Press release

Inside a USD 1.9 Billion Market: How Continuous Metabolite Monitor Patches Are Reshaping Global and ASEAN Diagnostics

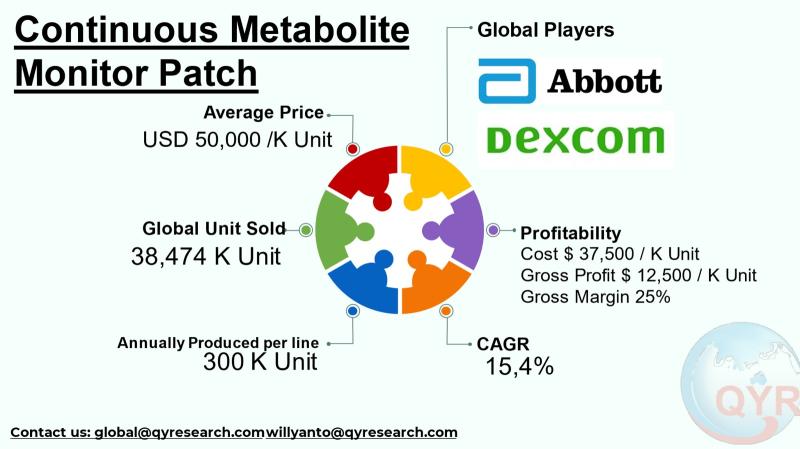

The continuous metabolite monitor patch industry sits at the intersection of wearable biosensors, point-of-care diagnostics, and connected health platforms. These patches measure metabolites (for example glucose, lactate and other small molecules) continuously or semi-continuously from interstitial fluid or sweat, enabling clinicians, athletes, and consumers to monitor metabolic state in real time without repeated invasive blood draws. The technologys appeal is driven by demand for better chronic disease management, precision lifestyle medicine, clinical-trial monitoring, and new applications in sports performance and critical-care monitoring. Recent advances in microfluidics, electrochemical sensing, enzyme stabilization, and low-power electronics have turned the patch format from a lab demonstration into an increasingly commercial product category. (Background and scientific reviews: Frontiers review on wearable lactate monitoring; historical/regulatory coverage for glucose patch devices).The global continuous metabolite monitor patch market size in 2024 is USD 1,924 million and a projected compound annual growth rate of 15.4% through 2031, reaching market size USD 5,243 million by 2031. With an average selling price of USD 50,000 per K unit, the implied total units sold globally in 2024 are approximately 38,474 K units. Applying a factory gross margin of 25% produces a cost-of-goods-sold per unit of USD 37,500 and a factory gross profit per unit of USD 12,500. A COGS breakdown is materials and consumables (raw sensing chemistries and substrates), electronics and precision components, assembly and labor, quality control and calibration, and packaging/shipping/other. A single line full machine production capacity is around 300 K unit per line per year. Downstream demand is dominated with diabetes followed by sports performance and research development. Sweat lactate patch is used in field testing to monitor anaerobic threshold and training load in sports.

Latest Trends and Technological Developments

The last 1836 months show rapid movement on several fronts: multi-analyte and lab-on-a-patch platforms have advanced from proof-of-concept to clinical trials and early commercial planning. For example, news about Nutromics lab-on-a-patch program and its funding rounds and planned ICU trials (reported with coverage that includes plans for clinical research and manufacturing scale-up) highlights the shift toward patches capable of monitoring multiple biomarkers beyond glucose (reported September 2025). Research publications and conference papers during 20232025 described battery-free and highly miniaturized sweat- and interstitial-fluid lactate sensors and improved enzyme stabilization for multi-day wear (Frontiers review, 2024; ACS/ScienceDirect sensor papers 20232025). There has been renewed commercial focus on non-invasive and needle-free sensors: Nemauras SugarBEAT (CE marked) and a wave of startups (Biolinq, Biolinq financing / de-novo approvals in 2024 to 2025 reporting cycles) show both regulatory progress and investor interest. Clinical/diabetes technology trackers also reported growing interest in continuous monitoring as a complementary capability to CGMs (reported December 2024). Taken together, the most important short-term trendlines are (1) movement from single-analyte glucose patches to multi-analyte platforms, (2) active rounds of VC financing and regulatory filings that accelerate commercialization, and (3) stronger integration with telehealth and data analytics platforms. Sources for these items include market reports, peer-reviewed wearable-sensor reviews, and industry press on Nutromics and Biolinq.

