Press release

Algae Proteins Breakout Moment: Inside a 7.8% CAGR Industry Driven by Asian Innovation and ASEAN Expansion

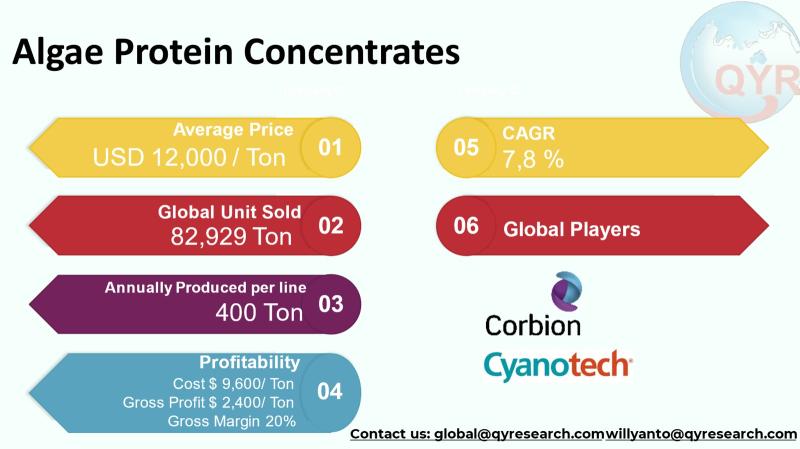

Algae protein concentrates (APCs) derived mainly from microalgae and cyanobacteria such as Spirulina (Arthrospira/Limnospira), Chlorella and Dunaliella are increasingly recognized as sustainable, high-protein ingredients for food, feed, nutraceuticals and personal care. Their environmental profile, high protein yield per area, and multifunctional nutritional/functional properties have shifted them from niche superfood status toward broader industrial adoption across health foods, functional ingredients, cosmetic actives and specialty feed formulations. Global production volumes are concentrated in Asia with major production clusters in China, India, Japan and Southeast Asia, while North America and Europe are important markets for value-added formulations and specialty extracts. Industry reports and manufacturer lists indicate a mature and diversifying supplier base that ranges from large specialty ingredient firms to vertically integrated algae producers and food ingredient conglomerates.The global market for algae protein concentrates in 2024 is at USD 995 million and a projected compound annual growth rate of 7.8% through 2031, reaching market size at USD 1,688 million by 2031. With an average selling price at USD 12,000 per ton, the global unit volume implied by the 2024 market size is approximately 82,929 tons. A factory gross margin of 20% translate into an approximate factory gross profit of USD 2,400 per ton and a cost of goods-sold of USD 9,600 per ton. A COGS breakdown is raw materials, labor, energy, processing & extraction and packaging/logistics. A single line full machine production capacity is around 400 ton per line per year. Downstream demand is concentrated in supplement followed by food & beverages, cosmetics and pharmaceutical.

Latest Trends and Technological Developments

Commercialization of higher-value algae protein applications and strategic industry partnerships has accelerated across 2024 to 2025. In OctoberNovember 2025 several supply and product partnerships were announced: an example is a recent commercial partnership announced in late November 2025 between a microalgae ingredient producer and an institutional foodservice operator to introduce spirulina-based protein into catering channels (Nov 2025), illustrating the scaling of algae ingredients beyond supplements into mainstream foodservice. Other 2024 to 2025 industry headlines show ingredient suppliers partnering with CPG and cosmetics firms to incorporate algae proteins and extracts into meat-alternative prototypes, functional foods and skincare lines, and investors backing startups developing texturized algae mince and high-moisture algae protein formats. These developments reflect both product innovation (texturization, de-colorization, fractionation to isolate protein vs pigments) and business model innovation.

erraFuel Nutrition, a European producer of premium athletic supplements, has entered into a 12-month supply agreement with Corbion for its proprietary AlgaVia® whole algal protein. Under the terms of the contract, TerraFuel purchases the protein concentrate at a bulk price of USD 8,500 per metric ton, with quarterly deliveries to its manufacturing facility in Germany. This algae protein, derived from the non-GMO microalgae Chlorella, is a key ingredient in TerraFuel's new line of vegan recovery shakes, valued for its complete amino acid profile and high digestibility.

