Press release

Top 30 Indonesian Public Hospitality Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)Q3 2025 showed a mixed but overall improving picture for Indonesian hospitality: strong earners (cinema & Bali/Leisure resorts) posted solid 9M top-line growth vs prior year, while smaller hotel names still struggle with narrower margins and in some cases continuing net losses. Several mid-cap hotel companies reported recovery in room revenue and F&B but were pressured by finance costs and FX movements during 9M25. The cinema operator (CNMA) and beachfront resort owner (BUVA) stood out as material net-earners in 9M25, while smaller single-asset hotels reported continued losses.

Below is a compiled list of the 30 hospitality / hotels-resorts-related issuers listed on the IDX:

PT Panorama Sentrawisata Tbk (PANR)

PT Nusantara Sejahtera Raya Tbk

PT Bukit Uluwatu Villa Tbk

PT Pollux Hotels Group Tbk

PT Eastparc Hotel Tbk

PT Dafam Property Indonesia Tbk

PT Hotel Sahid Jaya International Tbk

PT Sunter Lakeside Hotel Tbk

PT Hotel Fitra International Tbk

PT Red Planet Indonesia Tbk / PSKT

PT Hotel Mandarine Regency Tbk

PT Hotel Properti Internasional

PT Jaya Hospitality / Jakarta Intern. Hotels & Development

PT Island Concepts Indonesia Tbk

PT Jakarta International Hotels & Development Tbk

PT Indonesian Paradise Property Tbk

PT Hotel Fitra International Tbk

PT Bukit Darmo Property Tbk

PT Pikko Land Development Tbk

PT Bayu Buana Tbk

PT Panorama Sentrawisata Tbk

PT Citra Putra Realty Tbk

PT Menteng Heritage Realty Tbk

PT Grand House Mulia Tbk

PT Jakarta Setiabudi Internasional Tbk

PT Surya Semesta Internusa Tbk

PT Intra GolfLink Resorts Tbk

PT Idea Indonesia Akademi Tbk

PT Jaya Bersama Indo Tbk

PT Grahamas Citrawisata Tbk

2) Q3-2025 earnings highlights Top 10 Indonesian hospitality public companies

1. PT Nusantara Sejahtera Raya Tbk CNMA (Cinema XXI)

Q3 / 9M-2025 net income (IDR): Rp 444.9 billion (9M25).

Equivalent (USD): ≈ $26,640,719.

Brief: Cinema operator Cinema XXI recorded sustained revenue (~Rp4.3 trillion 9M25) with net profit of ~Rp445bn through Sep 30 2025 profit down around mid-teens YoY but still the largest net earner among hospitality peers. This reflects resilient box-office recovery and operational scale.

2. PT Bukit Uluwatu Villa Tbk - BUVA

Q3 / 9M-2025 net income (IDR): Rp 108.6-109.1 billion (reported ranges in filings/news).

Equivalent (USD): ≈ $6,526,946 (Rp109bn → ≈ $6.53M).

Brief: Resort owner reported a strong rebound (large YoY jump in net income in Q3/9M), benefiting from leisure tourism and asset recoveries.

3. PT Pollux Hotels Group Tbk - POLI / Pollux

Q3 / 9M-2025 net income (IDR): Rp 65.8 billion (Q3/9M disclosed in filings).

Equivalent (USD): ≈ $3,940,120.

Brief: Pollux posted a marked improvement QoQ and YoY with net profit recovery driven by higher occupancy and cost discipline.

4. PT Panorama Sentrawisata Tbk - PANR

Q3 / 9M-2025 net income (IDR): Rp 54.1 billion (Q3 result announced).

Equivalent (USD): ≈ $3,239,521.

Brief: Panorama (travel & tour operator / hotel management exposures) recorded revenue growth ~16% and a 58% rise in net income YoY for Q3 as year-end holiday sales picks up.

5. PT Eastparc Hotel Tbk - EAST

Q3 / 9M-2025 net income (IDR): ≈ Rp 20.9 billion (9M25).

Equivalent (USD): ≈ $1,251,497.

Brief: Eastparc reported positive net profit (9M25), though margins compressed vs prior period; revenue growth and stable operating cashflow were noted.