St. Jude Children's Research Hospital purchases a bulk order of DexCom G7 Professional Continuous Glucose Monitoring (CGM) patches from DexCom, Inc. for its pediatric endocrinology study, amounting to USD 450 per starter kit (sensor and transmitter), with a total contract value of USD 112,500 for 250 units.

The Mayo Clinic's Department of Endocrinology installs and utilizes Abbott Freestyle Libre 3 sensor patches in a large-scale remote patient monitoring program for individuals with Type 2 diabetes. The initiative, covering 1,200 patients over a six-month period, uses sensors at a cost of USD 120 per patch per month, resulting in a total program expenditure of USD 864,000 for the monitoring period. The data is integrated into the clinic's digital health platform to enable real-time therapeutic adjustments by care teams.

Asia shows a combination of large patient populations (diabetes, metabolic disease), rapidly growing middle-class healthcare spending, and ambitious local manufacturing initiatives that together provide a receptive environment for continuous metabolite patches. Regulatory pathways in parts of Asia are becoming more active for wearable diagnostics: European CE-marked devices have frequently entered APAC markets via regional approvals and distributors, and local startups and research groups across China, South Korea, Japan, India, and Southeast Asia are advancing sweat- and interstitial-fluid sensing research. Chinas larger medtech players and electronics supply chain strengths create opportunities for scale manufacturing of patch electronics and microfluidics, while regulatory frameworks in countries such as Singapore and South Korea encourage pilot deployments and digital-health integration. Asias healthcare systems (from high-end private care to large public-charged systems) create both premium and volume pathways; premium systems buy advanced multi-analyte patches for hospital and chronic-care settings, while volume pathways (e.g., diabetes management programs) can absorb high numbers of single-analyte devices once price and reimbursement allow. Industry and market research publishers point to Asia as a high-growth region for wearable-patch adoption, supported by electronic component ecosystems and rising telehealth adoption.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5516831

Continuous Metabolite Monitor Patch by Type:

Glucose Monitoring Patch

Lactate Monitoring Patch

Multi Metabolite Monitoring Patch

Others

Continuous Metabolite Monitor Patch by Product Category:

Microbeedle ISF Patches

Sweat Based Noninvasive Patches

Optical Patches

Others

Continuous Metabolite Monitor Patch by Market Segment:

Disc Patch

Strip Patch

Array Patch

Others

Continuous Metabolite Monitor Patch by Material:

Medical Grade Silicone Adhesives

Hydrogel Sensor Interfaces

Conductive Polymer Films

Microfluidic Polymer Substrates

Others

Continuous Metabolite Monitor Patch by Feature:

Real Time Metabolite Tracking

NFC Wireless Connectivity

Rechargeable or Disposable

Others

Continuous Metabolite Monitor Patch by Application:

Hospital and Clinics

Home Care Settings

Sport and Fitness Center

Research Industries

Others

Global Top 20 Key Companies in the Continuous Metabolite Monitor Patch Market

Abbot Laboratories

Dexcom Inc

Nutromics Pty.Ltd

Ascensia Diabetese Care Holdings AG

LifeScan IP Holdings LLC

Profusa Inc

Biolinq Inc

Texas Instruments Inc

Roche Diabetese Care Inc

Afon Technology Ltd

iSense Inc

DiaMonTech AG

Medtrum Technologies Inc

PercuSense Inc

Gentag Inc

Nemaura

SibioSensor

Valencell

Huzhou Meiqi Medical Instruments Co., Ltd.

