Press release

1F Cash Advance Review: Pros, Cons, and Real Cost of Borrowing

When unexpected costs arise, many Americans turn to online short-term loans.The reason?

Well, financial emergencies don't follow schedules. Medical bills, car repairs, or broken appliances don't wait for payday. They want a fast, non-traditional option that is reliable.

1F Cash Advance operates as one provider in this space, offering quick cash solutions through both digital platforms and physical locations. Are you looking for a way to figure out if their services are actually what you need? This article might help.

This review examines what the service provides, how it works, and what consumers should consider before borrowing.

What is 1F Cash Advance: Overview and Service Offerings

1F Cash Advance operates over 80 locations across 37 states while maintaining an online presence for digital applications. The company has issued more than 3 million loans since its establishment. They offer three primary loan products: cash advances, installment loans, and same-day loans.

The company positions itself as accessible to borrowers with bad credit. They use alternative credit reporting rather than relying exclusively on traditional FICO scores. This approach evaluates income, employment history, and banking patterns to determine eligibility.

1F Cash Advance loan amounts range from $200 to $5,000. They promise APR as low as 16% for the best borrowers. It ranges from 299% to 299%, depending on state regulations and individual qualifications.

Is It Secure?

Worried about sharing your bank details online? Fair question.

1F Cash Advance uses SSL encryption on its application forms. This means your information gets scrambled during transmission so that nobody can intercept it along the way.

The company has been in operation for 6 years and has handled over 3 million loan requests. That's a decent track record.

Trustworthy, yes. They haven't had major security scandals pop up in the news, which counts for something in this industry.

That said, do the basics on your end too. It is a good idea to read their privacy policy before proceeding.

How 1F Cash Advance Works Step By Step

The application process consists of three stages designed for quick completion.

1. Quickly Apply For The Loan Online ( Takes >5 Minutes)

Begin by visiting the 1F Cash Advance homepage to choose the loan option that fits your needs.

Now, you can choose between the following paths:

a. Enter your zipcode in the top bar & click Go.

b. Fill the quick form & click Apply Now.

It will open a loan application form in front of you.

In the form, you need to fill in the information such as the amount, purpose, contact details, address, etc.

Next, the details related to your income and residence are required.

Finally, the borrower has to fill in the details needed to verify their financial status.

An SSL-protected and encrypted form ensures that your data is privately shared with the company.

2. Your Application is Reviewed in 1 Working Day

The company reviews submitted information and provides approval or denial within minutes. A soft check is done. No hard credit check occurs during this stage.

3. Get Your Funds

Applications approved before 10:30 am on weekdays receive same-day funding. Approvals after this time or on weekends are processed on the next business day.

Cost Structure And Fee Breakdown

The company advertises APRs starting as low as 16%, though this rate applies only to borrowers with strong credit profiles choosing optimal terms. In reality, 1F Cash Advance APRs range from 16.00% to 299.00% (it goes up to 700% for many lenders), which is on the lower end.

The actual rate depends on credit score, loan amount, borrowing purpose, repayment term, and whether automatic payments are selected.

Loan Amount Low APR (16%) Mid APR (150%) High APR (299%)

$500 (14 days) $3 fee $29 fee $57 fee

$1,000 (14 days) $6 fee $58 fee $115 fee

$2,000 (14 days) $12 fee $115 fee $230 fee

According to the Consumer Financial Protection Bureau, consumers should carefully review all terms before accepting any short-term loan.

As far as 1F Cash Advance is concerned, the company states that all fees are clearly stated in the loan agreements. They also vouch for their no-hidden-charge policy. So, read about the final details and obligations before signing.

Advantages Of The Service

1F Cash Advance offers several benefits that appeal to borrowers facing time-sensitive financial needs.

● The site is safe.

● Instant loan approval decisions are unlike bank loans.

● Low APR.

● Potential same-day funding addresses urgent situations.

● There is no fee for applying for the loan.

