Press release

Private Lenders in Toronto - How Private Money Lending Helps Home Equity Loans Get Approved

The Toronto real estate market is one of the most competitive in Canada, with rising property prices making traditional financing options less accessible for many buyers. In such a scenario, private mortgage lenders have emerged as a viable alternative for those who may not qualify for conventional bank loans. Understanding how private money lenders operate, their benefits, risks, and how to choose the right one can help borrowers make informed decisions.● What Are Private Mortgage Lenders?

Private mortgage lenders are non-institutional individuals or companies that provide short-term, asset-based loans secured by real estate. Unlike banks or credit unions, they operate outside traditional lending regulations, offering more flexible approval criteria. Private lenders in Toronto

https://torontomortgagesite.ca/private-lenders-toronto/ typically focus on "Equity Lending" rather than the borrower's credit score or income, making them an attractive option for self-employed individuals, investors, or those with credit challenges.

● How Private Lending Works

Private mortgage loans are typically short-term, ranging from six months to three years, with interest rates higher than conventional mortgages. The loan-to-value (LTV) ratio-the percentage of the property's value that can be borrowed-usually ranges between 65% and 80%, though some lenders may go higher for low-risk properties.

The process involves:

1. Application & Property Assessment - Borrowers submit basic financial details, and the lender evaluates the property's market value.

2. Loan Approval & Terms - If approved, the lender outlines interest rates, fees, and repayment schedules.

3. Funding - Once legal documentation is finalized, funds are disbursed quickly, often within days.

● What Do Lenders Review with Borrowers:

-Borrower's creditworthiness - Lower credit scores result in higher rates.

-Loan term - Short-term loans (6 months to 1 year) often have higher rates. longer-term arrangements.

-Property type and location - High-demand areas may secure better rates.

-Market conditions - Economic trends influence private lending rates.

● Benefits of Private Mortgages

1. Fast Approvals - Private lenders can process loans in days, unlike banks, which may take weeks.

2. Flexible Qualifications - Poor credit, self-employment, or recent bankruptcy are less of a barrier.

3. Bridge Financing - Ideal for investors flipping properties or buyers needing interim financing before securing long-term loans.

4. Customizable Terms - Negotiable repayment structures, including interest-only payments or balloon payments at term-end.

Risks to Consider

1. Higher Interest Rates - Rates can range from 6% to 12% , significantly higher than bank mortgages.

2. Shorter Terms - Borrowers usually refinance or sell the property before the term expires

3. Additional Fees - Origination fees, appraisal costs, and legal expenses can add up.

4. Equity Risk - If property values decline, borrowers may struggle to refinance.

● Choosing the Right Private Lender

1. Verify Credibility - Check for licensing, reviews, and a proven track record in Toronto's market.

2. Compare Rates & Terms - Obtain multiple quotes to ensure competitive terms.

3. Understand the Fine Print - Review prepayment penalties, renewal options, and default conditions. 4. Seek Professional Advice - A mortgage broker or real estate lawyer can help navigate the process.

● Common Uses for Private Mortgages

- Home Purchases - When traditional financing falls through.

- Renovations & Construction - Funding property upgrades before refinancing.

- Debt Consolidation - Using equity to pay off high-interest loans.

- Investment Properties - Quick financing for real estate flips or rental acquisitions.

- Second Mortgages - Fast Loans that do not replace an existing first mortgage.

● Second Mortgages in Toronto

With housing affordability remaining a challenge, private mortgage lending is expected to grow. Stricter bank regulations and rising demand for flexible financing will continue to drive borrowers toward private solutions. Homeowners find it difficult to apply for lines of credit which have strict qualifying policies.

Private lenders offer Second Mortgages https://torontomortgagesite.ca/second-mortgage-toronto/ which are very popular transactions but come with higher rates while first mortgages are lower. Second mortgages in Toronto are available for fast lending solutions without paying off your first mortgage.

By understanding the nuances of private mortgage lending, Toronto residents and investors can leverage these loans strategically to achieve their real estate goals while mitigating financial pitfalls.

● Who Benefits from Private Lending?

- Real Estate Investors - Quick funding for property acquisitions and renovations.

- Small Businesses - Capital for expansion when banks decline applications.

- Individuals with Poor Credit - An alternative when traditional loans are unavailable.

- Private Investors - High-yield returns by funding loans.

Legal and Regulatory Aspects Private lending is subject to state and federal laws, including usury limits (maximum interest rates) and disclosure requirements. Contracts must clearly outline terms to avoid disputes. Borrowers should review agreements carefully, and lenders must ensure compliance with lending regulations.

● Conclusion

Private lending provides a vital alternative for borrowers who need fast, flexible financing outside traditional banking systems. While it comes with higher costs and risks, its speed and accessibility make it a valuable tool for real estate investors, businesses, and individuals in need of capital. Understanding the terms, risks, and legal considerations ensures that both borrowers and lenders can benefit from private lending arrangements.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Private Lenders in Toronto - How Private Money Lending Helps Home Equity Loans Get Approved here

News-ID: 4304960 • Views: …

More Releases from Finixio Digital

Why Your Foreign Company Is Still Taxable in the US

There's a moment most US expats remember clearly. You register a company abroad. The paperwork goes through. A local accountant confirms everything is compliant. You pay tax in your new country. It feels settled.

