Press release

Virtual Power Plant (VPP) Market Outlook 2035: Growth Dynamics, Revenue Forecast, Key Drivers, Competitive Landscape, and Investment Opportunities

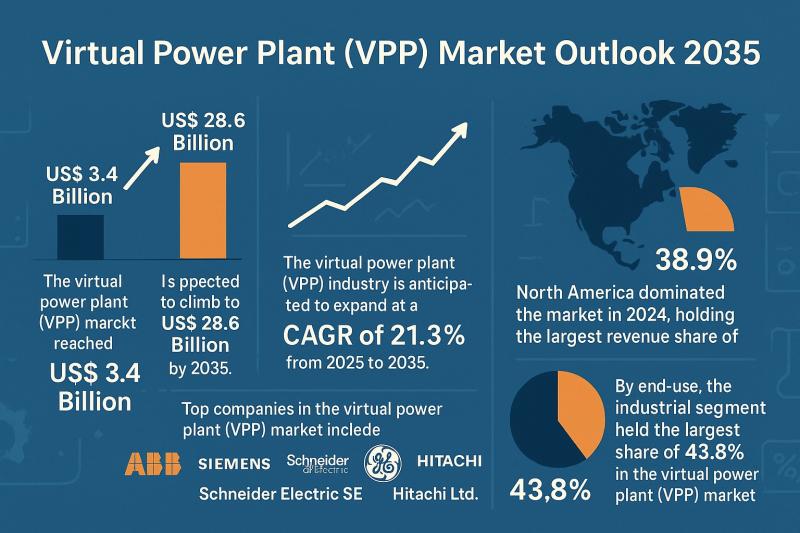

The global virtual power plant (VPP) market is undergoing a transformative expansion driven by the rapid integration of distributed energy resources (DERs), the global shift toward renewable power, and the rising need for grid flexibility. Valued at US$ 3.4 billion in 2024, the market is forecast to reach US$ 28.6 billion by 2035, exhibiting an impressive CAGR of 21.3% from 2025 to 2035. As energy systems evolve toward decentralized and intelligent architectures, VPPs have emerged as a core enabler of modern, resilient, and cost-optimized power grids.Discover Market Opportunities - Request Your Sample Copy Now: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=24971

Market Overview

A Virtual Power Plant (VPP) is a digital ecosystem that aggregates geographically distributed energy resources-such as solar PV systems, battery storage, EV chargers, smart appliances, CHP units, and demand-response loads-to function as a coordinated power plant. Through AI-powered forecasting, IoT sensors, and real-time analytics, VPP operators manage generation, consumption, and storage to deliver grid services such as peak shaving, load shifting, demand-response participation, and ancillary services.

VPPs offer utilities a compelling alternative to costly physical power plant construction or grid infrastructure upgrades. By coordinating thousands of small distributed assets, VPPs deliver flexibility, reduce intermittency challenges from renewables, and enhance overall grid reliability. As electrification expands across mobility, industry, and buildings, VPPs are becoming indispensable for managing peak loads and maintaining grid stability.

Key Market Growth Drivers

Rising Distributed Energy Resource (DER) Adoption

DER installations-solar rooftop systems, behind-the-meter batteries, EV chargers, and smart home loads-are expanding rapidly worldwide due to falling component costs and supportive regulatory incentives. This has resulted in billions of watts of small-scale resources being added annually, yet many remain underutilized.

VPPs unlock their economic value by aggregating them into a dispatchable power resource. Asset owners can now earn revenues from energy trading and demand-response services, creating new monetization pathways. For utilities, VPP-enabled DER aggregation reduces the need for grid reinforcements and helps manage reverse power flows caused by high solar penetration.

Growing Need for Grid Flexibility and Peak Load Optimization

Global grids face rising stress due to increased renewable penetration, EV load surges, and climate-driven extreme weather events. Conventional power plants struggle to respond rapidly to fluctuating loads.

