Press release

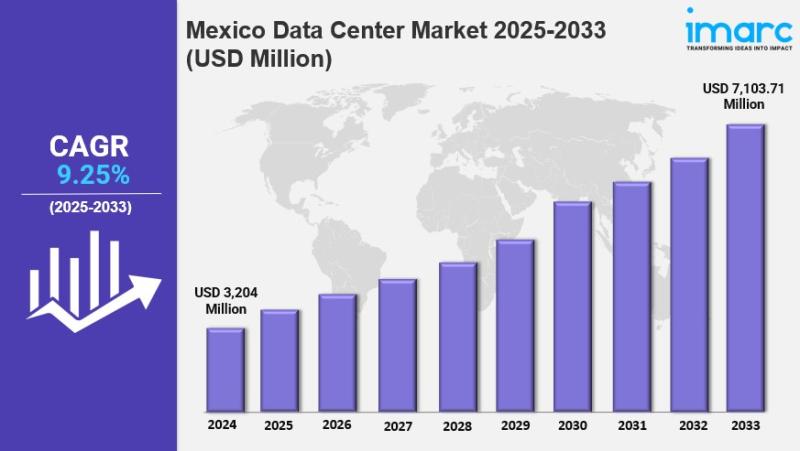

Mexico Data Center Market Size to Hit USD 7,103.71 Million by 2033: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Data Center Market Size, Share, Trends and Forecast by Component, Type, Enterprise Size, End User, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.Market Overview

The Mexico data center market reached a size of USD 3,204 Million in 2024. It is projected to grow to USD 7,103.71 Million by 2033, exhibiting a CAGR of 9.25% over the forecast period 2025-2033. Growth is driven by hyperscale cloud provider expansion, strategic nearshoring investments capitalizing on Mexico's geographic advantage, and a focus on renewable energy and energy-efficient technologies. The deployment of edge computing infrastructure further broadens the market share.

Study Assumption Years

● Base Year: 2024

● Historical Years: 2019-2024

● Forecast Period: 2025-2033

Mexico Data Center Market Key Takeaways

● Current Market Size: USD 3,204 Million in 2024

● CAGR: 9.25% (2025-2033)

● Forecast Period: 2025-2033

● Major hyperscale cloud providers are expanding regional

data center infrastructure to meet growing demand for localized cloud services and data sovereignty compliance.

● Microsoft launched its first hyperscale cloud datacenter region in Mexico (Mexico Central region, Querétaro) in May 2024.

● Nearshoring strategies leveraging Mexico's strategic geographic location stimulate significant data center investments, especially in Querétaro and Monterrey.

● Amazon Web Services announced plans to launch an AWS infrastructure region in Mexico by early 2025 with three Availability Zones.

● Environmental sustainability is a priority, with data centers adopting renewable energy sources and advanced cooling technologies.

Sample Request Link: https://www.imarcgroup.com/mexico-data-center-market/requestsample

Mexico Data Center Market Growth Factors

The Mexico data center market growth is fueled by considerable investments from major global cloud service providers establishing hyperscale data centers across Mexico. These investments address the increasing demand for localized cloud computing resources and comply with evolving data sovereignty regulations. For example, Microsoft launched its first hyperscale cloud datacenter region in the Querétaro Metropolitan area in May 2024, offering scalable, resilient cloud services that improve latency and data localization. These hyperscale environments support workloads involving AI, machine learning, analytics, and digital transformation initiatives, ensuring enterprise-grade reliability and business continuity through availability zones designed for high performance.

Mexico strategic location between the United States and Latin America, combined with strong telecommunications infrastructure and submarine cable links, is catalyzing significant data center investments. Multinational corporations leverage Mexico for nearshoring IT and digital service operations, benefiting from reduced data transmission latency and cost advantages compared to U.S. and Canadian data centers. Querétaro and Monterrey have become key data center hubs due to favorable business conditions, electrical infrastructure, and skilled talent availability. AWS's plan to establish a cloud region in Mexico with three availability zones by early 2025 exemplifies the country's growing significance as a nearshoring destination for digital infrastructure.

