Press release

Indonesia Private Equity Market Size, Demand, Share, Industry Analysis & Forecast 2025-2033

Indonesia Private Equity Market OverviewThe Indonesia private equity market size reached USD 10,166.72 Million in 2024. It is expected to grow robustly, reaching USD 21,468.82 Million by 2033, with a Compound Annual Growth Rate (CAGR) of 8.66% during the forecast period from 2025 to 2033. Key growth drivers include a growing middle class, rising digital penetration, and strong GDP growth that attract private equity investments.

Download Full PDF Sample Copy of Market Report : https://www.imarcgroup.com/indonesia-private-equity-market/requestsample

Indonesia Private Equity Market Study Assumption Years

Base Year : 2024

Historical Year/Period : 2019-2024

Indonesia Private Equity Market Key Takeaways

Current Market Size : USD 10,166.72 Million

CAGR : 8.66%

Forecast Period : 2025-2033

• The market is projected to almost double by 2033 to reach USD 21,468.82 Million.

• Growth is fueled by economic diversification, infrastructure development, and startup innovation.

• Supportive regulatory reforms and foreign direct investment (FDI) policies continue to enhance market participation.

• Digital economy investments in sectors like e-commerce, fintech, and digital health drive significant private equity activity.

• Increasing adoption of ESG frameworks is shaping investment strategies towards sustainability.

Indonesia Private Equity Market Growth Factors

The growth of the Indonesian private equity market can be attributed to a number of factors. Increasing numbers of middle-class consumers in Indonesia, combined with increasing digital penetration rates, and strong GDP growth, provide a strong basis for attracting large amounts of private equity capital.

Last, the economic diversification measures that have been taken in conjunction with the large-scale investment in the infrastructure sector create other opportunities for private equity investors as they expand their portfolios into other sectors of the Indonesian economy.

Macro-economically speaking, the overall economic environment of Indonesia is favourable for both private equity and foreign capital investments due to recent regulatory and foreign direct investment (FDI) reforms that have created an environment that encourages greater transparency and reduces the amount of time needed for investors to obtain approval for investments. Overall, these improvements enhance investor confidence and create a better business environment for the growth of private equity and the inflow of capital.

Purchase This Premium Research Report Up-to Heavy Discount at: https://www.imarcgroup.com/checkout?id=40527&method=1200

Indonesia Private Equity Market Trends

With the rise of digital economy investment into Indonesia's ecosystem, the private equity space in Indonesia is becoming increasingly strong, especially in the e-commerce, fintech, and digital health sectors. Indonesia is one of the largest internet-user markets in Southeast Asia, allowing for a great deal of scalability for all technology-enabled services. With a focus on the early and growth stages of technology-enabled ventures that cater to mobile-first consumers, private equity companies are positioning themselves to be successful.

The Indonesian government is taking steps to position

Indonesia as the digital leader for Southeast Asia by 2030, as part of its strategic initiative known as Making Indonesia 4.0. Key programmes and initiatives supporting this initiative include 100 Smart Cities, as well as the national AI strategy (2020-2045). According to current projections, the digital economy could be valued at over USD 130 billion by 2025, with 79.5% of the population being young and 99% of them currently using the internet. The fintech sector, especially digital payment methods, are projected to grow by 15% per annum to 2025, continuing to drive growth in this segment.

ESG (Environmental, Social and Governance) principles are becoming an increasing part of the investment strategy. Firms are implementing ESG frameworks to reduce risk and enhance brand value, as well as align with investors' expectations. The rise of ESG investments are causing an increase in the targeting of clean energy, sustainable agricultural processes, and, in particular, inclusive finance, as well as regulatory action in support of sustainable investments.

A significant development is the launch of Indonesia's sovereign wealth fund, Danantara, in February 2025. Backed by an initial USD 20 billion pledge, Danantara focuses commercially on large domestic projects with strong returns and job creation prospects, especially in AI, natural resources, and food security. Its unique stance avoids the need for investment partners, emphasizing risk management, and already attracting global investor interest.

Indonesia Private Equity Market Segmentation

Fund Type Insights:

• Buyout: Includes investments involving the acquisition of controlling stakes in established companies.

• Venture Capital (VCs): Focuses on funding early and growth-stage startups with high potential.

• Real Estate: Encompasses investments in property and related assets.

• Infrastructure: Investments directed towards infrastructure projects and assets.

• Others: Covers other fund types not classified above.

Regional Insights

• Java

• Sumatra

• Kalimantan

• Sulawesi

• Others

The regionally dominant market is Java, exhibiting the largest market share and contributing significantly to the overall growth. The Indonesia private equity market across these regions is projected to grow at a CAGR of 8.66% during 2025-2033.

Indonesia Private Equity Market Recent Developments & News

In December 2024, Mayapada Healthcare Group secured a

USD 157 million strategic growth investment from Bain Capital aimed at expanding its premium hospital network in Indonesia. The funds will facilitate scaling operations, upgrading technology, and meeting increasing healthcare demand.

