Press release

Polyurethane Catalyst A-1 Unlocked: Global Growth Drivers, Asias Dominance, and Critical Insights for 2031 Investors

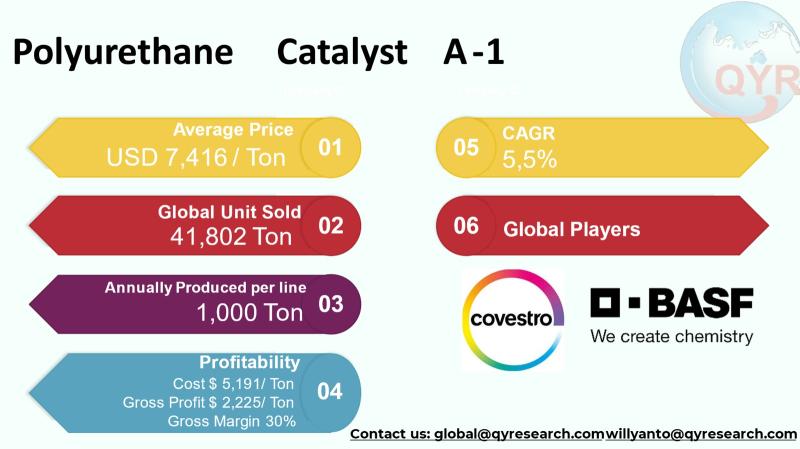

This report examines the global market for Polyurethane Catalyst A-1 with emphasis on Asia and Southeast Asia, describing industry structure, market sizing, unit economics and downstream demand. Polyurethane catalysts such as A-1 are a small but critical chemical niche used to control the gel and blowing reactions in both flexible and rigid polyurethane formulations. Catalyst A-1 variants are widely used in soft polyether foams and in mixed systems where precise control of gas generation and gelation is required; they are often combined with organotin catalysts or other amines to tune the foam profile.The global market size for Polyurethane Catalyst A-1 is USD 310 million for 2024 and the market is expected to grow at a compound annual growth rate of 5.5% to 2031, reaching market size USD 450 million by 2031. With an average selling price at USD 7,416 per ton corresponds to roughly 41,802 tons sold globally in 2024. Using a factory gross margin of 30%, the factory gross profit per ton is USD 2,225 while cost of goods sold per ton is USD 5,191. The COGS breakdown is raw materials, labor, utilities, maintenance, packaging and other site costs. A single line full machine production is around 1,000 tons per line per year. Downstream demand is concentrated in polyurethane flexible foam, rigid foam for insulation, coatings & adhesives, elastomers and sealants.

Latest Trends and Technological Developments

In late 2025 and throughout 2024 to 2025 the polyurethane catalyst field has continued to see incremental technology introductions emphasizing lower VOC/reactivity-tailored amine catalysts, supply-chain capacity additions for specialty amine intermediates, and industry exhibitor gatherings that accelerate commercialization. For example, BASF announced a new low-VOC amine catalyst addition to its Lupragen family (Lupragen N 208) in an announcement dated December 2025, reflecting supplier focus on regulatory and indoor-air quality drivers for foam and molded parts applications. Capacity projects for key tertiary amine intermediates used to make A-type catalysts (commodity intermediates such as DMDEE and related amines) have been reported in China with planned new tonnages announced through mid-2024 and referenced in 2025 updates, indicating regional capacity build-out that will affect pricing and availability. Industry exhibitions such as Putech Eurasia 2025 (late November 2025) continue to serve as commercialization and networking hubs for catalyst formulators and OEMs seeking low-emissions formulations and process efficiencies. These developments show a clear emphasis on lower-emission catalyst chemistries, supply-side capacity additions in Asia and continued product-line extensions by incumbent global suppliers.

Shanghai Jiatong Composite Materials Co., Ltd. purchases Polyurethane Catalyst A-1 from Huntsman Corporation for the amount of USD 5,200 per metric ton, with annual procurement volumes exceeding 20 tons to support its production of flexible polyurethane foam for automotive seating applications.

