Press release

United States Diabetes Therapeutics Market to Reach USD 321.96 Billion by 2033 | CAGR 15.4% | North America Leads with 38% Share | Key Players: Novo Nordisk, Eli Lilly, Merck, Boehringer Ingelheim, Johnson & Johnson, Novartis, Biocon, Innogen Biopharmaceu

Diabetes Therapeutics Market Overview:The global diabetes therapeutics market reached US$ 76.75 billion in 2023, increased to US$ 89.46 billion in 2024, and is projected to reach US$ 321.96 billion by 2033, expanding at a strong CAGR of 15.4% during the forecast period 2025-2033. The market is undergoing rapid transformation, driven by demographic shifts, changing lifestyles, technological advancements, and evolving regulatory frameworks.

As diabetes continues to rise globally as one of the most prevalent and costly chronic diseases, the demand for effective, safe, and accessible therapeutic options has intensified. While traditional drugs such as insulin and metformin remain widely used, the market is seeing a major shift toward innovative drug classes, including GLP-1 receptor agonists, SGLT-2 inhibitors, DPP-4 inhibitors, and emerging dual and triple agonists. These next-generation therapies not only improve glycemic control but also offer weight reduction and cardiovascular protection, making them increasingly preferred by both physicians and patients.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/diabetes-therapeutics-market?Juli

Recent Developments:

✅ October 2025: Novo Nordisk launched its next-generation oral semaglutide formulation, improving patient adherence and expanding accessibility in type 2 diabetes management. The new version enhances bioavailability and reduces gastrointestinal side effects.

✅ September 2025: Eli Lilly and Company announced the global expansion of Mounjaro (tirzepatide) into additional markets following strong clinical results demonstrating dual GIP and GLP-1 receptor agonist efficacy in reducing HbA1c and body weight.

✅ July 2025: Sanofi introduced a smart insulin delivery pen system integrated with digital glucose monitoring and mobile app connectivity, improving patient compliance and real-time insulin dosing accuracy.

✅ June 2025: AstraZeneca launched an updated SGLT-2 inhibitor therapy with demonstrated renal protection benefits for diabetic kidney disease, strengthening its presence in the cardio-renal-metabolic segment.

✅ March 2025: Global health agencies and pharmaceutical companies initiated multiple AI-powered diabetes management programs, integrating predictive analytics for insulin dosing, lifestyle tracking, and remote patient monitoring.

Mergers & Acquisitions:

✅ November 2025: Eli Lilly and Company acquired a U.S.-based biotech specializing in next-generation GLP-1 analogs, aiming to expand its pipeline of multi-receptor agonists for obesity and diabetes.

✅ September 2025: Novo Nordisk acquired Catalent's fill-finish manufacturing facilities to strengthen its diabetes and obesity drug production capabilities and streamline global supply chains.

✅ August 2025: AstraZeneca entered a strategic partnership with a digital health startup to co-develop AI-driven diabetes management and remote patient monitoring platforms.

✅ June 2025: Sanofi completed the acquisition of a biotech company focused on gene-based diabetes therapies, supporting the development of long-acting insulin analogs and curative treatment approaches.

✅ April 2025: Boehringer Ingelheim announced a collaboration with Roche Diagnostics to integrate advanced CGM data with diabetes therapeutics, creating a personalized treatment ecosystem for patients.

Key Players:

Novo Nordisk | Eli Lilly and Company | Merck & Co., Inc. (MSD) | Boehringer Ingelheim | Johnson & Johnson (via Janssen) | Novartis AG | Biocon Limited | Innogen Biopharmaceuticals

Key Highlights:

• Novo Nordisk - 22.5% share: A global leader in diabetes care, Novo Nordisk dominates with its extensive insulin portfolio (Tresiba, Levemir, NovoRapid) and innovative GLP-1 receptor agonists such as Ozempic and Rybelsus, along with expanding production capacity for obesity-linked diabetes treatments.

