Press release

Growth Outlook: Germany Biliary Tract Cancers (BTCs) Treatment Market Set for Strong Expansion Through 2035

The Germany Biliary Tract Cancers (BTCs) Treatment Market is entering a period of sustained growth, supported by rising cancer awareness, improved healthcare infrastructure, and the increasing adoption of advanced therapies. According to the latest projections, the market is expected to reach USD 18.5 million by 2025 and surge to USD 42.5 million by 2035, registering a steady 8.7% CAGR. This upward trend underscores the strategic importance of the Germany Biliary Tract Cancers (BTCs) Treatment Market in shaping the country's long-term oncology landscape."Explore trends before investing - request a sample report today!"

https://www.futuremarketinsights.com/reports/sample/rep-gb-20924

Key Market Growth Drivers

Germany's market expansion is strongly propelled by increased BTC incidence among aging populations and lifestyle-related risk factors. Early diagnosis rates are improving, driven by enhanced awareness programs and broader access to screening technologies. Personalized medicine continues to move into the spotlight, particularly with the advancement of FGFR inhibitors, immunotherapies, and biomarker-driven treatments.

Key contributors to market acceleration include:

Accelerated adoption of precision medicine

Higher demand for targeted and combination therapies

Expanded oncology care capacity within institutions

Growing collaboration between pharma innovators and German research centers

Robust Forecast Supported by Evolving Treatment Strategies

Germany's oncology sector is embracing more sophisticated protocols, integrating targeted therapies and immune checkpoint inhibitors tailored to tumor genetics. The shift toward individualized treatment plans is improving outcomes while strengthening market confidence.

Market Size 2025: USD 18.5 million

Forecast 2035: USD 42.5 million

CAGR (2025-2035): 8.7%

Strategic alliances among pharmaceutical companies play a critical role, enabling efficient clinical research, cost-effective drug development, and broader therapy accessibility.

Semi-Annual Market Performance Update

The Germany BTCs treatment market demonstrates a dynamic CAGR pattern:

2023:

H1: 8.9%

H2: 9.1%

2024:

H1: 8.7%

H2: 9.4%

This reflects shifting regulatory landscapes, patient treatment demand trends, and rapid advancements in therapy development. The rise of genetic profiling and precision oncology further enhances market adaptability.

"Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates -"

https://www.futuremarketinsights.com/reports/brochure/rep-gb-20924

Recent Industry Developments

Germany's BTCs treatment ecosystem continues to evolve with significant industry activities:

March 2024: Jazz Pharmaceuticals launched collaborative research in German hospitals on a new BTC drug candidate.

2024: Daiichi Sankyo initiated a Phase 3 clinical trial for its FGFR inhibitor DS-1205.

January 2024: Hutchmed received approval for HMPL-523, a promising Syk inhibitor for advanced BTC cases.

Key Drivers Strengthening Market Momentum

Increased Adoption of Targeted Therapies

Targeted agents such as FGFR and IDH1 inhibitors are gaining traction due to their ability to address specific genetic mutations linked to BTC. Improved biomarker identification and growing clinical evidence fuel wider adoption.

Government-Supported Cancer Initiatives

Germany's prioritization of oncology research, funding incentives, and improved access to innovative therapies are boosting BTC treatment availability and efficacy.

Market Segmentation Insights

By Type

Targeted therapy (FGFR2, IDH1, HER2-targeted agents)

Immune checkpoint inhibitors (pembrolizumab, durvalumab)

By Route of Administration

Oral

Intravenous

By Line of Therapy

First-line

Second-line

By Sales Channel

Institutional sales

Retail sales

Competitive Landscape

The market remains moderately fragmented, with leading global players-including Incyte, Merck & Co., and AstraZeneca-dominating through innovation, R&D investments, and widespread oncology networks. Meanwhile, regional players are strengthening their presence with niche offerings tailored to local clinical needs.

