Press release

United States Electronic Data Capture (EDC) Systems Market to Reach US$ 3.10 Billion by 2030 at 9.2% CAGR | Key Players: Medidata Solutions, Veeva Systems, Oracle, OpenClinica, Castor EDC | North America Leads with 38% Share

Electronic Data Capture (EDC) Systems Market OverviewThe global Electronic Data Capture (EDC) Systems Market reached US$ 1.52 billion in 2022 and is projected to grow to US$ 3.10 billion by 2030, expanding at a CAGR of 9.2% during the forecast period (2024-2031). This growth is driven by the rising adoption of digital clinical trial technologies, increasing regulatory emphasis on data accuracy, and growing complexity of clinical research requiring real-time data validation and integration.

EDC systems are essential digital tools designed to electronically collect, validate, and manage clinical trial data, effectively replacing traditional paper-based methods. Their widespread adoption has been fueled by their proven advantages greater accuracy, improved data quality, faster data entry and query resolution, and enhanced overall trial efficiency. As clinical research expands globally, concerns regarding data integrity, human error, and connectivity challenges have diminished due to advancements in secure cloud-based systems and reliable IT infrastructure. Modern EDC platforms now seamlessly integrate with Electronic Health Records (EHRs), Clinical Trial Management Systems (CTMS), and Laboratory Information Management Systems (LIMS), enabling unified clinical data ecosystems that enhance transparency and operational efficiency.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/electronic-data-capture-systems-market?Juli

Recent Developments:

✅ August 2025: Oracle enhanced its Electronic Data Capture (EDC) platform, Oracle Clinical One Data Collection, introducing advanced interoperability with Electronic Health Record (EHR) systems and improved integration with safety-reporting tools. The update enables seamless data exchange, regulatory compliance, and end-to-end visibility across clinical trials.

✅ June 2025: Medidata expanded its Rave EDC platform with AI-powered data validation features and real-time monitoring dashboards to improve data accuracy and speed up clinical trial timelines. The upgrade also supports decentralized and hybrid clinical trial models.

✅ April 2025: Veeva Systems launched new cloud-based EDC modules under its Veeva Vault Clinical Suite, offering unified access to clinical data, automated query management, and enhanced site collaboration capabilities.

✅ February 2025: Dassault Systèmes integrated advanced analytics capabilities into its Medidata Rave EDC system, allowing sponsors and CROs to analyze trial data in real time and optimize patient recruitment and retention strategies.

✅ December 2024: IBM Watson Health collaborated with several CROs to develop AI-assisted EDC platforms capable of automated anomaly detection, improving data accuracy and integrity in large-scale clinical studies.

✅ September 2024: Oracle Health Sciences announced partnerships with multiple research organizations to pilot decentralized clinical trial models using its EDC technology, focusing on direct-to-patient data capture and remote monitoring.

✅ June 2024: Veeva Systems introduced enhanced EDC interoperability features enabling seamless integration between EDC, CTMS, and ePRO systems, streamlining end-to-end clinical data management.

✅ March 2024: Medrio expanded its EDC solutions for small and mid-sized pharmaceutical companies, emphasizing flexibility, cost efficiency, and rapid deployment for Phase I and II clinical trials.

✅ January 2024: CRF Health upgraded its EDC and eCOA platforms to support real-time patient data capture in decentralized clinical trials, improving data accessibility and regulatory compliance.

Mergers & Acquisitions:

✅ October 2025: OpenClinica, Inc. acquired BuildClinical, Inc., a U.S.-based digital engagement and patient recruitment company. This acquisition strengthens OpenClinica's clinical trial software ecosystem by integrating advanced enrollment tools and improving patient engagement for decentralized and hybrid trials.

✅ July 2025: Veeva Systems acquired a European clinical data management startup to expand its EDC capabilities and enhance interoperability between its Veeva Vault Clinical Suite and third-party CTMS and ePRO platforms.

✅ March 2025: Oracle Health Sciences completed the acquisition of a clinical AI software firm specializing in real-time data validation and predictive analytics to enhance automation and intelligence within its EDC platform.

✅ January 2025: Medrio acquired a smaller clinical trial software provider to strengthen its presence in emerging markets and expand its offerings for small and mid-sized pharmaceutical sponsors.

✅ 2020: Dassault Systèmes completed the acquisition of Medidata Solutions in a landmark deal valued at US$ 5.8 billion, consolidating its position as a global leader in life sciences software and clinical data management.

