Press release

Beyond the Screen: The USD 800 Million Global QLED Mural TVs Market Reshaping Homes and Hospitality

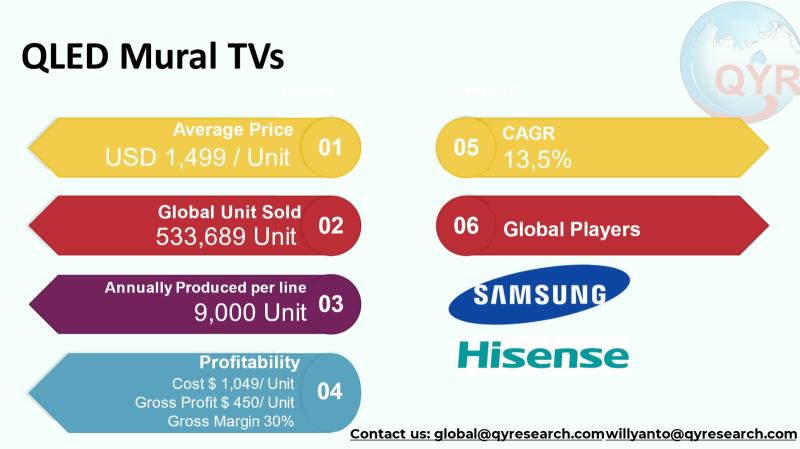

QLED Mural TVs is a premium, wall-integrated large displays that combine QLED (quantum-dot-enhanced LCD) picture technology with mural or flush-to-wall lifestyle design have shifted from niche luxury living-room pieces into a cross-sector product that serves high-end residential buyers, hospitality and corporate display projects, and premium retail/showroom applications. The product category is defined not only by image performance but by design, mounting and integration features that let a TV read as art or architecture rather than a conventional appliance.The global market for QLED mural TVs in 2024 totaled USD 800 million and a growing compound annual growth rate of 13.5% through 2031, reaching market size USD 1,941 million by 2031, With an average selling price of USD 1,499 per unit, total reported global shipments in 2024 is around 533,689 units. The gross margin of 30% equals to cost of goods sold is USD 1,049 per unit and factory gross profit is USD 450 per unit. A COGS breakdown is panel and module, LED/backlight & modules, electronics/PCB, chassis & assembly, packaging & logistics, warranty/other. A single line full machine production capacity is around 9,000 units per line per year. Downstream demand is concentrated in home and commercial.

Latest Trends and Technological Developments

In 2025 the category moved faster on two fronts: (1) premiumization of lifestyle and art-by-display features across QLED lines Samsung expanded its Art/Frame and QLED offerings and announced wider Art Store integration on Neo QLED and QLED models (April 2025), explicitly pushing TV designs that read as wall art; and (2) the migration of truly massive wall displays from microLED video-wall solutions toward more integrated modular options, with Samsung continuing to promote its The Wall microLED family as a premium mural/video-wall proposition while adding easier installation and higher brightness in newer MPF-series modules (announcements and product posts in 2025 and late 2025 show this trajectory). At CES 2025 Samsung emphasized anti-glare surfaces, AI upscaling branded as Vision AI, and larger sizes (announced January 2025), reinforcing a market push toward premium visual quality and lifestyle fit rather than only sheer resolution. These moves signal that QLED mural products will increasingly borrow feature sets from microLED/OLED (anti-glare, AI picture enhancement, flush installations) while keeping the QLED value proposition for certain size/price points.

TechVision Interiors purchases a lot of 15 Samsung 'The Premiere' 8K QLED Mural TV panels (model QM-85R) directly from Samsung Electronics for a total project amount of USD 254,850, averaging approximately USD 16,990 per unit. This premium bulk order is intended for a luxury hotel chain renovation.