Polyurethane Catalyst A-1 is utilized in the manufacturing process at Recticel NVs production facility in Belgium, where it accelerates the foaming reaction in the production of insulation panels for commercial refrigeration. The catalyst is applied at a dosage of 0.8 parts per hundred polyol, with an annual consumption of 12 tons, amounting to an estimated USD 62,400 in annual catalyst expenditure for this specific application line.

Asia is the largest regional market by volume for polyurethane catalysts driven by the regions dominant share of global polyurethane production, local appliance and construction activity, furniture and automotive seating output, and capacity expansion for raw materials. China remains the single biggest producer and consumer with numerous domestic suppliers offering generic A-1 formulations alongside international licensees and distributors; capacity announcements for tertiary amine intermediates and specialty amine projects in China through 20242025 are a key signal that feedstock supply for A-1 catalysts will remain plentiful regionally, with effects on pricing and competitiveness. India has exhibited high growth in rigid and flexible PU consumption (insulation and furniture markets), while South Korea and Japan remain important markets for high-performance, low-odor or low-VOC catalyst variants used in automotive and electronics applications. Within Asia, supply competition is intense: multinational catalyst brands defend premium positioning through regulatory compliance and formulation support while local producers compete on price and lead times. Regional logistics, feedstock costs and environmental permitting remain the principal operating variables shaping margins for Asia-based producers.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5540444

Polyurethane Catalyst A-1 by Type:

Solid

Liquid

Polyurethane Catalyst A-1 by Product Category:

Content ≥70%

Content ≥90%

Content ≥99%

Polyurethane Catalyst A-1 by Material:

Amina Based Catalyst

Metal Free Catalyst

Low VOC Environmentally Friendly Catalyst

High Reactivity Catalytic Formulations

Others

Polyurethane Catalyst A-1 by Features:

Fast Foaming Reaction

Low Odor Formulation

Reduced Emissions

Balanced Blowing Action

Others

Polyurethane Catalyst A-1 by Usage:

Footwear Soles

Appliance Insulation

Spray Foam Insulation

Automotive interior Components

Others

Polyurethane Catalyst A-1 by Application:

Foam

Coatings

Adhesives

Elastomers

Others

Global Top 10 Key Companies in the Polyurethane Catalyst A-1 Market

Momentive

BASF

Covestro

Gulbrandsen

Tosoh

Jiangsu Wansheng Dawei Chemical

Jiangsu Maysta Chemical

Z River Group

Evonik Industries

Huntsman International LLC

Regional Insights

Within Southeast Asia (ASEAN), demand is driven by growing construction activity (rigid PU insulation panels and sandwich panels), furniture manufacturing (flexible foam for bedding and upholstery) and a rising light-vehicle and two-wheeler production base that uses specialized foams and adhesives. Indonesia stands out as both a growing consumption market and a potential production hub for regional formulators: domestic foam converters and appliance manufacturers source A-1 type catalysts from regional distributors and Chinese suppliers, while local chemical firms are increasingly able to offer tailored blends. Logistics and local regulatory trends (emissions, storage and handling of amine-based catalysts) influence purchasing patterns; many ASEAN converters prefer regional supply to avoid extended lead times, though branded global catalysts retain pricing premiums where technical support and regulatory documentation are critical. Overall, ASEAN is growing faster than established mature markets, making it a high-priority sales region for both multinational and regional catalyst suppliers.

The catalyst A-1 supply chain faces several persistent challenges. Regulatory pressure on volatile organic compounds and workplace exposure limits compels suppliers to reformulate or offer low-VOC alternatives while maintaining performance, which raises R&D and reformulation costs. Feedstock volatility for amine intermediates and shifts in organotin regulatory status (in some end-use geographies) can disrupt established formulations and procurement patterns. Price sensitivity in commodity foam markets forces many converters toward lower-cost generic catalysts, pressuring margins for premium suppliers. Environmental permitting, safe-storage requirements and transportation of reactive amine products also create capex and compliance burdens for new entrants. Finally, intellectual property and formulation know-how are guarded by incumbents, creating barriers for pure-play new suppliers to rapidly capture share in higher-value sales channels.