In November 2024, Intudo Ventures raised a total of USD 125 million across two funds to support startups and renewable energy initiatives in Indonesia. The USD 75 million Intudo Ventures IV targets sectors such as consumer products, aquaculture, horticulture, and deep tech, aiming to acquire significant ownership in 14-18 companies. The USD 50 million fund concentrates on downstream natural resources and renewable energy, leveraging Indonesia's prominence in nickel and cobalt markets. Investors include entities from the U.S., Europe, Asia, and the Middle East, such as Orient Growth Ventures and Black Kite Capital.

Indonesia Private Equity Market Key Highlights of the Report

• Comprehensive quantitative analysis of market segments and trends from 2019 to 2033.

• Detailed insights on market drivers, challenges, and opportunities.

• Porter's Five Forces analysis to assess market competitiveness and attractiveness.

• In-depth competitive landscape evaluation including key player positioning and strategies.

• Extensive coverage of fund types and regional segmentation.

• Flexible customization and analyst support post-purchase.

Get Your Customized Market Report Instantly: https://www.imarcgroup.com/request?type=report&id=40527&flag=E

Customization Note:

If you require any specific information not covered within this report's scope, we will provide it as part of the customization.

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel: (D) +91 120 433 0800

United States: +1-201971-6302

IMARC Group is a global management consulting firm that helps ambitious changemakers create a lasting impact. The company offers comprehensive market assessment, feasibility studies, incorporation support, regulatory assistance, branding and strategy services, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Indonesia Private Equity Market Size, Demand, Share, Industry Analysis & Forecast 2025-2033 here

News-ID: 4318241 • Views: …

More Releases from IMARC Group

India Plastic Pipes Market Outlook 2026-2034: Size, Share, Growth, Trends, Deman …

According to IMARC Group's report titled "India Plastic Pipes Market Size, Share, Trends and Forecast by Type, Diameter, End Use, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Plastic Pipes Market Report

The India plastic pipes market size was valued at USD 2.10 Billion in 2025 and is projected to reach USD 3.65 Billion by 2034, exhibiting a CAGR…

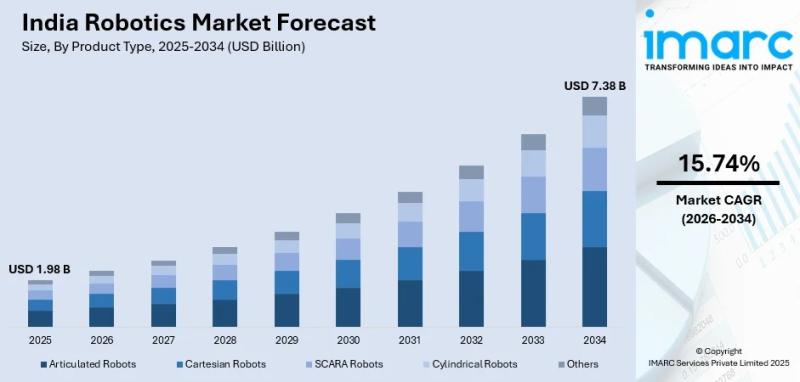

India Robotics Market Expanding at 15.74% CAGR by 2034, Driven by Make in India …

Summary

The India robotics market size reached USD 1.98 Billion in 2025, according to the latest comprehensive industry analysis by IMARC Group. Fueled by a massive push toward manufacturing modernization, rising labor costs, and robust government support for digital transformation, the market is projected to reach an impressive USD 7.38 Billion by 2034. This highlights a rapid compound annual growth rate (CAGR) of 15.74% during the forecast period (2026-2034).

Request a…

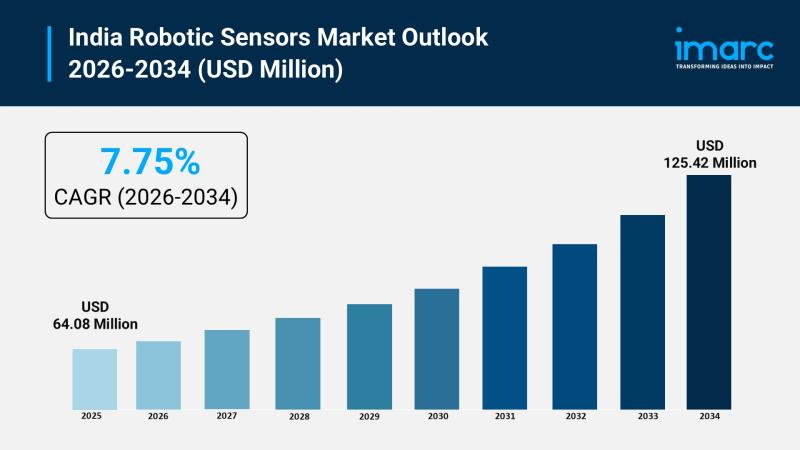

India Robotic Sensors Market Growing at 7.75% CAGR Through 2034, Driven by AI & …

Summary

The India robotic sensors market size reached USD 64.08 Million in 2025, according to the latest comprehensive industry analysis by IMARC Group. Fueled by robust government initiatives, escalating labor costs, and the rapid integration of artificial intelligence in industrial automation, the market is projected to reach USD 125.42 Million by 2034. This highlights a steady compound annual growth rate (CAGR) of 7.75% during the forecast period (2026-2034).

