Press release

Future of the Creator Economy Insurance Market: Key Innovations and Long-Term Forecasts Through 2034

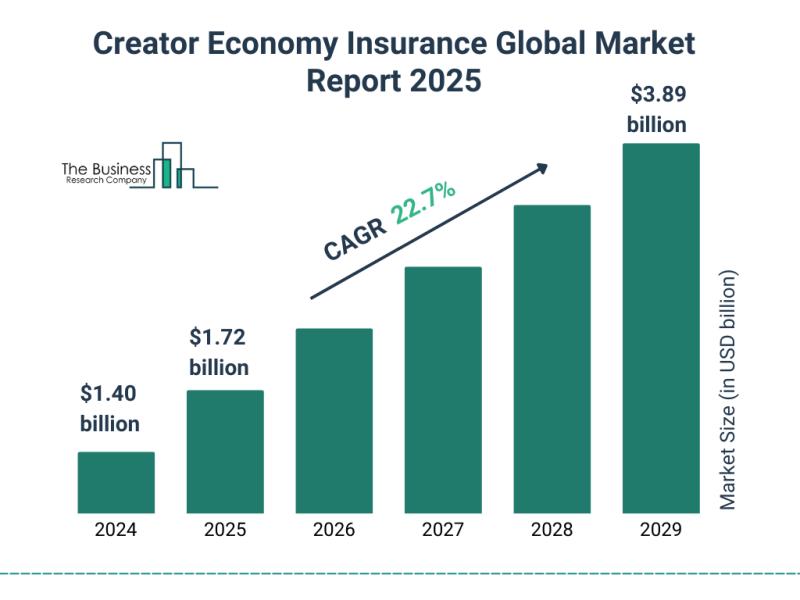

What Market Value Will the Creator Economy Insurance Industry Achieve by 2025?Exponential expansion characterizes the recent trajectory of the creator economy insurance sector, which is projected to increase from a value of $1.40 billion in 2024 to $1.72 billion in 2025, reflecting a compound annual growth rate (CAGR) of 23.0%. This historical upswing is largely fueled by the expanding cohort of self-employed professionals, the greater consumption of digital content, the growing trend of deriving income from social media, the proliferation of digital arenas, coupled with a heightened need for tailored insurance offerings.

What Is the Expected Creator Economy Insurance Market Value by 2029?

Exponential expansion is anticipated for the insurance market catering to the creator economy over the forthcoming years, with projections indicating it will reach a substantial 3.89 billion US dollars by the year 2029, spurred by a compound annual growth rate (CAGR) of 22.7%. This significant upswing during the projection timeframe is fundamentally driven by the increasing number of individuals dedicating themselves full-time to content creation, escalating expenditures in influencer marketing efforts, broader acceptance of digital transaction mechanisms, the proliferation of tools enabling creators to generate revenue, and a heightened recognition among content creators regarding the perils inherent in their profession. Key movements shaping this market presently and into the future encompass progress in insurtech solutions, novel approaches in integrating insurance offerings, advancements in handling digital threats, ongoing studies into personalizing insurance policies, and the implementation of artificial intelligence for streamlining both the claims handling process and risk assessment for underwriting purposes.

Access the full Creator Economy Insurance Market report here:

https://www.thebusinessresearchcompany.com/report/creator-economy-insurance-global-market-report

What Key Drivers Are Powering the Creator Economy Insurance Market's Growth Momentum?

The expanding population of individuals making content creation their primary occupation is anticipated to boost the trajectory of the creator economy insurance sector in the period ahead. An individual classified as a full-time content creator allocates most of their professional time to developing and earning revenue from digital material, foregoing a traditional main occupation. This surge in people taking up content creation as their exclusive profession is fueled by better avenues for income generation and strengthened platform backing, transforming content production into a practical and enduring line of work. Insurance tailored for the creator economy offers crucial protection to these dedicated creators by mitigating unique perils like disputes over intellectual property, accountability stemming from material uploaded by their audience, and physical harm to their technical gear, allowing a larger pool of creators to function more formally and with bolstered fiscal confidence. To illustrate this trend, data from the Interactive Advertising Bureau (IAB), an American trade organization, showed that by April 2025, the US digital sector experienced an influx of approximately 1.5 million new positions during 2025, wherein creators represented the most substantial and rapidly ascending category, making up over ten percent of all full-time occupations reliant upon the internet. Consequently, this increasing count of full-time content creators serves as the primary impetus behind the market expansion for creator economy insurance.