VPPs provide immediate grid-balancing capability by coordinating flexible loads and distributed storage resources. With real-time digital control systems, VPPs can curtail consumption, inject stored power, and shift loads to off-peak hours. This helps utilities avoid costly peaker plants and transmission upgrades, enhancing operational efficiency while stabilizing voltage and frequency.

Decarbonization Mandates and Energy Transition Policies

Governments worldwide are implementing net-zero commitments, renewable portfolio standards, and DER-incentive programs. Policies facilitating VPP participation in grid markets-such as dynamic pricing, capacity markets, and open-access frameworks-are accelerating VPP adoption.

Rapid Digitalization and AI-based Energy Forecasting

Modern VPP platforms use AI to forecast renewable generation, predict demand patterns, and optimize asset dispatch. This elevates reliability, reduces operational costs, and improves revenue stacking across wholesale markets, ancillary services, and retail programs.

Analysis of Key Players and Their Strategies

Leading companies in the VPP market include ABB, Siemens AG, Schneider Electric SE, GE Vernova, and Hitachi Ltd, supported by strong competition from SolarEdge, Tesla, Shell plc, Enel X, Next Kraftwerke, Bosch GmbH, Mitsubishi, Honeywell, and AGL Energy.

Key strategies adopted by major players:

Expansion of DER Aggregation Platforms

Companies like Siemens and GE Vernova are heavily investing in advanced DER management systems to expand load-control and renewable integration capabilities.

AI Integration for Real-time Grid Optimization

ABB, SolarEdge, and Tesla are refining their software platforms with machine learning tools to enhance forecasting accuracy and optimize multi-asset dispatch.

Vertical Integration Through Hardware + Software Ecosystems

Many players are bundling hardware-such as inverters, storage systems, and control devices-with cloud-based VPP management platforms to deliver end-to-end solutions.

Large-scale Enrollment Programs and Utility Partnerships

Companies are forging agreements with utilities to enroll thousands of residential and commercial customers into VPP programs, increasing asset pools for grid flexibility.

Expansion into Adjacent Markets

Several VPP players are entering sectors like AI data center energy optimization, EV charging orchestration, and microgrid integration to capture growing revenue opportunities.

Market Challenges & Opportunities

Key Challenges

Regulatory fragmentation across regions, especially in Europe, limits standardized VPP deployment.

Cybersecurity vulnerabilities arise from large interconnected IoT devices.

DER interoperability issues due to diverse hardware and communication protocols.

Limited customer awareness in emerging economies restricts VPP enrollment rates.

Opportunities

AI-driven autonomous energy trading represents a multi-billion-dollar emerging market.

EV fleet aggregation will create vast virtual storage and flexible load networks.

Commercial and industrial demand-response markets are expected to triple by 2035.

Developing markets (India, ASEAN, Latin America) offer massive untapped DER pools ready for VPP integration.

Explore Strategies & Trends - Request Full Report Access - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=24971

Recent Developments (RD)

ABB - October 2025

Partnered with NVIDIA to implement 800V DC architectures for AI data centers, strengthening its role in advanced flexibility solutions aligned with VPP models.

SolarEdge - October 2025

Expanded its residential storage VPP portfolio with the enrollment of over 500 MWh of batteries across multiple U.S. states, enhancing grid-interactive energy capabilities.

ABB - December 2024

Acquired Siemens Gamesa's power electronics division to bolster renewable power conversion technologies-key components for VPP-linked systems.

These developments show how VPP ecosystem players are diversifying into DER control, storage interface solutions, and large-scale energy optimization.

Investment Landscape and ROI Outlook

Investors are increasingly viewing VPPs as high-growth digital infrastructure assets with strong long-term demand.

Key investment signals

21.3% CAGR offers substantial compounding return potential.

VPP business models generate multiple revenue streams: capacity markets, frequency response, demand-response, and energy trading.

Geopolitical pressure for energy independence boosts adoption of decentralized models.