6. PT Dafam Property Indonesia Tbk - DFAM

Q3 / 9M-2025 net result (IDR): Net loss Rp 4.6 billion (Q3 2025).

Equivalent (USD): ≈ -$275,449.

Brief: Dafam reported a narrower loss vs prior year (improvement from deeper prior losses) - signs of operational stabilization but still small net loss for Q3.

7. PT Hotel Sahid Jaya International Tbk - SHID

Q3 / 9M-2025 net result (IDR): Net loss Rp 55.2 billion (Q3 / 9M cited in filings).

Equivalent (USD): ≈ -$3,305,389.

Brief: Sahid reported increased losses Sept 30, 2025 vs prior year, pressured by lower occupancy in some properties, higher financing costs and provisions. Full interim filing is available in the company's Q3 report.

8. PT Sunter Lakeside Hotel Tbk - SNLK

Q3 / 9M-2025 net result (IDR): Net loss Rp 5.7 billion (9M25).

Equivalent (USD): ≈ -$341,317.

Brief: Sunter Lakeside saw revenue decline ~20.5% to ~Rp30.05bn (9M25) and widening losses (vs prior year). Management flagged margin pressure from falling room/F&B revenue.

9. PT Hotel Fitra International Tbk - FITT

Q3 / 9M-2025 net result (IDR): Net loss Rp 5.7 billion (Q3/9M reported).

Equivalent (USD): ≈ -$341,317.

Brief: Hotel Fitra reported a modestly smaller loss YoY; revenues show small improvement but margins still negative.

10. PT Red Planet Indonesia Tbk - PSKT / Red Planet

Q3 / 9M-2025 net result (IDR): Net loss ≈ Rp 7.96 billion (9M25 consolidated).

Equivalent (USD): ≈ -$476,647.

Brief: Red Planet's consolidated Q3/9M reports show slightly higher losses (operations impacted by some temporary closures/renovations but scale remains small). Management disclosed temporary closure/renovation of certain properties that were immaterial to consolidated continuity.

3) Key trends & insights from Q3 2025 (hospitality)

Scale wins (cinema & multi-asset groups): Larger operators with diversified revenue streams (cinema chain CNMA, multi-resort BUVA, bigger hotel groups like Pollux) delivered the most consistent profits scale allowed fixed-cost dilution and better F&B/ancillary margins. CNMAs Rp~445bn profit highlights scale advantage.

Leisure demand rebound but uneven recovery: Bali / resort-oriented assets and leisure-destination owners outperformed city-centrics. Domestic holiday demand strengthened in Q3 (pre-year-end bookings), lifting room revenues for resort players.

Smaller single-asset hotels still fragile: Single-hotel issuers (SNLK, FITT, SHID) continued to face occupancy swings, higher unit operating costs (labour, energy) and financing costs that kept net profit negative.

Cost & financing pressure: Several companies referenced elevated finance costs and provisions; in some case these eroded gains from higher revenue. FX (IDR volatility) also affected group-level expenses for companies with forex exposures.

Seasonality & forward bookings: Managements (particularly PANR and POLI) flagged stronger year-end holiday bookings and A-/B-class domestic travel trends indicating Q4 is expected to benefit from tourism seasonality.

4) Outlook for Q4 2025 and beyond

Q4 is seasonally stronger: Many hospitality companies guided to an improved Q4 on the back of year-end holiday travel and corporate events. If bookings hold, room revPAR and F&B revenue should improve sequentially for most operators.

Watch interest rates & FX: High finance costs remain a downside risk. Companies with meaningful debt could see margins squeezed further if rates remain elevated smaller issuers are most exposed.

Consolidation & asset plays: Given the performance dispersion, expect selective asset sales, renovations, and possible M&A or strategic alliances (brand management deals) companies will push to improve asset yields ahead of 2026. Larger groups with balance-sheet flexibility may pursue opportunistic expansion.

Domestic demand resilience; inbound recovery is the upside: Domestic travel is the immediate driver; further inbound tourist recovery (from key markets) would be a significant upside for Bali/resort names and city hotels. Monitor visa / travel policy and airline seat capacity data for leading indicators.

