Press release

NFL Players' 2025 Salary Changes: How To Manage Taxes Effectively

The National Football League (NFL) is a lucrative industry, with players earning substantial salaries that place them in high tax brackets. As of 2025, the salary cap for NFL teams has increased to $279 million, according to Sports Illustrated and the NFL Players Association. This rise impacts player contracts and the overall financial landscape of the league. However, with great earnings come significant tax responsibilities. Understanding how to manage these tax obligations effectively is crucial for players looking to maximize their take-home pay.Understanding NFL Salaries in 2025

In 2025, the average salary for an NFL player is approximately $5.2 million, as reported by Sports Illustrated. For rookies entering the league, the minimum salary is set at $840,000. These figures highlight the substantial earnings potential in the NFL, but they also underscore the importance of strategic financial planning, especially with regard to taxes.

The financial potential in the NFL can be life-changing, but it comes with complexities that require careful management. For instance, players like Josh Allen, who signed a $250 million deal, find themselves exploring through some of the highest tax brackets. As such, the necessity for sophisticated tax planning becomes apparent. High-profile contracts such as Allen's not only attract media attention but also exemplify the critical need for players to protect their earnings through effective tax strategies.

Beyond the contracts themselves, players must consider the implications of performance incentives and bonuses, which are often tied to individual and team achievements. Such incentives can dramatically alter a player's financial situation within a season and must be anticipated in tax planning.

Tax Obligations for NFL Players

NFL players face a complex web of tax obligations due to their high incomes and the various states they work and play in. According to SmartAsset, top players can lose over 45% of their income to taxes. This includes federal and state taxes and the so-called "jock tax," which requires athletes to pay taxes in every state where they play games.

The "jock tax" is a particularly onerous aspect of a player's tax burden. Originating in California in the early 1990s, this tax targets income earned by athletes and entertainers in states where they perform. A player might play 16 games in a season, each in a different state, with varying tax implications. For example, if a player from a team based in a state with no income tax, such as Florida or Texas, plays a game in California, he must pay California income taxes for that game's income. This complex tax structure makes it essential for players to work with knowledgeable tax advisors who understand these nuances. Advisors can help explore these challenges by ensuring compliance and finding opportunities for tax savings.

Federal Tax Considerations

The Tax Cuts and Jobs Act (TCJA) introduced several changes that continue to affect professional athletes. According to CLA Connect, despite initial reductions in federal income tax rates, many athletes ended up paying more due to eliminated deductions. For instance, agent fees, which often amount to significant sums, are no longer deductible. This change can diminish any perceived tax savings from lower rates.

The elimination of itemized deductions for miscellaneous expenses, such as agent fees and training costs, has had a profound impact. Players who rely on agents to negotiate contracts and secure endorsements must absorb these costs without the benefit of tax deductions, which can amount to hundreds of thousands of dollars annually.

Furthermore, the TCJA's sunset provisions are set to expire at the end of 2025, potentially leading to a return of higher rates if new legislation isn't passed. It's crucial for players and their advisors to stay informed about these potential changes and plan accordingly. The possibility of reverting to pre-2018 tax rates means players could face increased liabilities, making proactive planning more important than ever.

State Tax Implications

State taxes vary widely across the United States, affecting how much an NFL player ultimately takes home. According to SmartAsset, relocating to or playing for teams in states without income taxes can save players significant amounts. However, it's not just about where they live; it's also about where they play. Players need to account for all states in which they earn income throughout the season.

The variance in state tax rates can lead to strategic decisions about team selection and contract negotiation. Some states have higher marginal tax rates than others. For example, California's top rate is 13.3%, while Florida does not impose a state income tax. This disparity can result in substantial differences in net income depending on team location and game schedules. Players might consider the tax implications as part of their decision-making process when entering free agency or negotiating contract extensions.

Moreover, tax residency rules can be complicated, with states employing different criteria to determine residency status. A player's primary residence, length of stay, and even where their family lives can influence their tax liabilities. Understanding these rules and structuring their lives accordingly can help players minimize their tax burden.

Managing Endorsement and Investment Income

Beyond salaries, NFL players often earn additional income through endorsements and investments. According to a report from February 2025 titled "The NFL Tax Playbook," these earnings are typically categorized as 1099 income or dividends and interest. This type of income comes with its own set of tax implications.

Players must be strategic about how they handle endorsement deals and investments. Structuring endorsement contracts effectively can help manage taxes more efficiently. For instance, endorsements that pay in the form of stock options or deferred payments can offer tax advantages by spreading income over several years.

Additionally, by deferring investment income or utilizing tax-advantaged accounts, players can potentially reduce their taxable income. Utilizing retirement accounts like IRAs or other investment vehicles can offer tax benefits. For example, contributions to a Roth IRA are made with after-tax dollars, but qualified withdrawals are tax-free, providing a potential tax-efficient income stream during retirement.