Then, months later, usually while dealing with your US tax return, a different question lands:

Why is the IRS still involved?

It feels unfair at first. Even a little absurd. The company isn't in the US. The clients…

Filing U.S. Taxes Abroad: Tax Expert vs. Tax Preparation Firm

What Americans in the UK need to know before choosing how to file

For the growing number of Americans living in the United Kingdom, U.S. tax season comes with a familiar question: Should you hire a tax expert or use a tax preparation firm?

The answer is not the same for everyone. Your income type, visa status, length of stay and financial footprint in the UK all play a role in determining…

FaceAuraAI Launches a Beauty & Wellness Hub Powered by AI Face Analysis and Expe …

The platform combines free AI-powered face and body analysis tools with a growing library of expert-written guides covering skincare, hair care, natural oils, and holistic wellness.

Kolkata, India - February 18, 2026 - FaceAuraAI, an AI-powered beauty and wellness platform, today announced the expansion of its digital hub - bringing together a suite of free AI face and body analysis tools alongside an expert-curated content library covering skincare, hair care, natural…

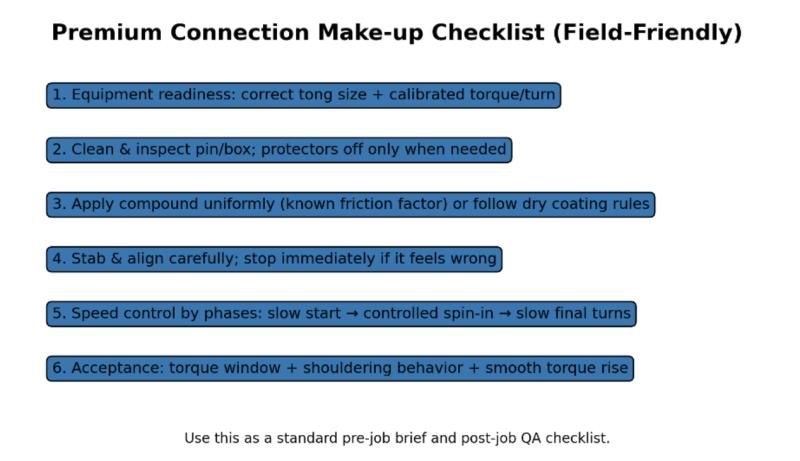

How to Choose a Bucking Unit for Tubing & Casing Connections: A Practical Buyer' …

A field-ready checklist to improve repeatability, reduce rework, and support QA documentation.

When teams evaluate a https://galipequipment.com/bucking-unit/ the first comparison is usually torque range. That matters, but it is not the only factor that determines whether your connection work stays consistent over time. In real operations, the biggest costs often come from rework, inconsistent make-up behavior, damaged surfaces, and unclear documentation when customers request proof.

This guide breaks down what to evaluate…

More Releases for Private

real estate private equity firms,private equity manager,private equity financing …

Real estate private equity is the practice of investing in real estate properties or real estate-related assets using private capital. Private equity firms, high net worth individuals, and institutional investors are among the primary players in this market. These investors provide the capital for real estate transactions, such as the purchase of properties, and in return, they receive a share of the profits generated by the properties.

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The…

private asset management,private wealth management firms,middle market private e …

Private asset management is the management of assets on behalf of private individuals, families, or institutions. It involves the creation of a customized investment strategy to achieve specific financial goals, such as wealth preservation, growth, income generation, or a combination of these objectives. The assets managed can include cash and cash equivalents, stocks, bonds, real estate, private equity, and alternative investments.

https://tendawholesale.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private asset management is typically provided by…

private equity international,private equity investment, equity firm,private inve …

Private equity firms are investment companies that specialize in acquiring and managing private companies. These firms typically provide capital to mature companies that have a proven track record of revenue and earnings, but that may be underperforming or undervalued. Private equity firms typically hold their investments for several years and then exit through a sale or an initial public offering (IPO).

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The private equity process begins with the…

private investment,private equity,private equity firms,private equity fund,capit …

Private investment refers to the purchase or financing of a private company or a portion of it, typically by a private equity firm, venture capital firm, or angel investor. Private investments can take various forms, including equity investments, debt investments, or a combination of both.

http://pandacuads.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private equity firms typically invest in mature companies that have a proven track record of revenue and earnings, but that may be underperforming…

Asia Private Equity Firm, Asia Private Equity Management, Asia Private Equity Se …

The private equity market in China has been rapidly growing in recent years. Private equity (PE) refers to the purchase of shares in a company that are not publicly traded on a stock exchange. PE firms typically target companies that are undervalued or in need of capital for growth, and aim to improve the company's operations and financial performance before selling it at a higher value.

https://boomingfaucet.com/

Asia Private Equity Consulting

E-mail:nolan@pandacuads.com

In China,…

China Private Equity Financing Consulting, China Private Equity Investment Corpo …

Pandacu China is a venture capital firm that focuses on early-stage investments in technology companies based in China. The firm was founded in 2015 by a group of experienced venture capitalists and entrepreneurs who have a deep understanding of the Chinese market and a strong network of contacts in the tech industry.

http://pandacuads.com/

China Private Equity Financing Consulting

Email:nolan@pandacuads.com

Pandacu China's mission is to help innovative and ambitious entrepreneurs turn their ideas into successful…