Download your free Creator Economy Insurance Market sample now:

https://www.thebusinessresearchcompany.com/sample.aspx?id=29375&type=smp

Which Key Trends Are Poised to Redefine the Creator Economy Insurance Market by 2029?

Leading entities within the creator economy insurance sector are directing their efforts toward forging novel approaches, exemplified by insurance literacy fellowship schemes aimed at boosting general knowledge and involvement with insurance via educational outreach spearheaded by content creators. This type of fellowship represents a collaborative undertaking with digital influencers designed to demystify intricate insurance principles and advance fiscal consciousness across wider demographics. Specifically, in August of 2025, Heirs Insurance Group, an insurance firm rooted in Nigeria operating as a division of Heirs Holdings, introduced the Heirs Insurance Creators Fellowship; this program enlists specific influencers to convey information regarding insurance and financial proficiency through engaging, contextually appropriate digital storytelling methods. Such a move signals a groundbreaking attempt to connect the insurance business more effectively with younger demographics active online, thereby cultivating increased confidence, recognition, and broader participation within the insurance framework.

Which Emerging Segments Are Shaping the Future of the Creator Economy Insurance Market?

The creator economy insurance market covered in this report is segmented -

1) By Insurance Type: Health Insurance, Liability Insurance, Income Protection, Intellectual Property Insurance, Equipment Insurance, Other Insurance types

2) By Coverage: Individual Creators, Agencies, Platforms, Other Coverages

3) By Distribution Channel: Direct, Brokers Or Agents, Online Platforms, Other Distribution Channels

4) By End-User: Content Creators, Influencers, Streamers, Podcasters, Other End Users

Subsegments:

1) By Health Insurance: Medical Expense Coverage, Mental Health Coverage, Pandemic And Infectious Disease Coverage, Preventive Care Coverage

2) By Liability Insurance: Professional Liability Coverage, Media Liability Coverage, Cyber Liability Coverage, Public Liability Coverage

3) By Income Protection: Loss Of Income Coverage, Disability Income Coverage, Business Interruption Coverage, Short-Term Income Replacement

4) By Intellectual Property Insurance: Copyright Infringement Coverage, Trademark Infringement Coverage, Patent Infringement Coverage, Trade Secret Protection Coverage

5) By Equipment Insurance: Camera And Production Equipment Coverage, Studio Equipment Coverage, Electronic Devices Coverage, Portable Equipment Coverage

6) By Other Insurance Types: Event Cancellation Coverage, Travel Insurance Coverage, Property Damage Coverage, Reputation Management Coverage

Who Are the Leading Innovators and Market Shapers in the Creator Economy Insurance Market?

Major companies operating in the creator economy insurance market are Berkshire Hathaway (biBERK); Allianz; Zurich Insurance Group; Progressive; Chubb; Liberty Mutual; The Hartford; Markel Corporation; Nationwide; Hiscox; Thimble; AXA XL; Next Insurance; Beazley Group; Simply Business; Coterie Insurance; Insureon; Superscript; CoverWallet (Aon); PolicyBee; Embroker

What Are the Key Geographic Areas Fueling Growth in the Creator Economy Insurance Market?

North America was the largest region in the creator economy insurance market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the creator economy insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Purchase your detailed Creator Economy Insurance Market report now:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=29375

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.

Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/

Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email us at info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Future of the Creator Economy Insurance Market: Key Innovations and Long-Term Forecasts Through 2034 here

News-ID: 4302391 • Views: …

More Releases from The Business Research Company

Key Growth Factors, Market Segmentation, and Competitive Approaches Influencing …

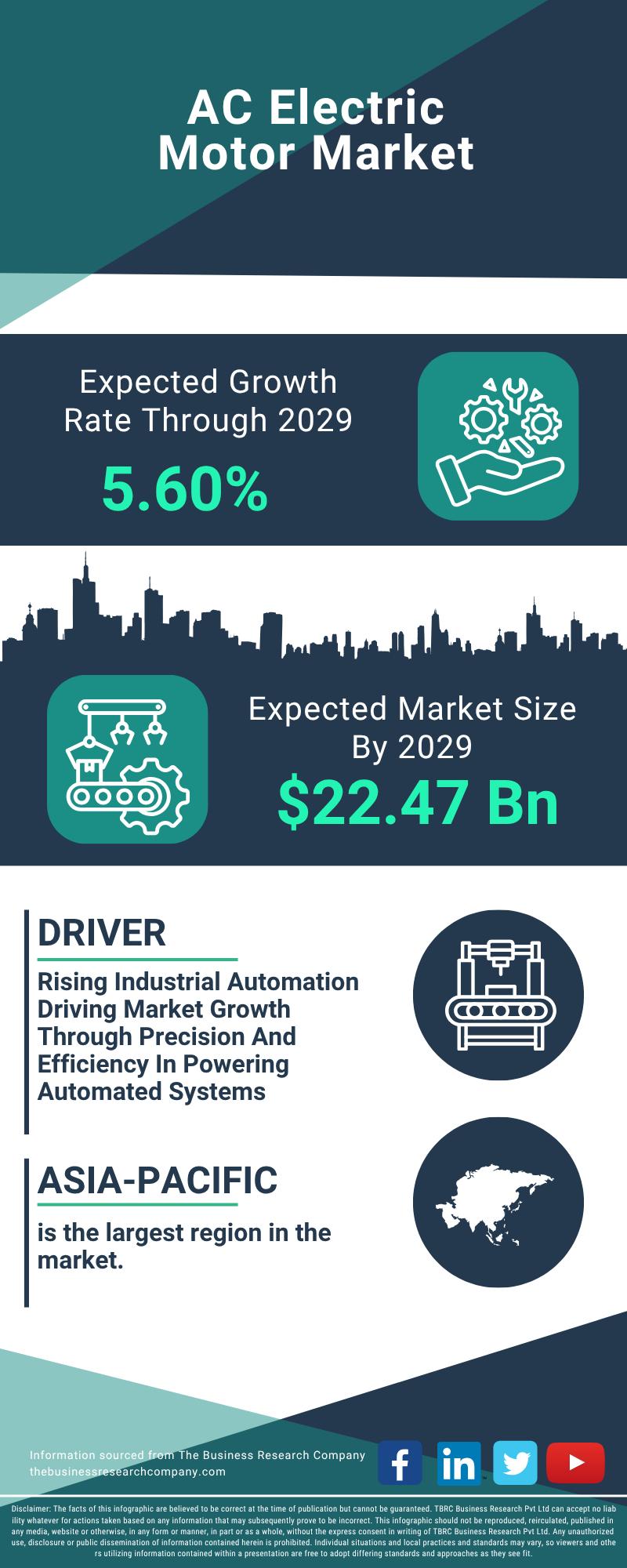

The AC electric motor market is poised for substantial growth in the coming years, driven by advancements in technology and evolving industrial needs. As industries adapt to modern demands like smart manufacturing and electric mobility, this sector is expected to expand significantly. Let's explore the market's size, key players, emerging trends, and the main segments shaping its future.

Forecasted Growth of the AC Electric Motor Market Size Through 2029

The…

Segment Evaluation and Major Growth Areas in the Semiconductor Capital Equipment …

The semiconductor capital equipment sector is set for substantial growth in the coming years, driven by technological advancements and increasing demand across various industries. This market reflects the dynamic nature of semiconductor manufacturing, where innovations and shifting industry needs play a pivotal role. Let's explore the current market valuation, key players, emerging trends, and segment-specific insights shaping the future of this industry.