Environmental concerns drive data center operators in Mexico to prioritize sustainability and energy efficiency. Operators increasingly incorporate renewable energy sources, such as solar and wind, through power purchase agreements aiming for carbon neutrality. Cutting-edge cooling solutions including liquid cooling, free cooling, and AI-driven thermal management optimize energy consumption and reduce operating costs. Green building certifications like LEED and water conservation strategies reflect efforts to minimize environmental impact. Furthermore, enterprise customers demand ESG performance from providers, compelling operators to demonstrate progress in renewable energy adoption, waste reduction, and community engagement.

Buy Report Now: https://www.imarcgroup.com/checkout?id=43481&method=980

Mexico Data Center Market Segmentation

Breakup by Component:

• Solution

• Services

The report provides a detailed analysis of solutions and services components within the data center market.

Breakup by Type:

• Colocation

• Hyperscale

• Edge

• Others

Market types include colocation, hyperscale, edge, and others, reflecting diverse infrastructure deployment models.

Breakup by Enterprise Size:

• Large Enterprises

• Small and Medium Enterprises

Market segmentation by enterprise size includes large enterprises and small and medium enterprises.

Breakup by End User:

• BFSI

• IT and Telecom

• Government

• Energy and Utilities

• Others

End users cover BFSI, IT and telecom, government, energy and utilities, and other sectors.

Breakup by Region:

• Northern Mexico

• Central Mexico

• Southern Mexico

• Others

The analysis covers the major regional markets within Mexico including northern, central, southern regions, and others.

Regional Insights

Central Mexico is a dominant region in the Mexico data center market, hosting key infrastructure such as Microsoft's Mexico Central hyperscale cloud datacenter region in Querétaro. The region benefits from a favorable business climate, skilled workforce, and robust infrastructure. The report highlights Querétaro and Monterrey as primary development hubs for data center investments, driven by nearshoring strategies and connectivity advantages. Precise regional market share and CAGR data are not provided in the source.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=43481&flag=C

Recent Developments & News

In September 2025, Alibaba Cloud announced plans to establish new data centers including in Mexico, as part of a growth strategy also involving Brazil, France, the Netherlands, Japan, South Korea, Malaysia, and Dubai. In September 2024, Genesys declared a strategic investment in Mexico to establish a local data center, integrating advanced Agentic AI solutions aimed at transforming business-customer engagement.

Competitive Landscape

The market research report covers a comprehensive competitive landscape analysis including market structure, key player positioning, winning strategies, competitive dashboards, and company evaluation quadrants. Detailed profiles of all major companies have been provided.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mexico Data Center Market Size to Hit USD 7,103.71 Million by 2033: Trends & Forecast here

News-ID: 4302528 • Views: …

More Releases from IMARC Group

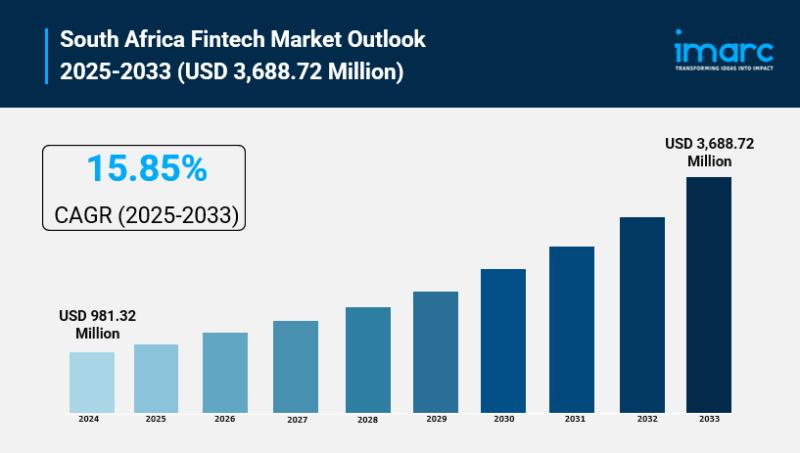

South Africa Fintech Market Size to Surpass USD 3,688.72 Million by 2033 | With …

South Africa Fintech Market Overview

Market Size in 2024: USD 981.32 Million

Market Size in 2033: USD 3,688.72 Million

Market Growth Rate 2025-2033: 15.85%

According to IMARC Group's latest research publication, "South Africa Fintech Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the South Africa fintech market size reached USD 981.32 Million in 2024. The market is projected to reach USD 3,688.72 Million by 2033, exhibiting a growth rate (CAGR) of 15.85%…