5) Conclusion

Q3-2025 shows an industry in recovery but uneven: larger multi-asset operators and high-traffic leisure names delivered meaningful profits (CNMA, BUVA, POLI, PANR), while many single-asset hotels still reported losses or slim margins due to occupancy volatility and financing costs. Q4-2025 is expected to be better seasonally, but interest-rate and FX risks remain the principal downside. Investors should favor scale, diversified revenue and healthy balance sheets when screening hospitality issuers in Indonesia.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 30 Indonesian Public Hospitality Companies Q3 2025 Revenue & Performance here

News-ID: 4317701 • Views: …

More Releases from QY Research

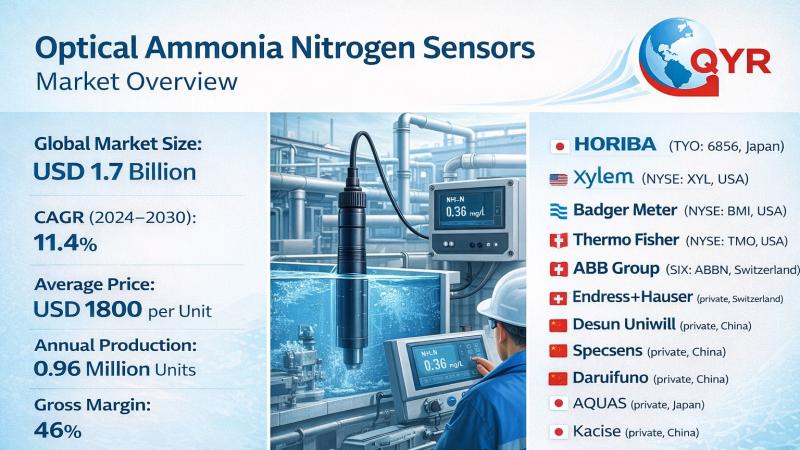

Global and U.S. Optical Ammonia Nitrogen Sensors Market Report, Published by QY …

QY Research has released a comprehensive new market report on Optical Ammonia Nitrogen Sensors, advanced water-quality monitoring instruments that measure ammonia nitrogen (NH3-N / NH4+-N) concentrations using optical detection principles rather than electrochemical reactions. By leveraging spectrophotometry, fluorescence, or colorimetric optical methods, these sensors deliver high selectivity, low drift, and reduced maintenance-making them increasingly essential for wastewater treatment, surface water monitoring, aquaculture, and industrial process control. This report provides an…

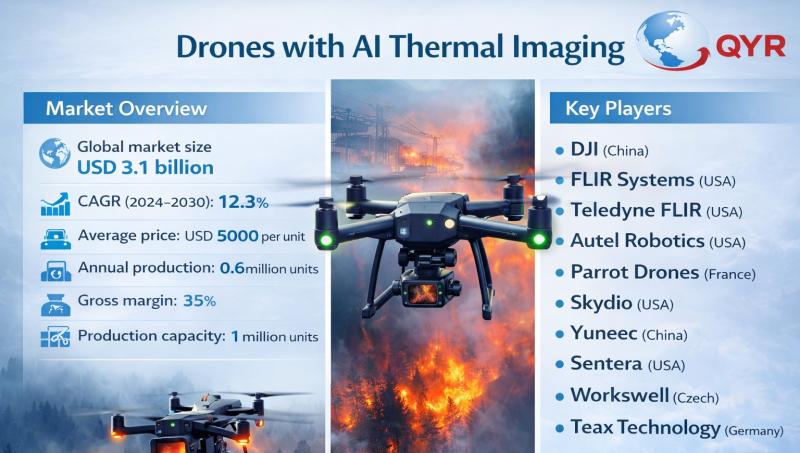

Global and U.S. Drones with AI Thermal Imaging Market Report, Published by QY Re …

QY Research has released a comprehensive new market report on Drones with AI Thermal Imaging, are unmanned aerial vehicles (UAVs) equipped with thermal cameras and artificial intelligence algorithms to detect, analyze, and interpret heat signatures in real time. These drones combine high-resolution infrared sensors with machine learning-based analytics to identify temperature variations, locate humans, detect equipment malfunctions, or monitor environmental conditions. They are widely used in applications such as search…

