Press release

Global PCSK9 Inhibitor Industry Surges from USD 1.7 Billion in 2023 to USD 9.3 Billion by 2034

The PCSK9 Inhibitor Market is set for remarkable expansion, growing from USD 1.7 billion in 2023 to an impressive USD 9.3 billion by 2034. This strong trajectory, driven by a high CAGR of 16.9% from 2024 to 2034, reflects rising adoption of PCSK9 inhibitors for managing high cholesterol levels, especially among patients who do not respond adequately to traditional lipid-lowering therapies. Increasing awareness of cardiovascular risk reduction, expanding clinical applications, and continuous advancements in biologic drug development are further fueling market growth globally.Rise in the number of patients battling bad cholesterol is the factor augmenting the PCSK9 inhibitor market opportunities. Increase in incidence of cardiovascular diseases is another factor catalysing the PCSK9 modulators landscape. PCSK9 inhibitors help in reducing the level of bad cholesterol, which helps in checking the coronary heart diseases.

Dive Deeper into Data: Get Your In-Depth Sample Now! https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=83528

The high-risk patients can thus target bad cholesterol, thereby doing away with the extremities such as heart failure. The market participants are also working toward further optimization of PCSK9 inhibitors and analysis of plaque reduction data to simplify the task of tracing the patient's history related to LDL.

Healthcare personnel recommend PCSK9 inhibitors as appropriate second- or third-line agents or alternative therapies in cases of 100% statin intolerance, especially for patients suffering from established atherosclerotic or cardiovascular diseases or familial hypercholesterolemia with persistent hypercholesterolemia.

Market Segmentation

The market is segmented across several key dimensions:

Segmentation Category

Key Segments

Dominant/Noteworthy Sub-Segments (2024)

By Drug Type

Evolocumab (Repatha), Alirocumab (Praluent), Inclisiran (Leqvio), Pipeline Drugs (e.g., Lerodalcibep, MK-0616, Tafolecimab)

Evolocumab held the dominant share (approx. 52.4%).

By Modality

Fully-humanized Monoclonal Antibodies (mAbs), Small Interfering RNA (siRNA)

Monoclonal Antibodies accounted for the largest revenue share, though siRNA therapies are projected to see the fastest growth due to their biannual dosing schedule.

By Indication

Familial Hypercholesterolemia (FH), Atherosclerotic Cardiovascular Disease (ASCVD), Primary Hyperlipidemia

Heterozygous Familial Hypercholesterolemia (HeFH) accounted for the largest revenue share.

By Distribution Channel

Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Specialty Clinics

Hospital Pharmacies dominated the market (approx. $1.4 Billion in 2024), reflecting the specialized nature of these treatments.

Note: The segmentation for 'By service type,' 'By sourcing type,' and 'By industry vertical' is not directly applicable to this pharmaceutical market, which is segmented primarily by drug, modality, indication, and distribution channel.

Regional Analysis

North America currently dominates the global PCSK9 inhibitor market, accounting for the largest revenue share (over 40-46% in 2024).

United States: The U.S. market is the single largest contributor, projected to generate approximately USD 5.9 billion by 2034.12 This dominance is fueled by a high cardiovascular disease burden, advanced healthcare infrastructure, favorable reimbursement policies, and early adoption of novel biologics.

Asia-Pacific (APAC): This region is projected to be the fastest-growing market during the forecast period.13 Market expansion is driven by a rapidly aging population, increasing prevalence of dyslipidemia and CVDs due to lifestyle changes, and rising healthcare expenditure and awareness.

Europe: A substantial market, but growth is sometimes constrained by strict reimbursement policies from public healthcare systems, which often limit the drugs' use to the highest-risk patient cohorts.

Market Drivers and Challenges

🚀 Market Drivers

Rising Prevalence of CVDs and Hypercholesterolemia: The increasing global incidence of heart and circulatory diseases, familial hypercholesterolemia (FH), and uncontrolled high LDL-C levels is the primary market driver.

Superior Efficacy and Clinical Outcomes: PCSK9 inhibitors offer a significant reduction in LDL-C (often over 50%) and a confirmed reduction in major cardiovascular events, making them indispensable for very high-risk patients.

