Press release

Analysis of Key Market Segments Influencing the Executive Protection Firm Insurance Market

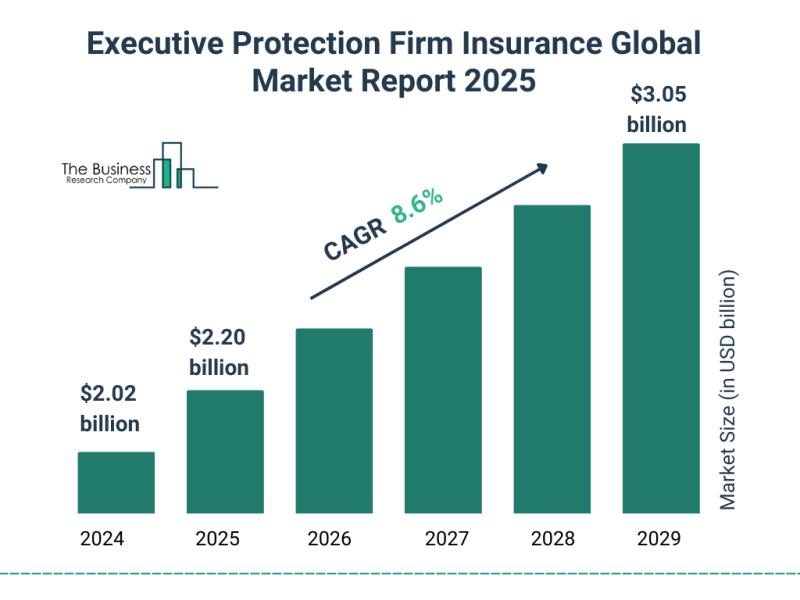

The executive protection firm insurance sector is on track for impressive expansion over the coming years, driven by several evolving global factors. As risks become more complex and security demands increase, this specialized insurance market is attracting greater attention and investment. Let's explore the current market size, major drivers, key players, segmentation, and emerging trends shaping the future of executive protection firm insurance.Projected Growth and Market Size of Executive Protection Firm Insurance

The executive protection firm insurance market is expected to reach a value of $3.05 billion by 2029, growing at a compound annual growth rate (CAGR) of 8.6%. This steady increase reflects the rising need for comprehensive insurance solutions tailored to the unique risks faced by executive protection firms. Growth in this period is largely fueled by factors such as heightened geopolitical tensions, political instability, and an expanding private security industry.

Download a free sample of the executive protection firm insurance market report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=30275&type=smp

Major market expansion also stems from increased corporate travel to high-risk locations, which drives demand for integrated cyber and physical protection services. Additionally, more stringent liability requirements and insurance regulations worldwide are compelling firms to invest in better coverage options. These combined influences create a favorable environment for sustained growth in executive protection firm insurance.

Key Factors Contributing to Market Growth

One significant driver is the surge in geopolitical unrest and political uncertainty, which elevates risk levels for executives and VIPs needing protective services. This instability pushes companies toward securing reliable insurance coverage to mitigate potential threats. At the same time, the private security sector itself is growing rapidly, with more firms offering specialized executive protection services, which increases overall insurance demand.

View the full executive protection firm insurance market report:

https://www.thebusinessresearchcompany.com/report/global-executive-protection-firm-insurance-market-report

Another important factor is the rise in corporate travel, especially to politically or socially volatile regions. This trend necessitates robust insurance policies that cover both physical threats and cyber risks, reflecting the growing convergence of digital and physical security concerns. Strengthened regulations governing liability and insurance for protection firms further stimulate market growth by enforcing higher coverage standards.

Leading Organizations in Executive Protection Firm Insurance

Several prominent companies dominate the executive protection firm insurance landscape, including Allianz SE, Zurich Insurance Group Ltd., Chubb Limited, Munich Reinsurance Company (Munich Re), and The Travelers Companies Inc. Other key players include American International Group Inc. (AIG), Marsh & McLennan Companies Inc., Arthur J. Gallagher & Co., Willis Towers Watson Public Limited Company, Swiss Re Ltd., AXA XL Insurance, Moody's Insurance Services Inc., Beazley Group plc, Lloyd's of London, Heffernan Insurance Brokers Inc., Assicurazioni Generali S.p.A., GenStar Capital LLC, ProFinity Insurance Services Inc., Polaris Risk Management LLC, and Apex Risk & Insurance Services Inc.