San Meditech

Regional Insights

Within Southeast Asia (ASEAN), adoption and commercialization are heterogeneous but show clear momentum. Singapore and Malaysia often lead with clinical pilots and digital-health integration, Indonesia and the Philippines represent very large potential patient pools and expanding private healthcare demand, and Vietnam and Thailand are improving regulatory and manufacturing capability for medtech. Indonesia, specifically, combines a large population with accelerating smartphone penetration and expanding private healthcare providers; that makes it an attractive market for subscription-driven remote monitoring services and pilot partnerships with hospital networks or managed-care providers. However, price sensitivity and reimbursement uncertainty in many ASEAN markets mean that premium-priced Kunits (USD 50,000 per unit pricing profile) will likely target hospitals, research centers, and specialty clinics initially; broader consumer or public-program adoption would require lower-cost product variants or leasing/subscription models. Regional market reports and wearable-patch analyses identify Southeast Asia as a near-term growth hotspot for pilot deployments and an important locale for manufacturing partnerships due to lower labor costs and growing medtech clusters.

Key challenges persist: regulatory clearance for multi-analyte devices is more complex than single-analyte CGMs because clinical validation must demonstrate each biomarkers accuracy and clinical utility; manufacturing repeatability and long-term enzyme/stability of biochemical sensing layers remain technical hurdles; cost reduction to reach broader consumer markets is nontrivial given precision electronics and bioactive consumables; and reimbursement pathways for novel continuous metabolite metrics (e.g., continuous monitoring) are not yet standardized. Data privacy and integration with health records is an operational challenge for companies pursuing clinical adoption. Finally, competition from established CGM incumbents (Abbott, Dexcom, Medtronic) and from regionally strong OEMs can make commercial channel access and payer negotiations demanding for newer entrants. Industry analyses and technology reviews emphasize that while the technology is promising, many devices still require extensive clinical evidence and regulatory clarity to reach mass clinical adoption.

Companies should prioritize building rigorous clinical evidence for each metabolite claimed, structure consumable economics (patch + transmitter models, subscription services) to improve lifetime-value, and pursue manufacturing partnerships in Asia to exploit scale economies and supply-chain proximity. Piloting in hospital systems and research centers in Asia and ASEAN can accelerate validation while offering proof points for regional payers. Strategic licensing or distribution deals with regional medtech incumbents can shorten time-to-market. For investors, staged capital deployment that ties financing tranches to regulatory milestones (CE, FDA de-novo/510(k) steps) and to manufacturing scale targets can limit risk while allowing participation in upside from multi-analyte platforms. Recent fundraising and regulatory milestones in companies such as Biolinq and multiple startup funding rounds demonstrate investor appetite for differentiated wearable biosensor platforms.

Product Models

Continuous metabolite monitor patches are skin-applied wearable sensors designed to continuously track key biochemical markers in real time.

Glucose Monitoring Patch is a wearable continuous glucose monitoring (CGM) sensor patch that measures interstitial glucose levels in real time, commonly used for diabetes management and metabolic tracking. Notable products include:

FreeStyle Libre 3 Abbott: A popular CGM patch offering 14-day continuous glucose readings with smartphone connectivity.

Dexcom G7 Dexcom: A compact CGM patch providing real-time glucose alerts and integration with health apps and smartwatches.

Medtronic Guardian Sensor 3 Medtronic: A glucose patch designed for closed-loop insulin pump systems with predictive alerts.

GlucoMen Day CGM A. Menarini Diagnostics: A 14-day CGM system using a minimally invasive patch sensor.

SugarBEAT CGM Patch Nemaura Medical: A non-invasive daily patch measuring glucose through skin-surface osmotic extraction

Lactate Monitoring Patch is a wearable sensor patch designed to continuously monitor lactate levels, mainly used in athletic performance tracking, fatigue analysis, and early detection of metabolic stress. Notable products include:

LactiScan Athlete Patch Lattice Medical Sensors: A microneedle-based lactate patch for metabolic fatigue prediction.