In a landmark project for sustainable aquaculture, the salmon farming giant Salmar ASA has integrated Veramaris® algal oil (a co-product closely tied to algae protein production) into its feed supply chain. While not the protein concentrate itself, this application highlights the parallel marine algae sector. Veramaris, a joint venture between DSM and Evonik, produces omega-3 rich oil from marine algae. Salmar uses this oil to replace traditional fish oil in its feed, amounting to an annual procurement valued at over USD 12 million, significantly reducing the company's reliance on wild-caught fish and improving the nutritional profile of its farmed salmon.

Asia is the production heartland for many algae species used in APCs. China and India account for very large shares of raw Spirulina and Chlorella biomass production, driven by low-cost land/pond operations, long domestic supply chains for nutraceuticals, and scaling of commercial facilities. Several Asian producers report individual-site capacities in the low hundreds of tonnes per year up to several hundred tonnes (and some integrated players reporting output above 500 tonnes annually), making Asia the dominant source of dry biomass that is then concentrated and processed into APCs and extracts. Demand in Asia is a mix of domestic consumption (supplements, fortified foods) and export flows to Europe, North America and other Asian markets. Southeast Asia is an increasingly active production and formulation base: Indonesia, Thailand and Malaysia host both cultivation farms and ingredient processors, often serving regional aquafeed, nutraceutical and specialty food markets. Indonesia shows both local specialty producers and contract processors that supply domestic and export channels; local regulatory pathways and strong aquaculture/feed demand are important drivers for APC adoption in the region. These regional dynamics are underpinned by growing private investment into cultivation technology and downstream processing capacity in Asia.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5537407

Algae Protein Concentrates by Type:

Spirulina

Chlorella

Dunaliella

Others

Algae Protein Concentrates by Product Category:

Dry Powder

Granules

Freeze Dried Flakes

Wet Paste

Others

Algae Protein Concentrates by Market Segment:

Low-grade concentrate (2035% protein)

Mid-grade concentrate (3550% protein)

High-grade concentrate (5065% protein)

Isolate-grade (6580%)

Others

Algae Protein Concentrates by Feature:

High Protein Content

Enriched Amino Acid

Non GMO and Organic Certified

Low Odor or Deodorized Grades

Others

Algae Protein Concentrates by Functional:

High Digestibility

Antioxidant Rich Algae Protein

Anti Inflammatory Bioactive Protein

High Omega 3 Content

Others

Algae Protein Concentrates by Application:

Food and Beverages

Supplements

Animal Feed and Aquaculture

Cosmetic and Personal Care

Others

Global Top 10 Key Companies in the Algae Protein Concentrates Market

Corbion N.V

DIC Corporation

Cyanotech Corporation

Parry Nutraceuticals

Far East BioTec Co., Ltd.

Algenuity

Cargill Inc

DSM Firmenich

Archer Daniels Midland

Allmicroalgae

Sun Chlorella Corporation

AlgoSource S.A.

Pond Technologies Holdings Inc

Seagrass Tech

Algama Foods

Qualitas Technologies

Algix, LLC

Roquette Frères

Beijing Gingko Group Co., Ltd

Dongtai City Spirulina Bio-Engineering Co., Ltd.

Regional Insights

Within ASEAN the APC value chain is developing along two complementary paths: lower-cost, pond-based biomass cultivation for bulk powder/concentrate supply, and smaller high-value producers that focus on specialty extracts and certified organic or premium formulations. Indonesia is notable for both native algal biodiversity and an expanding small-to-mid scale spirulina and seaweed ingredient sector; several Indonesian firms appear on industry supplier lists and in regional market reports as processors and exporters of algae-derived ingredients. ASEAN demand is driven by large regional food & beverage OEMs adopting algae protein for fortification and by a fast-growing nutraceutical/functional food market in Southeast Asia. The regions logistical advantages to larger Asian markets and relatively lower cultivation cost base make it attractive for investors seeking nearshore supply capacity serving APAC and export markets.

Commercial APC manufacturing faces several persistent constraints that shape margins and scaling speed. First, raw biomass yield and quality variability (strain performance, contamination risk, pigment content) result in product heterogeneity and processing complexity. Second, energy and drying costs are significant drivers of COGS, especially for premium dried concentrates and isolated protein fractions. Third, regulatory acceptance and novel-food pathways differ by market, adding time and cost for new species or novel processing claims. Fourth, competition from lower-cost plant proteins (soy, pea) pressures pricing at commodity protein levels; APCs generally compete on sustainability credentials and functionality rather than pure cost parity. Finally, supply chain development (consistent large-scale supply, traceability, certification) remains a gating factor for many large food manufacturers considering long-term sourcing commitments. These challenges influence where, how and at what scale investors and manufacturers choose to deploy capital and technology.