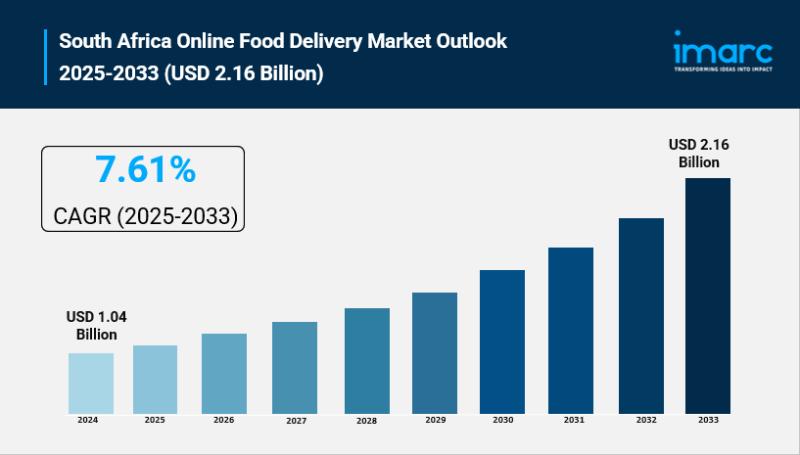

South Africa Online Food Delivery Market Size to Hit USD 2.16 Billion by 2033 | …

South Africa Online Food Delivery Market Overview

Market Size in 2024: USD 1.04 Billion

Market Size in 2033: USD 2.16 Billion

Market Growth Rate 2025-2033: 7.61%

According to IMARC Group's latest research publication, "South Africa Online Food Delivery Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the South Africa online food delivery market size reached USD 1.04 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.16 Billion…

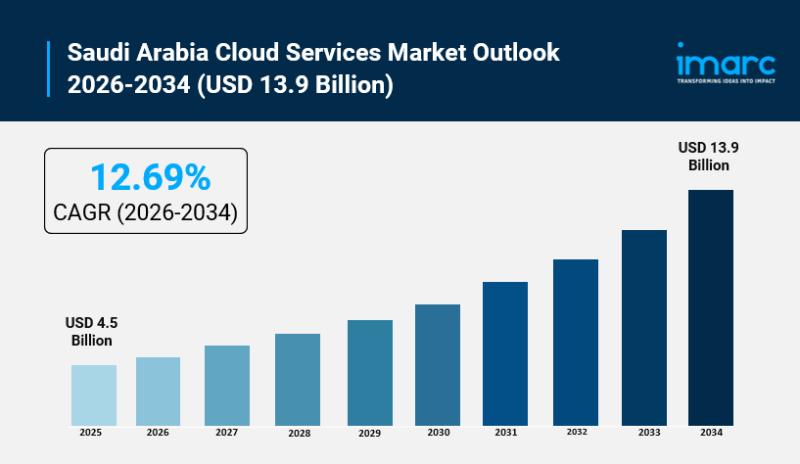

Saudi Arabia Cloud Services Market Poised for Explosive Growth to USD 13.9 Billi …

Saudi Arabia Cloud Services Market Overview

Market Size in 2025: USD 4.5 Billion

Market Forecast in 2034: USD 13.9 Billion

Market Growth Rate 2026-2034: 12.69%

According to IMARC Group's latest research publication, "Saudi Arabia Cloud Services Market Report by Deployment (Public Cloud, Private Cloud), End Use Industry (Oil, Gas, and Utilities, Government and Defense, Healthcare, Financial Services, Manufacturing and Construction, and Others), and Region 2026-2034", The Saudi Arabia cloud services market size reached USD…