Global and U.S. Optical Ammonia Nitrogen Sensors Market Report, Published by QY …

QY Research has released a comprehensive new market report on Optical Ammonia Nitrogen Sensors, advanced water-quality monitoring instruments that measure ammonia nitrogen (NH3-N / NH4+-N) concentrations using optical detection principles rather than electrochemical reactions. By leveraging spectrophotometry, fluorescence, or colorimetric optical methods, these sensors deliver high selectivity, low drift, and reduced maintenance-making them increasingly essential for wastewater treatment, surface water monitoring, aquaculture, and industrial process control. This report provides an…

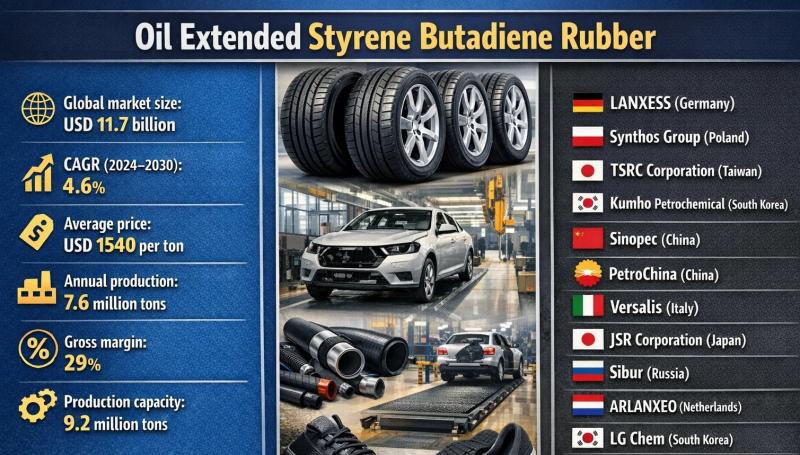

Market Overview - Oil Extended Styrene Butadiene Rubber

QY Research has recently published a comprehensive market study on Oil Extended Styrene Butadiene Rubber (OE-SBR), a cost-efficient elastomer grade produced by incorporating processing oils into SBR to enhance flexibility, processability, and filler dispersion. OE-SBR is a cornerstone material for tire treads and sidewalls, automotive rubber goods, footwear, hoses, belts, and general industrial rubber products.

The market is evolving from conventional aromatic oil-extended grades toward low-PAH, environmentally compliant formulations, alongside performance…

More Releases for Tbk

Indonesia Textile Industry Market Valuation Expected to Hit USD 28.57 billion by …

USA, New Jersey: According to Verified Market Research analysis, the global Indonesia Textile Industry Market size was valued at USD 21.7 Billion in 2023 and is projected to reach USD 28.57 Billion by 2031, growing at a CAGR of 3.50% from 2024 to 2031

How AI and Machine Learning Are Redefining the future of Indonesia Textile Industry Market?

AI-powered production planning systems optimize yarn selection, fabric blends, and loom utilization, improving output…

Infrastructure Market 2021 Strategic Assessments - PT. Acset Indonusa Tbk.., Pt. …

The Infrastructure Market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The Infrastructure sector in Indonesia is…

Indonesia Telecom Tower Market Demand, Size, Share, Scope & Forecast To 2025 |To …

The Indonesia telecom tower market accounted to US$ 557.9 Mn in 2017 and is expected to grow at a CAGR of 27.1% during the forecast period 2018 – 2025, to account to US$ 3,695.5 Mn by 2025.

Get Sample Copy of this Indonesia Telecom Tower Market research report at - https://www.businessmarketinsights.com/sample/TIPRE00004113

The Business Market Insights provides you regional research analysis on “Indonesia Telecom Tower Market” and forecast to 2025. The research report…

Coal Mining in Indonesia Market 2022| PT Bumi Resources Tbk, PT Adaro Energy Tbk …

Researchmoz added Most up-to-date research on "Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption" to its huge collection of research reports.

Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption

Summary

GlobalData's "Coal Mining in Indonesia to 2022", provides a comprehensive coverage on Indonesias coal industry. It provides historical and forecast data on coal production by grade, reserves, consumption and exports by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes

Summary

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by type; exports, exports by type and exports by country. Detailed analysis of the…