Producers and investors should prioritize (1) vertical integration or secure offtake to control biomass supply and reduce raw feedstock volatility, (2) selective focus on higher-value end uses (nutraceuticals, specialty food ingredients, cosmetic actives) to protect margins while technology lowers production cost, (3) investment in drying and extraction efficiency (energy optimization, membrane/centrifuge advances) to lower COGS, and (4) validated sustainability and traceability claims (LCA, certification) to capture premium pricing from eco-conscious brands. In Asia and Southeast Asia, site selection should balance land/solar availability for ponds against higher-capex photobioreactor options that deliver cleaner, higher-value biomass for specialty markets. Collaboration with large CPG or feed OEMs via pilot offtakes and co-development agreements can shorten commercialization cycles for texturized and meat-alternative formats.

Product Models

Algae Protein Concentrates have emerged as high-value functional ingredients across nutrition, nutraceutical, and specialty food sectors. Their appeal comes from dense protein content, bioactive compounds, natural pigments, and sustainable cultivation advantages.

Spirulina is a blue-green microalgae rich in protein (up to 6570%), phycocyanin, vitamins, and essential minerals. It is widely used in supplements, sports nutrition, and natural color applications. Notable products include:

Earthrise Spirulina Natural Earthrise Nutritionals: A U.S.-grown spirulina powder known for high purity and phycocyanin content.

Spirulina Powder Cyanotech: High-protein spirulina used for supplements and food fortification.

Organic Spirulina Parry Nutraceuticals: India-based organic spirulina produced with controlled photobioreactors.

Spirulina Pacifica Cyanotech: Premium spirulina ingredient with stable pigment concentration.

Spirulina Tablets NOW Foods: Commercial spirulina supplement for general wellness.

Chlorella is a green microalgae known for its high protein content (5060%), chlorophyll concentration, and detoxification-supportive properties. It is commonly used in immunity products and whole-food supplements. Notable products include:

Yaeyama Chlorella Sun Chlorella Corp.: Japanese chlorella known for cracked-cell wall processing.

Organic Chlorella Allmicroalgae: EU-certified organic chlorella for ingredient applications.

Chlorella Vulgaris Powder Roquette: Nutrient-dense chlorella ingredient for plant-based foods.

Chlorella Growth Factor Tablets Natures Way: Supplement formulated using chlorella extract rich in nucleotides.

Chlorella Tablets NOW Foods: Consumer-grade chlorella supplement supporting detoxification.

Dunaliella is a saltwater microalgae best known for its high beta-carotene content and antioxidant properties. It is used in functional foods, natural colorants, and anti-aging nutraceutical formulations. Notable products include:

Dunaliella Salina Capsules Marine Resources Group: supplement focusing on eye and skin health.

Bio-Dunaliella Extract Algal Bio Co.: Concentrated antioxidant extract for skincare and supplements.

Dunaliella Protein Complex Desert Bioenergy: Protein-enhanced Dunaliella ingredient for functional foods.

Dunaliella Salina High-Protein Fraction AlgaeProtein Innovations: A protein-enriched Dunaliella ingredient for functional shakes and plant protein foods.

Dunaliella Salina Biomass Seagrass Tech: High-antioxidant microalgae biomass used for food coloring, supplements, and beauty applications.

Algae protein concentrates are at an inflection point: they combine compelling sustainability and nutritional narratives with improving process technology that is lowering unit costs. Market sizing in 2024 assumption to 2031 indicate a sizeable and growing global opportunity, particularly in Asia and Southeast Asia where production capacity, raw biomass supply and rising regional demand coalesce. The map for winners will be controlled by producers who can reduce COGS via process improvements, lock in reliable raw material supply, and move upstream into higher-value formulations that match consumer and industrial demand curves.

