Press release

Top 30 Indonesian Industrial Public Companies Q3 2025 Revenue & Performance

1) Overall snapshot Top 30 (Q3 2025)The industrial segment in Indonesia (cement, petrochemicals & chemicals, steel, heavy equipment, paper & pulp, building materials, logistics/industrial distribution, and certain large industrial conglomerates) delivered mixed Q3-2025 results. Of the top-tier industrial companies, several petrochemical and heavy-equipment names recorded very large profits driven by commodity cycles and recovery in manufacturing; cement and basic materials companies showed a mixed picture with margins pressured by lower volumes and cost increases; several mid-cap industrials posted resilient profits thanks to cost discipline.

Top 30 (alphabetical order within the list sector indicated briefly):

Astra International Tbk (ASII) automotive & heavy equipment conglomerate.

AKR Corporindo Tbk (AKRA) logistics, chemical distribution.

Barito Pacific Tbk (BRPT) petrochemicals & energy holdings.

Chandra Asri Petrochemical Tbk (TPIA) petrochemicals.

Indocement Tunggal Prakarsa Tbk (INTP) cement.

PT Semen Indonesia (Persero) Tbk (SMGR) cement (group).

Krakatau Steel (Persero) Tbk (KRAS) steel.

PT United Tractors Tbk (UNTR) heavy equipment & mining services.

PT Pabrik Kertas Tjiwi Kimia Tbk (TKIM) pulp & paper.

Solusi Bangun Indonesia Tbk (SBI) building materials (SIG group).

Semen Baturaja Tbk (SMBR) cement.

Holcim/ subsidiaries (now Solusi Bangun Indonesia group / related) building materials.

Pembangunan Perumahan (PTPP) heavy construction/engineering (industrial infra).

Wijaya Karya (WIKA) heavy construction, engineering.

Adhi Karya (ADHI) engineering & construction.

PP Presisi (PPRE) / PP (PP) heavy engineering & EPC.

Toba Pulp Lestari / pulp & paper players (if listed).

Chandra Asri downstream affiliates (chemicals).

Barito affiliates (power & petrochemical subsidiaries).

Indorama (local affiliates) chemicals & fibers (if applicable).

Holcim/ Solusi Bangun Indonesia related companies (concrete & aggregates).

International metal & parts manufacturers listed on IDX.

Industrial conglomerates with big manufacturing arms (selected IDX tickers).

Specialty chemical manufacturers (e.g., local chemical producers).

Paper & packaging group companies (other than TKIM).

Textile / fiber manufacturers relevant to industrial supply chains.

Industrial parts & components SMEs (grouped mid-caps).

Large industrial distributors & logistics (other than AKRA).

Steel service centers and plate / coil processors.

Equipment manufacturers and industrial engineering firms..

2) Earnings call results Top 10 industrial public companies (Q3 2025)

1. Astra International Tbk (ASII) Q3 2025

Q3 2025 net profit (reported): Rp 24.47 trillion (this is the quarterly net figure cited in the Q3 financial statements summary).

USD equivalent (approx.): ~USD 1.47 billion (Rp 24,470,000,000,000 ÷ 16,638 ≈ USD 1.47 bn).

Brief explanation: Astra's diversified exposure (automotive retail & distribution, heavy equipment via United Tractors, financial services and infrastructure) helped it produce a large consolidated profit despite some slowdown in vehicle sales; management highlighted margins in after-sales and financing as key contributors.

2. Chandra Asri Pacific Tbk (TPIA) Q3 2025

Q3 2025 net profit (reported): Rp 21.64 trillion (IndoPremier summary of Chandra Asri filings 9M/QQ extracts show a large turnaround).

USD equivalent (approx.): ~USD 1.30 billion (Rp 21,641,500,000,000 ÷ 16,638 ≈ USD 1.30 bn).

Brief explanation: Petrochemical margins recovered strongly in 2025; Chandra Asri swung back from prior-year losses to large profits on higher volumes and improved spreads. Management flagged strong exports and a better product mix as drivers.

3. United Tractors Tbk (UNTR) Q3 2025

Q3 2025 net profit (reported): Rp 11.47 trillion (quarterly net profit reported in the UNTR quarterly report).

USD equivalent (approx.): ~USD 689.4 million.

Brief explanation: UNTRs profit remained high though below the prior year quarter; the result was supported by heavy equipment sales (Komatsu), mining contracting and aftermarket services. Management pointed to softer commodity cycles vs 2024 as a headwind but highlighted order pipelines.

4. Barito Pacific Tbk (BRPT) Q3 2025

Q3 2025 net profit (reported): Rp 9.71 trillion.

USD equivalent (approx.): ~USD 583.6 million.

Brief explanation: Significant improvement YoY driven by petrochemical and integrated energy affiliates; Baritos industrial holdings (petchems & power) were the main profit engines.