Strong policy backing in Europe, China, and North America reduces investment risk.

ROI Outlook

Given the global pace of DER installations, investments in VPP software platforms, AI analytics, and DER integration hardware offer high ROI, often exceeding returns from traditional utility infrastructure.

Market Segmentation with Regional Insights

By Region

North America (38.9% share) - Largest market due to rapid rooftop solar adoption, advanced smart grid systems, and strong utility-backed VPP programs.

Europe (31.1% share) - Large renewable base and aggressive carbon-neutrality goals drive adoption.

Asia Pacific - Fastest-growing region, fueled by solar expansion in China and India and increasing grid reliability challenges.

Latin America & Middle East/Africa - Early-stage adoption with high potential in industrial zones and microgrid-based energy resilience programs.

By End-use

Industrial (43.8% share) - Data centers, refineries, manufacturing plants, and processing facilities contribute massive flexible loads ideal for VPP integration.

Commercial - Retail chains, campuses, and office complexes increasingly participate in demand-response initiatives.

Residential - Growing with battery storage and rooftop solar adoption, especially in the U.S., Japan, Australia, and Germany.

Why Buy This Report?

Provides detailed market sizing from 2024 to 2035 with accurate forecasts and growth estimates.

Includes comprehensive analysis of drivers, challenges, trends, and opportunities.

Offers competitive landscape profiling of top global VPP market players.

Delivers regional insights essential for market-entry strategies.

Presents investment attractiveness and ROI potential across segments.

Covers recent developments and technology roadmaps shaping next-generation VPP systems.

Frequently Asked Questions

How big was the virtual power plant (VPP) market in 2024?

The market was valued at US$ 3.4 billion in 2024.

What is the expected market size by 2035?

The VPP industry is forecast to reach US$ 28.6 billion by 2035 at a CAGR of 21.3%.

What are the major drivers of market growth?

The key drivers include rising adoption of distributed energy resources (DERs), the growing need for grid flexibility, peak load optimization, and increased digitalization of power networks.

Which segment dominated the market in 2024?

The industrial segment, with a 43.8% share, dominated due to high flexible load availability and widespread DER integration.

Which region led the market in 2024?

North America was the leading region with 38.9% of global market revenue.

Buy Full Report Now: https://www.transparencymarketresearch.com/checkout.php?rep_id=24971<ype=S

Explore Latest Research Reports by Transparency Market Research:

Portable Power Fuel Cell Market: https://www.transparencymarketresearch.com/portable-power-fuel-cell-market.html

Co-refining Market: https://www.transparencymarketresearch.com/co-refining-market.html

FPSO Market: https://www.transparencymarketresearch.com/fpso-vessels-equipments-market.html

Contact Us:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Virtual Power Plant (VPP) Market Outlook 2035: Growth Dynamics, Revenue Forecast, Key Drivers, Competitive Landscape, and Investment Opportunities here