The product was installed as a flagship digital art and information display within the corporate headquarters lobby of Global Investment Partners Inc. in New York. A customized Samsung 'The Frame' 4K QLED Mural TV (75-inch, art-mode display) was integrated into the main reception wall. The total cost for supply, specialized installation, and integration with the building's AI-driven content management system amounted to USD 22,500 per unit, serving both as dynamic corporate art and a real-time data visualization board for visitors.

Asia remains the single largest demand and manufacturing hub for mural-style premium TVs. East Asia (Korea, China, Japan) supplies most high-end panel and module technology while China and multiple regional contract manufacturers handle final assembly and system integration. South Koreas OEMs continue to push premium feature sets (AI, art modes), and Chinese brands scale large-format production and price competitiveness. The regions large urban affluent populations and premium hospitality sectors (luxury hotels, serviced residences, corporate HQs) drive disproportionate uptake of mural and design-centric TV systems. At the same time, major brands are expanding their product and software ecosystems (art stores, content partnerships, AI features) across the region to strengthen recurring revenue and after-sales engagement. Samsungs product and business communications in 2025 and Omdia analyses of display dynamics highlight these regional dynamics and ongoing capacity shifts.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5540385

QLED Mural TVs by Type:

4K TV

8K TV

QLED Mural TVs by Product Category:

Wall Mounted TVs

Floor Standing TVs

QLED Mural TVs by Features:

Low Power Always on Display

Ambient Art Display Mode

Anti Glare Matte finish

WiFi Smart Control

Others

QLED Mural TVs by Usage:

Home Living Room Decorative Display

Office Reception or Meeting Rooms

Art Galleries / Museums

Retail Digital Signage

Others

QLED Mural TVs by Shape:

Slim Bezel Rectangular Frame

Zero-Bezel Flush to Wall Design

Picture-Frame Style Border

Rounded Edge Modern Frame

Others

QLED Mural TVs by Application:

Home

Commercial

Global Top 10 Key Companies in the QLED Mural TVs Market

Samsung

Vizio

TCL

Hisense

Skyworth

LG Electronics

Sharp

Philips

Xiaomi

Panasonic

Regional Insights

Southeast Asia is following a two-track pattern: fast-growing consumer demand in urban, middle-class segments for lifestyle TVs and aggressive local/regional manufacturing expansion by Chinese OEMs and brands to serve both ASEAN and export markets. Manufacturers have been expanding assembly and panel capacity in Vietnam, Indonesia and other ASEAN locations to mitigate tariffs and shorten lead times; industry reporting in 2025 notes capacity expansion projects and multi-million units annual targets among Chinese brands operating in SEA. In Indonesia local electronics assembly operations have demonstrated line capacities in the hundreds of thousands per year for general TV assembly; local demand is amplified by growing premium retail and hospitality refurbishment activity. For mural-style premium displays, adoption in Indonesia is concentrated at the high end (luxury homes, boutique hotels, corporate installations), with tiered distribution via premium appliance retailers, integrators and interior designers.

The QLED Mural TV category faces several structural obstacles. The first is component cost and panel supply volatility quantum-dot panel and large-format backlight/module costs remain the single largest input and can compress margins if ASPs decline faster than component costs. The second is competitive pressure from OLED and microLED alternatives on picture quality and perceived premium status (microLEDs modular mural fit is a direct competitive threat at the very top end). The third challenge is logistics and installation: mural integration requires tighter tolerances, bespoke mounting and installation services that raise total cost of ownership and complicate distribution. Finally, trade/tariff shifts and regional incentives for local assembly can abruptly change landed costs and supply chain footprints. Analysts and industry trackers in 202425 emphasize BOM sensitivity and how tariff and capacity shifts in SEA affect both unit economics and sourcing decisions.

