Press release

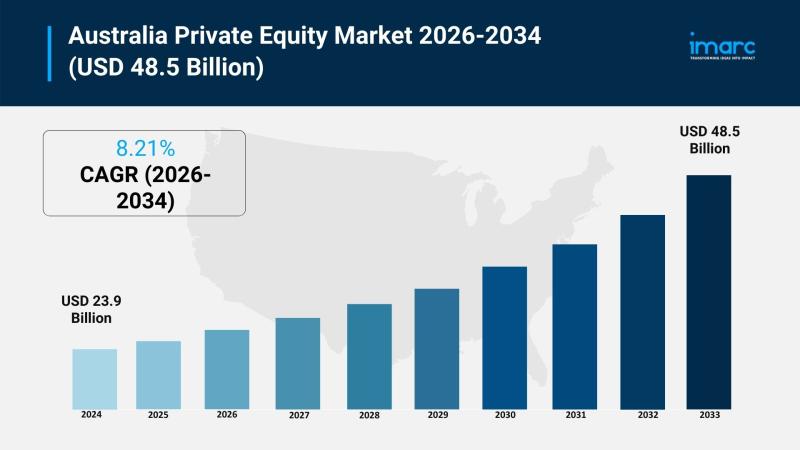

Australia Private Equity Market Report Projected to Reach USD 48.5 Billion by 2034

Market OverviewThe Australia private equity market size reached USD 23.9 Billion in 2025. It is expected to grow significantly, reaching USD 48.5 Billion by 2034, reflecting a robust expansion driven by diverse factors. The forecast period of 2026-2034 is characterized by a growth rate of 8.21%. Drivers include rising investments in venture capital and buyouts, growing infrastructure and real estate fund activity, and increasing focus on ESG-aligned investments. The availability of strong superannuation sector backing, regulatory support, and demand for operational transformation further enhance market potential. For more details, visit the Australia Private Equity Market

https://www.imarcgroup.com/australia-private-equity-market

How AI is Reshaping the Future of Australia Private Equity Market

• AI is revolutionizing due diligence processes by analyzing vast datasets quickly, identifying investment opportunities, and assessing risks with greater accuracy and speed.

• AI-driven analytics enable private equity firms to optimize portfolio management, track performance metrics in real-time, and make data-informed investment decisions.

• Machine learning algorithms support valuations and predictive modeling, helping firms identify undervalued assets and forecast market trends more effectively.

• AI tools enhance operational efficiencies within portfolio companies through process automation, supply chain optimization, and cost reduction strategies.

• Natural language processing and AI-powered platforms streamline deal sourcing by scanning market intelligence, news, and financial reports to identify potential targets.

• Real-world applications of AI range from automated financial modeling to ESG compliance monitoring, driving faster deal execution and improved returns for investors.

Grab a sample PDF of this report: https://www.imarcgroup.com/australia-private-equity-market/requestsample

Market Growth Factors

Because a growing amount of money allocates to venture capital and buyout investments, Australian institutions, superannuation funds and family offices invest in both fast growing startups and well-established companies with strong growth potential. Technology companies, fintech, healthcare, and renewables have attracted growing interest from investors. Fund commitments have increasingly focused on private equity investments into infrastructure assets, such as digital infrastructure, transport, and renewable energy. When government policies and business regulations support and promote innovation and entrepreneurship, Australia attracts private equity firms for investment. Companies backed by private equity outperform public companies, attracting more private equity investors to the country. This has caused competition among firms to be fierce for quality deals and high valuations.

Infrastructure and real estate are expected to have the highest growth. Economic development and urbanization have caused private equity funds to increasingly turn to large-scale infrastructure investments in the areas of transportation, energy, and telecommunications for long-term returns. And there are indications that property funds management is beginning to consolidate following increasing demand for real estate from the population growth, urbanization and economic growth which has increased demand for commercial and residential property. Growing foreign direct investment and government investment in infrastructure drive investment flows. Sustainable and ESG investing is shaping private equity strategy and priorities towards more sustainable investments, including in real estate and infrastructure. Further, firms have shown an understanding that ESG performance is linked with long-term financial return and risk.