Projected Market Growth of the Semiconductor Capital Equipment Market…

Worldwide Trends Review: The Fast-Paced Development of the Hollow Fiber Filtrati …

The hollow fiber filtration market is poised for impressive expansion over the coming years, driven by evolving healthcare needs and technological advancements. This sector is set to experience significant shifts that will shape its future landscape, fueled by innovation and changing consumer preferences. Let's explore the current market valuation, key players, emerging trends, and segment breakdowns that define this growing industry.

Forecasted Market Valuation and Growth Trajectory of the Hollow Fiber…

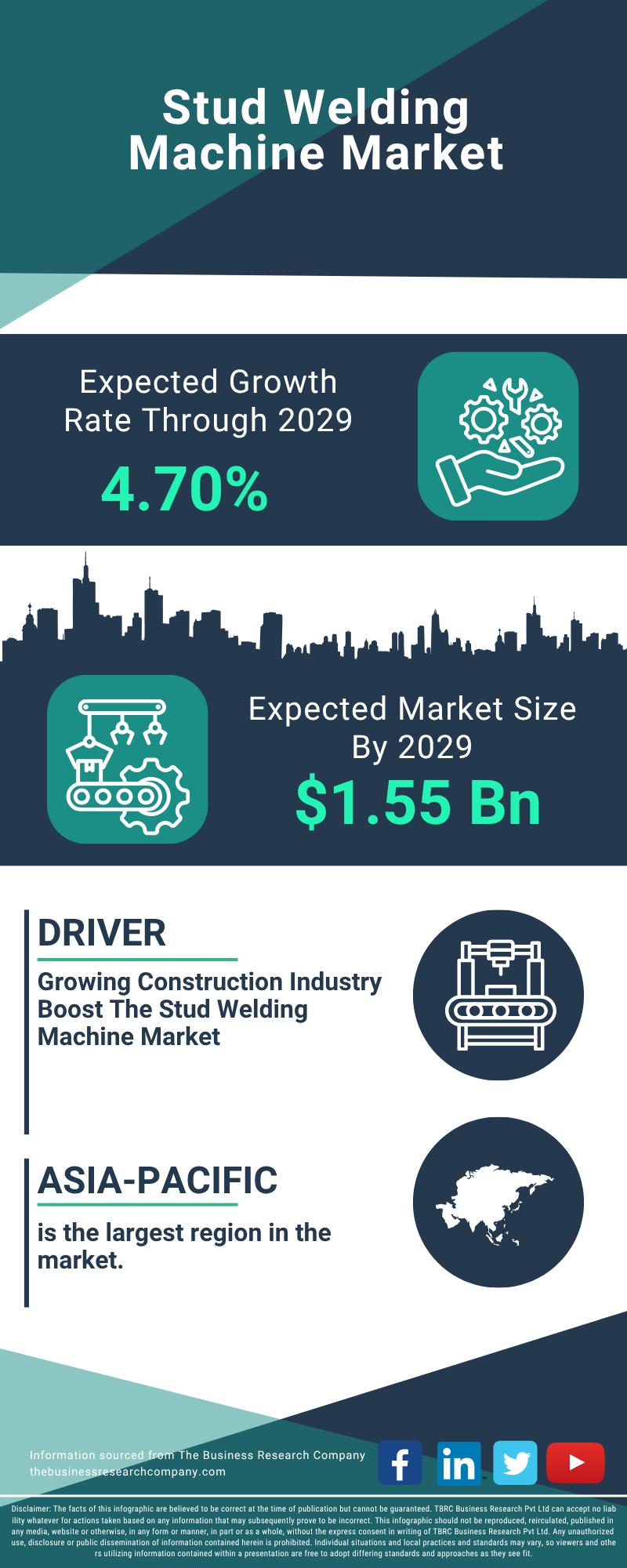

Emerging Sub-Segments Transforming the Stud Welding Machine Market Landscape

The stud welding machine market is positioned for steady growth over the coming years, driven by evolving industrial demands and technological advancements. As industries such as renewable energy, shipbuilding, and aerospace expand, the need for efficient and precise welding solutions is becoming increasingly critical. This overview delves into the market's valuation, key players, emerging trends, and segment insights shaping its trajectory.

Stud Welding Machine Market Valuation and Growth Outlook

The…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…