5. AKR Corporindo Tbk (AKRA) Q3 2025

Q3 2025 net profit (reported): Rp 1.65 trillion.

USD equivalent (approx.): ~USD 99.2 million.

Brief explanation: AKRs logistics & chemical distribution business recorded higher throughput and improved margins; management emphasized better utilization in regional terminals.

6. PT Pabrik Kertas Tjiwi Kimia Tbk (TKIM) Q3 2025

Q3 2025 net profit (reported): Rp 3.56 trillion (TKIM Q3 disclosure / research summaries).

USD equivalent (approx.): ~USD 214.0 million.

Brief explanation: TKIM benefited from cost controls and a stronger contribution from associated mills; despite some top-line pressure, net margin expanded.

7. Indocement Tunggal Prakarsa Tbk (INTP) Q3 2025

Q3 2025 net profit (reported): Rp 1.06 trillion (reported by research outlets summarizing INTPs Q3).

USD equivalent (approx.): ~USD 63.7 million.

Brief explanation: Indocement saw modest profit growth as domestic cement demand was mixed; margin management and regional sales mix helped offset volume softness in some areas.

8. Semen Indonesia (SMGR) Q3 2025

Q3 2025 net profit (reported): Rp 114.8 billion (SMGRs Q3 net figure reported in the 9M/quarterly release).

USD equivalent (approx.): ~USD 6.9 million.

Brief explanation: SMGR reported a notably smaller quarterly profit compared to peers; management noted weaker domestic volumes and margin pressure from higher energy and logistics costs. (SMGR is executing cost-efficiency programs and asset optimization).

9. Krakatau Steel (KRAS) Q3 2025

Q3 2025 net profit (reported): Rp 369.9 billion.

USD equivalent (approx.): ~USD 22.2 million.

Brief explanation: Krakatau Steel returned to profit after previous losses, helped by deleveraging and better steel spreads; management cited debt reduction as a pivotal factor in the turnaround.

10. Semen Baturaja (SMBR) Q3 2025

Q3 2025 net profit (reported): Rp 146.3 billion.

USD equivalent (approx.): ~USD 8.8 million.

Brief explanation: SMBR saw YoY profit growth driven by regional demand (Sumbagsel) and operational efficiencies, supported by synergy with parent group (Semen Indonesia).

3) Key trends & insights from Q3 2025 (Industrial sector)

Concentration of profits in petrochemicals and equipment: Q3 2025 shows petrochemical players (notably Chandra Asri) and diversified heavy-equipment conglomerates (Astra/United Tractors) producing disproportionately large profits, indicating cyclical recovery in petrochemical spreads and still-robust aftermarket and services for heavy equipment.

Cement & basic materials mixed margin pressure: Cement majors and many construction-materials firms reported weaker or modest profits as domestic construction demand softened in parts of the country and energy/logistics costs remained an issue. Solusi Bangun Indonesia and some regional cement players (Semen Baturaja, Indocement) showed a mix of resilience (cost control) and near-term pressure.

Currency & macro sensitivity remains important: The rupiahs movement in 2025 and BI policy actions materially affect industrial input costs (imports of feedstock, machinery) and FX gains/losses in financials. Bank Indonesias communications and market FX behavior through Q3Oct 2025 were a notable backdrop for corporate forex effects.

Operational efficiency & deleveraging visible: Several industrial firms emphasized cost discipline, working-capital optimization and debt reduction as drivers of improved bottom lines (e.g., Krakatau Steels turnaround, some cement units efficiency gains).

Dividend / cash deployment signals from winners: Large profits at petrochemical and conglomerate players raised market expectations for dividend payouts or share buybacks (some companies flagged possible interim dividends in their releases).

4) Outlook for Q4 2025 and beyond

Near term (Q4 2025): Expect profit concentration to persist among petrochemicals and heavy equipment segments if global petrochemical spreads and domestic infrastructure activity remain steady. Cement and commodity sensitive names may continue to face pressure if construction demand doesnt re-accelerate. FX volatility remains a watchpoint any renewed IDR weakness would raise imported input costs and create forex translation effects. (Bank Indonesia signaled maintaining currency stability while focusing on growth; markets monitored BIs interventions and rate posture.)

Medium term (2026 and beyond): Structural drivers government infrastructure projects, energy transition investments (green chemicals, renewables), and domestic manufacturing upgrades could re-rate certain industrial names. Companies with cleaner balance sheets and flexible pricing will likely outperform. Watch for: (a) petrochemical CAPEX cycle and international spreads; (b) domestic construction project awards and off-take for cement/aggregates; (c) commodity cycles that drive mining and equipment demand (which support UNTR/Astra group).