Investor Analysis

The what: key commercial metrics provide a clear unit economics snapshot for valuation, break-even modeling and scenario stress tests. The how: investors should use the production capacity ranges and COGS breakdown to prioritize investments that target the largest COGS drivers (raw feedstock, drying energy) and to compare technology options (e.g., raceways vs. photobioreactors, membrane vs. spray-drying) by ROI and payback timeline. The why: these specifics matter because APCs are a premium ingredient market where margin capture depends on process efficiency, product differentiation (purity, color/pigment removal, functionality) and secured distribution. For strategic investors, the combination of rising demand in food/functional food markets and an Asia-centric production base presents opportunities for nearshore manufacturing platforms, bolt-on acquisitions to secure feedstock, and technology plays that materially lower processing costs. Use the numbers in this report to model candidate investments under conservative and aggressive scaling scenarios and to set milestones for technical performance, offtake agreements and regulatory approvals.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5537407

5 Reasons to Buy This Report

You get a concise, Asia-aware view of APC unit economics (price per ton, implied volume and factory margin) for modeling investment cases.

The report synthesizes production capacity ranges and regional strengths helpful for site selection in Asia and ASEAN.

It ties recent commercial news and partnerships to practical strategic moves (offtake, co-development, premium segment focus).

The COGS breakdown and gross-profit per ton figures let you stress-test process and technology investments quickly.

The Top-10 player list and regional supplier references speed up vendor due diligence and potential M&A target screening.

5 Key Questions Answered

What is the 2024 market size and what are the unit economics at average selling price?

How many tonnes of finished APC did the market imply in 2024?

What is a reasonable COGS breakdown and the expected factory gross profit and margin per ton?

Where in Asia and ASEAN is the most active production and what are the practical capacities per line?

Who are the primary companies and supplier types to approach for supply, partnership, or acquisition?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

Global Algae Protein Concentrates Market Research Report 2025

https://www.qyresearch.com/reports/5537407/algae-protein-concentrates

Global Algae Protein Concentrates Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5537408/algae-protein-concentrates

Global Algae Protein Concentrates Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/5537423/algae-protein-concentrates

Algae Protein Concentrates - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5537432/algae-protein-concentrates

Global Fish Protein Concentrate Market Research Report 2025

https://www.qyresearch.com/reports/4326643/fish-protein-concentrate

Global Alfalfa Protein Concentrate Market Research Report 2025

https://www.qyresearch.com/reports/4028574/alfalfa-protein-concentrate

Global Functional Protein Concentrate Market Research Report 2025

https://www.qyresearch.com/reports/3780535/functional-protein-concentrate

Global Fish Protein Concentrate Powder Market Research Report 2025

https://www.qyresearch.com/reports/4326578/fish-protein-concentrate-powder

Global Non-Functional Protein Concentrate Market Research Report 2025

https://www.qyresearch.com/reports/3780536/non-functional-protein-concentrate

Global Cottonseed Protein Concentrate (CPC) Market Research Report 2025

https://www.qyresearch.com/reports/4504606/cottonseed-protein-concentrate--cpc

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Algae Proteins Breakout Moment: Inside a 7.8% CAGR Industry Driven by Asian Innovation and ASEAN Expansion here

News-ID: 4308186 • Views: …

More Releases from QY Research

Top 30 Indonesian Rubber Public Companies - Q3 2025 Revenue & Performance

1) Overall companies' performance (Q3 2025 snapshot)

PT Gajah Tunggal Tbk

PT Multistrada Arah Sarana Tbk

PT Goodyear Indonesia Tbk

PT King Tire Indonesia

PT Indo Kordsa Tbk

PT Kirana Megatara Tbk

PT Bumi Serpong Damai Tbk

PT Adaro Energy Tbk

PT ACE Hardware Indonesia Tbk

PT Suryaraya Rubberindo Tbk

PT Dharma Polimetal Tbk

PT Selamat Sempurna Tbk

PT Indospring Tbk

PT Autopedia Sukses Lestari Tbk

PT Nipress Tbk

PT Prima Alloy Steel Universal Tbk

PT Anugerah Spareparts Sejahtera Tbk

PT Bintang Oto…

Smart Vacuum Grippers Reshape Industrial Handling Market Through 2032

Rubber suction cups are flexible vacuum-based gripping components used for temporary adhesion and handling across consumer, industrial, and automation applications

Widely applied in packaging lines, glass handling, automotive assembly, electronics pick-and-place, medical devices, and household accessories

Manufactured primarily from silicone rubber, EPDM, nitrile (NBR), natural rubber, and thermoplastic elastomers

Industry characterized by high-volume standardized parts combined with customized industrial vacuum grippers for robotics and smart factories

Demand closely linked to automation penetration, e-commerce packaging…

Renewable Plastic Packaging 2025: ASEAN Growth and 28% Margins Driving the Next …

Renewable plastic packaging refers to packaging materials produced from bio-based, compostable, or renewable feedstocks such as PLA, PHA, starch blends, bio-PE, and bio-PET.