● No hard credit checks means poor credit history won't automatically disqualify applicants.

● Operations in 37 states provide broad geographic coverage

Disadvantages And Concerns

Short-term loans carry significant drawbacks that potential borrowers must evaluate carefully.

● Limited coverage: State lending laws create availability gaps in some regions

● Maximum amounts: Loan caps may not cover larger emergency expenses

Who Benefits Most From This Option

Traditional bank loans often require days or weeks (even months) for processing. Credit card applications involve similar delays. Emergency situations, such as car repairs or medical bills, don't always allow time for lengthy approval processes.

The instant approval process stands out for borrowers who need decisions quickly.

Responsible Borrowing Considerations

Financial experts recommend several steps before accepting any short-term loan.

● Confirm the expense truly qualifies as an emergency rather than a want.

● Calculate the total repayment amount and verify it fits within the next budget cycle.

● Borrow only the minimum amount needed rather than the maximum available.

● Have a specific plan to avoid future short-term loans by building an emergency fund.

Final Assessment

1F Cash Advance provides a legitimate service for specific emergency funding needs. The company offers transparency about costs, delivers funds quickly, and maintains accessibility for borrowers with poor credit.

Used appropriately for genuine emergencies with clear repayment plans, short-term loans from 1F Cash Advance can solve immediate problems. Used as ongoing budget support, they often worsen financial difficulties rather than resolving them. So, potential borrowers should carefully evaluate whether their situation justifies the costs.

Marica 25 G Plovdiv, Bulgaria

ESBO LTD is a leading digital marketing company specializing in bespoke local campaigns!

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release 1F Cash Advance Review: Pros, Cons, and Real Cost of Borrowing here

News-ID: 4315991 • Views: …

More Releases from ESBO ltd

How to plan moving with kids

How to plan moving with kids

Moving is always a big event for a family, but when children are part of the picture, it can feel like you're juggling ten things at once. Between packing boxes, sorting paperwork, and saying goodbye to a familiar home, kids often pick up on the stress just as much as adults do. Some families choose to bring in professional help, like movers in Airdrie https://easymovingcalgary.com/airdrie-movers/…

How to Read Market Cycles Like a Professional Trader

Market cycles represent the natural rhythm of financial markets as they move through periods of growth, peak performance, decline, and recovery. These cycles occur across all timeframes, from short-term daily fluctuations to multi-year trends that shape entire economic eras. When you learn to identify these patterns, you gain a significant advantage in timing your trades and investment decisions.

Professional traders don't rely on luck or gut feelings. They study these…

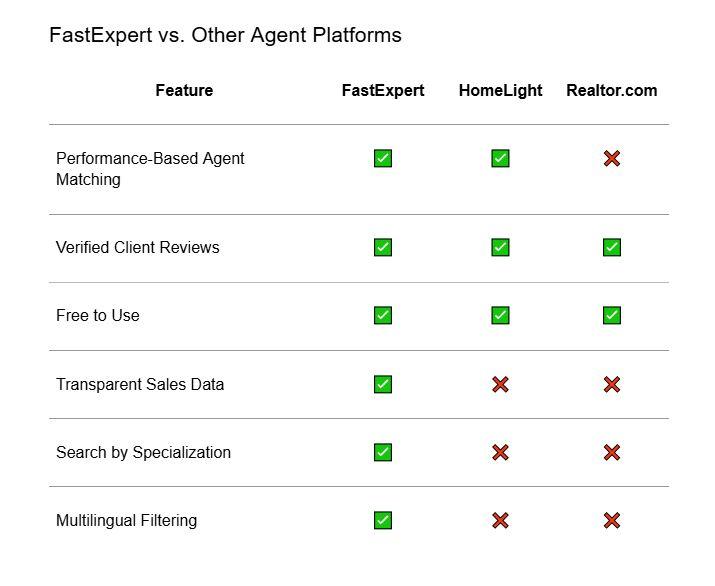

FastExpert Review: Is This Agent-Matching Platform Worth It?