Risks: global recession risk (weaker export demand for petrochemicals), upstream feedstock price swings, and a weaker rupiah (raising imported capex/input costs). Companies with significant FX exposure or high leverage could be the most vulnerable.

5) Conclusion

Q3-2025 was a mixed but instructive quarter for Indonesian industrials: a handful of large players (Chandra Asri, Astra, United Tractors, Barito) produced the lions share of aggregate profits while many cement and building-materials companies faced margin pressure and slower demand. The industry outlook into Q4 depends on macro (rupiah stability, interest rates) and commodity cycles (petchems spreads, steel prices).

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 30 Indonesian Industrial Public Companies Q3 2025 Revenue & Performance here

News-ID: 4305717 • Views: …

More Releases from QY Research

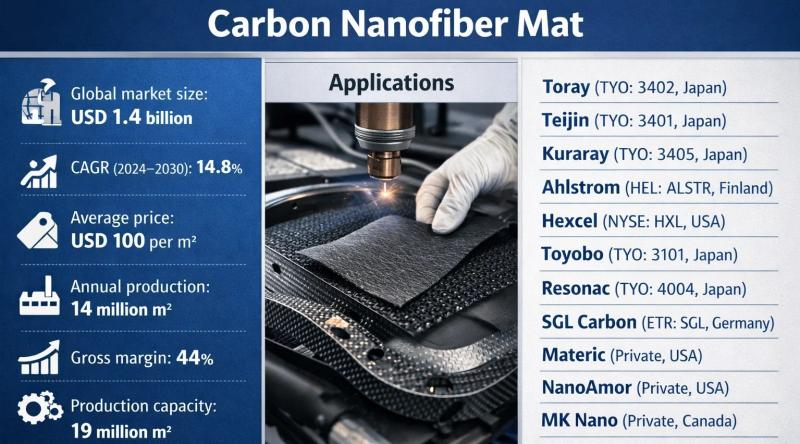

Carbon Nanofiber Mats: Breaking the Limits of Traditional Carbon Materials

Problem

Pylontech (China) in energy storage, filtration, and advanced composite materials relying on conventional carbon fabrics, carbon black additives, or metal meshes encountered multiple performance bottlenecks:

Limited electrical conductivity uniformity

Insufficient surface area for electrochemical reactions

Poor flexibility at low basis weight

Trade-offs between porosity, mechanical strength, and thickness

In lithium-ion batteries, supercapacitors, fuel cells, EMI shielding, and industrial filtration, these constraints resulted in:

Lower energy density and rate capability

Higher material loading and system weight

Reduced durability under…

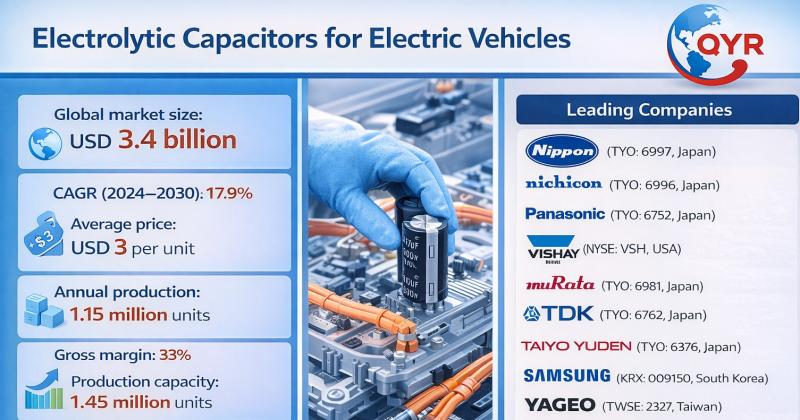

Global and U.S. Electrolytic Capacitors for Electric Vehicles Market Report, Pub …

QY Research has released a comprehensive new market report on Electrolytic Capacitors for Electric Vehicles, high-capacitance energy-storage components used for voltage smoothing, ripple-current suppression, and transient energy buffering in EV power electronics. Automotive-grade aluminum electrolytic capacitors play a critical role in traction inverters, onboard chargers (OBCs), DC-DC converters, battery management systems, and auxiliary power modules. As EV architectures migrate to higher voltages (400 V → 800 V) and higher switching…

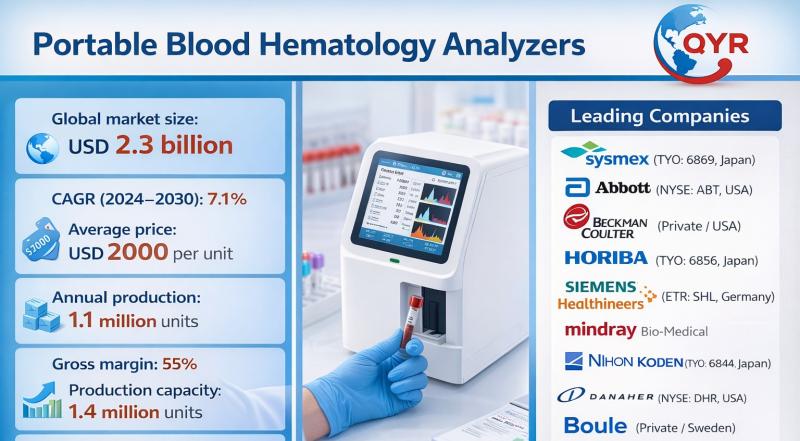

Global and U.S. Portable Blood Hematology Analyzers Market Report, Published by …