Suppliers should pursue a dual strategy of product differentiation (low-VOC, reactive-matched catalysts with regulatory-compliant documentation) and cost competitiveness (local production or toll-manufacturing in Asia to reduce logistics costs). Strategic partnerships with foam OEMs and converters to co-develop catalysts tuned to specific processes (e.g., slabstock flexible foam, spray foam insulation or integral skin molding) will entrench sales and create switching costs. Capacity additions for amine intermediates in China and Asia more broadly may put downward pressure on spot pricing, so margin management through feedstock hedging and blended product offerings is critical. For investors, prioritize companies with balanced global distribution networks, strong R&D portfolios, and demonstrated ability to reformulate for environmental and indoor-air quality requirements; these companies are better positioned to command pricing and to grow in higher-value segments.

Product Models

Polyurethane Catalyst A-1 Type: A widely used tertiary amine catalyst typically based on bis(2-dimethylaminoethyl) ether designed to promote the waterisocyanate reaction in polyurethane foam production.

Solid A-1 catalysts are formulated for controlled release, increased storage stability, and applications requiring minimal volatility. Notable products include:

A-1 Solid Grade S10 Evonik: A stabilized solid amine catalyst designed for foam systems requiring controlled blowing reactivity.

A-1 Blocked Solid Catalyst BS-21 Kumi Chemical (China): A blocked A-1 derivative designed for delayed reaction systems.

Lupragen® A1-G Granular BASF: A granular, easy-handling A-1 solid catalyst providing consistent performance in molded foam applications.

Desmorapid® A1-Solid Covestro: A stabilized solid A-1 blowing catalyst suitable for rigid and semi-rigid PU systems requiring low volatility.

Maysta A-1 Solid M-P10 Jiangsu Maysta: A pelletized blowing catalyst enabling smooth feeding and stable blowing activity.

Liquid A-1 catalysts provide high reactivity, easy blending, and efficient dispersibility in most PU systems. Notable products include:

Dabco® A-1 Evonik: A benchmark liquid A-1 catalyst widely used globally for controlling foam rise in flexible PU foams.

Niax® A-1 Momentive: A highly reactive liquid catalyst applied in both flexible and rigid PU foam systems.

U-Cat A1-Liquid Tosoh Corporation: A fast-reacting liquid catalyst optimized for precision molded PU parts.

Amine Catalyst A-1L Huntsman: A low-odor A-1 liquid catalyst providing good process control in automotive foams.

A-1 Liquid Catalyst 99 Shandong Lianmeng Chemical: A standard-strength A-1 liquid widely used in bedding foam production.

Polyurethane Catalyst A-1 occupies a strategically important niche that links upstream amine/intermediate chemistry to the large global polyurethane value chain. With an estimated 2024 market value and a projected CAGR to 2031, the segment offers steady growth supported by rising polyurethane consumption in Asia and Southeast Asia. Supply-side capacity additions in Asia, regulatory drivers pushing low-VOC chemistry and product differentiation opportunities for premium catalysts will shape competitive dynamics. For producers and investors, the combination of specialized technical know-how, regional manufacturing footprint and regulatory-compliant product lines will be decisive for margin capture and long-term growth.

Investor Analysis

This report provides unit-level economics (price per ton, COGS breakdown, per-ton gross profit and aggregate market volumes), regional demand patterns and a short list of leading suppliers so investors can quickly evaluate yield, margin sensitivity to feedstock moves, and the competitive landscape. How: By translating market value into volume and per-unit economics and coupling that with an understanding of regional capacity additions and regulatory trends, investors can model downside/upside scenarios for margin compression or premiumization. Why: Catalyst A-1 is a small but high-leverage component of polyurethane value chains; modest shifts in price, R&D advantage or regional supply can materially affect converter economics and therefore supplier pricing power. Investors who prioritize companies with resilient supply chains, strong R&D and regional manufacturing in Asia/ASEAN stand to benefit from both stable demand and potential margin improvement via product premiumization and cost optimization.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5540444

5 Reasons to Buy This Report

Immediate access to unit economics (price/ton, estimated volumes and per-ton gross margins) for quick valuation work.

