Press release

Demand for Automotive Hoses and Assemblies for OEM in USA Outlook 2026-2036: Strategic Trends, Innovation Drivers & Growth Opportunities

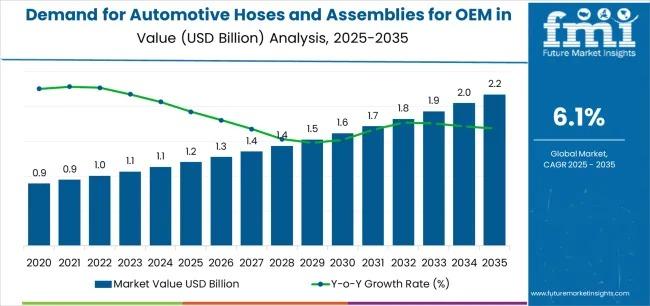

USA automotive hoses and assemblies for OEM market is entering a decade of steady and strategically significant growth, underpinned by rising vehicle production, tightening safety and performance standards, and accelerating adoption of advanced vehicle systems across commercial and passenger platforms. Market demand is projected to increase from USD 1.2 billion in 2025 to approximately USD 2.1 billion by 2035, reflecting an absolute expansion of USD 0.9 billion and a compound annual growth rate (CAGR) of 6.1% over the forecast period. This translates into 79.7% total growth, with sales expected to rise nearly 1.8 times between 2025 and 2035.The United States continues to demonstrate strong growth potential due to its advanced automotive manufacturing infrastructure, deep-rooted OEM partnerships, and a sustained emphasis on operational efficiency and precision engineering. As vehicles become more technologically complex and performance-driven, automotive hoses and assemblies are increasingly recognized as mission-critical components that enable safe, reliable, and efficient fluid management across braking, cooling, fuel, and steering systems.

Get access to comprehensive data tables and detailed market insights - request your sample report today!

https://www.futuremarketinsights.com/reports/sample/rep-gb-28294

Safety-Critical Brake System Hoses Anchor Market Demand

By type, brake system hoses and assemblies held the leading position in 2025, accounting for 36.2% of total national demand. Their dominance reflects the central role braking systems play in vehicle safety and regulatory compliance. Brake hoses are engineered to deliver predictable pressure behavior while withstanding extreme thermal and mechanical stress, making them essential for modern braking architectures.

Their seamless integration with ABS, ESC, and electronically controlled braking systems, as well as compatibility across internal combustion and electric vehicle platforms, reinforces their long-term relevance. With OEMs prioritizing safety, durability, and system reliability-particularly in high-volume production corridors across the Midwest and South-brake system hoses remain the preferred solution for both legacy platforms and next-generation vehicle programs.

Continuous innovation in materials, reinforcement structures, and assembly techniques is further enhancing pressure resistance, fatigue life, and overall system integrity. These improvements are enabling manufacturers to meet higher performance thresholds without compromising cost efficiency, solidifying brake system hoses as the backbone of the USA automotive hose ecosystem.

Commercial Vehicles Drive Volume and Technology Adoption

From an application perspective, commercial vehicles accounted for 61.4% of total demand in 2025, making them the largest and most influential segment in the market. Heavy-duty trucks, vocational vehicles, utility fleets, and commercial transport platforms rely extensively on high-strength, abrasion-resistant, and temperature-tolerant hose assemblies capable of supporting extended duty cycles and load-intensive operations.

OEMs serving commercial vehicle markets prioritize hose systems that deliver leak-free performance, pressure stability, and long-term reliability under demanding operating conditions. These requirements position commercial vehicles as the anchor application for next-generation hose technologies, particularly as electric trucks, last-mile delivery fleets, and specialized vocational vehicles expand their operational footprints nationwide.

As fleet operators and OEMs focus on minimizing downtime and lifecycle costs, demand is rising for advanced hose assemblies that support reliability, ease of maintenance, and system integration. This trend is expected to intensify as electrification reshapes commercial vehicle platforms and introduces new fluid management pathways.