Competitive factors include:

Rising demand for personalized oncology solutions

Strong institutional uptake of advanced BTC therapies

Strategic acquisitions expanding product pipelines and geographic reach

Latest Therapy Area Reports

Medical Eye Shield Film Market

https://www.futuremarketinsights.com/reports/medical-eye-shield-film-market

Medical Far Infrared Therapy Device Market

https://www.futuremarketinsights.com/reports/medical-far-infrared-therapy-device-market

Kids Splint Market

https://www.futuremarketinsights.com/reports/kids-splint-market

Why Choose FMI - Empowering Decisions that Drive Real-World Outcomes

https://www.futuremarketinsights.com/why-fmi

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware - 19713, USA

T: +1-347-918-3531

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Growth Outlook: Germany Biliary Tract Cancers (BTCs) Treatment Market Set for Strong Expansion Through 2035 here

News-ID: 4312503 • Views: …

More Releases from Future Market Insights

Japan Caramel Food Colors Industry Outlook to 2036: Strategic Insights for R&D, …

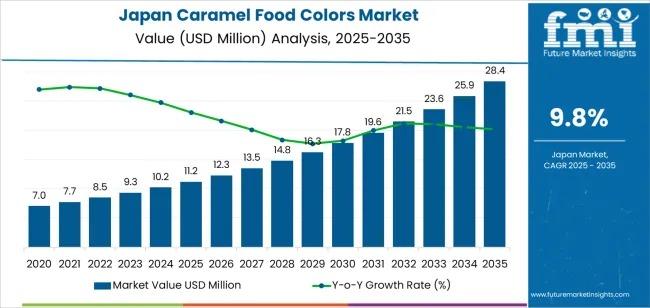

The Japanese caramel food colors market is on a steady growth trajectory, with demand projected to rise from USD 11.2 million in 2025 to USD 28.4 million by 2035, registering a CAGR of 9.8%. The initial phase of the forecast period (2025-2030) anticipates a steady increase in demand, reaching approximately USD 17.8 million by 2030, driven by the expanding use of caramel colors across confectionery, dairy, and baked goods.

The market's…

Comprehensive Analysis of the Japan Butter Flavor Market: Technology Evolution, …

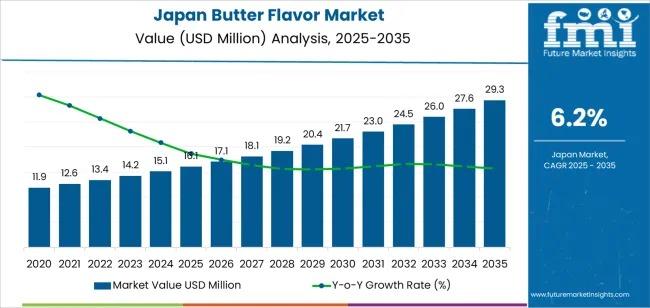

The demand for butter flavor in Japan is projected to rise from USD 16.1 million in 2025 to USD 29.4 million by 2035, reflecting a steady compound annual growth rate (CAGR) of 6.2%. This growth is underpinned by increasing adoption across bakery products, confectionery items, and dairy-based preparations, as manufacturers seek to enhance taste experiences and deliver authentic dairy character in a wide range of food offerings.

The Japanese bakery and…

Japan Casein Peptone Market Deep-Dive 2026-2036: Strategic Forecasts, Market Ent …

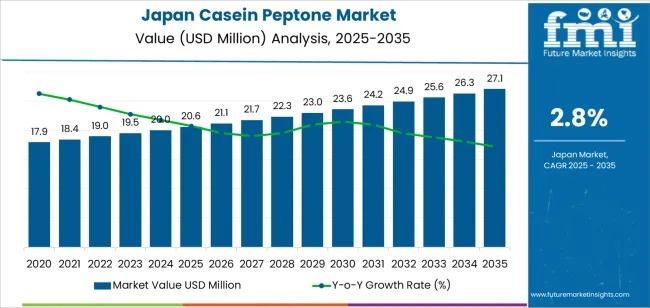

The demand for casein peptone in Japan is projected to grow steadily, reaching USD 27.1 million by 2035, up from USD 20.6 million in 2025, reflecting a compound annual growth rate (CAGR) of 2.8%. During the early forecast period (2025-2030), demand is expected to rise from USD 20.6 million to approximately USD 23.6 million, supported by its widespread applications in biotechnology, pharmaceuticals, and food industries. Casein peptone continues to play…