✅ 2019-2024 (Industry Trend): The EDC market has seen growing consolidation, with leading vendors acquiring niche technology firms to offer unified platforms covering EDC, eCOA, CTMS, and real-world data management. This trend reflects the industry's shift toward integrated, cloud-based solutions supporting complex, multi-site, and decentralized clinical trials.

Key Players:

Medidata Solutions (Dassault Systèmes) - Holds a 17.8% share, leading the global EDC systems market with its flagship Medidata Rave platform, widely used for large-scale, multi-phase clinical trials. The company's integration of AI-driven analytics, decentralized trial support, and unified data management solutions continues to strengthen its dominance.

Veeva Systems - Holds a 14.6% share, supported by its Veeva Vault Clinical Suite offering unified EDC, CTMS, and ePRO capabilities. Its strong cloud infrastructure and rapid study build functionality make it a preferred choice among biopharmaceutical and CRO organizations.

Oracle Corporation - Holds a 13.9% share, leveraging its Oracle Clinical One platform that combines EDC, randomization, and trial management in a unified environment, enhancing data accuracy and global regulatory compliance.

OpenClinica, LLC - Holds an 11.2% share, known for its open-source, cloud-based EDC systems designed for academic, nonprofit, and mid-tier research organizations. Its scalability, affordability, and compliance with GxP and 21 CFR Part 11 have driven widespread adoption.

Castor EDC - Holds a 9.8% share, offering flexible, user-friendly EDC systems optimized for decentralized and hybrid trials. Its cloud-native platform supports rapid trial setup, patient engagement, and seamless integration with wearables and ePRO solutions.

Florence Healthcare - Holds an 8.5% share, specializing in site enablement, clinical document automation, and data capture systems that streamline study startup and compliance monitoring.

Clinical Ink - Holds a 7.1% share, delivering EDC and eSource platforms with strong mobile data capture capabilities, real-time patient monitoring, and remote data validation for decentralized trials.

RAYLYTIC GmbH - Holds a 6.3% share, focusing on AI-assisted EDC and medical imaging data capture solutions for orthopedic and musculoskeletal clinical studies, with strong adoption in Europe.

Sitero - Holds a 5.2% share, offering EDC and regulatory-compliant clinical data management solutions tailored to CROs and pharmaceutical firms seeking secure, cloud-based research platforms.

Acceliant - Holds a 3.6% share, providing flexible EDC and clinical data management systems designed for small to mid-sized biopharma and medical device trials, emphasizing speed, accuracy, and affordability.

Fountayn - Holds a 2.9% share, offering cloud-enabled EDC and eClinical platforms with configurable workflows for end-to-end trial data management and monitoring.

Speak to Our Analyst and Get Customization in the Report as per Your Requirements: https://www.datamintelligence.com/customize/electronic-data-capture-systems-market?Juli

Market Segmentation:

➥ By Delivery Mode Type:

The Web & Cloud-based EDC systems dominate the market with approximately 65% share, driven by increasing adoption of decentralized clinical trials, remote data access, and seamless integration with digital health platforms. These solutions offer scalability, real-time monitoring, and cost efficiency for global trials. On-premise EDC systems account for around 35% share, preferred by organizations with stringent data security requirements, regulatory compliance needs, or in regions with limited internet infrastructure.

➥ By Components:

The Software Solutions segment leads with a 70% share, comprising comprehensive EDC platforms, clinical trial management systems (CTMS), and eSource data capture tools. Services account for 25% share, including implementation, validation, training, consulting, and technical support for efficient system deployment and regulatory compliance. Hardware contributes the remaining 5%, mainly supporting data capture devices, servers for on-premise deployments, and connected devices for hybrid and decentralized trials.

➥ By End User:

Pharma & Biotech Organizations hold the largest share at 45%, leveraging EDC systems to improve data integrity, accelerate trial timelines, and comply with global regulatory standards. Hospitals and Clinical Centers account for 30%, using EDC systems to manage investigator-initiated studies and hospital-based research projects. Academic Institutes and Research Organizations represent 20%, driven by clinical research initiatives, multi-site trials, and grant-funded studies. The remaining 5% includes CROs, government research bodies, and non-profit organizations, which increasingly adopt EDC solutions for operational efficiency and centralized data management.