• Eli Lilly and Company - 19.8% share: Holds strong market presence with Mounjaro (tirzepatide) and Trulicity (dulaglutide), leading in dual-agonist drug innovation and next-generation injectable and oral diabetes therapeutics.

• Merck & Co., Inc. (MSD) - 14.6% share: Offers Januvia (sitagliptin) and other DPP-4 inhibitors, focusing on combination therapies and long-acting diabetes medications for improved patient outcomes.

• Boehringer Ingelheim - 11.7% share: Collaborates with Eli Lilly on the Empagliflozin (Jardiance) franchise, a top-performing SGLT-2 inhibitor that provides both glucose and cardiovascular benefits.

• Johnson & Johnson (via Janssen) - 8.9% share: Markets Invokana (canagliflozin), an SGLT-2 inhibitor offering renal and cardiovascular protection, with ongoing development of next-gen oral antidiabetic agents.

• Novartis AG - 7.6% share: Focused on developing novel oral antidiabetic and peptide-based therapies, along with strategic partnerships for metabolic and obesity-related diabetes treatments.

• Biocon Limited - 8.1% share: A leading biosimilar insulin manufacturer with a growing global footprint, Biocon's Insulin Glargine (Semglee) and Insulin Aspart biosimilars are expanding access to affordable diabetes care.

• Innogen Biopharmaceuticals - 6.8% share: Emerging player specializing in peptide-based and gene-targeted diabetes therapies, focusing on next-generation long-acting insulin analogs and oral peptide delivery platforms.

Buy Now & Unlock 360° Market Intelligence:-https://www.datamintelligence.com/buy-now-page?report=diabetes-therapeutics-market?Juli

Market Segmentation:

➥ By Type, Type 2 Diabetes dominates the market, accounting for approximately 85% of global revenue in 2024, driven by its high prevalence, sedentary lifestyles, and aging population. Type 1 Diabetes represents around 10%, with consistent demand for insulin therapy and continuous glucose monitoring systems. Gestational Diabetes holds the remaining 5%, supported by rising maternal obesity rates and increased screening awareness during pregnancy.

➥ By Drug Class, Insulin remains the largest segment, contributing 35% of the market share, driven by widespread use in both Type 1 and advanced Type 2 diabetes. GLP-1 Receptor Agonists account for 25%, reflecting their strong adoption due to weight management and cardiovascular benefits. SGLT-2 Inhibitors capture 20%, growing rapidly because of proven renal and cardiac protection effects. DPP-4 Inhibitors hold 15%, favored for their safety and oral administration advantages, while other drug classes such as dual/triple agonists and amylin analogs represent the remaining 5%.

➥ By Route of Administration, injectable formulations dominate with 65%, driven by the prevalence of insulin, GLP-1 receptor agonists, and combination injectables. Oral therapies account for 35%, expanding steadily with the introduction of oral semaglutide and improved oral delivery technologies for peptide-based drugs.

➥ By Distribution Channel, hospital pharmacies lead with 40%, supported by large-scale insulin distribution and chronic patient management programs. Retail pharmacies follow with 35%, reflecting strong accessibility for routine prescriptions, while online pharmacies account for 25%, witnessing rapid growth due to telemedicine expansion, subscription-based diabetes care platforms, and digital health integration.

Regional Insights:

North America dominates the global diabetes therapeutics market with a 38% share (USD 34.0 billion in 2024), driven by the high prevalence of diabetes, strong adoption of next-generation drugs such as GLP-1 receptor agonists and SGLT-2 inhibitors, and advanced healthcare infrastructure. The United States leads the region with robust insulin production capacity, expanding biosimilar adoption, and widespread use of digital diabetes management tools like continuous glucose monitoring (CGM) systems and smart insulin delivery devices.

Europe holds a 30% share (USD 26.8 billion in 2024), supported by favorable reimbursement policies, increasing focus on personalized diabetes care, and growing demand for cost-effective biosimilars. Key markets including Germany, the UK, France, and the Nordic countries are investing in AI-enabled diabetes management platforms and promoting the use of novel oral therapies and dual agonists to improve patient adherence and clinical outcomes.

