Press release

Saudi Arabia Data Center Market Growth Accelerates amid Cloud Adoption and Vision 2030 Push (2025-2033)

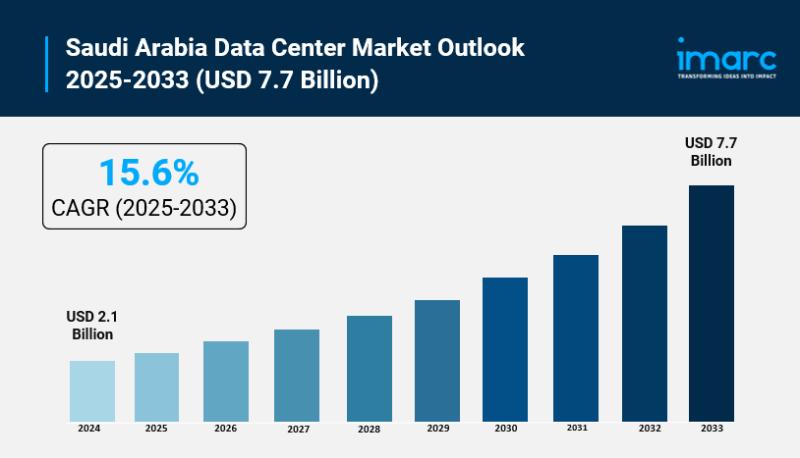

Saudi Arabia Data Center Market OverviewMarket Size in 2024: USD 2.1 Billion

Market Forecast in 2033: USD 7.7 Billion

Market Growth Rate 2025-2033: 15.6%

According to IMARC Group's latest research publication, "Saudi Arabia Data Center Market Report by Data Center Size (Large, Massive, Medium, Mega, Small), Tier Type (Tier 1 and 2, Tier 3, Tier 4), Absorption (Non-Utilized, Utilized), and Region 2025-2033", the Saudi Arabia data center market size reached USD 2.1 Billion in 2024. Looking forward, the market is expected to reach USD 7.7 Billion by 2033, exhibiting a growth rate (CAGR) of 15.6% during 2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-data-center-market/requestsample

How AI and Digital Transformation is Reshaping the Future of Saudi Arabia Data Center Market

● AI-optimized cooling and energy management systems in Saudi data centers use real-time analytics and digital twins to cut cooling-related power use by up to 30%, keeping AI workloads efficient and sustainable.

● At NEOM's Oxagon, a net-zero AI data center backed by about 5 billion dollars and 1.5 gigawatts of capacity will run entirely on renewable energy, purpose-built for large AI and HPC clusters.

● Investors have pledged over 22 billion dollars at AI-focused events like LEAP, with a big share directed to AI-ready data centers, high-density racks, and sovereign AI infrastructure across the Kingdom.

● Saudi developers are rolling out immersion-cooled "desert-proof" facilities, where dielectric fluid systems slash energy consumption by roughly 45% while supporting ultra-dense 100 kilowatt-per-rack AI servers in harsh climates.

● AI itself is embedded into DC operations, automatically shifting workloads, predicting failures, and fine-tuning power usage effectiveness to near 1.2, unlocking higher uptime and better economics for hyperscalers and enterprises.

Saudi Arabia Data Center Market Trends & Drivers:

One of the biggest forces pushing Saudi Arabia's data center market forward is the sheer scale of capital flowing into digital infrastructure tied to AI and cloud. At the LEAP tech conference, commitments worth around 22-23 billion dollars were announced for AI and data centers in just a couple of days, with plans that collectively target more than 1.3 gigawatts of capacity across the Kingdom. A single KKR-Gulf Data Hub program alone is sized at up to 300 megawatts, while broader strategies led by the Ministry of Communications and SDAIA aim to attract roughly 18 billion dollars to hyperscale facilities. This level of funding is turning Saudi Arabia into a serious regional hub for cloud, AI, and high‐performance computing workloads.