News-ID: 4305475 • Views: …

More Releases from Transparency Market Research

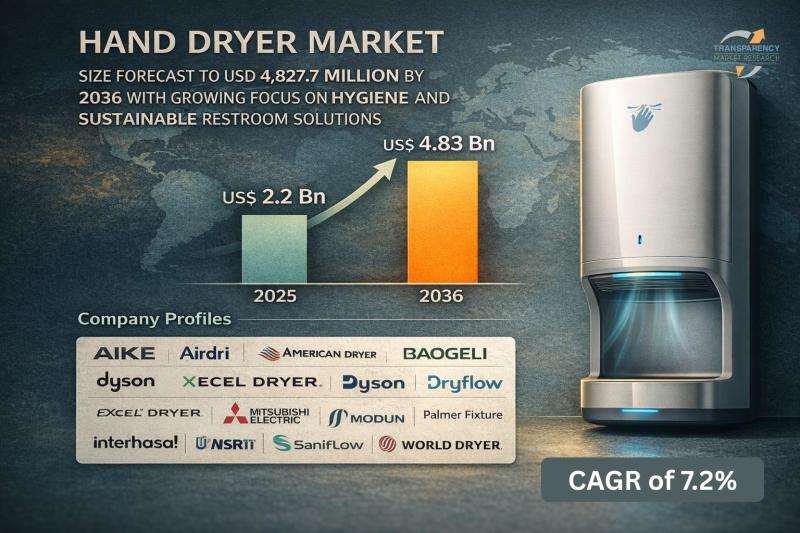

Hand Dryer Market Size Forecast to USD 4.83 Billion by 2036 with Growing Focus o …

Hand Dryer Market Outlook 2036

The global hand dryer market was valued at US$ 2.23 Billion in 2025 and is projected to reach US$ 4.83 Billion by 2036, expanding at a steady CAGR of 7.2% from 2026 to 2036. Market growth is driven by increasing emphasis on hygiene and sanitation, rising adoption in commercial infrastructure, and growing preference for eco-friendly and cost-effective hand drying solutions.

👉 Get sample market research report copy…

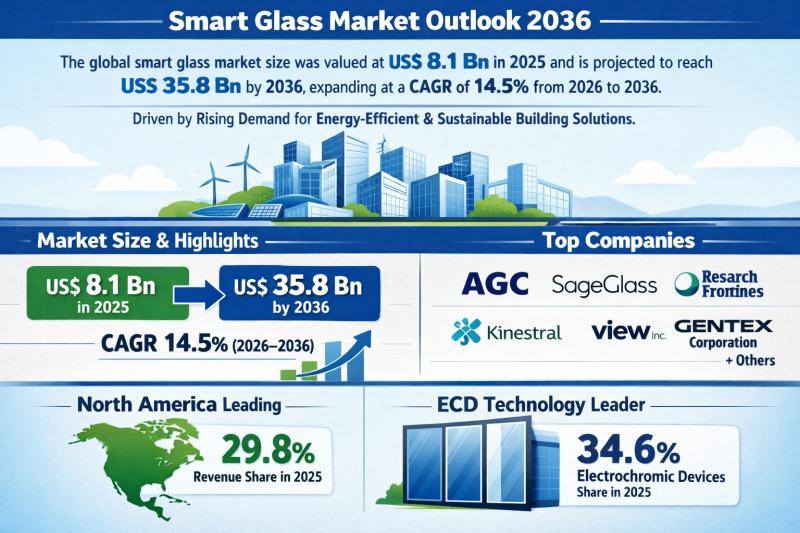

Smart Glass Market Outlook 2036: Projected to Reach USD 35.8 Billion at 14.5% CA …

The global smart glass market was valued at US$ 8.1 Bn in 2025 and is projected to surge to US$ 35.8 Bn by 2036, expanding at a robust CAGR of 14.5% from 2026 to 2036. This nearly 4.4x growth over eleven years underscores the accelerating demand for intelligent glazing solutions across commercial, residential, automotive, and infrastructure sectors.

North America emerged as the leading regional market in 2025, accounting for 29.8% of…

Smoking Cessation and Nicotine De-Addiction Market to Reach USD 46.4 Bn by 2036, …

The global smoking cessation and nicotine de-addiction market is witnessing strong and sustained growth, fueled by intensifying public health initiatives and rising awareness about the long-term consequences of tobacco use. Valued at USD 15.5 Bn in 2025, the market is projected to expand at a robust CAGR of 10.5% from 2026 to 2036, reaching USD 46.4 Bn by 2036.

Smoking cessation solutions encompass a wide range of products and services designed…

3D Imaging Market to be Worth USD 266 Bn by 2036 - By Component Type / By End-Us …

The global 3D imaging market is witnessing exponential growth, reflecting strong demand across healthcare, manufacturing, media, and industrial sectors. Valued at US$ 50 billion in 2025, the market is projected to reach US$ 266 billion by 2036, expanding at a robust CAGR of 18.2% from 2026 to 2036.