Emergence of Novel Therapies: The introduction of siRNA-based therapies (like inclisiran, with biannual dosing) and the pipeline development of oral PCSK9 inhibitors are expected to drastically improve patient adherence and broaden market reach.

Favorable Guideline Updates: Updated national and international clinical guidelines increasingly position PCSK9 inhibitors as essential therapy for specific high-risk and secondary prevention patient groups.

🚧 Market Challenges

High Cost and Reimbursement Barriers: PCSK9 inhibitors are significantly more expensive than generic statins. Despite price cuts, high costs and complex prior-authorization processes or payer rejection rates (near 31% in the U.S.) continue to limit patient access.

Competition from Pipeline Agents: The market faces competition from other advanced non-statin lipid-lowering therapies, such as oral small molecules and gene therapies, which could offer better price or convenience profiles.

Logistical Challenges: The requirement for cold-chain storage and handling, particularly for monoclonal antibodies, poses logistical hurdles, especially in low-income regions.

Market Trends

Shift Towards RNA-Interference (RNAi) Therapies: The clinical convenience of biannual dosing for siRNA drugs is a major trend, positioning these therapies for rapid market share growth despite the current dominance of monoclonal antibodies.

Development of Oral PCSK9 Inhibitors: The development of small-molecule oral PCSK9 inhibitors (e.g., Merck's MK-0616) represents a potential "game-changer." These could eliminate injection aversion and cold-chain issues, significantly expanding the eligible patient pool.

Focus on Primary Prevention: Ongoing clinical trials, such as the VICTORION-1 PREVENT program, are exploring the use of PCSK9 inhibitors for primary prevention in a wider, high-risk population without established ASCVD, which could vastly expand the addressable market size.

AI in Lipidomics: The integration of AI-enabled lipidomics and direct-to-consumer gene panels is helping to identify high-risk cohorts (like HeFH patients) earlier and more accurately, driving demand for targeted therapies.

Future Outlook (2034)

The PCSK9 inhibitor market's future is exceptionally bright, moving beyond niche status for familial hypercholesterolemia. By 2034, the market will be defined by:

Broader Patient Access: Driven by the entry of less expensive generics (following patent expirations) and the launch of convenient, potentially oral therapies, access will improve globally.

Diverse Portfolio: A portfolio spanning monoclonal antibodies, biannual siRNA, and oral small-molecule inhibitors will address different patient needs and preferences.

Standard of Care: Increased clinical evidence and guideline updates will solidify the role of PCSK9 inhibitors as an essential component of care for high- and very high-risk cardiovascular patients.

Key Market Study Points

The prevalence of familial hypercholesterolemia (FH) is a critical metric, representing a core, high-need patient population for these drugs.

Reimbursement policies remain the most critical variable impacting market uptake, particularly in price-sensitive geographies.

The launch of the first approved oral PCSK9 inhibitor will likely be the single largest catalyst for market acceleration post-2025.

Evolocumab (Repatha) and Inclisiran (Leqvio) are expected to drive the majority of market revenue, representing the leading mAb and siRNA modalities, respectively.

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=83528<ype=S

Competitive Landscape

The PCSK9 inhibitor market is dominated by a few major global pharmaceutical players, but it is becoming increasingly competitive with the entry of next-generation therapies.

Key Players:

Amgen (Repatha/Evolocumab)

Sanofi / Regeneron Pharmaceuticals (Praluent/Alirocumab)

Novartis (Leqvio/Inclisiran)

Merck & Co., Inc. (Developing the oral inhibitor, MK-0616)

LIB Therapeutics (Developing Lerodalcibep)

Innovent Biologics (SINTBILO/Tafolecimab - China market)

Recent Developments (2024-2025)

Oral Inhibitor Advancements: Merck's MK-0616 advanced through clinical trials, showing promising LDL-C reduction, fueling anticipation for a market entry around 2027.

Label Expansions and Approvals: The FDA and other regulatory bodies approved new label expansions for existing lipid-lowering agents, sometimes for use in combination with PCSK9 inhibitors, or for use in pediatric FH patients (e.g., Alirocumab).