These companies provide a wide range of insurance products designed to address the complex and evolving needs of executive protection firms across different geographies and client profiles.

Detailed Segmentation Within the Executive Protection Firm Insurance Market

The executive protection firm insurance market is divided into several key segments based on coverage type, firm size, distribution channel, and end-user category. Coverage types include General Liability, Professional Liability, Workers' Compensation, Commercial Auto, Property Insurance, Cyber Liability, and other specialized coverages.

In terms of firm size, the market distinguishes between small and medium enterprises (SMEs) and large enterprises, reflecting differing insurance requirements and risk profiles. Distribution channels include direct sales, brokers or agents, and online platforms, highlighting the variety of ways companies access insurance products.

End-users covered in this market range from corporate clients and government agencies to high-net-worth individuals and other specialized segments, each with unique protection needs.

Subcategories Highlighting Specific Insurance Coverage Types

Within the broader coverage categories, the market further breaks down into specific subtypes. For General Liability, this includes coverage for bodily injury, property damage, personal and advertising injury, and legal defense. Professional Liability encompasses errors and omissions (E&O), negligence, legal expense reimbursement, and contractual liability coverages.

Workers' Compensation covers medical expenses, disability benefits, rehabilitation, and death benefits. Commercial Auto insurance includes vehicle damage, liability, collision, and comprehensive coverage. Property Insurance addresses buildings, equipment, business interruptions, and contents.

Cyber Liability focuses on data breach coverage, network security liability, cyber extortion, and business interruptions caused by cyberattacks. Other coverage types consist of umbrella liability, directors and officers (D&O) insurance, employment practices liability, and crime and theft protection.

Emerging Trends and Innovations Influencing the Executive Protection Firm Insurance Market

Technological advancements are playing an increasingly important role in shaping insurance products for executive protection firms. Innovations in threat detection and risk assessment enable insurers to offer more precise and tailored coverage options.

There is also a noticeable shift toward preventive risk management strategies, which focus on anticipating and mitigating risks before they materialize. Customized executive protection policies that incorporate biometric access controls and facial recognition technologies are gaining popularity, addressing both cyber and physical security challenges.

Furthermore, the integration of cyber and physical security protocols-known as cyber-physical fusion-is becoming a key trend, reflecting the interconnected nature of modern threats and driving insurers to develop comprehensive, hybrid coverage solutions.

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email us at info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Analysis of Key Market Segments Influencing the Executive Protection Firm Insurance Market here

News-ID: 4309145 • Views: …

More Releases from The Business Research Company

Rail Transit Protective Coating Market Overview: Major Segments, Strategic Devel …

The rail transit protective coating sector is positioned for significant expansion in the coming years, driven by technological advancements and increasing infrastructure investments. This market is evolving rapidly as stakeholders prioritize durability, sustainability, and efficiency in rail transit systems. Let's explore the market's valuation projections, leading companies, emerging trends, and detailed segment analysis to get a clearer understanding of its future trajectory.

Expected Market Size and Growth Outlook for Rail Transit…

Analysis of Segments and Major Growth Areas in the Product Implementation Servic …

The product implementation services sector is on the verge of significant expansion, driven by evolving technology needs and increasing enterprise adoption of sophisticated systems. Understanding the current market size, key contributors, emerging trends, and segment breakdowns offers valuable insights into what lies ahead for this dynamic industry.

Market Size and Expected Growth Trajectory in the Product Implementation Services Market

The product implementation services market is projected to experience strong growth…

Key Strategic Developments and Emerging Changes Shaping the Polyvinylidene Fluor …

The polyvinylidene fluoride (PVDF) resin market is on track for significant expansion over the coming years. Driven by various technological advances and rising demands across multiple industries, this sector is expected to evolve rapidly. Let's explore the anticipated market growth, influential players, key trends, and detailed segmentation shaping the future of PVDF resin.

Projected Growth and Market Size of the Polyvinylidene Fluoride Resin Market

The PVDF resin market is forecasted…

Leading Companies Fueling Innovation and Growth in the Partyline Intercom System …

The partyline intercom systems market is gearing up for significant expansion as communication needs evolve across various industries. With increasing demand for more versatile and efficient communication tools, this sector is set to witness rapid advancements and growing adoption over the coming years. Let's explore the market size projections, key drivers, major players, emerging trends, and important segments shaping this dynamic industry.

Projected Market Size and Growth Trajectory of the Partyline…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…