Press release

Top 30 Indonesian Property Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)The Indonesian listed property sector delivered a mixed Q3-2025: several large developers reported solid pre-sales and recurring revenue from malls/hotels, while some companies remain under pressure from higher financing costs and slower land/housing recognitions. Marketing-sales and pre-sales recovery supported results for the largest developers; mid-cap and smaller names showed uneven recovery and occasional losses. For an index/sector view see recent IDX commentary and analyst summaries.

Top 30 (by prominence / market presence on IDX and sector lists)

Bumi Serpong Damai (BSDE)

Ciputra Development (CTRA)

Pakuwon Jati (PWON)

Lippo Karawaci (LPKR)

Summarecon Agung (SMRA)

Agung Podomoro Land (APLN)

Alam Sutera Realty (ASRI)

PP Properti (PPRO)

Jaya Real Property (JRPT)

Jakarta Setiabudi Internasional (JSPT)

Jaya Agung? / Jaya Real affiliates (group names vary)

Duta Pertiwi (DUTI) / Sinar Mas group affiliates (via listed subsidiaries)

Ciputra Residence / related listings

Metropolitan Land (MTLR) / MTDL group companies

Intiland Development Tbk

Puradelta Lestari Tbk

Duta Pertiwi Tbk

Bakrieland Development Tbk

Megapolitan Development Tbk

Fortune Mate Indonesia Tbk

Gading Development Tbk

Gowa Makassar Tourism Development Tbk

Perdana Gapuraprima Tbk

Metropolitan Land Tbk

Modernland Realty Tbk

Lippo Cikarang Tbk

Kawasan Industri Jababeka Tbk

DMS Propertindo Tbk

Pudjiadi Prestige Tbk

Plaza Indonesia Realty Tbk

2) Earnings-call / Q3-2025 summaries Top 10 Indonesian property public companies (numbers converted to USD)

Below are company-level Q3 (or 9M/ Q3 disclosures as reported) headline figures taken from company releases, analyst notes and IDX filings.

1. Bumi Serpong Damai (BSDE)

Q3 2025 revenue (reported): IDR 8.76 trillion → ~USD 525.3 million.

Q3 2025 net income: IDR 1.36 trillion → ~USD 81.55 million.

Takeaway: Larger recurring revenues plus strong pre-sales (~IDR 7.10 tn pre-sales reported to Sep 2025) - revenue YoY softness but pre-sales support management guidance.

2. Ciputra Development (CTRA)

Q3 / 9M 2025 net income (reported): IDR 1.62 trillion → ~USD 97.14 million.

Takeaway: Net profit improved YoY; 3Q showed some sequential softness in recognition but 9M still within FY expectations per broker notes.

3. Pakuwon Jati (PWON)

Q3 / 9M 2025 net income (reported): IDR 1.73 trillion → ~USD 103.74 million.

9M revenue (reported to Sep 2025): IDR 5.12 trillion → ~USD 307.01 million.

Takeaway: Strong contribution from retail (malls) & hotels; incentives (VAT) and recurring income helped results.

4. Lippo Karawaci (LPKR)

Q3 2025 net income (reported): IDR 368.2 billion → ~USD 22.08 million.

Takeaway: Results reflect continuing recovery dynamics but compare to very large prior-year items (LPKR's 9M figures showed volatility). See company interim report.

5. Summarecon Agung (SMRA)

Q3 / 9M 2025 net income (reported): IDR 549.6 billion → ~USD 32.96 million.

Takeaway: Laba (net) down YoY (~-41% reported) but marketing sales improved (solid pre-sales), reflecting portfolio mix (residential + recurring mall income).

6. PP Properti (PPRO)

Q3 2025 result (reported): Net loss IDR 37.0 billion → ~USD -2.22 million (loss).

Takeaway: Company reduced losses significantly vs prior year; still pressured by finance costs and provisions.

7. Agung Podomoro Land (APLN)

9M / Q3 2025 revenue (reported): IDR 2.64 trillion → ~USD 158.27 million; comprehensive profit Q3 2025: IDR 28.21 billion → ~USD 1.69 million.

Takeaway: Sales recognition and recurring mall/hotel revenue drive results; Q3 comprehensive profit small but company highlights stability.