Investing in municipal bonds, which are often exempt from federal taxes and sometimes state taxes, is another strategy that can provide tax-free income. Players can also consider investing in opportunity zones, which offer tax incentives for long-term investments in economically distressed communities.

Practical Tax Management Strategies

Effective tax management involves more than just understanding obligations; it requires proactive strategies. While relocating to a low-tax state is one option, there are other methods players can employ to optimize their tax situations.

1. Income Timing: Players might consider deferring some income until retirement when they may fall into lower tax brackets. By negotiating contracts that include deferred payments, players can manage their current tax burden and provide future financial security.

2. Charitable Contributions: Making charitable donations can provide significant deductions that reduce taxable income. Players can set up charitable foundations to manage their donations, allowing them to support causes they care about while receiving tax benefits.

3. Investment Strategies: Utilizing retirement accounts like IRAs or other investment vehicles can offer tax benefits. In addition to IRAs, players might explore health savings accounts (HSAs), which provide tax-free savings for medical expenses.

4. Professional Advice: Working with financial advisors who specialize in athlete finances can ensure compliance and optimization. These advisors understand the unique financial and tax challenges athletes face and can tailor strategies to each player's situation.

Using Technology for Financial Management

In today's digital age, technology plays a crucial role in managing finances effectively. Tools such as a mileage tracking app [https://www.everlance.com/automatic-mileage-tracking] can assist players in documenting travel expenses accurately and efficiently. While primarily used by businesses and freelancers for tracking miles driven for work purposes, such apps can also benefit athletes by helping them track expenses related to games played away from home.

Additionally, financial management apps can help players track their income, expenses, and investments in real-time. These tools can provide insights into spending habits and help players make informed decisions about their finances. By automating aspects of financial management, players can ensure accuracy and save time, allowing them to focus on their careers and personal lives.

The Impact of Salary Cap Changes

The increase in the NFL salary cap to $279 million per team has broader implications beyond simple player earnings. Teams have more flexibility in structuring contracts, which can affect how much players ultimately earn after taxes.

For example, teams might offer signing bonuses instead of higher base salaries as a way to manage cap space while providing players with immediate cash flow. Bonuses are taxed differently than regular salaries and can sometimes be structured favorably from a tax perspective. The bonus structure can be advantageous for players if spread over several years, reducing the immediate tax impact and providing financial security.

Moreover, the increased salary cap allows for more competitive player compensation, potentially attracting top talent to teams willing to invest in their roster. However, players should be aware of how different contract structures might affect their overall tax picture and work with advisors to negotiate deals that align with their financial goals.

Conclusion

Navigating the financial landscape as an NFL player requires more than just understanding one's salary; it demands strategic tax management and planning. With salaries rising and complex tax obligations at both federal and state levels, players must adopt proactive strategies to manage their finances effectively.

By staying informed about tax laws, using technology for financial tracking, and working with experienced advisors, NFL players can optimize their earnings and reduce their tax burdens in 2025 and beyond. Understanding these dynamics is key for players looking to maximize their career earnings while ensuring compliance with all applicable tax regulations.

Media Contact

Company Name: Everlance

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=nfl-players-2025-salary-changes-how-to-manage-taxes-effectively]

Country: United States

Website: https://www.everlance.com

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release NFL Players' 2025 Salary Changes: How To Manage Taxes Effectively here

News-ID: 4301384 • Views: …

More Releases from ABNewswire

Prime Dumpster Expands Dumpster Rental Services for Dallas Construction Industry

Prime Dumpster is a leading facilitator of waste management services, offering dumpster rentals and comprehensive site services for construction projects, residential cleanouts, commercial facilities, and events. With a focus on customer satisfaction and tailored solutions, Prime Dumpster helps clients across the United States easily arrange the waste management services they need.

Dallas, TX - The Dallas-Fort Worth metroplex's explosive growth has prompted Prime Dumpster to significantly expand its roll-off container services,…

"One-Link Affiliate Marketing" Guide Published as Creators Seek Simpler, Tool-Li …

An OLSP Mega Link explainer has been released, with a focus on lifetime lead tracking, automated follow-up, and daily micro-action execution.

A new educational resource titled "OLSP Mega Link" has been published at QuickProfitFormulaX [https://www.quickprofitformulax.com/], with a simplified, one-link approach to affiliate promotion being highlighted as an alternative to funnel-stacking and tool overload.

The release has been framed around a growing demand for low-friction affiliate workflows, where a single primary link can…

Coast Seawall Dock & Boatlifts Celebrates 45 Plus Years of Protecting South Flor …

Family-Owned Marine Construction Company Ranks Among Top 1% of Florida Licensed Contractors.