Asia-Pacific is the fastest-growing region, accounting for 22% (USD 19.7 billion in 2024), with a projected CAGR exceeding 17% during 2025-2033. Growth is fueled by the rapid rise in diabetes prevalence, urbanization, and dietary shifts in countries such as China, India, and Japan. Increasing healthcare spending, availability of affordable generics, and government programs like India's National Diabetes Control Programme (NDCP) are accelerating market expansion across the region.

Latin America, Middle East & Africa (LAMEA) contribute 10% (USD 8.9 billion in 2024), with market growth supported by expanding access to insulin therapy, increased public health initiatives, and the entry of global pharmaceutical companies offering affordable treatment options. Key markets such as Brazil, Mexico, South Africa, and the UAE are focusing on strengthening diabetes awareness campaigns, improving diagnosis rates, and integrating digital health solutions to support patient management.

Speak to Our Analyst and Get Customization in the report as per your requirements:-https://www.datamintelligence.com/customize/diabetes-therapeutics-market?Juli

Market Dynamics:

Drivers

The diabetes therapeutics market is primarily driven by the rising global prevalence of diabetes, fueled by sedentary lifestyles, poor dietary habits, and an aging population. Increasing awareness of early diagnosis and treatment, along with technological advancements in insulin delivery systems, continuous glucose monitoring (CGM), and AI-driven digital health platforms, is further accelerating market growth. The introduction of innovative drug classes such as GLP-1 receptor agonists, SGLT-2 inhibitors, and dual/triple agonists has significantly improved patient outcomes, offering benefits like weight reduction, cardiovascular protection, and improved glycemic control. Additionally, government initiatives promoting diabetes care, favorable reimbursement policies, and growing healthcare expenditure are expanding market access worldwide.

Restraints

High treatment costs and limited affordability in developing countries continue to restrain market growth. The complex manufacturing processes of biologics and peptide-based therapies such as GLP-1 agonists and insulin analogs contribute to high pricing. Furthermore, side effects associated with certain medications, stringent regulatory approvals, and supply chain disruptions affecting insulin and drug availability in low- and middle-income countries pose additional challenges. Patient reluctance toward injectable therapies and lack of adherence also hinder optimal disease management.

Opportunities

Significant growth opportunities lie in biosimilar insulin production, oral peptide formulations, and AI-integrated diabetes management systems. Emerging economies across Asia-Pacific, Latin America, and the Middle East are witnessing rapid urbanization, increased healthcare spending, and expansion of diabetes care infrastructure. Collaborations between pharma companies, tech startups, and healthcare providers for digital therapeutics and remote patient monitoring are creating new revenue streams. Moreover, the rise of personalized medicine, wearable insulin devices, and connected drug delivery platforms presents vast potential for market expansion.

Trends

The market is witnessing a major shift toward combination therapies that target multiple metabolic pathways for enhanced glycemic and cardiovascular benefits. There is growing adoption of digital diabetes ecosystems, integrating smart insulin pens, continuous glucose monitors, and AI-enabled analytics to improve real-time disease management. Weight management-linked diabetes therapies such as GLP-1 and dual agonists (e.g., tirzepatide) are setting new treatment benchmarks. Additionally, a strong pipeline of gene therapies, oral peptides, and long-acting insulins is redefining the therapeutic landscape, making diabetes care more precise, accessible, and patient-centric.

Key Developments:

✅ June 2025: Eli Lilly and Company launched its blockbuster diabetes drug Mounjaro (tirzepatide) in the KwikPen, a single-patient-use prefilled pen designed for once-weekly administration in the Indian market. The new device offers a more convenient and accessible treatment option for adults with type 2 diabetes, supporting improved adherence and expanding Eli Lilly's global reach in the diabetes therapeutics segment.

✅ April 2025: Novo Nordisk announced plans to expand its Ozempic and Rybelsus (semaglutide) production capacity in Denmark and the U.S. to meet surging global demand for GLP-1 receptor agonists used in diabetes and obesity management.