Get a concise overview of key insights from our Report in this sample -

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=2743

This impressive trajectory highlights the rapid integration of advanced imaging…

More Releases for VPP

Virtual Power Plants (VPP) Market Strategic Overview for 2025

The Virtual Power Plants (VPP) market represents a transformative shift in energy management, where distributed energy resources (DERs) are aggregated and operated as a single entity to deliver electricity and ancillary services. This innovative approach enhances grid reliability and efficiency by enabling better integration of renewable energy sources, such as wind and solar power, into the existing energy infrastructure.

Recent developments in the VPP market have been driven by significant advancements…

Virtual Power Plant (VPP) Market Report Till 2031

Visiongain has published a new report on Virtual Power Plant (VPP) Market Report 2021-2031: Forecasts by Component (Energy Generation Technology, Energy Storage Technologies, Information Communication Technology (ICT)), by Energy Generation Technology (Wind Based Energy Generation, Small Hydro-Plants, Solar Production, Combined Heat and Power (CHP), Small Power Plants, Other), by Information Communication Technology (ICT) (Energy Management Systems (EMS), Supervisory Control and Data Acquisition (SCADA), Distribution Management System (DMS), Smart Meters, Other),…

Virtual Power Plant (VPP) Market: Study Navigating the Future Growth Outlook

HTF MI announces the release of the "Global Virtual Power Plant (VPP) Market Growth (Status and Outlook) 2021-2026" by technology, Type, Component, End User and Region. The Global Virtual Power Plant (VPP) Market report provides an in-depth analysis of the, drivers & opportunities, market size & estimations, competitive landscape, top investment pockets, top winning strategies and changing market trends.

Request Sample of Global Virtual Power Plant (VPP) Market Growth (Status and…

Puredrive Virtual Power Plants (VPP) - changing energy management, providing con …

Puredrive Energy (PDE), is one of the UKs leading battery storage specialist, and manufacturers with their founders having more than 10 years’ experience in the development, deployment, and placement of battery storage solutions.

PDE launches one of the first Virtual Power Plants in the UK, a digital control system that can connect hundreds of households and businesses together, enabling their battery storage systems to charge and discharge simultaneously. This unlocks greater…

Global Virtual Power Plant (VPP) Market Size, Status and Forecast 2022

This report studies the global Virtual Power Plant (VPP) market, analyzes and researches the Virtual Power Plant (VPP) development status and forecast in United States, EU, Japan, China, India and Southeast Asia. This report focuses on the top players in global market, like

DONG Energy

Duke Energy

RWE

Alstom Grid

Bosch

GE Digital Energy

IBM

Schneider Electric

Siemens

ENBALA Power Networks

Joule Assets

Power Analytics

Power Assure

Spirae

Ventyx/ABB

Viridity Energy

Comverge

Consert

Cooper Power Systems/Eaton

Customized Energy Solutions

EnerNOC

Request For Report Sample @ http://www.qyresearchreports.com/sample/sample.php?rep_id=1045016&type=E

Market segment by Regions/Countries, this report…

Global Virtual Power Plant (VPP) Market Size, Status and Forecast 2022

This report studies the global Virtual Power Plant (VPP) market, analyzes and researches the Virtual Power Plant (VPP) development status and forecast in United States, EU, Japan, China, India and Southeast Asia. This report focuses on the top players in global market, like

DONG Energy

Duke Energy

RWE

Alstom Grid

Bosch

GE Digital Energy

IBM

Schneider Electric

Siemens

ENBALA Power Networks

Joule Assets

Power Analytics

Power Assure

Spirae

Ventyx/ABB

Viridity Energy

Comverge

Consert

Cooper Power Systems/Eaton

Customized Energy Solutions

EnerNOC

Request for Sample of Premium Research Report @ http://www.qyresearchreports.com/sample/sample.php?rep_id=1045016&type=E

Market segment by Regions/Countries,…