Press release

Key Players in the Commercial Aircraft Aftermarket Parts Market: Share Positioning & Investor Performance Outlook

The commercial aircraft aftermarket parts market is undergoing a significant transformation as airlines modernize fleets, extend aircraft lifecycles, and shift toward predictive maintenance and digitalized supply chains. With rising pressure to minimize aircraft downtime and optimize operational efficiency, demand for high-quality MRO solutions, rotables, consumables, and line-replaceable units (LRUs) continues to accelerate. The aftermarket ecosystem-comprising OEMs, independent suppliers, distributors, and MRO providers-is becoming more competitive as companies expand global repair networks, strengthen parts reliability, and adopt data-driven service models.This article provides an in-depth analysis of the top companies driving competitive dynamics in the commercial aircraft aftermarket parts market, followed by a detailed SWOT breakdown and an overview of the latest investment trends shaping the MRO ecosystem through 2035.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-2239

Top Companies & Their Strategies

1. Boeing Global Services (BGS) - Boeing strengthens its aftermarket dominance with integrated support solutions, including component services, modifications, digital analytics, and global logistics hubs. Its strategy focuses on expanding lifecycle service offerings and leveraging proprietary aircraft data to enhance maintenance planning. With an extensive global footprint and strong OEM-backed reliability, BGS continues to lead in rotables, exchange programs, and structural component upgrades.

2. Airbus Services - Airbus leverages its Skywise digital ecosystem, global MRO partnerships, and comprehensive spare parts programs to expand its aftermarket influence. The company emphasizes predictive maintenance insights and standardized repair solutions to minimize aircraft downtime for operators. Airbus's strategic advantage lies in its ability to integrate parts availability with fleet performance analytics across a large operator base.

3. GE Aerospace - GE Aerospace plays a critical role in the commercial aircraft aftermarket parts market through its engine services, component repair technologies, and materials innovations. The company's strength lies in deep engineering expertise, advanced repair methodologies, and a large installed engine fleet, enabling sustained demand for OEM-certified spares. GE's digital tools for monitoring engine health further position it as a preferred partner for long-term maintenance programs.

4. Safran Aircraft Engines & Safran Landing Systems - Safran maintains strong competitive positioning through diversified aftermarket solutions covering engines, landing gear, brakes, and nacelles. Its strategic partnerships with OEMs and MRO service centers enhance its ability to provide quick-turn repairs and parts replacements. The company's technological advancements in carbon brakes and maintenance-efficient systems ensure high fleet reliability and lower lifecycle costs for operators.

➤ Explore detailed profiles of top players and new entrants in this space - access your free sample report → https://www.researchnester.com/sample-request-2239

5. Honeywell Aerospace - Honeywell stands out for its expansive portfolio of avionics, auxiliary power units (APUs), environmental control systems, and sensors. Its aftermarket strategy prioritizes long-term service agreements, digital troubleshooting tools, and cost-effective repair cycles. Honeywell's global distribution network and certified repair facilities give it strong leverage across both narrow-body and wide-body aircraft platforms.

6. Collins Aerospace (Raytheon Technologies) - Collins Aerospace dominates aftermarket demand through its broad product catalog-spanning interiors, sensors, actuation systems, and landing gear. The company focuses on innovation-driven parts production, reliability upgrades, and strategic MRO partnerships. Its integrated supply chain and engineering strength support strong customer loyalty across major airlines and leasing companies.

7. Lufthansa Technik - Lufthansa Technik operates one of the world's most comprehensive MRO networks, providing component repairs, engine services, and custom modifications. Its strength lies in engineering flexibility, rapid repair capabilities, and independent service positioning. The company's strong presence across Europe, Asia, and the Middle East enhances aftermarket parts accessibility for global fleets.

8. AAR Corp. - AAR Corp. delivers competitive cost advantages through asset trading, component pooling, and logistics solutions. The company specializes in providing rapid-response aftermarket parts to commercial carriers and government fleets. Its multi-regional warehouses and partnerships with OEMs and airlines allow AAR to remain a reliable sourcing partner for hard-to-find components and rotables.

➤ View our Commercial Aircraft Aftermarket Parts Market Report Overview here: https://www.researchnester.com/reports/commercial-aircraft-aftermarket-parts-market/2239

SWOT Analysis

Strengths - Leading companies in the commercial aircraft aftermarket parts market benefit from strong engineering capabilities, global repair infrastructure, and deep OEM expertise. Their ability to provide certified, high-reliability components enhances aircraft safety and supports long-term operator confidence. Integrated data analytics, predictive maintenance tools, and advanced repair technologies further improve turnaround times and fleet performance. Strategic alliances between OEMs and MRO providers create efficient supply chains that reinforce market leadership.