Regional Insights:

North America dominates the EDC market, accounting for approximately 38% of the global share (USD 1.98 billion in 2024). The growth is driven by the high adoption of digital health technologies, well-established clinical trial infrastructure, and strong regulatory support from agencies like the FDA. The U.S. leads the region due to widespread implementation of web/cloud-based EDC systems, decentralized trial platforms, and increasing investment in clinical research and data analytics solutions.

Europe represents around 30% of the global market (USD 1.56 billion in 2024). Market growth is supported by stringent regulatory compliance standards (e.g., GDPR), a high number of ongoing clinical trials, and increasing adoption of cloud-based EDC systems. Countries such as Germany, the UK, and France are major contributors, with strong demand from pharma, biotech companies, and academic research institutions.

Asia-Pacific accounts for approximately 22% of the global market (USD 1.14 billion in 2024) and is expected to witness the highest CAGR at 9.5% during 2025-2033. Rapidly growing clinical trial activities, government initiatives to digitize healthcare data, and increasing outsourcing of clinical trials to countries like India, China, and Japan are fueling demand. The region is also witnessing adoption of mobile EDC solutions and hybrid trial models.

Latin America contributes about 6% of the global market (USD 0.31 billion in 2024). Growth in this region is driven by the expansion of multinational clinical trials, improved clinical research infrastructure, and adoption of cloud-based EDC systems in countries such as Brazil and Mexico.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=electronic-data-capture-systems-market?Juli

Industry Developments in EDC Systems:

Rapid shift to cloud‐ and web‐based EDC solutions: Cloud-based platforms continue to gain dominance, supporting decentralized and hybrid clinical trials, offering scalability, and reducing IT burden for sponsors and CROs.

Integration of AI / ML for data validation, anomaly detection, and predictive analytics: Leading EDC providers are embedding artificial-intelligence tools into their systems to automate tasks like data checks, detect inconsistencies quickly, reduce manual query resolution, and support real-time decision making in trials.

Mobile and decentralized data capture entering mainstream use: EDC systems increasingly support mobile data entry, ePRO/eConsent, and remote patient-reported data collection enabling decentralized clinical trial models and facilitating participation from remote or underserved populations.

Interoperability and integration with wider clinical-trial and healthcare data ecosystems: Growing trend toward integrating EDC with other platforms such as ePRO/eCOA, Clinical Trial Management Systems (CTMS), Remote Monitoring Systems, and healthcare databases to provide unified data workflows and streamline regulatory, reporting, and monitoring needs.

Rising demand driven by expansion of global clinical trials, R&D growth, and regulatory emphasis on data integrity: As pharmaceutical, biotech, and medical-device industries expand pipelines especially in complex fields like oncology, immunology, rare diseases demand for robust, scalable, and compliant EDC platforms has surged.

Focus on usability and streamlined workflows for faster study setup and execution: EDC vendors have redesigned interfaces and workflows to reduce setup times, facilitate study amendments, and make platforms more user-friendly for site staff and researchers.

Growing adoption in emerging markets and non-traditional geographies: Clinical research activity in Asia-Pacific, Latin America, and other regions has increased, expanding EDC uptake beyond traditional markets.

Emerging interest in advanced technologies: Blockchain for data security and integrity, real-world data (RWD) / real-world evidence (RWE) integration, and decentralized trial ecosystems are being explored to enhance traceability, auditability, and long-term data capture capabilities.

Market Dynamics:

The global Electronic Data Capture (EDC) systems market is witnessing robust growth, driven by the increasing adoption of digital solutions in clinical trials, the growing complexity of research protocols, and stringent regulatory requirements for data accuracy and compliance. EDC systems enhance data quality, streamline workflows, and enable real-time access to clinical trial information, which is crucial for faster decision-making and improved patient outcomes.

Drivers:

Rising adoption of digital and decentralized clinical trials: The shift from paper-based to electronic data collection has accelerated, particularly with the increase in hybrid and remote trial models. Need for data accuracy and regulatory compliance: Regulatory agencies, such as the FDA and EMA, emphasize data integrity, traceability, and audit-readiness, driving adoption of robust EDC solutions.

Integration of AI and advanced analytics: AI-enabled data validation, anomaly detection, and predictive analytics help reduce errors, improve operational efficiency, and enhance decision-making capabilities. Demand for faster study execution: EDC systems reduce manual data entry, speed up query resolution, and streamline monitoring, allowing quicker trial completion. Expansion of clinical trials globally: Increasing R&D investments in pharmaceuticals, biotechnology, and medical devices, especially in emerging markets, are creating a growing need for EDC platforms.