A second major growth driver is the rapid build-out of cloud regions and sovereign cloud offerings by global hyperscalers working with national telecom champions. Oracle has committed multi‐billion‐dollar investment into several Saudi cloud regions, with two regions already live in Jeddah and Riyadh and another planned for NEOM, while stc is rolling out a sovereign cloud based on Oracle Alloy to host over 100 cloud infrastructure services locally for public and private clients. At the same time, center3, an stc subsidiary, is pushing to reach 300 megawatts of installed capacity on the way to a one‐gigawatt footprint, reinforcing Saudi Arabia's role as a landing point for subsea cables and a neutral carrier hub. All of this keeps hyperscale demand anchored inside the Kingdom and pulls enterprise workloads into domestic data centers rather than overseas.

The third powerful trend is how tightly Saudi Arabia is linking data center expansion with renewable energy, sustainability, and AI‐intensive workloads from giga‐projects like NEOM. Industry trackers estimate that announced and under‐construction sites could lift national data center power demand to around 1.6 gigawatts, with roughly 55% of capacity clustering around Riyadh and about 500 megawatts designed to run fully on renewable energy, including NEOM and Oxagon campuses. One flagship net‐zero AI data center in NEOM alone has a budget of about 5 billion dollars and is engineered to operate entirely on green power using a mix of solar, wind, and green hydrogen. This energy advantage, paired with efficient liquid cooling and desert-optimized designs, gives operators a cost and ESG edge that resonates strongly with hyperscalers, banks, and global cloud customers.

Buy the Latest 2026 Edition: https://www.imarcgroup.com/checkout?id=16106&method=1315

Saudi Arabia Data Center Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Data Center Size:

● Large

● Massive

● Medium

● Mega

● Small

Breakup by Tier Type:

● Tier 1 and 2

● Tier 3

● Tier 4

Breakup by Absorption:

● Non-Utilized

● Utilized

Breakup by Region:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

● Detecon Al Saudia DETASAD Co. Ltd.

● Electronia

● Gulf Data Hub

● Mobily

● NashirNet

● NourNet

● Sahara Net

● Shabakah Integrated Technology

● Systems of Strategic Business Solutions

Recent News and Developments in Saudi Arabia Data Center Market

● September 2025: ICS Arabia's Desert Dragon project is showcased at DCCI Saudi, positioning its sustainable, scalable data center ecosystem as a core platform for the Kingdom's digital future.

● July 2025: XDS and ICS Arabia announce a landmark 10 megawatt immersion-cooled data center in Riyadh and Jeddah, with rack densities reaching up to 368 kilowatts for AI workloads.

● February 2025: UK-based XDS Datacentres signs a 15-year deal to host 10 megawatts of AI workloads in Saudi's Desert Dragon facilities, targeting ultra-high-density GPU environments.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=16106&flag=E

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Data Center Market Growth Accelerates amid Cloud Adoption and Vision 2030 Push (2025-2033) here

News-ID: 4318429 • Views: …

More Releases from IMARC Group

Australia Solar Street Lighting Market Projected to Grow to USD 757.08 Million f …

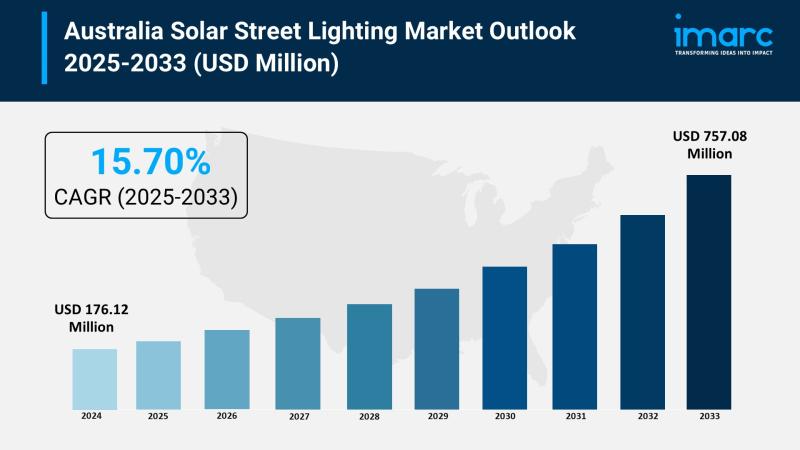

Market Overview

The Australia solar street lighting market was valued at USD 176.12 Million in 2024 and is anticipated to reach USD 757.08 Million by 2033. The forecast period spans 2025 to 2033, during which the market is expected to grow at a CAGR of 15.70%. This growth is fueled by innovations like smart technology integration, infrastructure expansion in remote areas, and supportive government policies promoting energy efficiency, cost reduction, and…

How to Start a Lighting Design Services Business: Investment, Revenue Streams & …

Overview

IMARC Group's "Lighting Design Services Business Plan and Project Report 2026" provides a structured roadmap for establishing a professional lighting design consultancy. This comprehensive report analyzes industry demand, technical and creative requirements, project workflows, investment needs, revenue models, and financial sustainability, making it essential for architects, interior designers, event companies, real estate developers, infrastructure firms, and investors.