Strategic Partnerships and Commercialization: Companies like LIB Therapeutics partnered with regional players (e.g., Hasten Biopharmaceuticals in China) to expand the geographic reach and commercialization of their pipeline candidates.

Reimbursement Inclusion: Products like Innovent Biologics' SINTBILO were added to national reimbursement drug lists (NRDL) in key emerging markets, a critical step for accelerating adoption.

Explore Latest Research Reports by Transparency Market Research:

Kidney Cancer Drugs Market - https://www.transparencymarketresearch.com/kidney-cancer-drugs-market.html

Sarcopenia Treatment Market - https://www.transparencymarketresearch.com/sarcopenia-treatment-market.html

Acromegaly Treatment Market - https://www.transparencymarketresearch.com/acromegaly-treatment-market.html

Abortion Drugs Market - https://www.transparencymarketresearch.com/abortion-drugs-market.html

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global PCSK9 Inhibitor Industry Surges from USD 1.7 Billion in 2023 to USD 9.3 Billion by 2034 here

News-ID: 4309896 • Views: …

More Releases from transparencymarketresearch

Global Telecommunications Market to Reach USD 3.3 Trillion by 2035, Growing at a …

The global telecommunications market reached USD 1.9 trillion in 2024 and is projected to expand steadily, reaching USD 3.3 trillion by 2035. This growth reflects rising demand for high-speed connectivity, 5G deployment, cloud-based services, and digital transformation across industries. From 2025 to 2035, the telecommunications industry is anticipated to grow at a CAGR of 5.3%, driven by increasing mobile data consumption, IoT adoption, and continued investments in network infrastructure worldwide.

The…

Automotive E-Compressor Market to Surge from USD 2.4 Bn in 2022 to USD 26.4 Bn b …

The global Automotive E-Compressor Industry was valued at USD 2.4 billion in 2022 and is projected to reach USD 26.4 billion by the end of 2031. Driven by strong demand and rapid adoption across key sectors, the market is estimated to expand at a robust CAGR of 30.9% from 2023 to 2031, reflecting significant growth potential over the forecast period.

Surge in demand for fuel-efficient and environment-friendly solutions, and the rise…

Home Diagnostics Market Set to Reach USD 13.1 Bn by 2036, Growing at 5.5% CAGR

The global home diagnostics market was valued at USD 7.3 billion in 2025 and is projected to reach USD 13.1 billion by 2036. The industry is expected to grow at a CAGR of 5.5% from 2026 to 2036, driven by rising demand for convenient at-home testing solutions, increasing prevalence of chronic diseases, and growing adoption of digital and rapid diagnostic technologies.

The market witnesses expansion as key market drivers emerge ranging…

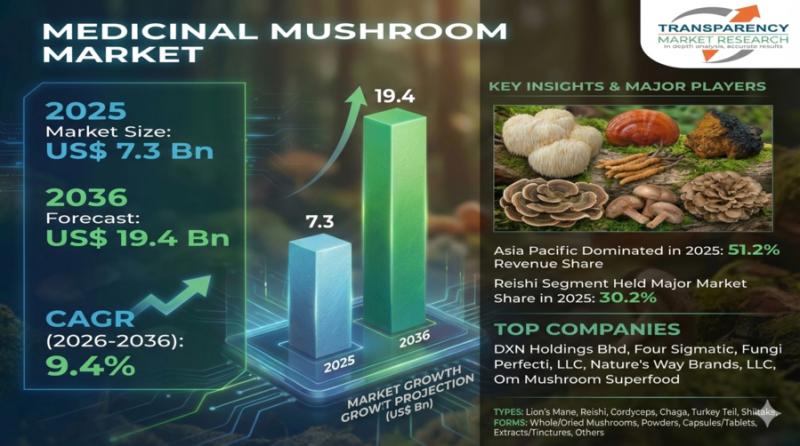

Medicinal Mushrooms Market to Reach USD 19.4 Bn by 2036, Growing at 9.4% CAGR

The global Medicinal Mushrooms Market size was valued at US$ 7.3 Bn in 2025 and is projected to reach US$ 19.4 Bn by 2036, expanding at a CAGR of 9.4% from 2026 to 2036. The global Medicinal Mushrooms industry is expanding due to increased awareness of natural health solutions, rising chronic disease prevalence, wider acceptance of traditional medicine, growing use in supplements and pharmaceuticals, and enhanced accessibility through e-Commerce and…

