Press release

Royal York Property Management Built an $11 Billion Empire by Rejecting Every Rule in the Startup Playbook

Canada's largest residential property management company spent nearly a decade without turning a profit and rejected outside investors. Now it operates across seven countries with over 25,000 properties under management.In 2010, a 19-year-old Nathan Levinson sat in a Toronto coffee shop, making cold calls to property owners who almost universally hung up on him. He had no employees, no office, and no backup plan. His business model-a rental guarantee that promised landlords their rent even if tenants defaulted-was dismissed by professors and peers alike as financial suicide.

Fifteen years later, Royal York Property Management [https://royalyorkpropertymanagement.ca] is Canada's largest residential property management company, with over 25,000 properties under management and $11 billion in assets across seven countries. The company services more than 40 cities from 21 office locations in Ontario alone, with additional operations spanning North America and Europe.

The path to that position violated nearly every principle taught in business schools and venture capital pitch meetings. Royal York Property Management operated at a loss for almost a decade. Levinson rejected investor after investor, even when the company desperately needed capital. And the rental guarantee that everyone said would bankrupt the company became its defining competitive advantage.

The Guarantee That Changed Everything

The concept behind Royal York Property Management's rental guarantee is deceptively simple: if a tenant stops paying rent, the company pays the landlord anyway. For property owners accustomed to the anxiety of missed payments and the nightmare of eviction proceedings, the promise was almost too good to believe.

"Everyone told me it would destroy the company," Levinson has said. "What they didn't understand was that the guarantee would force us to become excellent at the one thing that matters most in this business: putting the right tenants in the right properties."

Because Royal York Property Management bears the financial risk of tenant default, the company has an overwhelming incentive to screen tenants rigorously. The property management company has built proprietary AI systems that analyze applicants against a database of over 60,000 historical tenancies, detecting fraudulent documents and identifying patterns that predict payment behavior in ways traditional credit checks miss.

Technology as Competitive Moat

Royal York Property Management is the only property management company in Canada with bank accreditation from all eight major financial institutions. This means tenants can pay rent through their bank's official Bill Pay system-the same way they pay utility bills or credit cards. Over the past three years, the company has processed one million rent transactions, with 100,000 of those flowing through the bank-accredited system. Today, approximately 3,000 families per month use this secure payment method.

Achieving this accreditation required two years of audits and compliance work with each bank separately. The rigor of the process is precisely what makes it valuable-competitors cannot simply decide to offer bank-integrated payments without demonstrating comparable security infrastructure and financial controls.

The property management company's operations reflect the same commitment to excellence. Royal York Property Management maintains in-house maintenance teams and a network of vetted contractors, dispatching help within 40 minutes for emergencies. The six-ring call answer policy means property owners and tenants reach a human quickly, not a voicemail system.

Patient Capital, Permanent Control

What makes Royal York Property Management's story particularly unusual is the timeline. The company did not turn a profit until nearly a decade after its founding. In a business environment where growth at all costs is the mantra, Levinson took the opposite approach: build the infrastructure first, grow organically, and let profitability come when the foundation was solid.

"I had opportunities to raise money," Levinson has acknowledged. "But every time I got close to a deal, I asked myself: what problem does this money solve that I cannot solve with time and discipline? The answer was usually that it would just make things faster. And faster, without the right foundation, is how companies die."

The decision to reject outside capital meant complete control over the company's direction-and no pressure to prioritize anything other than what's best for clients. Levinson, now a panel member for the Bank of Canada, remains the company's sole owner.

The company Levinson started with cold calls from a coffee shop now operates around the clock, across continents, in over 20 languages. The guarantee that everyone said would destroy the business became the foundation of its competitive advantage. The patience that meant nearly a decade without profit produced a property management company with no debt, no outside shareholders, and a singular focus on service.

Whether this model can be replicated remains to be seen. What's clear is that in an industry notorious for poor service and misaligned incentives, one property management company found a different approach. And the market responded.

About Royal York Property Management

Royal York Property Management [https://royalyorkpropertymanagement.ca] is Canada's largest residential property management company, committed to managing investment properties with exceptional care and professionalism. With 21 office locations across Ontario and service coverage spanning more than 40 cities, Royal York Property Management prioritizes the needs of clients and tenants in every task. The property management company's mission to redefine property management is driven by innovation, transparency, and accessibility. Managing $11 billion in assets across seven countries, Royal York Property Management offers services in over 20 languages, empowering both property owners and tenants.