8. Alam Sutera Realty (ASRI)

Q3 2025 net income (reported): IDR 8.0 billion → ~USD 0.48 million.

Takeaway: Smaller but resilient result; marketing sales momentum and target pre-sales remain focal points.

9. Jaya Real Property (JRPT)

Q3 / 9M 2025 net income (reported): IDR 903.1 billion → ~USD 54.15 million.

Takeaway: Strong profitability growth YoY driven by housing/unit sales and improved gross margins.

10. Jakarta Setiabudi Internasional (JSPT)

Q3 2025 revenue (reported): IDR 1.7957 trillion → ~USD 107.68 million.

Takeaway: Solid revenue performance with strategic projects contributing to top-line stability.

3) Key trends & insights from Q3 2025

Pre-sales and marketing sales matter more than ever. Top developers reporting strong marketing sales (pre-sales) were better able to convert pipeline into recognized revenue and protect margins. Summarecon and BSDE highlighted marketing-sales contributions.

Recurring income cushions volatility. Owners of malls, offices and hotels (e.g., PWON, BSDE) benefited from recurring rental and hospitality revenue, improving cash flow stability vs developers reliant purely on land-lot recognition.

Financing costs remain a constraint for some mid/small caps. Companies with higher leverage (PPRO and some smaller listings) still show losses or thin profits due to finance charges and provisions.

Recognition timing & project mix drove QoQ differences. Several large names (CTRA, BSDE) noted slower recognition in Q3 but maintained FY targets via deferred recognition patterns and solid 9M progress. Broker notes flagged this for investors.

Sector is heterogeneous recovery uneven across groups. Large-cap integrated developers that combine land development + recurring assets outperformed narrow product-play listed names. Index/sector commentary from IDX and brokers confirms mixed recovery.

4) Outlook for Q4 2025 and beyond

Near term (Q4 2025): Expect continued focus on marketing sales campaigns (year-end promotions), and recognition timing will shape headline numbers. Companies with substantial mall/hotel portfolios should show steadier Q4s; those reliant on large land recognitions may see lumpy results. Central bank and currency move (and domestic fiscal policy) may influence funding cost and investor sentiment.

Medium term (2026): If the rupiah remains stable and interest rate dynamics moderate, demand for primary housing and investment property should slowly normalize boosting developers with ready inventory and steady presales. However, structural headwinds (higher building costs, policy changes on incentives or taxes) will remain watch points.

Investor considerations: Look for (a) marketing sales / pre-sales trajectory, (b) recurring revenue share (malls/hotels), (c) leverage & interest coverage, (d) cash conversion and receivables aging these will determine winner vs laggards.

5) Conclusion

Q3-2025 showed a sincere but uneven recovery across Indonesias listed property sector. The largest, well-diversified developers (BSDE, PWON, CTRA) demonstrated resilience via pre-sales and recurring income streams. Several mid / small caps remain pressured by financing costs or recognition timing (PPRO, some others). For Q4-2025 the picture will be shaped by year-end pre-sales, funding costs, and currency/ macro sentiment; investors should focus on pre-sales, recurring income and balance-sheet strength when comparing names.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 30 Indonesian Property Public Companies Q3 2025 Revenue & Performance here

News-ID: 4310252 • Views: …

More Releases from QY Research

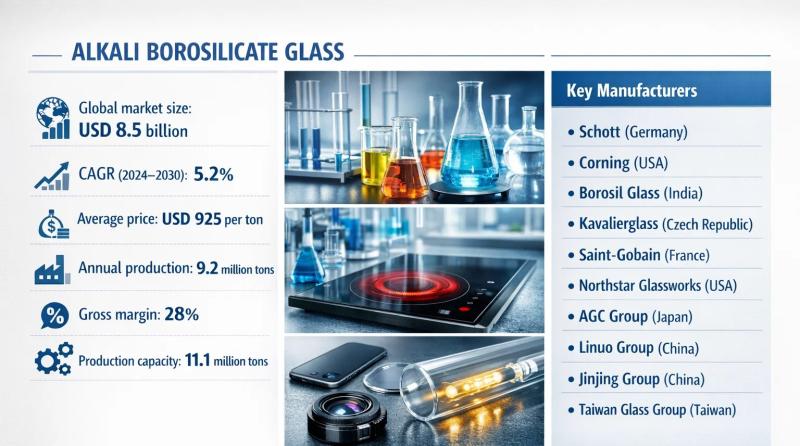

Market Overview - Alkali Borosilicate Glass

QY Research has recently published a comprehensive market study on Alkali Borosilicate Glass, a widely used technical glass material combining good thermal stability, chemical resistance, and cost efficiency. Positioned between soda-lime glass and high-boron borosilicate glass, alkali borosilicate glass is extensively applied in pharmaceutical packaging, laboratory ware, lighting, display components, and industrial glass assemblies.