Image: https://www.abnewswire.com/upload/2026/02/30d67c98dbce5bf224a70df57ef41cba.jpg

Jupiter, FL - Coast Seawall Dock & Boatlifts [https://www.coastseawall.com], one of South Florida's premier marine construction companies, proudly marks more than 45 years of excellence in protecting and enhancing the region's waterfront properties. Founded in 1979 by Mike Duncan as Duncan Seawall, the company has grown into a full-service coastal and marine construction firm while maintaining its commitment…

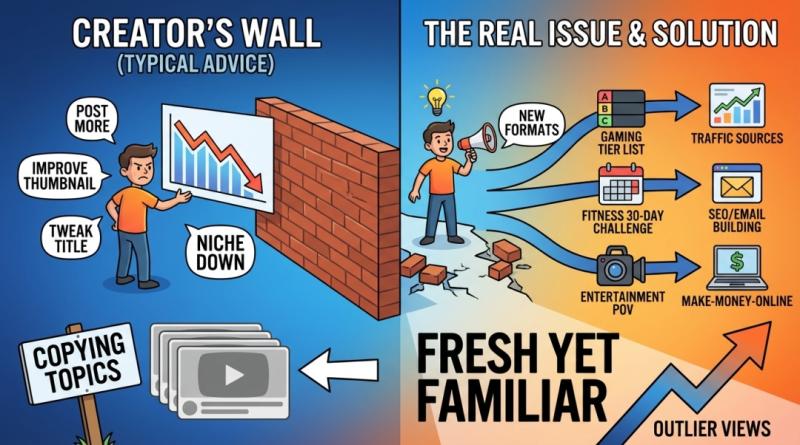

Faceless Channel Automation Giveaway Announced as "Nichebending" Gains Momentum …

Faceless Channel Automation Giveaway Announced as "Nichebending" Gains Momentum in the Post-AI Content Era-Systemized workflows and niche-selection guidance are being provided to help creators build policy-safe, repeatable YouTube growth without on-camera presence

A new Faceless Channel Automations Giveaway [https://www.quickprofitformulax.com/free-faceless-channel-automation/] has been announced to support creators seeking scalable, non-personal-brand YouTube growth as platform standards tighten and low-quality AI content is increasingly filtered. The giveaway is being positioned around "nichebending"-a strategy where proven…

More Releases for NFL

Nitrogen Sports' NFL Survivor Pool

Everything is a culmination of a string of decisions. Making decisions is a big part of competing in an NFL Survivor Pool, where there’s no room for mistakes. That doesn’t mean it’s difficult, though. In fact, it’s one of the easiest off-the-field football-related contests that anyone can join.

We’re not trying to be profound here. We’re just merely laying out the groundwork of this piece, which aims to introduce what…

New NFL partnership ahead of 100th season announced

International luxury leather brand Maxwell-Scott has entered into an exciting collaboration with Dallas Cowboys’ Xavier Woods and Tampa Bay Buccaneers’ Kentrell Brice for this coming football season.

Throughout the 100th season of the NFL Maxwell-Scott will provide both players with luxury leather accessories to accompany their busy schedules, as well as offer an edit of the players’ favorite luggage bags and travel accessories. The players have chosen pieces that will…

Will 2011 Be The Year Without An NFL Season?

Diehard football fans shudder to think of it. Television executives are scrambling to develop contingency plans. College football players are holding their breath in agony. Could the 2011-2012 NFL football season come and go without a single game being played?

With 162 days remaining until Thursday night, September 8, the first game of the regular season is looking more and more in jeopardy with each passing day.

During negotiations in late February…

NFL Targeted in Lawsuit Over “Phantom” Super Bowl Seats

DALLAS – Two Green Bay Packers fans who were denied their dream of attending Sunday’s Super Bowl game even though they paid for tickets have filed a lawsuit in Dallas against the National Football League, The Dallas Cowboys, and Cowboys Stadium.

Dallas-based law firm Goldfarb Branham filed the suit on behalf of two Wisconsin residents who were sold tickets to seats that did not exist – “phantom” seats – sold by…

Thomson Sport Teams Up With NFL

Thomson Sport has signed a three-year sponsorship agreement to become Official Travel Partner of the NFL in the UK.

As well as offering official NFL travel packages to European fans, commencing with Super Bowl XLV in North Texas on 6 February 2011, Thomson Sport will have comprehensive sponsorship rights relating to the NFL’s marks and key events such as the International Series at Wembley and the Super Bowl. In addition,…

Update: DTLR and NFL Players Host FREE Football Camp

Professional football players, Ovie Mughelli, Chauncey Davis and Daniel Wilcox, along with local student-athletes between age 12 and rising seniors (entering their senior year of high school later this summer).

What:

Local urban retailer DTLR (Downtown Locker Room) has organized a FREE one-day football camp to meet the unique needs of Atlanta-area high school athletes who are preparing for college football. As part of DTLR’s ongoing community outreach in the Atlanta area,…