Media Contact:

Company Name:Royal York Property Management

Media Contact:Nathan Levinson

Email ID:canada@royalyorkpm.com

Website:royalyorkpm.com

Country:Canada

Media Contact

Company Name: Royal York Property Management

Contact Person: Nathan Levinson

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=royal-york-property-management-built-an-11-billion-empire-by-rejecting-every-rule-in-the-startup-playbook]

Country: Canada

Website: http://royalyorkpm.com

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Royal York Property Management Built an $11 Billion Empire by Rejecting Every Rule in the Startup Playbook here

News-ID: 4318029 • Views: …

More Releases from ABNewswire

Real Estate Agent in Austin, TX, Adds Mortgage Licensing to Support Buyers Throu …

Austin, TX - In a strategic move to provide more comprehensive service to his clients, Brian C Folsom has recently obtained his mortgage license, positioning himself as a unique resource in the Austin real estate market. This additional credential allows him to guide buyers through both the home search and financing qualification processes, offering an integrated approach that streamlines the journey to homeownership.

The decision to pursue mortgage licensing stems from…

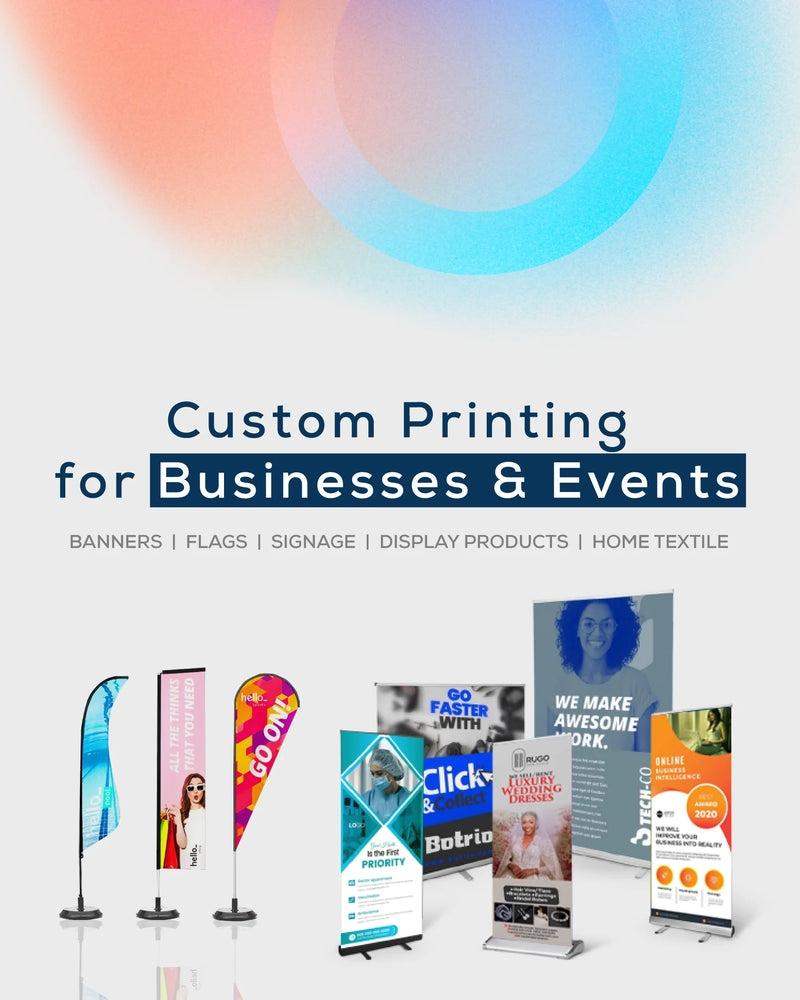

Digital Printing Service Support in Nazareth, PA Expanded by Sign Textile to Cov …

Sign Textile, a full-service digital printing company based in Nazareth, PA, has expanded its production and fulfillment support to businesses across Allentown, Philadelphia, Trenton, and Princeton. The company now offers direct access to custom outdoor signs, banner printing, vehicle wrap services, large format printing, and custom textile products across the broader Pennsylvania and New Jersey region. Orders are available online at signtextile.com.

