Press release

Australia Fintech Market Projected to Reach USD 9.50 Billion by 2033

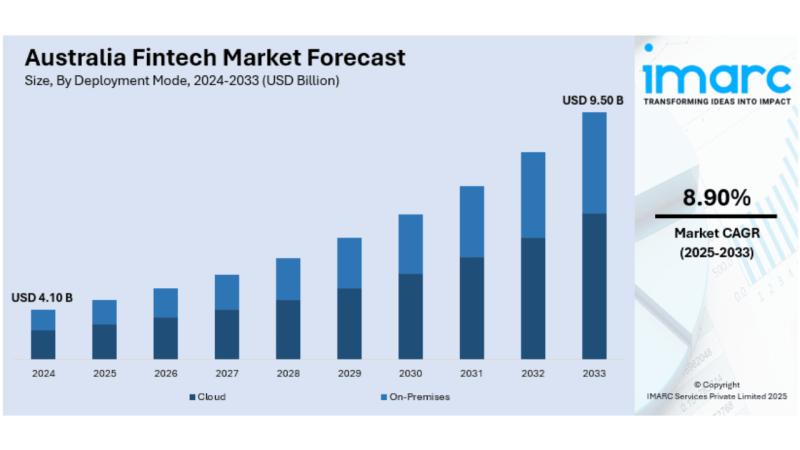

Market OverviewThe Australia fintech market was valued at USD 4.10 Billion in 2024 and is projected to reach USD 9.50 Billion by 2033, spanning a forecast period from 2025 to 2033. The market is growing at a CAGR of 8.90%, driven by widespread adoption of digital payment platforms, mobile banking, and regulatory reforms such as the Consumer Data Right (CDR). New South Wales dominates with over 45.0% market share, supported by strong government initiatives and a growing fintech startup ecosystem.

For more details, visit the Australia Fintech Market

https://www.imarcgroup.com/australia-fintech-market

How AI is Reshaping the Future of Australia Fintech Market:

• AI-powered tools are automating fraud detection, reporting, and risk management, enhancing compliance and operational efficiency.

• Artificial intelligence facilitates tailored financial products and customer experiences, driving personalized services adoption.

• Fintech firms are increasingly leveraging machine learning to support regulatory technology (RegTech), reducing compliance costs.

• AI analytics platforms improve real-time credit risk assessment and fraud identification, enhancing alternative credit scoring models.

• Integration of AI enhances digital payment security, facilitating smoother consumer transactions and boosting trust.

• Companies such as AMP have launched digital banks incorporating AI-driven cash flow and accounting management features for micro and small enterprises.

Grab a sample PDF of this report: https://www.imarcgroup.com/australia-fintech-market/requestsample

Australia Fintech Market Growth Factors

Financial inclusion is a strong driver for growth in the Australia fintech industry. Online banking, micro-lending, and investment solutions fill particular service gaps for people living in rural and regional areas. Low barriers to entry and a simple interface have allowed Australians to sensibly manage their money via fintech apps (buy-now-pay-later or digital credit products), eventually leading to them being commercially adopted by many individual Australians.

Millennials and Generation Z who know technology influence the fin-tech space. They value simplicity, speed, and transparency in their financial transactions and choose app-based alternatives for peer-to-peer (P2P) payments, automatic investment, and instant loan approval, thus becoming a major driver of this space. User knowledge, adoption and experimentation with technology allows for innovation in the fintech space. The growth of smartphone and internet penetration allows access to financial products via mobile.

Australian SMEs have increasingly turned to fintech to meet their lending needs, and fintech funding provides loans more quickly than bank financing, as well as real-time tools for payment, accounting, and overall cash flow management. These features help SMEs cope with the pressure of having low profit margins. Easy and quick access that bypasses customary credit evaluations - through personalized and efficient services - help SMEs as the market of fintech continues to develop.

Australia Fintech Market Segmentation

Analysis by Deployment Mode:

• Cloud

• On-Premises

Analysis by Technology:

• Application Programming Interface (API)

• Artificial Intelligence (AI)

• Blockchain

• Data Analytics

• Robotic Process Automation (RPA)

• Others

Analysis by Application:

• Payments and Fund Transfer

• Loans

• Insurance and Personal Finance

• Wealth Management

• Others

Analysis by End-User:

• Banking

• Insurance

• Securities

• Others

States Covered:

• New South Wales

• Victoria

• Queensland

• Western Australia

• South Australia

• Tasmania

• Others

Key Players

• Afterpay

• Airwallex Pty Ltd

• Athena Mortgage Pty Ltd

• Divipay Pty Ltd

• Judo Bank Pty Ltd (Judo Capital Holdings)

• mx51 Pty Ltd

• PTRN Pty Ltd

• Stripe Inc.