Whether launching a new lighting design studio or expanding an existing architecture or design…

Philippines Cybersecurity Market 2026 | Surge to Grow to USD 2.8 Billion by 2034

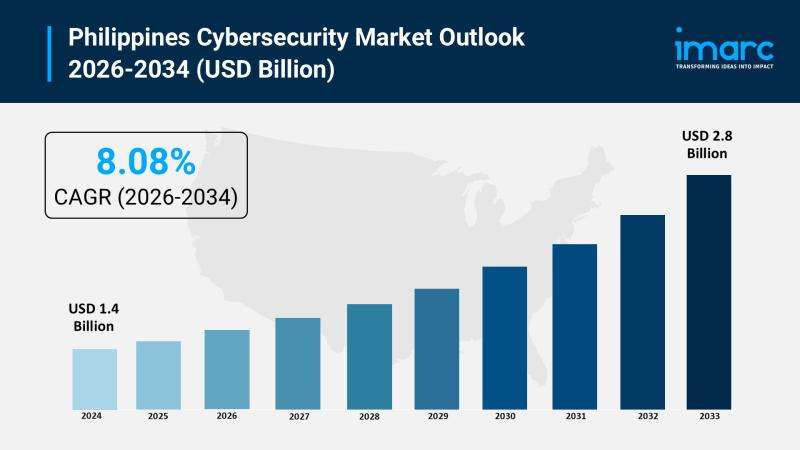

Market Overview

The Philippines cybersecurity market growth was valued at USD 1.4 Billion in 2025 and is projected to reach USD 2.8 Billion by 2034, growing at a compound annual growth rate of 8.08% from 2026 to 2034. This expansion is driven by accelerating digital transformation in public and private sectors, increasing adoption of cloud computing and IoT technologies, and heightened awareness of cyber threats among enterprises. Government initiatives establishing comprehensive…

Philippines Tooling Market | Worth USD 2.69 Billion From 2025 to 2033

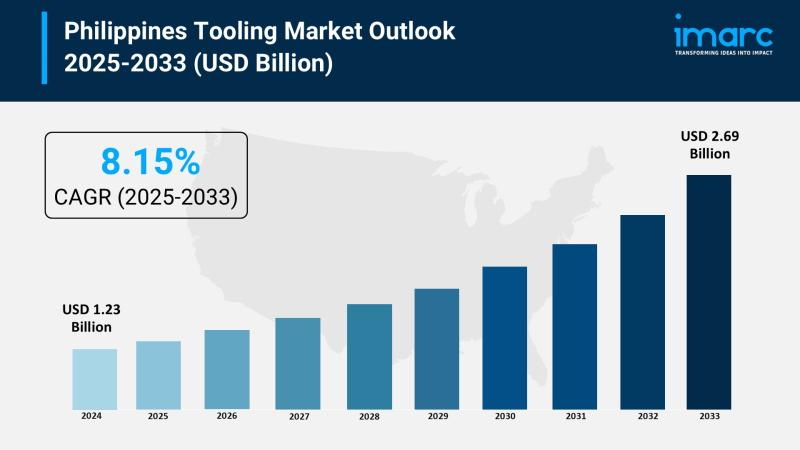

Market Overview

The Philippines tooling market size was USD 1.23 Billion in 2024 and is projected to reach USD 2.69 Billion by 2033, expanding steadily at a CAGR of 8.15% during the forecast period 2025-2033. This growth is supported by the manufacturing, automotive, and electronics industries, where rising demand for precision components and modern production techniques is driving tooling adoption. Additionally, government initiatives promoting industrial development foster new opportunities and enhance…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…