BioLac Continuous Patch Biosensics: A wearable research-grade lactate sensor for physiological studies.

LactoGuard Performance Patch Beurer Sports Lab: A consumer fitness patch enabling workout intensity tracking.

SweatLac MicroPatch Eccrine Systems: A sweat-based continuous lactate sensor for clinical and sports research.

LactoOne SportWear Patch Suzhou HealthTech (China): A lactate-monitoring patch designed for competitive sports training.

Monitoring Patch is a continuous level sensing patch used to track, detect early acidosis risk, or monitor low-carb diet adherence. Notable products include: Metabolic Patch Biosensics: A research patch tracking fluctuations for clinical studies.

KetaCheck SmartPatch Huma Health: A patch concept integrated with AI metabolic analysis.

SiBio KS1 Continuous Sensor - SiBio Technology: a wearable electrochemical sensor system designed for real-time tracking and user notifications.

Multi-Metabolite Monitoring Patch is an advanced wearable patch capable of measuring two or more metabolites simultaneously for a more comprehensive metabolic profile. Notable products include:

MultiFlux Metabolic Patch Epicore Biosystems: A sweat-analysis patch monitoring electrolytes + lactate + glucose.

Metabolite Fusion Patch Nemaura Medical: A multi-sensor wearable for glucose, and hydration biometrics.

MetaboFlow Insight Patch Eccrine Systems: A sweat-based multi-metabolite monitoring patch for sports analytics.

Biowear Dual Sensor (Glucose - Abbott: an announced biowearable that aims to continuously measure glucose levels from a single sensor platform.

Biolinq Multi-Function Patch (multi-analyte) - Biolinq: a microneedle-based biosensor platform being developed toward multi-marker metabolic health monitoring

The continuous metabolite monitor patch market is transitioning from promising demonstrations to an early commercial era characterized by focused clinical pilots, targeted regional rollouts, and rapid technology maturation. The market size you provided for 2024 (USD 1,924 million) together with the CAGR you specified (15.4% to 2031) positions this sector as a high-growth, high-value corner of the broader wearable-health economy. The most attractive near-term opportunities lie in clinical and specialty uses (hospital monitoring, diabetes management, clinical trials) and in partnerships that can both validate clinical benefit and provide manufacturing scale. Asia and ASEAN stand out as strategic geographies for both demand and manufacturing partnerships, but price sensitivity and regulatory variability mean that market entry strategies must be localized. Continued technical progress toward reliable multi-analyte sensing, stable consumables, and lower unit cost will unlock much broader consumer and public-health adoption over the next five to seven years.

Investor Analysis

What investors should focus on: regulatory milestones (CE, FDA de-novo or PMA decisions) and clinical trial endpoints for each claimed analyte; validated manufacturing capacity and unit economics that enable acceptable margins at scale; and strategic partnerships for distribution and reimbursement in Asia & ASEAN. How to use this report: use the market size/CAGR framing and the unit economics example (price, COGS per unit, gross profit per unit) to model revenues, gross margins, and break-even manufacturing scale; prioritize investments into companies that show a clear pathway from clinical validation to repeatable manufacturing and recurring-revenue consumable models. Why its important: this market combines high unit ASPs and subscription-friendly consumables (patch + transmitter + data services), creating the potential for reliable recurring revenue streams once clinical and regulatory risk is mitigated. The Asia and ASEAN context is critical because manufacturing partnerships, supply-chain cost advantages, and very large patient populations can materially accelerate top-line growth and margin expansion. Recent funding rounds and regulatory headlines demonstrate investor interest but also show that successful exits will require clinical evidence and scalable manufacturing capacity.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5516831

5 Reasons to Buy This Report

Market sizing and growth framing that uses your 2024 base and a 15.4% CAGR to benchmark opportunity across geographies.

Unit-economics example (price per K unit, COGS per unit, factory gross profit per unit, gross margin) and an illustrative manufacturing-capacity assumption to support financial modeling.

Asia & ASEAN regional analysis to guide market-entry priorities.

