Press release

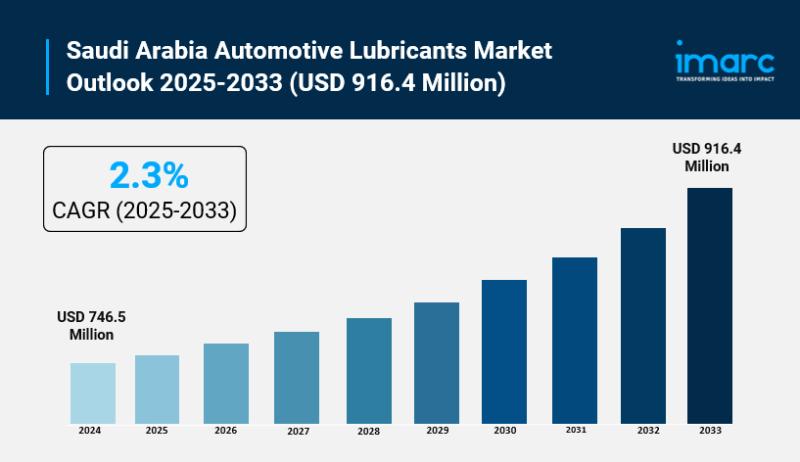

Saudi Arabia Automotive Lubricants Market Size to Hit USD 916.4 Million by 2033 At a CAGR of 2.3%

Saudi Arabia Automotive Lubricants Market OverviewMarket Size in 2024: USD 746.5 Million

Market Forecast in 2033: USD 916.4 Million

Market Growth Rate 2025-2033: 2.3%

According to IMARC Group's latest research publication, "Saudi Arabia Automotive Lubricants Market Report by Vehicle Type (Commercial Vehicles, Motorcycles, Passenger Vehicles), Product Type (Engine Oils, Greases, Hydraulic Fluids, Transmission and Gear Oils), and Region 2025-2033", the Saudi Arabia automotive lubricants market size reached USD 746.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 916.4 Million by 2033, exhibiting a growth rate (CAGR) of 2.3% during 2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-automotive-lubricants-market/requestsample

How AI is Reshaping the Future of Saudi Arabia Automotive Lubricants Market

● AI-powered predictive maintenance tools cut vehicle downtime by 25% in Saudi Arabia's fleets, using real-time data to spot lubricant issues early, backed by Aramco's Metabrain AI trained on decades of oil data.

● Vision 2030 drives AI innovation in lubricants via the National AI Strategy, boosting R&D for smarter formulations that handle extreme desert heat better for growing vehicle numbers.

● Aramco's SAIL lab rolls out AI models optimizing lubricant blends, helping companies like Saudi Multichem add nanoparticles to slash engine friction and boost efficiency.

● Government EV push under Vision 2030 spurs AI-designed specialty lubricants for batteries and drivetrains, meeting demand from Lucid Motors' 100,000-unit fleet commitment.

● Saudi Arabia's predictive maintenance market hits USD 0.11 billion, with AI analytics on engine temps and oil flow extending lubricant life in harsh climates for fleet operators.

How Vision 2030 is Transforming Saudi Arabia Automotive Lubricants Industry?

Vision 2030 is accelerating the transformation of Saudi Arabia's automotive lubricants market by boosting vehicle modernization, expanding industrial activity, and promoting advanced mobility solutions. Rising adoption of fuel-efficient and electric vehicles is driving demand for high-performance, low-emission lubricants. Manufacturing localization initiatives and investments in automotive clusters are strengthening domestic production capabilities. Additionally, stricter environmental standards and smart transportation projects are encouraging innovation in synthetic, eco-friendly lubrication solutions across the Kingdom.