More Releases for PCSK9

United States PCSK9 Inhibitor Market 2033 | Growth Drivers, Key Players & Invest …

Market Size and Growth

PCSK9 Inhibitor Market reached US$ 1.96 Billion in 2024 and is expected to reach US$ 7.67 Billion by 2033, growing at a CAGR of 16.5% during the forecast period 2025-2033.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/pcsk9-inhibitor-market?sb

Key Development:

United States: Recent PCSK9 Inhibitor Developments

✅ In December 2025, the U.S. Food and Drug Administration approved Lerochol (lerodalcibep-liga), a third-generation PCSK9…

PCSK9 Inhibitors Market Is Going to Boom |• Amgen • Sanofi

According to Worldwide Market Reports (WMR) highlights that the "PCSK9 Inhibitors Market" is projected to experience substantial growth in the coming years. This report provides a comprehensive analysis of the market landscape using an integrated approach that includes research methodology, market size evaluation, data compilation, and insights gathered from multiple credible sources.

The study covers critical market elements such as market dynamics, drivers, restraints, challenges, threats, growth opportunities, development trends, technological…

United States PCSK9 Inhibitor Market 2025 | Growth Drivers, Competitive Landscap …

Market Size and Growth

PCSK9 Inhibitor Market reached US$ 1.96 Billion in 2024 and is expected to reach US$ 7.67 Billion by 2033, growing at a CAGR of 16.5% during the forecast period 2025-2033.

Key Development:

United States: Recent Industry Developments

✅ In September 2025, Merck's investigational oral PCSK9 inhibitor, Enlicitide Decanoate, achieved all primary and key secondary endpoints in the pivotal CORALreef Lipids study, demonstrating significant LDL-C reduction compared to placebo.

✅ In March…

PCSK9 Inhibitors Market Growth, Applications, Innovations and Business Outlook b …

Introduction

Cardiovascular diseases remain the leading cause of mortality worldwide, with elevated low-density lipoprotein cholesterol (LDL-C) being one of the most significant risk factors. While statins have long been the cornerstone of lipid-lowering therapy, many patients experience inadequate response or intolerance. This has driven the emergence of proprotein convertase subtilisin/kexin type 9 (PCSK9) inhibitors as a breakthrough class of drugs, offering dramatic LDL-C reductions and improved cardiovascular outcomes.

PCSK9 inhibitors work by…

PCSK9 Inhibitors Market Poised for Significant Growth by 2034, Predicts DelveIns …

The PCSK9 Inhibitors market is steadily advancing, driven by evolving treatment strategies and ongoing research. DelveInsight's latest 7MM report offers in-depth insights into key epidemiology trends and market dynamics.

DelveInsight's "PCSK9 Inhibitors - Market Insight, Epidemiology, And Market Forecast - 2034 [https://www.delveinsight.com/report-store/pcsk9-inhibitors-psck9i-market?utm_source=abnewswire&utm_medium=pressrelease&utm_campaign=jpr] report offers an in-depth understanding of the PCSK9 Inhibitors, historical and forecasted epidemiology as well as the PCSK9 Inhibitors market trends in the United States, EU5 (Germany, Spain, Italy,…

PCSK9 Inhibitor Pipeline Insights Report 2024

(Albany, United States) As per DelveInsight's assessment, globally, the PCSK9 Inhibitor Pipeline constitutes 14+ key companies continuously working towards developing 14+ PCSK9 Inhibitor Pipeline treatment therapies, analysis of Clinical Trials, Therapies, Mechanism of Action, Route of Administration, and Developments analysis DelveInsight.

In the PCSK9 Inhibitor Pipeline Report, a detailed description of the drug is given which includes mechanism of action of the drug, clinical studies, PCSK9 Inhibitor NDA approvals (if any),…