Latest trends and dated news calls (multi-analyte patch advances, funding, and regulatory updates) so buyers can align with near-term catalysts.

A strategic action checklist for investors and companies (clinical validation, manufacturing partnerships, reimbursement pathways) that turns market signals into executable priorities.

5 Key Questions Answered

What is the current global market size and implied unit volumes at the price point provided?

How do unit economics (COGS, gross margin, factory gross profit per unit) shape manufacturing and pricing strategy?

Where in Asia and ASEAN are the best near-term commercial opportunities and why?

What recent technological/ regulatory developments materially change the competitive landscape and timing to market?

Who are the top industry players and what roles might incumbents, startups, and regional partners play in consolidation or technology adoption?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

Global Continuous Metabolite Monitor Patch Market Research Report 2025

https://www.qyresearch.com/reports/5516831/continuous-metabolite-monitor-patch

Continuous Metabolite Monitor Patch - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5516830/continuous-metabolite-monitor-patch

Global Continuous Metabolite Monitor Patch Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5516827/continuous-metabolite-monitor-patch

Global Continuous Metabolite Monitor Patch Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/5516824/continuous-metabolite-monitor-patch

Global Dynamic Glucose Monitoring Patch Market Research Report 2025

https://www.qyresearch.com/reports/4724637/dynamic-glucose-monitoring-patch

Global Smart Blood Glucose Monitoring Patch Market Research Report 2025

https://www.qyresearch.com/reports/4349833/smart-blood-glucose-monitoring-patch

Global Monitoring Patches Market Research Report 2025

https://www.qyresearch.com/reports/3989450/monitoring-patches

Global Heart Patch Monitor Market Research Report 2025

https://www.qyresearch.com/reports/3876057/heart-patch-monitor

Global Cardiac Patch Monitor Market Research Report 2025

https://www.qyresearch.com/reports/4613056/cardiac-patch-monitor

Global Patch-type ECG Monitor Market Research Report 2025

https://www.qyresearch.com/reports/4786854/patch-type-ecg-monitor

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Inside a USD 1.9 Billion Market: How Continuous Metabolite Monitor Patches Are Reshaping Global and ASEAN Diagnostics here

News-ID: 4301191 • Views: …

More Releases from QY Research

Top 30 Indonesian Rubber Public Companies - Q3 2025 Revenue & Performance

1) Overall companies' performance (Q3 2025 snapshot)

PT Gajah Tunggal Tbk

PT Multistrada Arah Sarana Tbk

PT Goodyear Indonesia Tbk

PT King Tire Indonesia

PT Indo Kordsa Tbk

PT Kirana Megatara Tbk

PT Bumi Serpong Damai Tbk

PT Adaro Energy Tbk

PT ACE Hardware Indonesia Tbk

PT Suryaraya Rubberindo Tbk

PT Dharma Polimetal Tbk

PT Selamat Sempurna Tbk

PT Indospring Tbk

PT Autopedia Sukses Lestari Tbk

PT Nipress Tbk

PT Prima Alloy Steel Universal Tbk

PT Anugerah Spareparts Sejahtera Tbk

PT Bintang Oto…

Smart Vacuum Grippers Reshape Industrial Handling Market Through 2032

Rubber suction cups are flexible vacuum-based gripping components used for temporary adhesion and handling across consumer, industrial, and automation applications

Widely applied in packaging lines, glass handling, automotive assembly, electronics pick-and-place, medical devices, and household accessories

Manufactured primarily from silicone rubber, EPDM, nitrile (NBR), natural rubber, and thermoplastic elastomers

Industry characterized by high-volume standardized parts combined with customized industrial vacuum grippers for robotics and smart factories

Demand closely linked to automation penetration, e-commerce packaging…

Renewable Plastic Packaging 2025: ASEAN Growth and 28% Margins Driving the Next …

Renewable plastic packaging refers to packaging materials produced from bio-based, compostable, or renewable feedstocks such as PLA, PHA, starch blends, bio-PE, and bio-PET.