Digital Printing Service in Nazareth, PA

Digital printing service [https://www.google.com/maps/place/Sign+Textile/@40.7385309,-75.3075722,794m/data=!3m2!1e3!4b1!4m6!3m5!1s0x89c4698e5e06db87:0xec2c645ea7b860f8!8m2!3d40.7385309!4d-75.3075722!16s%2Fg%2F11zk5427c5?hl=en-GB&entry=ttu&g_ep=EgoyMDI2MDIyMy4wIKXMDSoASAFQAw%3D%3D#:~:text=digital%20printing%20service]…

CoreAge Rx Raises the Bar on Medication Delivery With Free 2-Day Shipping, Tempe …

As GLP-1 demand continues to grow across the United States, CoreAge Rx delivers compounded Semaglutide and Tirzepatide directly to patients' doors with speed, discretion, and pharmaceutical-grade handling at no extra cost.

Image: https://www.abnewswire.com/upload/2026/02/97f63fd2a72edd923f925e1750cfbd14.jpg

CoreAge Rx, a LegitScript-certified telehealth weight management provider based in Wichita Falls, Texas, has built a medication delivery model that independent reviewers and patients consistently describe as one of the strongest in the GLP-1 telehealth space. Free 2-day shipping…

CoreAge Rx Builds Its GLP-1 Program Around Patient Support That Goes Beyond the …

With 24/7 access, rapid response times, dedicated care coordinators, and physician continuity throughout treatment, CoreAge Rx has set a new standard for what patient support looks like in telehealth weight management.

Image: https://www.abnewswire.com/upload/2026/02/79b953c7d7b86bdc830623292680666e.jpg

CoreAge Rx, a LegitScript-certified telehealth weight management provider based in Wichita Falls, Texas, has built a patient support model that independent reviewers consistently identify as one of the most comprehensive in the GLP-1 telehealth space. From 24/7 access across…

More Releases for Royal

CalmGetaways Recognized with Royal Rising Star Award by Royal Caribbean

CalmGetaways, a rapidly growing Dubai-based travel agency specializing in cruises, is proud to announce that it has been awarded the prestigious Royal Rising Star Award by Royal Caribbean. This accolade recognizes the agency's exceptional growth, innovative approach to cruise travel, and dedication to providing outstanding experiences for travelers across the UAE and the GCC region.

Since its inception, CalmGetaways has redefined cruise travel by offering curated itineraries, personalized planning, and elevated…

Royal Forestry Society honoured by Royal Patronage of His Majesty King Charles

The Royal Forestry Society (RFS) is greatly honoured to receive the Royal Patronage of His Majesty King Charles.

His Majesty King Charles was President of the RFS for our Centenary from 1982-1983 and becomes the sixth monarch to be our Patron.

A Special Bond

RFS President Ben Herbert says: "This patronage continues a very special bond. His Majesty has always retained an active interest in the work of other foresters and woodland managers.…

Explore Seoul's Five Royal Palaces with K-Royal Palaces PASS

The Cultural Heritage Administration of Korea and the Korea Cultural Heritage Foundation have unveiled the "K-Royal Palaces PASS," granting unlimited entry to Seoul's five royal palaces: Gyeongbokgung Palace, Changdeokgung Palace, Deoksugung Palace, Changgyeonggung Palace, and Gyeonghuigung Palace during the "2024 K-Royal Culture Festival," spanning nine days from April 27 to May 5.

Image: https://i.imgur.com/LnuNeF5.png

https://www.kkday.com/en-us/product/165009

Celebrating its tenth anniversary this year, the K-Royal Culture Festival is Korea's premier cultural heritage event, held twice…

Royal Wealth Hack Reviews: Royal Wealth Hack Does It Legit?

Many people come across schemes that promise easy and quick money when they are pursuing financial freedom. A program called Royal Wealth Hack has gained a lot of interest due to its assertion that it can unlock abundance through an 8-second wealth "hack" that is "revolutionary." To distinguish the hype from genuine promise, though, you should conduct a thorough examination before jumping headfirst into this alluring offer.

"Use the Royal Wealth…

Whisky Market Growing Popularity & Emerging Trends | McDowell, 8PM, Royal Stag, …

A new business intelligence report released by HTF MI with title "India Whisky Market Outlook, 2023" is designed covering micro level of analysis by manufacturers and key business segments. The India Whisky Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics sources and it comprises both qualitative and quantitative detailing. Some of the…

Royal Jelly Market 2019-2025 Global Industry Size and in-Depth Analysis by Top P …

Industry Overview of the Royal Jelly Report 2025:

The market intelligence report on the Global Royal Jelly Market offers the readers a 360° market overview with definitions, market segments, applications, raw material used, product details, cost structures, production processes, and other essential data. The study evaluates the global market landscape, with an in-depth analysis of product pricing, production and consumption volume, cost, value, production capacity, supply and demand dynamics, annual market…