Targeted regional intelligence for Asia and ASEAN to support geographic investment allocation and market entry decisions.

Latest technology and regulatory trend summary (low-VOC catalysts, amine intermediate capacity moves) with dated source references.

A concise competitive leaderboard of top global and regional players to support M&A screening and supplier selection.

Actionable strategic recommendations that link R&D, manufacturing footprint and product positioning to margin outcomes.

5 Key Questions Answered

What is the estimated global market size in USD and metric tons for Catalyst A-1 in 2024?

What are the representative unit economics (price, COGS breakdown and factory gross profit per ton)?

How is demand distributed across downstream applications (flexible foam, rigid foam, coatings, elastomers, sealants)?

What are the latest technological and regulatory developments that will affect catalyst formulations and supplier strategy?

Who are the leading suppliers and which firms are best positioned to capture future premium pricing or volume growth in Asia and ASEAN?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

Global Polyurethane Catalyst A-1 Market Research Report 2025

https://www.qyresearch.com/reports/5540444/polyurethane-catalyst-a-1

Polyurethane Catalyst A-1 - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5539181/polyurethane-catalyst-a-1

Global Polyurethane Catalyst A-1 Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/5539180/polyurethane-catalyst-a-1

Global Polyurethane Catalyst A-1 Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5539177/polyurethane-catalyst-a-1

Global Polyurethane Catalysts Market Research Report 2025

https://www.qyresearch.com/reports/3432529/polyurethane-catalysts

Global Polyurethane Foam Catalyst Market Research Report 2025

https://www.qyresearch.com/reports/3495828/polyurethane-foam-catalyst

Global Amine Polyurethane Catalyst Market Research Report 2025

https://www.qyresearch.com/reports/5539164/amine-polyurethane-catalyst

Global Rigid Polyurethane Catalyst Market Research Report 2025

https://www.qyresearch.com/reports/4041419/rigid-polyurethane-catalyst

Global Polyurethane Metal Catalysts Market Research Report 2025

https://www.qyresearch.com/reports/4043969/polyurethane-metal-catalysts

Global Polyurethane Foaming Catalyst Market Research Report 2025

https://www.qyresearch.com/reports/4793057/polyurethane-foaming-catalyst

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Polyurethane Catalyst A-1 Unlocked: Global Growth Drivers, Asias Dominance, and Critical Insights for 2031 Investors here

News-ID: 4310247 • Views: …

More Releases from QY Research

Top 30 Indonesian Rubber Public Companies - Q3 2025 Revenue & Performance

1) Overall companies' performance (Q3 2025 snapshot)

PT Gajah Tunggal Tbk

PT Multistrada Arah Sarana Tbk

PT Goodyear Indonesia Tbk

PT King Tire Indonesia

PT Indo Kordsa Tbk

PT Kirana Megatara Tbk

PT Bumi Serpong Damai Tbk

PT Adaro Energy Tbk

PT ACE Hardware Indonesia Tbk

PT Suryaraya Rubberindo Tbk

PT Dharma Polimetal Tbk

PT Selamat Sempurna Tbk

PT Indospring Tbk

PT Autopedia Sukses Lestari Tbk

PT Nipress Tbk

PT Prima Alloy Steel Universal Tbk

PT Anugerah Spareparts Sejahtera Tbk

PT Bintang Oto…

Smart Vacuum Grippers Reshape Industrial Handling Market Through 2032

Rubber suction cups are flexible vacuum-based gripping components used for temporary adhesion and handling across consumer, industrial, and automation applications

Widely applied in packaging lines, glass handling, automotive assembly, electronics pick-and-place, medical devices, and household accessories

Manufactured primarily from silicone rubber, EPDM, nitrile (NBR), natural rubber, and thermoplastic elastomers

Industry characterized by high-volume standardized parts combined with customized industrial vacuum grippers for robotics and smart factories

Demand closely linked to automation penetration, e-commerce packaging…

Renewable Plastic Packaging 2025: ASEAN Growth and 28% Margins Driving the Next …

Renewable plastic packaging refers to packaging materials produced from bio-based, compostable, or renewable feedstocks such as PLA, PHA, starch blends, bio-PE, and bio-PET.