Derived from corn, sugarcane, cassava, cellulose, and plant oils, replacing fossil-fuel plastics to reduce carbon footprint and landfill load.

Applications include:

Food & beverage flexible packs

Retail carry bags

Personal care bottles

E-commerce mailers

Agricultural films

Adoption driven by:

Government plastic taxes & EPR mandates

ESG commitments from FMCG brands

Consumer preference for biodegradable/low-carbon materials

Retailers banning single-use fossil…

From Plastic-Free to Premium: The Future of the Global Facial Wipes Industry

Facial wipes are disposable non-woven textile products pre-saturated with cleansing or skincare solutions used for makeup removal, hygiene, moisturizing, and antibacterial purposes

Widely adopted across personal care, travel, baby care, sports, hospital, and on-the-go convenience segments

Increasing penetration driven by busy lifestyles, urbanization, higher disposable income, and rising skincare awareness

Core buyers include mass retail, convenience stores, e-commerce, beauty chains, pharmacies, and hospitality sectors

Industry Explanation and Global Overview

Combines nonwoven fabric manufacturing (spunlace, airlaid)…

More Releases for Patch

The American Patch Launches Premium Custom Patch Solutions

The American Patch Redefines Custom Patch Solutions with Quality, Creativity, and Reliability

San Jose, CA - The American Patch, a leading provider of custom patch solutions in the United States, is proud to announce the expansion of its premium patch services. From embroidery and woven to PVC and printed designs, The American Patch is helping businesses, organizations, and individuals create high-quality custom patches that reflect their unique vision.

Known for its dedication…

Patch of Progress: Insulin Patch Pumps Market Overview 2024

The insulin patch pumps market size has grown rapidly in recent years. It will grow from $1.32 billion in 2023 to $1.46 billion in 2024 at a compound annual growth rate (CAGR) of 11.0%. The growth in the historic period can be attributed to increased diabetes prevalence, patient preference for non-invasive delivery, increased geriatric population, increased safety concerns, miniaturization and improved form factors.

The insulin patch pumps…

Kaydia Patch Reviews 2021? Is this Kaydia Patented Patch Legit Or Scam?

Kaydia Patch Review

Pain is an unpleasant sensation that indicates that something is amiss. It can be described as constant, throbbing, stabbing, aching, pinching, or in a variety of various ways. It can also be a minor annoyance, such as a mild headache. It can also be debilitating at times.

Other physical symptoms such as nausea, dizziness, weakness, or drowsiness can occur as a result of pain. Anger, melancholy, mood changes, and…

Nuubu Detox Patch Australia - "HOAX or HYPE" #No.1 Patch 2021!

Nubbu is a detox patch that is valuable in purging harmful products from the body. It's anything but's a blend of all standard and also community blends that enhances its reasonableness. Essentially, it's anything but's a substantial patch that accomplices in reducing the risky products from the foot of an individual. The synthesis of this patch is crucial in increasing the inconceivable sufficiency of the particular region. The makers of…

Feetox Foot Patch Reviews-Does Feetox Foot Patch Work-Complete Info

Feetox Foot Patch: Everyone desires to stay ill-unfastened. However, the myriad of ailments and frame pains we get alongside the way as we age makes it hard for lots, but it’s no longer absolutely unavoidable! http://claimspecialdiscount.site/Feetox-Foot-Patch

Unhealthy lifestyle, growing old, and hereditary elements could have some of bad results on our body. The key's to shield our blood circulatory device. Not only is it responsible for the transportation of blood and…

Luminas Energy Patch Reviews-Does Luminas Energy Patch Work-Complete Info

Luminas Energy Patch The days of people risking their lives with risky painkillers may also soon be over. Thanks to a leap forward in ache remedy technological know-how, a new patch is available that doesn't use harsh pills or reason any regarded side effects. Yet it’s already confirmed in loads of checks to alleviate ache within minutes and for up to 24 hours. *See Thermography Study. http://claimspecialdiscount.site/Luminas-Energy-Patch

What’s greater, unlike present…