Manufacturers should prioritize three strategic moves: double down on software/ecosystem value (curated art/content stores, after-sales subscription features) to increase recurring revenue and distinguish mural products from commodity large TVs; develop installation and integration services or certified integrator networks to remove friction for architects and designers; and optimize BOM and panel sourcing via regional supply agreements and multi-country assembly to manage margin risk. For brands targeting ASEAN, combining a competitively priced QLED mural SKU with a premium installation package (mounting, anti-glare finish, content setup) helps capture higher net-present value per project. For investors, these strategies translate to measurable levers: higher ASP retention through services, improved gross margin with local sourcing, and defendable differentiation through content/UX..

Product Models

A QLED TV (Quantum-dot LED TV) is a type of television that uses quantum-dot technology combined with LED backlighting.

4K QLED TV provides sharp, high-definition images that are well suited for modern streaming, gaming, and everyday use. Notable products include:

Samsung 2024 Q60D QLED 4K Smart TV Samsung: A mainstream 4K QLED smart TV with Quantum HDR and a full-feature smart platform, suitable for streaming, movies, and everyday use.

TCL 43C655 4K QLED TV - TCL: A compact 43′′ QLED offering, balanced for smaller living spaces - delivers vibrant color and decent contrast for its size.

Xiaomi TV A Pro 55 4K QLED - Xiaomi: A 55′′ 4K QLED TV targeting value-oriented users - offers QLED panel benefits at a more accessible price point.

Aqua 55" QLED 4K Smart TV - Aqua: Entry-level 55′′ QLED 4K TV, useful for budget buyers who still want richer colors compared to basic LED TVs.

Hisense 4K QLED TVs Hisense: Offers competitive 4K QLED TVs with good brightness and smart-TV capabilities, often at more affordable price points.

8K QLED TV offers extremely high pixel density, hence potentially much greater detail. Notable products include:

Samsung QN900C Neo QLED 8K Smart TV Samsung: Premium 8K TV with Neo QLED panel, AI upscaling (8K AI Upscaling), rich Quantum Matrix backlight and HDR ideal for large-screen home cinema setups.

Hisense 75U80H 8K ULED Smart TV Hisense: 75" 8K ULED offering from Hisense, delivering very high resolution and large screen size - a value-oriented contender in 8K segment.

LG 75" QNED MiniLED 8K Smart TV - LG: 75′′ Mini-LED 8K TV from LG's QNED line, combining 8K resolution with mini-LED backlight for improved contrast and brightness (though "QLED" vs "QNED" is a slight variation).

Sharp 8TC60DW1X Android 8K TV - Sharp: A 60′′ 8K LED smart TV with "Real 8K" resolution and wide-gamut colour reproduction - an option for those seeking 8K detail at medium size.

Vizio 8K TV - Vizio: As of recent public info, Vizio reportedly has no plans to launch 8K TVs in its lineup, focusing instead on 4K/QLED models.

QLED Mural TVs occupy a steadily expanding niche that bridges premium consumer lifestyle design and high-end commercial/architectural displays. With a 2024 base market, a CAGR projected to 2031 and average selling prices that imply relatively modest global unit volumes today, the categorys near-term upside is driven more by ASP uplift and share gains in premium segments than by mass-market unit replacement. Regional dynamics in Asia and Southeast Asia where panel technology, manufacturing scale and premium consumer demand intersect will determine how quickly mural-style QLED moves from marquee projects into mainstream premium homes and hospitality installations.

Investor Analysis

This report highlights three investor-relevant facts: first, the markets size and growth profile indicate a growing premium niche with above-market price points attractive for investors seeking margin expansion rather than pure volume plays. Second, manufacturing and BOM sensitivity means margin expansion is achievable via supply-chain improvements and localized assembly in ASEAN; investors can benefit from backing companies that secure panel supply or invest in regional assembly capacity. Third, software/content and installation services are high-leverage areas: brands that monetize art/content stores and certified installation services convert one-time hardware sales into recurring revenue, improving lifetime value and making valuations less dependent on component cycles. For investors, the operational levers to watch are (a) ASP trends and product mix toward mural/lifestyle SKUs, (b) regional capacity and utilization (especially SEA shifts), and (c) recurring revenue growth from software/services each of these drives both upside and risk mitigation for portfolio companies in the space.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5540385

5 Reasons to Buy This Report

It quantifies the 2024 market baseline and unit economics at an industry ASP level to support valuation/forecasting.