Restraints:

High implementation and subscription costs: Small and medium-sized organizations may face financial challenges in adopting comprehensive EDC solutions. Technical complexity and integration issues: Integrating EDC with other systems, such as CTMS, ePRO, and lab management tools, can be challenging and resource-intensive. Limited digital infrastructure in emerging regions: Some developing markets may face connectivity, training, and technical limitations, slowing adoption.

Opportunities:

Growth of decentralized and mobile trials: Expansion of remote patient monitoring, eConsent, and ePRO integration opens new opportunities for EDC providers. Emerging technologies: Blockchain, cloud-based platforms, and AI-driven analytics offer potential to improve data security, compliance, and operational efficiency. Personalized medicine and complex trials: Increasing focus on rare diseases, oncology, and adaptive trial designs creates a demand for sophisticated data capture and management solutions. Expansion in emerging markets: Rising clinical research activity in Asia-Pacific, Latin America, and the Middle East provides new growth avenues.

📌 Request for 2 Days FREE Trial Access: https://www.datamintelligence.com/reports-subscription

☛ Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

☛ Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg?Juli

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release United States Electronic Data Capture (EDC) Systems Market to Reach US$ 3.10 Billion by 2030 at 9.2% CAGR | Key Players: Medidata Solutions, Veeva Systems, Oracle, OpenClinica, Castor EDC | North America Leads with 38% Share here

News-ID: 4307103 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

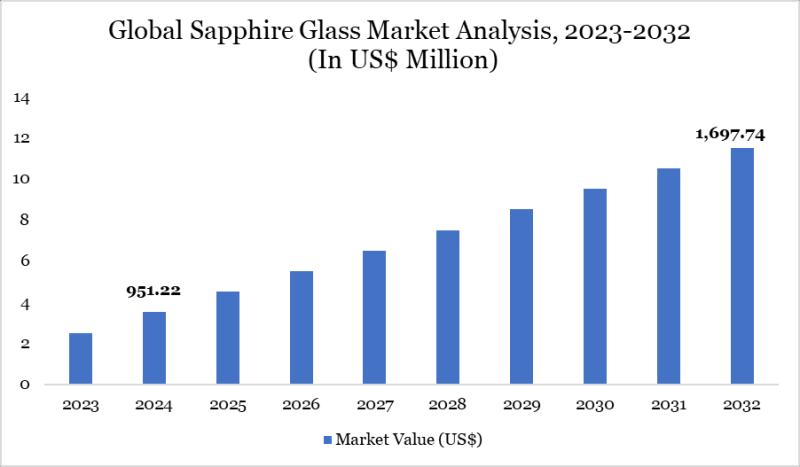

United States Sapphire Glass Market 2031 | Growth Drivers, Key Players & Investm …

Market Size and Growth

Global Sapphire Glass Market size reached US$ 951.22 million in 2024 and is expected to reach US$ 1,697.74 million by 2032, growing with a CAGR of 7.51% during the forecast period 2025-2032.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/sapphire-glass-market?sb

Key Development:

United States: Recent Industry Developments

✅ In December 2025, Sapphire Technologies introduced advancements in edge-defined film-fed growth (EFG) sapphire glass…

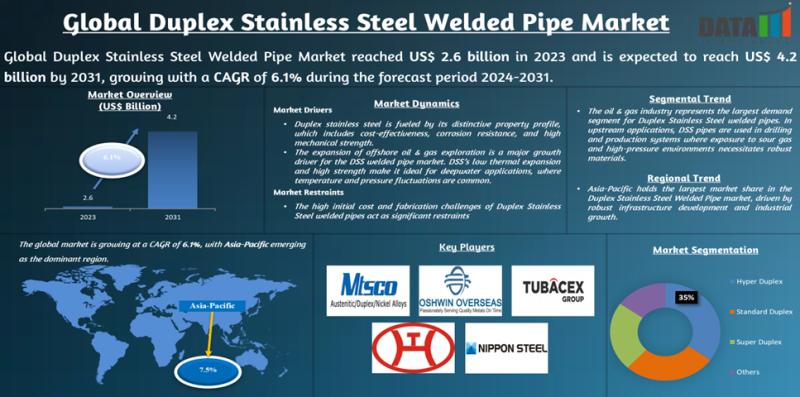

United States Duplex Stainless Steel Welded Pipe Market 2031 | Growth Drivers, K …

Market Size and Growth

Global Duplex Stainless Steel Welded Pipe Market reached US$ 2.6 billion in 2023 and is expected to reach US$ 4.2 billion by 2031, growing with a CAGR of 6.1% during the forecast period 2024-2031.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/duplex-stainless-steel-welded-pipe-market?sb

Key Development:

United States: Recent Industry Developments

✅ In January 2026, U.S. stainless steel manufacturers highlighted increased focus on duplex stainless…

United States Cooling Tower Market 2026 | Growth Drivers, Key Players & Investme …

Market Size and GRowth

The Global Cooling Tower Market is estimated to reach at a high CAGR of 4.38% during the forecast period (2024-2031).

