Press release

Natural Gas Price Insights 2025: Key Trends Across Regions - Get Forecast Now

Natural Gas Price Trends Analysis in North America: 2025 Break DownNatural Gas Prices in United States:

The USA recorded USD 3.81/MMBtu for natural gas in last quarter 2025, supported by stable domestic output and stronger cooling demand during peak summer months. As highlighted in the Natural Gas Price Trend Report, modest LNG export growth also influenced pricing. Using Natural Gas Historical Price Analysis, market participants noted that prices remained relatively moderate, reflecting balanced supply, consistent storage levels, and healthy production across key shale regions.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/natural-gas-pricing-report/requestsample

Note: The analysis can be tailored to align with the customer's specific needs.

Natural Gas Price Trends Analysis in APAC: 2025 Break Down

Natural Gas Prices in China:

China's natural gas price averaged USD 2.72/MMBtu in last quarter 2025, shaped by steady industrial consumption and government-driven supply security measures. According to insights from the Natural Gas Price Trend Report, competitive LNG imports helped maintain affordability. Drawing on Natural Gas Historical Price Analysis, analysts observed stable trends with minimal volatility, supported by diversified energy sourcing, gradual demand recovery, and improved infrastructure reliability across major consumption hubs.

Regional Analysis: The price analysis can be extended to provide detailed natural gas price information for the following list of countries.

China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries.

Natural Gas Price Trends Analysis in MEA: 2025 Break Down

Natural Gas Prices in Saudi Arabia:

Saudi Arabia registered USD 2.75/MMBtu in last quarter 2025, underpinned by strong domestic output and controlled pricing aligned with national energy strategies. The Natural Gas Price Trend Report highlights that stable industrial activity ensured consistent demand throughout the quarter. Through Natural Gas Historical Price Analysis, experts note that the country's prices remain among the lowest globally, supported by abundant reserves, predictable supply conditions, and sustained government-backed cost management policies.

Regional Analysis: The price analysis can be extended to provide detailed natural gas price information for the following list of countries.

Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries.

Natural Gas Price Trends in Europe: 2025 Break Down

Caustic Soda Prices in Germany:

Germany's natural gas prices averaged USD 11.6/MMBtu in last quarter 2025, influenced by elevated import costs and ongoing adjustments in the European energy market. As noted in the Natural Gas Price Trend Report, reliance on diversified LNG supplies pushed prices higher. Based on Natural Gas Historical Price Analysis, analysts observed continued sensitivity to geopolitical dynamics, storage levels, and fluctuating renewable output, all contributing to Germany's comparatively higher price environment.

Regional Analysis: The price analysis can be expanded to include detailed natural gas price data for a wide range of European countries:

such as Germany, France, the United Kingdom, Italy, Spain, Russia, Turkey, the Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, the Czech Republic, Portugal, and Greece, along with other European nations.

Natural Gas Price Trends Analysis in APAC: 2025 Break Down

Natural Gas Prices in India:

India reported USD 4.70/MMBtu in last quarter 2025, reflecting improving industrial activity and rising demand from city gas distributors and fertilizer units. The Natural Gas Price Trend Report indicates that LNG import patterns and currency movements shaped price direction. Drawing on Natural Gas Historical Price Analysis, experts highlight consistent pricing fluctuations linked to monsoon-driven consumption shifts, evolving supply contracts, and broader regional energy market dynamics.

Regional Analysis: The price analysis can be extended to provide detailed natural gas price information for the following list of countries.

China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries.

Natural Gas Price Trend, Factors, Recent Changes, History, and Forecast - 2025

Natural gas prices in Q3 2025 showed varying levels across regions. Prices in the USA fell to around 3.81 USD/MMBtu in September due to mild weather reducing heating needs and steady shale gas production. China recorded prices near 2.72 USD/MMBtu with stable supply and slower consumption growth. Germany's prices eased to 11.6 USD/MMBtu amid lower industrial demand and strong pipeline imports. India experienced a slight rise to 4.70 USD/MMBtu due to higher industrial and power use.

Key Influencing Factors

• Weather Conditions: Mild temperatures in key regions lowered heating demand, leading to softer prices in some quarters.