Strong Growth Concentrated in the Midwest and South

Regionally, the Midwest leads national demand, supported by its concentration of automotive manufacturing, component innovation, and long-established OEM ecosystems. The region is forecast to grow at a 6.8% CAGR through 2035, driven by early adoption of premium hose systems, advanced material integration, and automated assembly practices across Michigan and neighboring states.

The South follows closely with a 6.4% CAGR, benefiting from extensive manufacturing infrastructure, strong commercial vehicle production, and favorable industrial demographics. Automotive clusters across Texas, North Carolina, and surrounding corridors are driving consistent demand for specialized hose assemblies aligned with efficiency-focused manufacturing strategies.

The Northeast (5.9% CAGR) and West (5.6% CAGR) are also experiencing steady expansion, supported by automotive modernization initiatives, industrial diversification, and growing deployment of specialized hose technologies across expanding facilities.

Advanced Materials and Smart Assemblies Shape the Next Growth Phase

While the market showed steady expansion between 2020 and 2025, the most significant acceleration is expected in the 2030-2035 period, when demand is forecast to rise from USD 1.6 billion to USD 2.1 billion, accounting for nearly 57% of total ten-year growth.

This phase will be characterized by deeper integration of advanced polymers, reinforced elastomers, and hybrid materials, alongside modernization of hose assembly techniques. OEMs are increasingly investing in EV-compatible hose pathways, enhanced quality control systems, and performance monitoring capabilities that enable greater reliability and traceability across vehicle platforms.

The adoption of automated assembly principles, particularly in the Midwest and South, is also reshaping supplier strategies. Precision manufacturing, digital quality networks, and standardized hose specifications are becoming central to meeting evolving OEM requirements and regulatory expectations.

Personalize Your Experience: Ask for Customization to Meet Your Requirements

https://www.futuremarketinsights.com/customization-available/rep-gb-28294

Competitive Landscape Favors Scale, Materials Expertise, and OEM Integration

The competitive landscape is defined by established component leaders and specialized hose manufacturers with strong OEM relationships. Companies such as Continental, Gates Corporation, Parker Hannifin, Dayco, and Abbott Rubber continue to strengthen their positions through investments in material science, assembly optimization, and nationwide distribution networks.

Market leadership increasingly depends on the ability to deliver scalable, high-performance hose solutions supported by robust quality assurance, application engineering, and supply chain reliability. Strategic partnerships, technology-led differentiation, and early alignment with OEM electrification and efficiency roadmaps are emerging as decisive competitive advantages.

Outlook: A Critical Component Market with Expanding Strategic Value

With demand projected to reach USD 2.1 billion by 2035, automotive hoses and assemblies for OEMs are evolving from supporting components into strategic enablers of safety, efficiency, and vehicle performance. As regulatory scrutiny intensifies and vehicle architectures grow more complex, the importance of reliable, advanced hose systems will continue to rise.

The market's consistent growth trajectory, strong regional foundations, and expanding role in electrified and commercial vehicle platforms position it as a compelling opportunity within the broader automotive components landscape-one where material innovation, precision engineering, and operational excellence converge.

Similar Industry Reports

Automotive Hoses and Assemblies Market

https://www.futuremarketinsights.com/reports/automotive-hoses-and-assemblies-market

Automotive Brake Hoses and Assemblies Market

https://www.futuremarketinsights.com/reports/automotive-brake-hoses-and-assemblies-market

Automotive Power Steering Hoses and Assemblies Market

https://www.futuremarketinsights.com/reports/automotive-power-steering-hoses-and-assemblies-market

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware - 19713, USA

T: +1-845-579-5705

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Demand for Automotive Hoses and Assemblies for OEM in USA Outlook 2026-2036: Strategic Trends, Innovation Drivers & Growth Opportunities here

News-ID: 4319269 • Views: …

More Releases from Future Market Insights

Ice Cream and Frozen Dessert Market Forecast 2025-2035: Market to Reach USD 306, …

The global ice cream and frozen dessert market is projected to grow significantly over the next decade, expanding from USD 148,672.5 million in 2025 to USD 306,418.7 million by 2035, registering a CAGR of 7.5%. According to the latest analysis by Future Market Insights (FMI), growth is fueled by evolving consumer preferences toward indulgent yet healthier dessert options, innovative product formulations, and expanding retail accessibility.

