and major players, highlighting their product lines, pricing structures, financials, growth plans, and regional outreach.

The Global LNG Bunkering Market is expected to grow at a CAGR of 66.4% during the forecasting period (2024-2031).

Get a Free Sample…

Mea Floating Lng Power Vessel Market Emerging Trends and Growth Prospects 2034 | …

On April 8, 2025, Exactitude Consultancy., Ltd. released a research report titled "Mea Floating Lng Power Vessel Market". In-depth research has been compiled to provide the most up-to-date information on key aspects of the worldwide market. This research report covers major aspects of the Mea Floating Lng Power Vessel Market including drivers, restraints, historical and current trends, regulatory scenarios, and technological advancements. It provides the industry overview with growth analysis…

What's Driving the LNG Bunkering Market Trends? Key Companies are Skangass AS., …

A research report on 'LNG Bunkering Market' Added by DEC Research features a succinct analysis on the latest market trends. The report also includes detailed abstracts about statistics, revenue forecasts and market valuation, which additionally highlights its status in the competitive landscape and growth trends accepted by major industry players.

Request a sample of this research report @ https://www.decresearch.com/request-sample/detail/702

The size of LNG Bunkering Market was registered at USD 800 Million in…

LNG Bunkering Market Key Players Polskie LNG, Eagle LNG, ENN Energy, EVOL LNG, F …

The LNG Bunkering Market report add detailed competitive landscape of the global market. It includes company, market share analysis, product portfolio of the major industry participants. The report provides detailed segmentation of the LNG Bunkering industry based on product segment, technology, end user segment and region.

As per a recent news snippet, the Caribbean is one of the most lucrative regions for LNG bunkering market, as the shipping sector seeks compliance…

LNG Bunkering Industry to surpass $12bn by 2024:ENGIE,Polskie LNG,Eagle LNG, ENN …

LNG Bunkering Market size is set to exceed USD 12 billion by 2024.Growing demand for cleaner fuel coupled with strict emission regulations to reduce the airborne emissions predominantly in North America and Europe will stimulate LNG bunkering market. In 2015, International Maritime Organization (IMO) introduced Tier III norms to curb NOx emissions from marine vessels among Emission Control Areas (ECAs) under maritime boundaries.

Request for a sample copy of this…

Global Liquefied Natural Gas (LNG) Market 2018-22 : LNG bunkering, progressing L …

ResearchMoz presents Professional and In-depth Study of "Global Liquefied Natural Gas (LNG) Market: Industry Analysis & Outlook (2018-2022)" with coming years Industries Trends, Projections of Global Growth, Major Key Player and Case Study, Review, Share, Size, Effect.

' '

Liquefied Natural Gas (LNG) is a liquid form of natural gas, which is composed mainly of methane and other gases such as Ethane, Propane, Butane and Nitrogen. LNG liquefaction is a procedure…