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/cooling-tower-market?sb

Key Development:

United States: Recent Industry Developments

✅ In December 2025, Fermi America signed an MOU with MVM EGI to engineer and develop next‐generation hybrid dry-wet cooling towers for its planned 11 GW energy and…

Cladding System Market to Reach USD 387.8 Billion by 2031 | CAGR 5.0% | Key Play …

Leander, Texas and Tokyo, Japan - Jan.29.2026

The "cladding system market" size was worth USD 262.1 Billion in 2022 and is estimated to reach USD 387.8 Billion by 2031, growing at a CAGR of 5.0 % during the forecast period (2024-2031).

The cladding system market is expanding as architects and builders focus on building durability, energy efficiency, and aesthetic appeal. Cladding systems protect structures from weather, thermal fluctuations, and environmental damage while…

More Releases for EDC

Electronic Data Capture (EDC) Software Market to Witness Major Growth | Castor E …

The Worldwide Electronic Data Capture (EDC) Software Market study with 111+ market data Tables, Pie charts & Figures is now released by HTF MI. The research assessment of the Market is designed to analyze futuristic trends, growth factors, industry opinions, and industry-validated market facts to forecast till 2029. The market Study is segmented by key a region that is accelerating the marketization. This section also provides the scope of different…

Electronic Data Capture (EDC) Software Market Professional Report 2022-2029: IBM …

Electronic Data Capture (EDC) Software Market report consists of most-detailed market segmentation, a thorough analysis of major market players, consumer, and supply chain dynamics trends, and insights into new geographical markets. Research and analysis about the critical developments in the market, major competitors, and detailed competitor analysis covered in this report help businesses imagine the bigger picture of the marketplace and products, ultimately assisting in defining superior business strategies.

Request a…

Electronic Data Capture System Software Market Size 2022: Castor EDC, Viedoc, Cl …

The Electronic Data Capture System Software Market research report provides market forecast information, considering the history of the industry, and the future of the industry with respect to what situation it may face, it will grow or it will fail. Inputs of various industry experts, required for the detailed market analysis, have been used very carefully to structure this finest Electronic Data Capture System Software Market research report. A team…

EDC-VC ANNOUNCES BOARD EXPANSION

CAMARILLO, Calif. – The Economic Development Collaborative-Ventura County announces the addition of Amy Fonzo and Ron Galaviz to its board of directors. Fonzo, manager of external relations at California Resources Corporation, brings a unique blend of leadership, strategic planning and professional experience to the EDC-VC board. Galaviz, founder of Thousand Oaks construction company, Lead Builders, Inc, brings extensive first-hand experience in sustaining and growing a small business in Ventura County.

“Both…

Dichloroethane (EDC) Market Analysis Report by 2020

Dichloroethane is also known as ethylene dichloride (EDC). Dichloroethane is a colorless liquid with chloroform-like odor. Dichloroethane is a chlorinated hydrocarbon, generally used to produce vinyl chloride monomer, the major precursor of polyvinyl chloride (PVC).Dichloroethane is highly flammable, toxic and carcinogenic.Dichloroethane can be easily recycled and reused in the same facility for further use. Dichloroethane market is strongly depends on PVC market and construction industry.

Based on the application, the…

Dichloroethane (EDC) Market: Explores New Growth Opportunities By 2020

Dichloroethane is also known as ethylene dichloride (EDC). Dichloroethane is a colorless liquid with chloroform-like odor. Dichloroethane is a chlorinated hydrocarbon, generally used to produce vinyl chloride monomer, the major precursor of polyvinyl chloride (PVC).Dichloroethane is highly flammable, toxic and carcinogenic.Dichloroethane can be easily recycled and reused in the same facility for further use. Dichloroethane market is strongly depends on PVC market and construction industry.

Request for Sample Report: http://www.persistencemarketresearch.com/samples/3358

Based…