• Supply Levels: Stable shale gas production in the USA and steady pipeline and LNG imports in Europe and Asia helped maintain supply balance.

• Storage Capacity: Higher than average storage levels eased price spikes by improving availability during demand changes.

• Industrial and Power Demand: Increases in power generation and industrial activity, especially in India, added some upward pressure.

• Transport and Infrastructure: Improvements in pipeline transport and gas processing facilities helped reduce bottlenecks and price volatility.

• Government Policies: Pricing policies and subsidies in the Middle East contributed to stable and competitive pricing.

• Currency Stability: Stable exchange rates minimized import cost fluctuations for several countries.

Recent Changes

• The USA saw price declines as mild weather reduced demand and storage remained ample.

• China's domestic supply and LNG imports balanced slower consumption increases, keeping prices soft.

• Germany and broader Europe benefited from energy efficiency and strong imports, easing prices despite geopolitical concerns.

• India's prices rose slightly due to ongoing industrial and energy needs amid government policy support.

• The Middle East maintained steady prices through production consistency and subsidized rates.

Historical Context

Prices fluctuated significantly in early 2025 responding to weather and supply shocks. Cold snaps led to short-term increases, while mild spells, storage buildups, and higher LNG arrivals tempered prices. Geopolitical factors like pipeline flow disruptions contributed to volatility in Europe.

Forecast

Natural gas prices are expected to show moderate variation through 2025 with influences from storage levels, demand shifts, and new LNG projects. The energy agency forecasts a gradual increase, with a projected average price near 3.79 USD/MMBtu for the full year 2025 and a rise to about 4.16 USD/MMBtu in 2026, driven by tightening supply-demand balances and expanding LNG exports.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=22409&flag=C

Key Coverage:

• Market Analysis

• Market Breakup by Region

• Demand Supply Analysis by Type

• Demand Supply Analysis by Application

• Demand Supply Analysis of Raw Materials

• Price Analysis

o Spot Prices by Major Ports

o Price Breakup

o Price Trends by Region

o Factors influencing the Price Trends

• Market Drivers, Restraints, and Opportunities

• Competitive Landscape

• Recent Developments

• Global Event Analysis

How IMARC Pricing Database Can Help

The latest IMARC Group study, Natural Gas Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2025 Edition, presents a detailed analysis of Natural Gas price trend, offering key insights into global Natural Gas market dynamics. This report includes comprehensive price charts, which trace historical data and highlights major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines Natural Gas demand, illustrating how consumer behaviour and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the prices report uncovers critical factors influencing current and future prices.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC's data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Natural Gas Price Insights 2025: Key Trends Across Regions - Get Forecast Now here

News-ID: 4300288 • Views: …

More Releases from IMARC Group

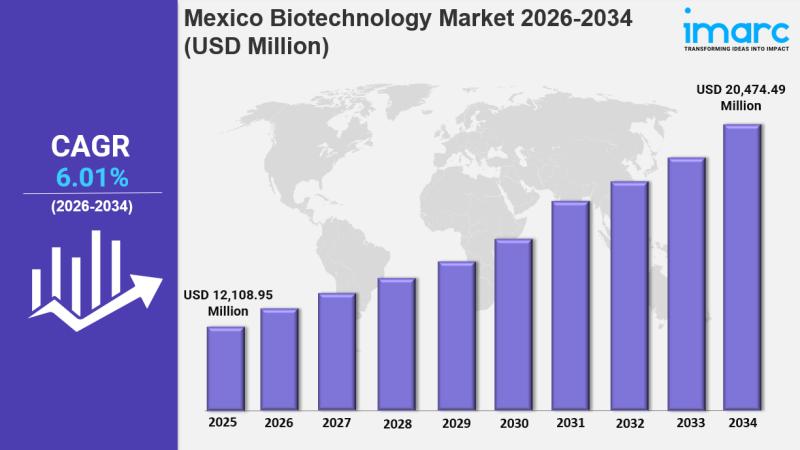

Mexico Biotechnology Market Size, Share, Latest Insights and Forecast 2026-2034

IMARC Group has recently released a new research study titled "Mexico Biotechnology Market Size, Share, Trends and Forecast by Product Type, Technology, Application, and Region, 2026-2034" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico biotechnology market size was valued at USD 12,108.95 Million in 2025 and is expected to reach USD 20,474.49…