Global Boride Powder Market Size, Share & Forecast: High-Growth Segments, Value …

The global boride powder market is valued at USD 19.7 billion in 2025 and is projected to reach USD 32.2 billion by 2035, advancing at a steady 5.0% CAGR over the forecast period. This upward trajectory reflects increasing adoption of boride-based compounds in aerospace technology, high-temperature processing environments, and advanced coating applications, where exceptional thermal stability, corrosion resistance, and mechanical strength are essential for operational performance and product reliability.

Key Market…

More Releases for BTC

Bitcoin (BTC) Price Prediction: Maxi Doge (MAXI) Gains Attention Amid BTC Foreca …

As markets head into the final months of 2025, traders and investors in the United States are parsing mixed signals that shape any Bitcoin price prediction. Macro themes like ETF approvals, staking rules and exchange support are pushing capital into both established assets and newer presales. Recent moves in Hedera (HBAR) after ETF-linked catalysts show how institutional endorsements can lift altcoins and feed broader crypto market news.

Meme-coin activity adds another…

Bitcoin (BTC) Price Prediction: AlphaPepe (ALPE) Gains Traction as Traders React …

Bitcoin enters early December 2025 in a very different mood from the euphoric highs of October. After briefly trading above $120,000 earlier in the autumn, BTC sold off aggressively into late November, with spot markets printing lows close to $84,000 before buyers re-emerged. The market has since stabilized but not fully recovered, leaving traders more selective and macro-sensitive than at any point this year.

As BTC's upside cools and short-term forecasts…

Bitcoin (BTC) Price Prediction: Pepenode (PEPENODE) Capitalizes on BTC Market Tr …

Global crypto market capitalization recently slipped to roughly $3.1 trillion as sentiment shifted toward risk-off. Bitcoin fell from near $100,000 on November 14 to below $92,000, an 8% pullback that squeezed leveraged positions and pushed traders toward caution. This BTC price outlook has tightened liquidity and amplified volatility across higher-beta segments of the market.

GameFi tokens and gaming-focused blockchains were hit harder, with the GameFi index down about 8.5% to $740…

BTC Price Prediction 2025: Is Bitcoin Hyper Set to Challenge BTC?

Bitcoin's 2025 outlook remains strong as analysts predict new all-time highs following the next halving. However, Bitcoin Hyper (HYPER) is quickly gaining attention with its innovative tokenomics and advanced blockchain scalability.

Investors are increasingly eyeing Bitcoin Hyper as a potential BTC challenger. With rapid ecosystem expansion, low transaction costs, and AI-driven architecture, HYPER could reshape long-term crypto market dynamics and investor sentiment.

BTC Price Prediction 2025: Major Factors Shaping the Market

Bitcoin continues…

Bitcoin (BTC) Plummets, BTC Holders Earn $9K Daily Through Contracts

Bitcoin whale dumped 24,000 BTC, triggering a market crash that sent the price plummeting by $110,000. Depressed market sentiment led to the liquidation of numerous leveraged long positions, triggering a sell-off among retail investors.

At the same time, GoldenMining launched a new Bitcoin mining contract to mitigate the risk of falling Bitcoin prices and help Bitcoin holders generate daily returns.

What is GoldenMining?

GoldenMining is a platform that provides computing services to…

$43,000,000 USD / 1 BTC

Go VIP Worldwide Secures $100,000 USD FDIC-Backed Loan Against Bitcoin Holdings To Further Accumulate More BTC.

MIAMI BEACH, FL - On July 29, 2025, Go VIP Worldwide-a privately held company solely owned by entrepreneur Matthew Barnes-executed a strategic $100,000 loan against its Bitcoin holdings through an FDIC-insured bank. The entirety of the loan was immediately redeployed into additional Bitcoin acquisitions.

This move underscores a deliberate divergence from the leveraged Bitcoin accumulation strategies…