✅ March 2025: Sanofi introduced an updated formulation of its Lantus (insulin glargine) biosimilar, featuring improved stability and lower production cost, aimed at expanding access to affordable insulin therapy in emerging markets.

✅ January 2025: Boehringer Ingelheim and Eli Lilly jointly launched a new cardio-renal-metabolic care program leveraging SGLT-2 inhibitor Jardiance (empagliflozin), integrating digital monitoring tools to manage diabetes patients with cardiovascular and renal complications.

✅ December 2024: Biocon Biologics received regulatory approval in multiple markets for its Insulin Aspart biosimilar, enhancing its biosimilar insulin portfolio and strengthening its position in the global diabetes therapeutics market.

Suggestions for Related Report:

Type 2 Diabetes Markethttps://www.datamintelligence.com/download-sample/type-2-diabetes-market?Juli

Diabetes Care Drugs & Devices Market https://www.datamintelligence.com/download-sample/diabetes-care-drugs-and-devices-market?Juli

📌 Request for 2 Days FREE Trial Access: https://www.datamintelligence.com/reports-subscription

☛ Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

☛ Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg?Juli

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release United States Diabetes Therapeutics Market to Reach USD 321.96 Billion by 2033 | CAGR 15.4% | North America Leads with 38% Share | Key Players: Novo Nordisk, Eli Lilly, Merck, Boehringer Ingelheim, Johnson & Johnson, Novartis, Biocon, Innogen Biopharmaceu here

News-ID: 4316703 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

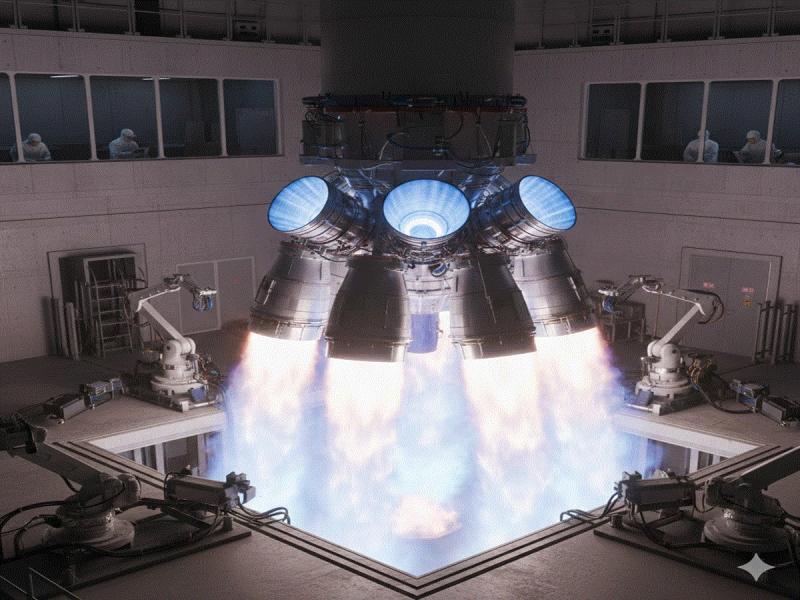

Advanced Rocket & Missile Propulsion Systems Market to Reach USD 77.58 Billion b …

Market Overview

The global advanced rocket and missile propulsion systems market reached US$ 38.79 billion in 2024 and is projected to grow to US$ 77.58 billion by 2032, expanding at a CAGR of 9.05% during the forecast period 2025-2032.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/global-advanced-rocket-and-missile-propulsion-systems-market?Juli

The market growth is primarily driven by increasing global defense spending and the strategic need for advanced missile and…

Electric Aircraft Charging Interfaces Market to Reach USD 2.1 Billion by 2030 | …

Electric Aircraft Charging Interfaces Market Overview

The Global Electric Aircraft Charging Interfaces Market reached USD 0.54 billion in 2022 and is projected to grow to USD 2.1 billion by 2030, registering a CAGR of 20.7% during the forecast period 2023-2030. The market growth is driven by the gradual adoption of electric aircraft in the aviation industry as a sustainable solution to reduce carbon emissions, operational costs, and noise pollution.