The market is transitioning from commodity glass supply toward application-specific formulations optimized for thermal shock resistance, ion…

Global and U.S. Spot Meters Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Spot Meters, are handheld or portable light-measuring instruments designed to measure the intensity of light from a very small, specific area (or "spot") within a scene. Using a narrow measurement angle, they allow precise evaluation of luminance or illuminance from targeted points, making them especially useful in photography, cinematography, lighting design, display calibration, and industrial inspections where accurate exposure or…

Global and U.S. Intralogistics Robots Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Intralogistics Robots, automated robotic systems designed to handle internal material movement, storage, picking, sorting, and palletizing within warehouses, distribution centers, and manufacturing facilities. Intralogistics robots form the physical execution layer of smart logistics, integrating closely with WMS, MES, and ERP platforms to enable high-throughput, flexible, and data-driven material flows. As labor shortages, SKU complexity, and fulfillment speed requirements intensify, this…

Top 30 Indonesian Personal Care Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Unilever Indonesia Tbk (UNVR) personal care leader

PT Victoria Care Indonesia Tbk (VICI) cosmetics & body care

PT Kino Indonesia Tbk (KINO) wide personal care portfolio

PT Mandom Indonesia Tbk (TCID) grooming & cosmetics

PT Mustika Ratu Tbk (MRAT) heritage cosmetics & herbal

PT Martina Berto Tbk (MBTO) cosmetics manufacturer

PT Akasha Wira International Tbk (ADES) …

More Releases for Tbk

Indonesia Textile Industry Market Valuation Expected to Hit USD 28.57 billion by …

USA, New Jersey: According to Verified Market Research analysis, the global Indonesia Textile Industry Market size was valued at USD 21.7 Billion in 2023 and is projected to reach USD 28.57 Billion by 2031, growing at a CAGR of 3.50% from 2024 to 2031

How AI and Machine Learning Are Redefining the future of Indonesia Textile Industry Market?

AI-powered production planning systems optimize yarn selection, fabric blends, and loom utilization, improving output…

Infrastructure Market 2021 Strategic Assessments - PT. Acset Indonusa Tbk.., Pt. …

The Infrastructure Market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The Infrastructure sector in Indonesia is…

Indonesia Telecom Tower Market Demand, Size, Share, Scope & Forecast To 2025 |To …

The Indonesia telecom tower market accounted to US$ 557.9 Mn in 2017 and is expected to grow at a CAGR of 27.1% during the forecast period 2018 – 2025, to account to US$ 3,695.5 Mn by 2025.

Get Sample Copy of this Indonesia Telecom Tower Market research report at - https://www.businessmarketinsights.com/sample/TIPRE00004113

The Business Market Insights provides you regional research analysis on “Indonesia Telecom Tower Market” and forecast to 2025. The research report…

Coal Mining in Indonesia Market 2022| PT Bumi Resources Tbk, PT Adaro Energy Tbk …

Researchmoz added Most up-to-date research on "Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption" to its huge collection of research reports.

Coal Mining in Indonesia to 2022 - Upcoming Power Plants to Encourage Domestic Consumption

Summary

GlobalData's "Coal Mining in Indonesia to 2022", provides a comprehensive coverage on Indonesias coal industry. It provides historical and forecast data on coal production by grade, reserves, consumption and exports by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes

Summary

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by…

Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported …

Publisher's "Coal Mining in Indonesia to 2021-Domestic Consumption Set to Increase Supported by Policy Changes", report covers comprehensive information on Indonesia's coal mining industry, coal reserves and reserves by grade, the historical and forecast data on coal production, by type, and by province. The report also includes the historical and forecast data on coal consumption, consumption by type; exports, exports by type and exports by country. Detailed analysis of the…