It synthesizes the latest product and OEM moves (AI, art stores, microLED overlap) so investors can spot product differentiation.

It explains regional manufacturing capacity shifts and what they mean for landed costs and margins in ASEAN.

It provides a practical BOM-style cost posture and gross-margin framing to test supplier and OEM scenarios.

It points to actionable strategic plays (services, installation, regional assembly) that materially move profit pools.

5 Key Questions Answered

What is the 2024 market size and expected growth profile for QLED Mural TVs?

How many units were sold globally in 2024 at the stated ASP, and what are the implied COGS and factory gross profit per unit?

Which regions and countries are most important for demand and manufacturing, and how is ASEAN positioned?

What are the current technology and product trends shaping premium mural TVs (QLED vs OLED vs microLED)?

What strategic moves should vendors, integrators and investors prioritize to capture margin and market share?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

Global QLED Mural TVs Market Research Report 2025

https://www.qyresearch.com/reports/5540385/qled-mural-tvs

Global QLED Mural TVs Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/5540379/qled-mural-tvs

QLED Mural TVs - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5540372/qled-mural-tvs

Global QLED Mural TVs Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5540371/qled-mural-tvs

Global QLED TVs Market Research Report 2025

https://www.qyresearch.com/search/QLED%20TVs%20research

Global QLED Frame TVs Market Research Report 2025

https://www.qyresearch.com/reports/5540378/qled-frame-tvs

Global QLED Gaming TV Market Research Report 2025

https://www.qyresearch.com/reports/5537890/qled-gaming-tv

Global Barrier Film for QLED TV Market Research Report 2025

https://www.qyresearch.com/reports/4505775/barrier-film-for-qled-tv

Global LED TVs Market Research Report 2025

https://www.qyresearch.com/reports/4285895/led-tvs

Global COG LED TV Market Research Report 2025

https://www.qyresearch.com/reports/3535430/cog-led-tv

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Beyond the Screen: The USD 800 Million Global QLED Mural TVs Market Reshaping Homes and Hospitality here

News-ID: 4310249 • Views: …

More Releases from QY Research

Market Overview - Ultra-low-k Dielectric Material

QY Research has recently published a comprehensive market study on Ultra-low-k Dielectric Material, a critical class of advanced insulating materials engineered to reduce parasitic capacitance and signal delay in advanced semiconductor interconnects. Ultra-low-k dielectrics are essential enablers for sub-7 nm logic nodes, advanced memory, high-performance computing, and AI accelerators, where interconnect RC delay increasingly limits device performance and power efficiency.

The market is transitioning from dense SiO2 and conventional low-k materials…

Global and U.S. Quadruped Mobile Robots Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Quadruped Mobile Robots, are four-legged robotic systems designed to move and operate in complex, unstructured environments by mimicking the locomotion of animals. They use a combination of advanced sensors, actuators, AI algorithms, and real-time control systems to maintain balance, navigate uneven terrain, climb obstacles, and adapt to dynamic conditions. Because of their high stability and mobility, quadruped robots are widely…

Global and U.S. Industrial Edge Cloud Devices Market Report, Published by QY Res …

QY Research has released a comprehensive new market report on Industrial Edge Cloud Devices, ruggedized computing platforms that bring cloud-native processing, storage, and AI analytics directly to the industrial edge-close to machines, sensors, and control systems. By executing latency-sensitive workloads locally while synchronizing with central or public clouds, these devices enable real-time decision-making, improved reliability, and secure data governance across factories, utilities, energy assets, and transportation infrastructure. As Industry 4.0,…