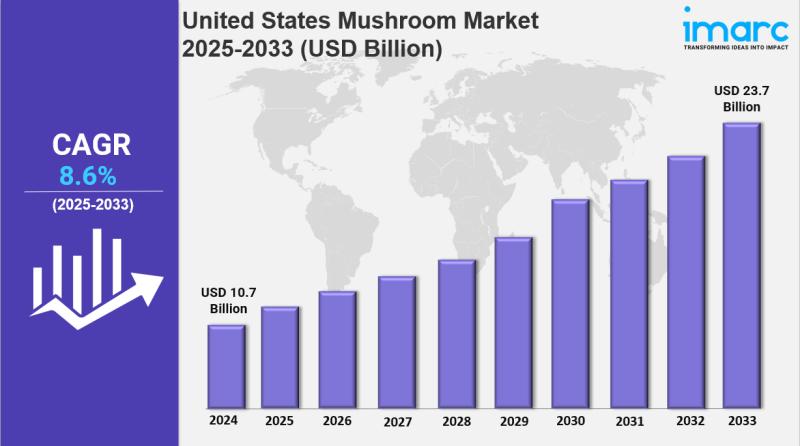

United States Mushroom Market Size, Trends, Growth and Forecast 2025-2033

IMARC Group has recently released a new research study titled "United States Mushroom Market Report by Mushroom Type (Button Mushroom, Shiitake Mushroom, Oyster Mushroom, and Others), Form (Fresh Mushroom, Canned Mushroom, Dried Mushroom, and Others), Distribution Channel (Supermarkets And Hypermarkets, Grocery Stores, Online Stores, and Others), End Use (Food Processing Industry, Food Service Sector, Direct Consumption, and Others), and Region 2025-2033" which offers a detailed analysis of the market drivers,…

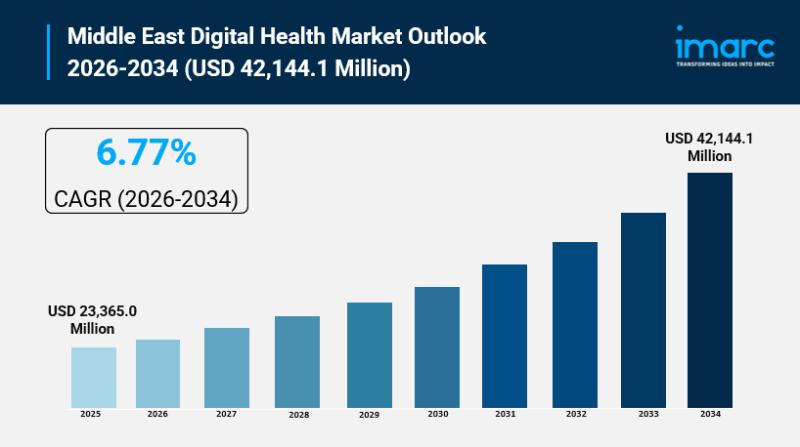

Middle East Digital Health Market Size to Reach USD 42,144.1 Million by 2034 | W …

Middle East Digital Health Market Overview

Market Size in 2025: USD 23,365.0 Million

Market Size in 2034: USD 42,144.1 Million

Market Growth Rate 2026-2034: 6.77%

According to IMARC Group's latest research publication, "Middle East Digital Health Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", the Middle East digital health market size reached USD 23,365.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 42,144.1 Million by 2034, exhibiting…