The market has evolved far beyond…

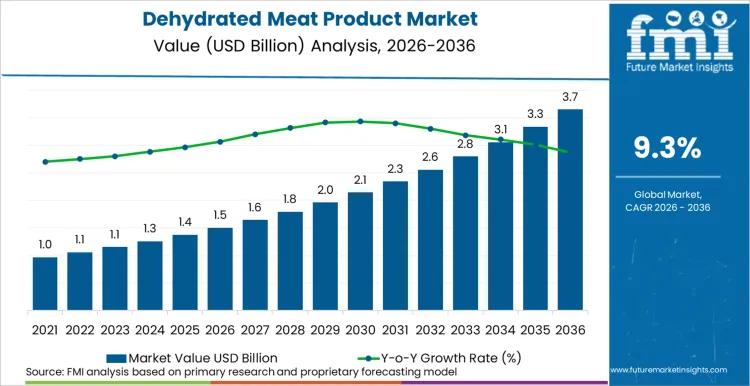

Dehydrated Meat Product Market Forecast 2026-2036: Market to Reach USD 3,784.7 M …

The global dehydrated meat product market was valued at USD 1,423.0 million in 2025 and is projected to grow to USD 1,555.3 million in 2026, reaching USD 3,784.7 million by 2036. According to the latest analysis by Future Market Insights (FMI), the market is set to register a CAGR of 9.3% during the forecast period.

Absolute dollar growth of USD 2,229.3 million over the decade reflects an accelerating shift in snacking…

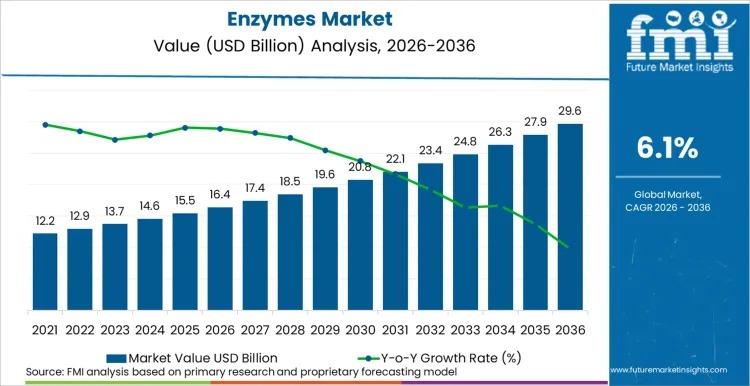

Enzymes Market Forecast 2026-2036: Market to Reach USD 29.7 Billion by 2036 at 6 …

The global enzymes market is projected to grow steadily over the next decade, expanding from USD 16.4 billion in 2026 to USD 29.7 billion by 2036, registering a CAGR of 6.1%. According to the latest analysis by Future Market Insights (FMI), growth is fueled by expanding industrial biotechnology integration, energy-efficient detergent formulations, and increasing demand for clean-label food processing solutions.