When you're buying or selling a home, one of the most important decisions you'll make is choosing the right real estate agent. But with so many agents out there, how do you know which agents are experienced and right for what you need?

We've looked at countless online services that claim to help you find the best real estate agent. There are a lot out there, and they promise you the…

Embracing the Digital Marketing Revolution in Dubai

In recent years, Dubai has transformed into a vibrant hub for digital innovation and marketing. With a strategic location that bridges the East to the West, the city has attracted a multitude of global and local businesses keen to tap into its bustling economy. For companies seeking a digital edge, finding Dubai's best digital marketing agency (https://absolute.digital/ae/) has become a pivotal step to staying competitive in this fast-paced market. The…

More Releases for Cash

Your Cash Pro Unlocks Immediate Cash from Lapsed Life Insurance

Available to Policyholders Aged 65 or Older with Policies of $100,000 or More

Your Cash Pro is redefining what happens when a life insurance policy no longer fits. Built on transparency and compassion, the company helps policyholders convert lapsed or unneeded policies into immediate cash. Each transaction is structured to protect the policyholder's interests, and Your Cash Pro extends the impact by donating 50% of its own proceeds, never from the…

Teller Cash Recycler Market: Optimizing Cash Management for a Smarter Banking Fu …

The Teller Cash Recycler (TCR) market is witnessing strong momentum as financial institutions, retailers, and cash-heavy industries embrace automation to enhance operational efficiency. Valued at US$ 4,143.47 million in 2024, the market is projected to reach US$ 6,441.49 million by 2033, growing at a steady CAGR of 5.16%.

𝐓𝐡𝐞 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐬𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞: - https://www.astuteanalytica.com/request-sample/teller-cash-recycler-market

TCRs automate cash deposit, dispensing, and recycling functions, significantly reducing manual cash handling and improving transaction…

Cell Phone Cash Review: Is Cell Phone Cash Legit? Find Out!

Ever wondered if you can make money just by using your smartphone? I started looking into cell phone cash with a lot of doubt. With so many sca.ms out there, figuring out if this program is real was key. This review aims to find out if cell phone cash is a genuine way to make money or just another sc.am.

Let's dive into this question together and see what I found…

Optimizing Cash Flow and Customer Satisfaction with Order to Cash Process Mining

Businesses have always been concerned about optimizing the process of business operations and the maximization of cash flow without compromising customer satisfaction. This has led many businesses today to use O2C process mining ( https://businessprocessxperts.com/process-mining/ ), a useful analytical method that helps them fulfill orders effectively and efficiently.

This analytical method helps in the identification of areas in the order fulfillment process, where there is a need for improvement and inefficiency.

𝗞𝗲𝘆…

"Cash Advance by Cash Tools" App Launched for iPhone Users

The "Cash Advance by Cash Tools" app offers up to $1,000 in quick, interest-free advances with flexible repayment options.

Image: https://www.abnewswire.com/uploads/6fb3472a9cfae1320523530583628e84.png

Cash Tools Inc., a financial technology company, has launched its latest service, "Cash Advance by Cash Tools," available now on the App Store [https://apps.apple.com/us/app/cash-advance-by-cash-tools/id6615087395] for iPhone users. This app aims to provide a straightforward and accessible way for individuals to manage short-term financial needs by offering immediate cash advances without traditional…

Car's Cash For Junk Clunkers Pays Cash On The Spot

Image: https://www.getnews.info/wp-content/uploads/2024/05/1716349569.png

Car's Cash gives free quotes over the phone or by email. The buyers pick up the car and pays cash on the spot, sometimes on the same day. A pink slip is not needed.

Car's Cash For Junk Clunkers [https://carscashforjunkclunkerslosangelesca.com/] and Henry Ford are pleased to announce that they pay cash on the spot for junkers cluttering the landscape. Upfront free quotes are available over the phone or by…