Saudi Arabia Automotive Lubricants Market Trends & Drivers:

Saudi Arabia's automotive lubricants market is booming thanks to Vision 2030's push to diversify the economy and ramp up vehicle numbers, with ownership expected to top 17 million vehicles soon. This ties directly into massive infrastructure projects and tourism growth, where over 27,000 buses shuttle pilgrims during Hajj alone, plus 3,500 more for holy sites, all needing reliable lubricants to handle harsh desert conditions. Government incentives for cleaner mobility and public transit expansion create steady demand, while rising female drivers-175,000 licensed in the first year post-ban-add to the personal car fleet, boosting needs for high-performance oils that protect engines and cut wear. Company moves like Al Jomaih & Shell's deal to supply Budget Saudi Arabia's fleet show how partnerships keep vehicles running smoothly across rentals and ride-hailing.

Another big driver is the surge in advanced synthetic lubricants tailored for modern engines, as brands like Castrol roll out products such as VECTON LONG DRAIN 5W-30 to meet strict ACEA standards for better fuel efficiency and engine life. These oils shine in Saudi's extreme heat, offering superior thermal stability and longer drain intervals, which appeal to owners of Toyota and Hyundai models dominating local roads. Collaborations, including Abdul Latif Jameel with Petronas Lubricants, bring eco-friendly synthetics that reduce emissions without sacrificing protection, aligning with regulations pushing bio-based alternatives over petroleum ones. Engine oils already claim 64% of lubricant volume, underscoring how innovation meets real-world demands for durability in high-mileage fleets.

Shifts toward electric vehicles are sparking fresh trends, with EV sales climbing under the Saudi Green Initiative and Vision 2030's sustainability goals, backed by SAR 1.2 billion in charging infrastructure. While traditional oils stick around for mixed fleets, demand spikes for EV-specific fluids like battery coolants and drivetrain greases-yet only 32% of owners know about them, opening doors for education and specialized products from Aramco's alliance with BYD. Tighter emissions rules for public transport mandate greener lubricants, blending old and new tech to support fleet electrification incentives. This evolution promises growth in high-performance fluids that handle both combustion and electric demands seamlessly.

Buy the Latest 2026 Edition: https://www.imarcgroup.com/checkout?id=13233&method=1315

Saudi Arabia Automotive Lubricants Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Vehicle Type:

● Commercial Vehicles

● Motorcycles

● Passenger Vehicles

Breakup by Product Type:

● Engine Oils

● Greases

● Hydraulic Fluids

● Transmission and Gear Oils

Regional Analysis:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

● Saudi Aramco (Petromin)

● Shell, TotalEnergies

● ExxonMobil

● Castrol

● Alhamrani Fuchs

● Aljomaih Lubricants

Recent News and Developments in Saudi Arabia Automotive Lubricants Market

● November 2025: Valvoline by Aramco partners as official lubricant for National Auto Award in Jeddah, boosting brand visibility amid rising vehicle maintenance needs.

● September 2025: Saudi Aramco launched AI-enhanced lubricants that boost engine efficiency by 20% and lower emissions, targeting heavy-duty vehicles for cleaner performance.

● September 2025: Local manufacturers adopt AI-driven production lines, reducing lubricant waste by 15% and enhancing quality control.

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Automotive Lubricants Market Size to Hit USD 916.4 Million by 2033 At a CAGR of 2.3% here

News-ID: 4304201 • Views: …

More Releases from IMARC Group

Taiwan Construction Market Size, Share, In-Depth Insights, Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Taiwan Construction Market Report by Sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities Construction), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Taiwan construction market size reached USD 37.4 Billion in 2025 and is projected to grow to USD 50.4…

Mexico Whiskey Market Size to Hit USD 1,468.1 Million by 2034: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico whiskey market size reached USD 905.2 Million in 2025. It is projected to grow to USD 1,468.1 Million…

Mexico LED Lights Market 2026 : Industry Size to Reach USD 2,904.4 Million by 20 …

IMARC Group has recently released a new research study titled "Mexico LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico LED lights market was valued at USD 1,466.9 million in 2025 and is projected to…

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…