In 2025, the global enzymes market was valued at USD 15.4…

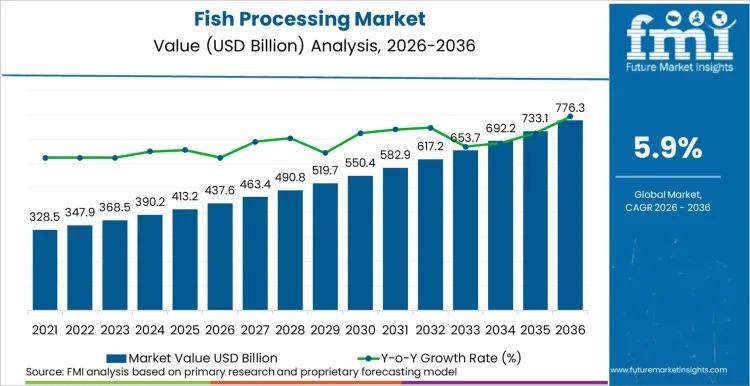

Fish Processing Market Forecast 2026-2036: Market to Reach USD 776.3 Billion by …

The global fish processing market was valued at USD 413.2 billion in 2025 and is projected to expand from USD 437.6 billion in 2026 to USD 776.3 billion by 2036, registering a CAGR of 5.9% during the forecast period, according to the latest analysis by Future Market Insights (FMI).

Absolute dollar growth of USD 338.7 billion over the decade reflects both volume expansion in developing economies and premiumization trends in mature…

More Releases for OEM

OEM Partnership Guide: Working with a Touch-free Automatic Kitchen Garbage Can O …

With increasing global demand for smart home solutions, Sinoware International Ltd, a top provider in household products industry, is pleased to unveil expanded OEM partnership initiatives.

Sinoware has established itself in Jiangmen--China's premier stainless steel industry zone--as an indispensable touch-free automatic kitchen garbage can OEM manufacturer for global brands seeking to incorporate high-tech sanitation solutions into their portfolios.

By combining their decades-old tradition of metal craftsmanship with cutting-edge infrared and…

Revolutionizing OEM Coatings With Sustainable Solutions Trend: A Crucial Influen …

Which drivers are expected to have the greatest impact on the over the oem coatings market's growth?

The surge in requirements from final consumer industries is forecasted to boost the expansion of the OEM coatings market. These coatings, referred to as OEM, are utilized during the integration of other firms' products into the substrate process or application. They prove to be beneficial for a variety of end-user sectors, including automotive and…

OEM Technology Partnerships Launches Brokerage Specializing in 100+ OEM Technolo …

San Francisco, California, USA - February 13, 2025 - OEM Technology Partnerships is thrilled to announce the launch of its specialized brokerage focused on connecting businesses with a comprehensive portfolio of over 100 Original Equipment Manufacturer (OEM) technologies. This new venture is poised to revolutionize how companies access and implement cutting-edge solutions across diverse industries.

Leveraging deep industry expertise and a vast network of OEM partners, OEM Technology Partnerships offers a…

OEM or ODM Watches? What's the Difference?

When searching for a watch manufacturer for your store or watch brand, you may come across the terms OEM and ODM. But do you truly understand the difference between them? In this article, we will delve into the distinctions between OEM and ODM watches to help you better grasp and choose the manufacturing service that suits your needs.

Image: https://www.naviforce.com/uploads/15a6ba3911.png

What's OEM / ODM Watches [https://www.naviforce.com/products/]

OEM (Original Equipment Manufacturer) watches are produced…

OEM Partnership with Extreme Networks

ComputerVault announces an OEM partnership with Extreme Networks and has certified its switches for use with ComputerVault enterprise software to deliver virtual desktop infrastructure (VDI).

Extreme Networks industry leading switches deliver ComputerVault Virtual Desktops at faster than PC speeds in the LAN and WAN.

“ComputerVault is very excited to work with Extreme Networks. Not only are their switches very reliable, but their exceptional performance guarantees a great user experience”, said Marc…

Humidity Measurement Module for OEM Applications

The EE1900 humidity module from E+E Elektronik is optimised for the measurement of relative humidity (RH) or dew point temperature (Td) in climate and test chambers. With outstanding temperature compensation across the working range from -70 °C to 180 °C (-94 °F to 356 °F) and the choice of stainless steel and plastic probes, the module is suitable for a wide range of applications.

High Accuracy in Harsh Environment

The excellent…