• Wise Australia Pty Ltd

• Zeller Australia Pty Ltd

Recent Development & News

• February 2025: Digital private equity manager Moonfare launched operations in Australia, offering access to top-tier private equity funds such as KKR, EQT, and Carlyle Group, expanding investor access to global assets via its digital platform.

• February 2025: AMP unveiled a new online bank aimed at side hustlers, solopreneurs, and micro enterprises, featuring sophisticated accounting and cash flow management tools alongside fee-free foreign exchange conversions, enhancing banking services for underserved markets.

• January 2025: AMP Bank partnered with Mastercard to launch Australia's first numberless debit card for small businesses, increasing transaction security and fraud reduction while enabling global payment and ATM access.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

https://www.imarcgroup.com/request?type=report&id=6065&flag=F

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Fintech Market Projected to Reach USD 9.50 Billion by 2033 here

News-ID: 4306626 • Views: …

More Releases from IMARC Group

Cost of Setting Up a PET Bottle Manufacturing Plant & DPR 2026

The global PET bottle industry is experiencing sustained growth propelled by rising packaged beverage consumption, pharmaceutical packaging expansion, increasing demand for ready-to-drink products, and the lightweight, recyclable advantages of PET packaging. As urbanization accelerates, consumer lifestyles shift toward convenience packaging, and regulatory frameworks increasingly mandate recyclable materials, establishing a PET bottle manufacturing plant positions investors in one of the most stable and essential segments of the consumer packaging value chain.

IMARC…

India Insurance Market Forecast 2026: Industry Size, Expansion & Future Scope 20 …

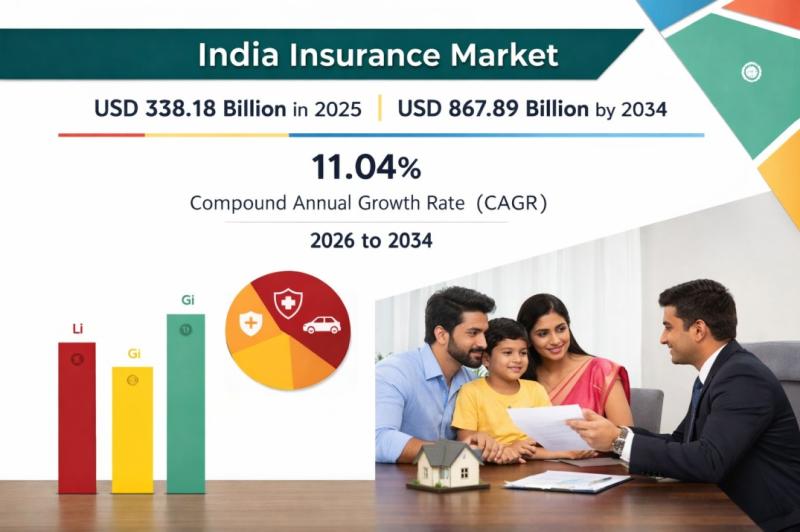

India Insurance Market Overview 2026-2034

According to IMARC Group's report titled India Insurance Market Size, Share, Trends and Forecast by Type of Product, Distribution Channel, End User, and Region, 2026-2034 the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

The India insurance market size was valued at USD 338.18 Billion in 2025 and is projected to reach USD 867.89 Billion by 2034, growing at…

Global Diammonium Phosphate (DAP) Prices January 2026: Asia Gains, Europe Steady …

What is Diammonium Phosphate (DAP)?

Diammonium Phosphate (DAP) is a widely used phosphorus-based fertilizer crucial for global agriculture. Monitoring Diammonium Phosphate (DAP) prices helps manufacturers, distributors, and buyers make informed procurement decisions and manage costs amid fluctuating demand and supply conditions.

Global Price Overview

The global Diammonium Phosphate (DAP) market shows moderate stability with regional supply differences affecting prices. The Diammonium Phosphate (DAP) price trend has remained mixed, while the price index and…

Titanium Prices, Index, Supply Factors & Uses | Jan 2026

North America Titanium Prices Movement Jan 2026

In January 2026, Titanium prices in North America reached USD 7.09/KG, reflecting a 3.1% increase. The upward movement was supported by firm demand from aerospace, automotive, and defense industries. Stable raw material supply and improving manufacturing activity strengthened market sentiment, contributing to positive pricing momentum across the region.

Regional Analysis: The price analysis can be extended to provide detailed Titanium price information for the following…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…