Get a Free…

Online Food Delivery Market to Reach USD 291.4 Billion by 2030 | CAGR 9.1% | Asi …

Market Overview

The global online food delivery market reached USD 145.2 billion in 2022 and is projected to grow to USD 291.4 billion by 2030, registering a CAGR of 9.1% during the forecast period 2024-2031. The growth is fueled by changing consumer lifestyles, rising smartphone penetration, and the increasing popularity of contactless food delivery services. Consumers are drawn to the convenience, speed, and accuracy offered by online food delivery platforms, while…

Animal Tracking Market to Reach US$ 4.9 Billion by 2030 | CAGR 11.5% | North Ame …

Animal Tracking Market Overview

The global animal tracking market reached US$ 2.1 billion in 2022 and is projected to grow significantly, reaching US$ 4.9 billion by 2030, expanding at a CAGR of 11.5% during the forecast period (2024-2031). Animal tracking involves the development and deployment of technologies designed to monitor the location, movement, behavior, and health of animals across diverse environments.

Get a Free Sample PDF Of This Report (Get Higher Priority…

More Releases for Diabetes

Major Force in the Diabetes Pen Market 2025: Diabetes Fuels Surge In Demand For …

How Will the Diabetes Pen Market Grow, and What Is the Projected Market Size?

The diabetes pen market is projected to grow from $29.24 billion in 2024 to $31.22 billion in 2025, at a CAGR of 6.8%. Growth is fueled by the rising need for managing diabetes, advancements in diabetes care, and an increasing focus on patient-friendly medication administration tools.

The diabetes pen market is projected to grow strongly, reaching $40.17 billion…

Diabetes Monitoring Devices Market: Regaining Its Glory| Ascensia Diabetes Care, …

The Latest Study Published by HTF MI Research on the "Diabetes Monitoring Devices Market'' evaluates market size, trend and forecast to 2029. The Diabetes Monitoring Devices market study includes significant research data and evidences to be a practical resource document for managers and analysts is, industry experts and other key people to have an easily accessible and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges…

Prevalence of Diabetes Drives Opportunities for Type-2 Diabetes Market

The Type-2 Diabetes Market Analysis, 2023, by MarkNtel Advisors, presents a well-researched, detail-driven, and accurate study for the stakeholders. This analysis entails prominent aspects like trends, & recent developments, drivers, opportunities, challenges, & restraints, among other parameters, influencing the overall industry expansion across different locations. This report comprises data from historic years (2018-21) & the base year (2022) to put together an estimation of the forecast period (2023-28).

According to Type-2 Diabetes Market…

Reverse Diabetes with Dr. Merritt’s Diabetes Reversal Recipe

[November 26, 2020] – People suffering from diabetes always search for ways to lower blood sugar levels in their bodies. Diabetes treatment available costs you hundreds of dollars yearly and also restricts you to a diabetic diet. That hampers your mental health and well-being. Apart from this, eye problems, kidney failure, amputations are some of the physical problems diabetic patients face.

Dr. Marlene Merritt (from the Merritt Wellness Center in…

Diabetes Treatment

Diabetes Treatment is a important way to help manage the healthy ,easy to use and improve the way of the treatment of blood glucose monitoring system.

As living standards improve, an increasing obesity, the Diabetes Treatment has improved peoples living habits, disease control effect, is becoming more and more important.

The global Diabetes Treatment market is valued at 43700 million US$ in 2018 and will reach 58000 million US$ by the end…

Self-Monitoring Blood Glucose Devices Market Study by Advance Application [Type …

The global self-monitoring blood glucose devices market was valued at $7,768 million in 2017 and is projected to reach $10,828 million by 2025 at a CAGR of 4.2% from 2018 to 2025. Monitoring of blood glucose is an essential step in diabetes management. Blood glucose monitoring devices are predominantly used to monitor a patient’s blood glucose level. Self-monitoring blood glucose (SMBG) devices are easy-to-use and enable people to monitor their…