QY Research has released a comprehensive new market report on Portable Blood Hematology Analyzers, a compact, mobile medical device designed to quickly measure and analyze key components of blood, such as red blood cells (RBCs), white blood cells (WBCs), hemoglobin, hematocrit, and platelets, outside of a traditional laboratory setting. These devices use microfluidics, optical detection, impedance, or fluorescence technology to perform rapid blood counts, enabling point-of-care testing (POCT) in hospitals,…

Top 30 Indonesian Paint Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Avia Avian Tbk Avian Brands (detailed Q3 numbers below)

PT Propan Raya Industrial Coating Chemicals (market participant)

PT Kansai Paint Indonesia (market participant)

PT Mowilex Indonesia Tbk (paint maker)

PT ICI Paints Indonesia (Asian Paints Indonesia) (market participant)

PT TOA Paint Indonesia (market participant)

PT Nippon Paint Indonesia (local arm of Nippon Paint)

PT Sika Indonesia (coatings & specialty chemicals)

PT Dulux Indonesia…

More Releases for USD

Bone Cement Market Outlook USD 1,871.10M-USD 3,512.31M

How Is the Bone Cement Market Supporting the Rise of Modern Orthopedic Surgery?

The Bone Cement Market plays a critical role in modern orthopedic and spinal procedures, acting as a foundational material for joint replacement, fracture fixation, and vertebral stabilization. Bone cement is widely used to anchor implants, restore bone structure, and improve patient mobility-making it an essential component of musculoskeletal care.

In 2025, the global bone cement market was valued at…

Autologous Cell Therapy Market Outlook USD 9.31B-USD 54.83B

How Is the Autologous Cell Therapy Market Redefining the Future of Precision Medicine?

The Autologous Cell Therapy Market is rapidly emerging as one of the most transformative areas in modern healthcare, offering highly personalized treatment options for complex and chronic diseases. By using a patient's own cells to repair, replace, or regenerate damaged tissues, autologous cell therapy minimizes immune rejection risks while maximizing therapeutic effectiveness.

In 2025, the global autologous cell therapy…

PACS Market USD 5.59B in 2025, USD 9.73B by 2035

Picture Archiving and Communication System (PACS) Market Expands as Digital Imaging Transforms Global Healthcare

Introduction: PACS at the Core of Modern Medical Imaging

The healthcare industry is undergoing a rapid digital transformation, with medical imaging playing a critical role in diagnosis, treatment planning, and patient monitoring. At the heart of this transformation lies the Picture Archiving and Communication System (PACS)-a technology that enables the storage, retrieval, management, and sharing of medical images…

Global HEOR Market USD 1.70B-USD 6.03B

Health Economics and Outcomes Research (HEOR) Market Accelerates as Value-Based Healthcare Redefines Global Decision-Making

Introduction: The Growing Importance of HEOR in Modern Healthcare

The global healthcare industry is undergoing a profound transformation, shifting from volume-driven care models to value-based healthcare systems that prioritize patient outcomes, cost efficiency, and real-world effectiveness. At the center of this transformation lies Health Economics and Outcomes Research (HEOR)-a discipline that evaluates the economic value, clinical outcomes, and…

Foam Tape Market Outlook 2035: Industry Growth from USD USD 4.89 Billion (2025) …

The Foam Tape Market plays a vital role in modern industrial and manufacturing ecosystems. Foam tapes are pressure-sensitive adhesive products manufactured using materials such as polyurethane, polyethylene, PVC, and acrylic foam. These tapes are widely used for bonding, sealing, insulation, cushioning, vibration damping, and noise reduction across multiple industries. Their ability to replace traditional mechanical fasteners like screws, bolts, and rivets has positioned foam tapes as a preferred solution in…

Chlorella Market Reach USD 465.85 Million USD by 2030

Market Growth Fueled by Increased Adoption of Plant-Based Proteins and Health Supplements

Global Chlorella Market size was valued at USD 303.75 Mn. in 2023 and the total Chlorella revenue is expected to grow by 6.3 % from 2024 to 2030, reaching nearly USD 465.85 Mn. . The growth of the market is majorly due to increase in the consumer awareness about health, the inclination towards plant-based food such as chlorella and…