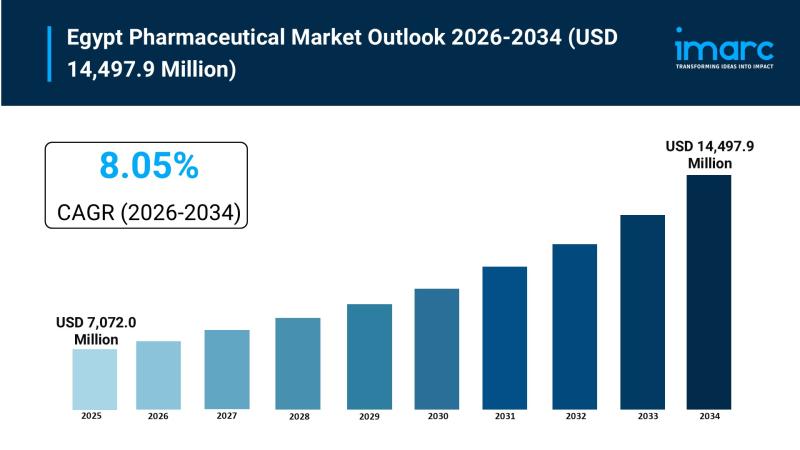

Egypt Pharmaceutical Market Size to Reach USD 14,497.9 Million by 2034 | With a …

Egypt Pharmaceutical Market Overview

Market Size in 2025: USD 7,072.0 Million

Market Size in 2034: USD 14,497.9 Million

Market Growth Rate 2026-2034: 8.05%

According to IMARC Group's latest research publication, "Egypt Pharmaceutical Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Egypt pharmaceutical market size reached USD 7,072.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 14,497.9 Million by 2034, exhibiting a growth rate (CAGR) of 8.05%…

More Releases for Mexico

Egg Freezing in Mexico: Leading Mexico City Clinics Launch 2026 Programs

Enlistalo Fertilidad offers expanded egg freezing services for international patients, including Americans, seeking fertility preservation.

Mexico City, Mexico - January 22, 2026 - Egg freezing is becoming an increasingly popular option for patients worldwide, and Mexico City continues to emerge as a leading destination for those seeking high-quality, affordable fertility care.

In 2026, Enlistalo Fertilidad stands out for its personalized approach, advanced medical standards, and focus on supporting international patients through every…

Human Resources Mexico Releases Employer Guide To Mexico 2026 Minimum Wage Compl …

Mexico's National Minimum Wage Commission (CONASAMI) has confirmed the new minimum wage levels that will take effect on January 1, 2026. The general daily minimum wage will increase to MXN [315.04], while the Northern Border Free Zone rate will rise to MXN [440.87] for 2026.

Image: https://www.globalnewslines.com/uploads/2025/12/d53f76670eba46736b7e94c6a16fb975.jpg

The adjustment reflects an estimated 13 percent increase for the general zone and about 5 percent for the Northern Border Free Zone compared to 2025.…

Mexico Rooftop Solar Market Research Report Segmented by Applications, Geography …

Mexico Rooftop Solar Market by Component, Application, Services, and Region- Forecast to 2025

The Global Mexico Rooftop Solar Market Research Report 2021-2025 published by Market Insights Reports is a significant source of keen information for business specialists. It furnishes the Mexico Rooftop Solar business outline with development investigation and historical and futuristic cost analysis, income, demand, and supply information (upcoming identifiers). The research analysts give a detailed depiction of the Mexico…

Mexico Rooftop Solar Market Research Report Segmented by Applications, Geography …

Mexico Rooftop Solar Market by Component, Application, Services, and Region- Forecast to 2025

The Global Mexico Rooftop Solar Market Research Report 2021-2025 published by MarketInsightsReports is a significant source of keen information for business specialists. It furnishes the Mexico Rooftop Solar business outline with development investigation and historical and futuristic cost analysis, income, demand, and supply information (upcoming identifiers). The research analysts give a detailed depiction of the Mexico Rooftop Solar…

The Mexico Online On-demand Home Services Market , Major Keyplayers - Aliada Inc …

Mexico Online On-demand Home Services Market 2021

Mexico online on-demand home services market offer a range of services within the comfort of home as well as save time and money. Additionally, these services help in bridging the gap between the real-world services and instant online services with improved efficiency. Recently, the demand for Mexico online on-demand home services marekt has started witnessing huge growth due to convenience and accessibility. The growing…

Mexico Agriculture Market, Mexico Agriculture Industry, Mexico Agriculture Grain …

Mexico Agriculture has been crucial sector of the country’s economy traditionally and politically even if it currently accounts for a really little share of Mexico’s GDP. Mexico is one in all the cradles of agriculture with the Mesoamericans emerging domesticated plants like maize, beans, tomatoes, squash, cotton, vanilla, avocados, cacao, number sorts of spices, and more. Domestic turkeys and Muscovy ducks were the solely domesticated fowl within the pre-Hispanic amount and little dogs…