Top 30 Indonesian Ceramic Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Arwana Citramulia Tbk (ARNA)

PT Cahayaputra Asa Keramik Tbk (CAKK)

PT Intikeramik Alamasri Industri Tbk (IKAI)

PT Keramika Indonesia Assosiasi Tbk (KIAS)

PT Mulia Industrindo Tbk (MLIA)

PT Asahimas Flat Glass Tbk (AMFG) (glass & ceramic-adjacent)

PT Niro Ceramic Nasional Indonesia

PT Eleganza Tile Indonesia

PT Roman Ceramic International

PT Platinum Ceramics Industry

PT Granito (Citra Granito)

PT Diamond Keramik Indonesia

PT Indogress (Inti Keramik Sejahtera)

PT Indopenta Sakti Teguh

PT Sun Power Ceramics

PT Satyaraya Keramindo Indah…

More Releases for LED

HSC LED Successfully Delivers Taxi LED Displays to Moldova

HSC LED [https://www.hscled.com/] is pleased to announce the successful completion of a major project involving the delivery of taxi LED displays to Moldova. This achievement underscores our dedication to providing high-quality, innovative LED display solutions to global markets.

Image: https://www.abnewswire.com/upload/2025/03/c632e02b61fa3f45fb036d4012a026b5.jpg

This project involved the production and deployment of state-of-the-art taxi top LED displays, designed for high visibility, durability, and intelligent operation. Equipped with high brightness levels, waterproof protection, and efficient heat dissipation,…

Enhancing LED Lighting: What is a reflective LED light?

Nowadays, LED lights [https://www.cnblight.com/products/] have become the mainstream of lighting. There is an interesting question, why do LED lights in homes nowadays, whether they are desk lamps, pendant lamps, ceiling lamps, etc., often need to add a lamp shell? You should know that LED lights emit solid light, unlike traditional lamps such as incandescent lamps and fluorescent lamps, which require a lamp shell on the outside.

There are many reasons that…

Global Backlight LED Market| Global Backlight LED Industry | Backlight LED Marke …

The backlight LED market comprises of sales of Backlight LED & related services. LED backlight is a flat panel display that uses LED backlighting instead of cold cathode fluorescent (CCFL) backlighting. LED backlight displays also use thin-film-transistor liquid-crystal display (TFT LCD) technologies that offer better contrast and brightness, reduced energy consumption, greater color range more quick response to changes in the scene, and photorefractive effects. These displays are small chips…

Global LED Packaging Market Size Detail Analysis focusing Market Segmentation li …

Global LED Packaging Market Size Detail Analysis focusing Market Segmentation like Lamp-LED, Side-LED, TOP-LED, High-Power LED, SMD-LED, and Flip-Chip LED & more

The LED market is one of the quickly growing segments as they are replacing the traditional lighting equipment like bulbs due to their high efficiency and power saving capability. The LED packaging industry is also growing with innovations along with the LED industry as new technologies are being included…

Global LED Driver (LED Lighting Driver) Market Research Report

This report studies the global LED Driver (LED Lighting Driver) market status and forecast, categorizes the global LED Driver (LED Lighting Driver) market size (value & volume) by manufacturers, type, application, and region. This report focuses on the top manufacturers in United States, Europe, China, Japan, South Korea and Taiwan and other regions.

Get sample copy of the report:

https://www.marketdensity.com/contact?ref=Sample&reportid=68754

Table of Contents:

Table of Contents

Global LED Driver (LED Lighting Driver) Market Research Report…

LED Driver And Chipset Market - Tax Exemptions For LED Technology Encourage Use …

Transparency Market Research, in a report titled “LED Driver and Chipset Market - Global Industry Analysis, Trend, Size, Share and Forecast 2015 - 2021,” states that the global LED driver and chipset market is projected to expand at a remarkable CAGR of 23.20% during the forecast period. The report states that the outstanding growth of the overall LED market in recent times will push the value of the LED driver…