Derived from corn, sugarcane, cassava, cellulose, and plant oils, replacing fossil-fuel plastics to reduce carbon footprint and landfill load.

Applications include:

Food & beverage flexible packs

Retail carry bags

Personal care bottles

E-commerce mailers

Agricultural films

Adoption driven by:

Government plastic taxes & EPR mandates

ESG commitments from FMCG brands

Consumer preference for biodegradable/low-carbon materials

Retailers banning single-use fossil…

From Plastic-Free to Premium: The Future of the Global Facial Wipes Industry

Facial wipes are disposable non-woven textile products pre-saturated with cleansing or skincare solutions used for makeup removal, hygiene, moisturizing, and antibacterial purposes

Widely adopted across personal care, travel, baby care, sports, hospital, and on-the-go convenience segments

Increasing penetration driven by busy lifestyles, urbanization, higher disposable income, and rising skincare awareness

Core buyers include mass retail, convenience stores, e-commerce, beauty chains, pharmacies, and hospitality sectors

Industry Explanation and Global Overview

Combines nonwoven fabric manufacturing (spunlace, airlaid)…

More Releases for Catalyst

Cr-based Alkanes Dehydrogenation Catalyst Market 2025: Innovations, Trends, and …

Los Angeles-United State: QY Research has recently published a research report titled, "Cr-based Alkanes Dehydrogenation Catalyst - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031" assessing various factors impacting its trajectory. The market research report is a perfect tool for digging deep into critical aspects of the global Cr-based Alkanes Dehydrogenation Catalyst market and closely understanding factors that influence its growth. Our research analysts are experienced enough…

Catalyst Market Economic Drivers Factors Influencing Catalyst Market Expansion - …

In recent years, the global Catalyst Market has witnessed a dynamic shift, influenced by changing consumer preferences, technological advancements, and a growing emphasis on sustainability. The Research report on Catalyst Market presents a complete judgment of the market through strategic insights on future trends, growth factors, supplier landscape, demand landscape, Y-o-Y growth rate, CAGR, pricing analysis. It also provides and a lot of business matrices including Porters Five Forces Analysis,…

Diesel Engine Catalyst Market Report 2024 - Diesel Catalyst Market Size And Grow …

"The Business Research Company recently released a comprehensive report on the Global Diesel Engine Catalyst Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive…

Continuous Catalyst Regeneration (CCR) Catalyst Market Segmentation & Analysis, …

Los Angeles, USA: QY Research has recently unveiled a comprehensive report titled, "Global Continuous Catalyst Regeneration (CCR) Catalyst Market Report: Insights, Forecast to 2030." This detailed analysis examines the multiple elements shaping the future of the global Continuous Catalyst Regeneration (CCR) Catalyst market.

The Continuous Catalyst Regeneration (CCR) Catalyst report serves as an invaluable resource for industry players, providing precise and extensive research insights necessary for strategic decision-making. The analysts have…

Refinery Catalyst Market: Refinery Catalyst Market Projections: Innovations and …

Market Overview:

Refinery catalysts are used in petroleum refining operations to facilitate and accelerate chemical reactions for conversion of crude oil into useful petroleum products like gasoline, diesel, jet fuel etc. Without catalysts, refining processes would be inefficient or not commercially viable.

Get Sample Report with Global Industry Analysis @ https://www.coherentmarketinsights.com/insight/request-sample/736

Major Players Are:

✤ BP Global and Royal Dutch Shell. Other key industry participants include YARA International

✤ Foster Wheeler AG

✤ OXEA GmbH

✤ W…

Global Homogeneous Catalyst Market, Global Homogeneous Catalyst Industry, Covid- …

Homogeneous catalysts such as transition metal complexes have been utilized for the chemical reactions on the biopolymers. Homogeneous catalysts were the catalysts of choice in the early days of metathesis reactions. They entailed of a transition metal compound and a non-transition metal compound, primarily organometallic as cocatalysts. Although, the homogeneous catalysts have high probable to speed up the reaction rate, augment selectivity, conversion rate, and diminish side reactions, they cannot…