Derived from corn, sugarcane, cassava, cellulose, and plant oils, replacing fossil-fuel plastics to reduce carbon footprint and landfill load.

Applications include:

Food & beverage flexible packs

Retail carry bags

Personal care bottles

E-commerce mailers

Agricultural films

Adoption driven by:

Government plastic taxes & EPR mandates

ESG commitments from FMCG brands

Consumer preference for biodegradable/low-carbon materials

Retailers banning single-use fossil…

From Plastic-Free to Premium: The Future of the Global Facial Wipes Industry

Facial wipes are disposable non-woven textile products pre-saturated with cleansing or skincare solutions used for makeup removal, hygiene, moisturizing, and antibacterial purposes

Widely adopted across personal care, travel, baby care, sports, hospital, and on-the-go convenience segments

Increasing penetration driven by busy lifestyles, urbanization, higher disposable income, and rising skincare awareness

Core buyers include mass retail, convenience stores, e-commerce, beauty chains, pharmacies, and hospitality sectors

Industry Explanation and Global Overview

Combines nonwoven fabric manufacturing (spunlace, airlaid)…

More Releases for Protein

Cell-Free Protein Synthesis Market Forecast: Opportunities in High-Throughput Pr …

"Cell-Free Protein Synthesis Market" in terms of revenue was estimated to be worth USD 299.9 million in 2024 and is poised to reach USD 585.3 Million by the year 2034, growing at a CAGR of 7.0% from 2025 to 2034 according to a new report by InsightAce Analytic.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/1445

Latest Drivers Restraint and Opportunities Market Snapshot:

Key factors influencing the global cell-free…

Plant Protein Market : Latest Market Research Report for Strategic Advantage | S …

Global Plant Protein Market

Market Overview:

Global Plant Protein Market Report 2022 comes with the extensive industry analysis by Introspective Market Research with development components, patterns, flows and sizes. The report also calculates present and past market values to forecast potential market management through the forecast period between 2022-2028.This research study of Plant Protein involved the extensive usage of both primary and secondary data sources. This includes the study of various parameters…

Pea Protein Ingredients Market Prospects, Consumption, Cost Structure, Competiti …

The food industry is continuously searching for healthier and cheaper protein ingredients that can be replaced by animal-based and gluten-based proteins. Pea protein is beneficial due to its low allergenicity, availability, and high nutritional value. The Global Pea Protein Ingredients Market is witnessing a major rise in its revenue from US$ 2.35 Bn in 2021 to US$ 6.78 Bn by 2030. The market is recording a CAGR of 12.5% during…

Astonishing growth in Dairy Protein Market Growth? Milk Protein Isolates (MPIs), …

Dairy Protein Market Business Insights and Updates:

The latest Market report by a Data Bridge Market Research with the title [Global Dairy Protein Market - Industry Trends and Forecast to 2026] . Dairy Protein Market research analysis and data lend a hand to businesses for the planning of strategies related to COVID-19 impact on industry, investment, revenue generation, production, product launches, costing, inventory, purchasing and marketing. Dairy Protein market insights with…

Global Plant Protein Market 2019 – Soy Protein, Wheat Protein, Pea Protein | K …

The Global Pea Protein Market Research Report conducts a deep estimation on the present state of Pea Protein Industry with the definition, classification and market scope. The fundamental Pea Protein Industry aspects like competitive landscape structure, eminent industry players, Pea Protein Market size and value is studied. The Pea Protein Market growth trends, development plans, dynamic market driving factors and risk assessment is conducted. All the traders, dealers, distributors of…

Protein Packaging Market Report 2018: Segmentation by Product (Rigid packaging, …

Global Protein Packaging market research report provides company profile for Amcor Limited, DuPont, Flexifoil Packaging Pvt., Swiss Pac Private Ltd. and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides detailed…