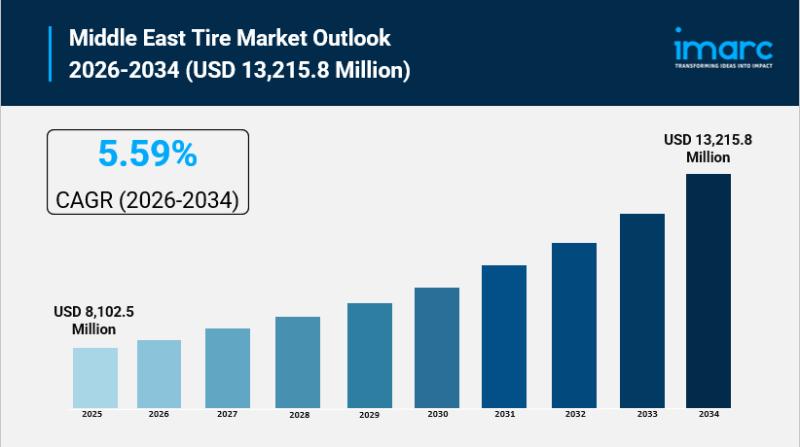

Middle East Tire Market Size is Expected to Reach USD 13,215.8 Million By 2034 | …

Middle East Tire Market Overview

Market Size in 2025: USD 8,102.5 Million

Market Size in 2034: USD 13,215.8 Million

Market Growth Rate 2026-2034: 5.59%

According to IMARC Group's latest research publication, "Middle East Tire Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", the Middle East tire market size reached USD 8,102.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 13,215.8 Million by 2034, exhibiting a growth rate…

More Releases for Price

Bitcoin Price, XRP Price, and Dogecoin Price Analysis: Turn Volatility into Prof …

London, UK, 4th October 2025, ZEX PR WIRE, The price movements in the cryptocurrency market can be crazy. Bitcoin price (BTC price), XRP price, and Dogecoin price vary from day to day, which can make it complicated for traders. Some investors win, but many more lose, amid unpredictable volatility. But there's a more intelligent way and that is Hashf . Instead of contemplating charts, Hashf provides an opportunity for investors…

HOTEL PRICE KILLER - BEAT YOUR BEST PRICE!

Noble Travels Launches 'Hotel Price Killer' to Beat OTA Hotel Prices

New Delhi, India & Atlanta, USA - August 11, 2025 - Noble Travels, a trusted name in the travel industry for over 30 years, has launched a bold new service called Hotel Price Killer, promising to beat the best hotel prices offered by major online travel agencies (OTAs) and websites.

With offices in India and USA, Noble Travels proudly serves an…

Toluene Price Chart, Index, Price Trend and Forecast

Toluene TDI Grade Price Trend Analysis - EX-Kandla (India)

The pricing trend for Toluene Diisocyanate (TDI) grade at EX-Kandla in India reveals notable fluctuations over the past year, influenced by global supply-demand dynamics and domestic economic conditions. From October to December 2023, the average price of TDI declined from ₹93/KG in October to ₹80/KG in December. This downward trend continued into 2024, with October witnessing a significant drop to ₹73/KG, a…

Glutaraldehyde Price Trend, Price Chart 2025 and Forecast

North America Glutaraldehyde Prices Movement Q1:

Glutaraldehyde Prices in USA:

Glutaraldehyde prices in the USA dropped to 1826 USD/MT in March 2025, driven by oversupply and weak demand across manufacturing and healthcare. The price trend remained negative as inventories rose and procurement slowed sharply in February. The price index captured this decline, while the price chart reflected persistent downward pressure throughout the quarter.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/glutaraldehyde-pricing-report/requestsample

Note: The analysis can…

Butane Price Trend 2025, Update Price Index and Real Time Price Analysis

MEA Butane Prices Movement Q1 2025:

Butane Prices in Saudi Arabia:

In the first quarter of 2025, butane prices in Saudi Arabia reached 655 USD/MT in March. The pricing remained stable due to consistent domestic production and strong export activities. The country's refining capacity and access to natural gas feedstock supported price control, even as global energy markets saw fluctuations driven by seasonal demand and geopolitical developments impacting the Middle East.

Get the…

Tungsten Price Trend, Chart, Price Fluctuations and Forecast

North America Tungsten Prices Movement:

Tungsten Prices in USA:

In the last quarter, tungsten prices in the United States reached 86,200 USD/MT in December. The price increase was influenced by high demand from the aerospace and electronics industries. Factors such as production costs and raw material availability, alongside market fluctuations, also contributed to the pricing trend.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/tungsten-pricing-report/requestsample

Note: The analysis can be tailored to align with the customer's specific…