Request a Free Sample…

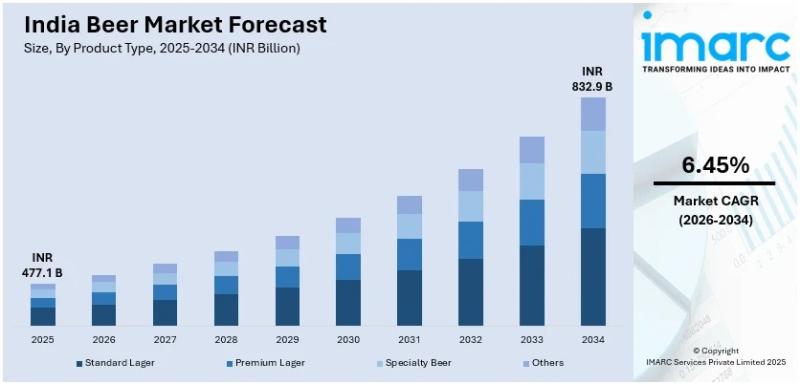

India Beer Market Size to Reach INR 832.93 Billion by 2034: Industry Trends, Gro …

Summary

The beer market size in india reached INR 477.05 Billion in 2025, according to the latest comprehensive industry analysis by IMARC Group. Driven by rapid urbanization, a burgeoning young demographic, and a massive cultural shift toward premium and craft beverages, the market is projected to reach INR 832.93 Billion by 2034. This represents a steady compound annual growth rate (CAGR) of 6.45% during the forecast period (2026-2034).

What are the Key…

More Releases for Indonesia

Indonesia Facility Management Market Size, Trends 2031 By Key Players- Sodexo, I …

Indonesia Facility Management Market Growth Factors

Market conditions reflect evolving infrastructure and service expectations. Urbanization accelerates demand as commercial buildings, transport hubs, and mixed use developments require integrated services. Regulatory compliance strengthens outsourcing through safety standards, sustainability mandates, and reporting requirements. Technology integration improves efficiency using sensors, analytics, and automated maintenance scheduling. Current challenges include skilled labor shortages, fragmented vendor ecosystems, and cost sensitivity among clients. Market scope for 2026 includes…

Indonesia Oil and Gas Market Size, Share Projections 2031 by Key Manufacturer- P …

USA, New Jersey: According to Verified Market Research analysis, the global Indonesia Oil and Gas Market size was valued at USD 281.50 Billion in 2024 and is projected to reach USD 499.94 Billion by 2032, growing at a CAGR of 7.66% during the forecast period 2026-2032.

What is the current outlook and growth potential of the Indonesia Oil and Gas Market?

The Indonesia Oil and Gas Market is showing signs of gradual…

Indonesia Amino Acid Fertilizer Market Anticipated for Positive Growth by 2031 | …

Indonesia Amino Acid Fertilizer Market Research Report By DataM Intelligence: A comprehensive analysis of current and emerging trends provides clarity on the dynamics of the Indonesia Amino Acid Fertilizer market. The report employs Porter's Five Forces model to assess key factors such as the influence of suppliers and customers, risks posed by different entities, competitive intensity, and the potential of emerging entrepreneurs, offering valuable insights. Additionally, the report presents research…

Overview of Indonesia MICE Market | SHIFTinc, Venuerific Indonesia, Werkudara Gr …

Astute Analytica, a leading provider of market research and analysis, released its highly anticipated Market Analysis Report on the Indonesia MICE Market. This comprehensive report aims to equip businesses with invaluable insights and data, enabling them to make informed decisions and stay one step ahead of the competition.

Access the Comprehensive PDF Market Research Analysis Report Here: https://www.astuteanalytica.com/request-sample/indonesia-mice-market

Indonesia MICE Market was valued at US$ 2,095.95 million in 2022 and is…

Clinical Laboratory Market in Indonesia, Clinical Laboratory Industry in Indones …

"Increase in healthcare expenditure from the Indonesian government has driven the growth of clinical laboratory market in Indonesia."

Increase in Healthcare Awareness: Largely driven by increase in healthcare spending by aging population (~$ 260 per person by 2050), rising income levels, rising awareness for preventive testing, advanced healthcare diagnostic tests offerings, and central government's healthcare measures.

Developments in Testing and Preference for Evidence based testing: There is also a rising number…

Baby Food Sector in Indonesia Market 2019 By PT Nestlé Indonesia, Danone, PT Ka …

"The Baby Food Sector in Indonesia, 2018", is an analytical report by GlobalData which provides extensive and highly detailed current and future market trends in the Indonesian market.

Dietary habits have inhibited sales of commercially prepared baby foods in Indonesia. With the exception of Jakarta, many Indonesians have a traditional diet, based on rice, fresh fruit, and vegetables, supplemented with meat, although, 80% of the population is Muslim, and do not…