Another trend in the Australian private equity market is a strong focus on small and mid-cap opportunities as investors look at smaller companies for growth in a volatile market and their ability to be nimble and react quickly. With the perception that they are less sensitive to fluctuations in economic cycles and regulations, and with inflation under control and interest rates normalizing, private equity firms have increasingly used available capital to acquire undervalued assets in sectors including healthcare, technology and renewable energy. Operational improvements and planned buying are the next big value creation sources. Another area to grow is through creative exits. Firms are increasingly using partial sell-down, backdoor and secondary sales to create liquidity, rather than just an IPO, and to optimize exit timing and valuations.

Market Segmentation

Fund Type:

• Buyout

• Venture Capital (VCs)

• Real Estate

• Infrastructure

• Others

Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent Development & News

• March 2025: I Squared Capital, a global infrastructure investment company, announced that Rest, one of Australia's largest profit-to-member superannuation funds, committed USD 300 million. This investment focuses on areas including digital infrastructure, transportation, and renewable energy with the goal of offering flexible financial solutions to critical infrastructure assets globally.

• December 2024: ISPT, a premier Australian property funds manager, merged with IFM Investors, a global private markets manager. This strategic integration aims to bring together their skills, expertise, and experience to increase customer value and accelerate growth strategies, with Chris Chapple appointed as IFM Investors' Global Head of Real Estate.

• 2025: Australian private equity firms have increasingly adopted creative exit strategies, including partial sell-downs, backdoor listings, and secondary transactions as viable alternatives to traditional IPO exits. Secondary deals have gained traction as a primary route for sponsor exits, driven by a maturing market and increased buyer interest in the evolving investment landscape.

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

https://www.imarcgroup.com/request?type=report&id=31707&flag=F

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Private Equity Market Report Projected to Reach USD 48.5 Billion by 2034 here

News-ID: 4300201 • Views: …

More Releases from IMARC Group

Helium Production Plant DPR & Unit Setup Cost- 2026: Machinery Requirements, Cap …

Setting up a Helium Production Plant positions investors in one of the most stable and essential segments of the industrial gas and strategic materials value chain, backed by sustained global growth driven by increasing demand from medical imaging, semiconductor manufacturing expansion, advanced scientific research applications, and the ultra-high purity, reliability, irreplaceable advantages of helium across critical technology sectors. As healthcare infrastructure accelerates, semiconductor fabrication intensifies, and space exploration initiatives expand…

Setting Up a Green Hydrogen Plant in India 2026- Complete Cost Model with CapEx, …

What Does It Cost to Set Up a Green Hydrogen Production Plant in India?

Setting up a 300-ton-per-year green hydrogen plant in India requires a carefully mapped investment across CapEx, OpEx, and long-term profitability. Raw material costs - primarily electricity - run between 60 to 70 percent of operating expenditure. Gross margins project between 25 and 30 percent. And capital investment spans electrolyzer procurement, renewable energy infrastructure, utilities, and compliance -…

Pharmaceutical Formulation Manufacturing Plant DPR & Unit Setup - 2026: Business …

Setting up a pharmaceutical formulation manufacturing plant positions investors in one of the most stable and essential segments of the global healthcare value chain, backed by sustained global growth driven by growing prevalence of chronic diseases, pharmaceutical industry expansion, rising demand for patient-centric dosage forms, and the safety, efficacy, stability advantages of finished medicinal products. As global healthcare spending accelerates, chronic and lifestyle diseases increase, and regulatory frameworks increasingly mandate…

Triple Superphosphate (TSP) Manufacturing Plant DPR & Unit Setup 2026: Demand An …

Setting up a triple superphosphate (TSP) manufacturing plant involves strategic planning, substantial capital investment, and a comprehensive understanding of production technologies. This essential high-analysis phosphate fertilizer serves field crop agriculture, horticulture, fertilizer blending, and soil nutrient management programs. Success requires careful site selection, efficient phosphate rock processing, stringent safety protocols, reliable raw material sourcing, and compliance with environmental regulations to ensure profitable and sustainable operations.

Market Overview and Growth Potential:

The global…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…