Weaknesses - Despite strong operational scale, industry players face challenges related to supply chain complexity, long lead times for specialized components, and constraints in repair capacity during peak demand. Dependence on OEM-controlled certification environments can limit independent suppliers' ability to innovate or offer cost-competitive alternatives. High inventory carrying costs and the complexity of managing global parts distribution networks add financial pressure. Additionally, legacy platforms with declining fleet numbers require specialized parts support, increasing operational burden for service providers.

Opportunities - The sector is witnessing rising opportunities through digitalization, predictive maintenance adoption, and increasing airline focus on lifecycle cost optimization. Companies that invest in automation, additive manufacturing, and AI-enabled inspection technologies are positioned to capture growing demand for rapid turnaround solutions. Emerging markets in Asia-Pacific, the Middle East, and Latin America are expanding their MRO infrastructure, creating new regional hubs for parts distribution. Growing interest in sustainable aviation also opens opportunities for components that reduce fuel burn, improve reliability, or extend maintenance intervals.

Threats - The market faces competitive pressures from independent distributors, PMA (Parts Manufacturer Approval) suppliers, and used serviceable material (USM) providers offering lower-cost alternatives to OEM parts. Regulatory changes, certification delays, and geopolitical disruptions pose risks to supply chain continuity. Volatility in airline operations, driven by economic downturns or travel restrictions, can reduce parts demand or delay maintenance cycles. Technological shifts, such as new aircraft platforms with longer maintenance intervals, may also reduce aftermarket revenue opportunities.

➤ Interested in a customized SWOT for your target competitor? Request your tailored assessment → https://www.researchnester.com/sample-request-2239

Investment Opportunities & Trends

1. M&A Activity and Consolidation

The commercial aircraft aftermarket parts market is experiencing steady consolidation as OEMs, MRO providers, and distributors acquire specialized repair shops and parts suppliers. Recent partnerships between engine manufacturers and regional MRO centers highlight an increasing focus on localized repair capability. Strategic acquisitions in component repair technologies, digital inspection tools, and materials engineering continue to attract interest from global investors and private equity firms.

2. Technology Integration and Digital Aftermarket Expansion

The shift toward digital MRO ecosystems, predictive health monitoring, and IoT-enabled parts tracking is emerging as a key investment theme. Companies integrating repair automation, advanced composites repair, and additive manufacturing capabilities are gaining traction. Digital twins, AI-enabled troubleshooting, and condition-based maintenance are reducing aircraft downtime and improving supply chain visibility-making them highly attractive for operators and technology investors alike.

3. Regional Expansion and Infrastructure Growth

Asia-Pacific and the Middle East are becoming high-priority markets due to rapid fleet growth and increasing investments in MRO infrastructure. Governments are supporting aerospace clusters, special economic zones, and parts manufacturing facilities to boost regional capability. North America and Europe remain innovation hubs, focusing on advanced manufacturing technologies and sustainability-driven repair solutions. Investors are increasingly backing companies that combine localized operations with globally integrated supply chains.

Notable Developments in the Last 12 Months

• Leading OEMs expanded global component repair facilities to support faster turnaround times for operators.

• Multiple MRO providers launched digital inspection platforms powered by AI and machine vision.

• Airline groups entered new long-term component pooling agreements to optimize parts availability.

• Additive manufacturing advancements enabled broader adoption of 3D-printed repair parts and tooling.

• Several aerospace suppliers announced sustainability initiatives focused on recycling, green materials, and repairable component designs.

• Strategic alliances emerged between airlines and PMA manufacturers to reduce aftermarket cost pressure.

• Global logistics companies increased aviation-specific warehousing capacity supporting rapid spares delivery.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-2239

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Key Players in the Commercial Aircraft Aftermarket Parts Market: Share Positioning & Investor Performance Outlook here

News-ID: 4298995 • Views: …

More Releases from Research Nester Pvt Ltd

Lutein and Zeaxanthin Market - Key Players, Capability Assessment & M&A Indicato …

The lutein and zeaxanthin market has expanded steadily as demand for eye-health supplements, functional foods, and preventive nutrition increases across global consumer segments. Lutein and zeaxanthin, two essential carotenoids concentrated in the retina, are widely recognized for their protective roles against oxidative stress, age-related macular degeneration (AMD), blue-light exposure, and general visual fatigue. Their adoption has accelerated with the rise of digital lifestyles, an aging population, and growing clinical evidence…

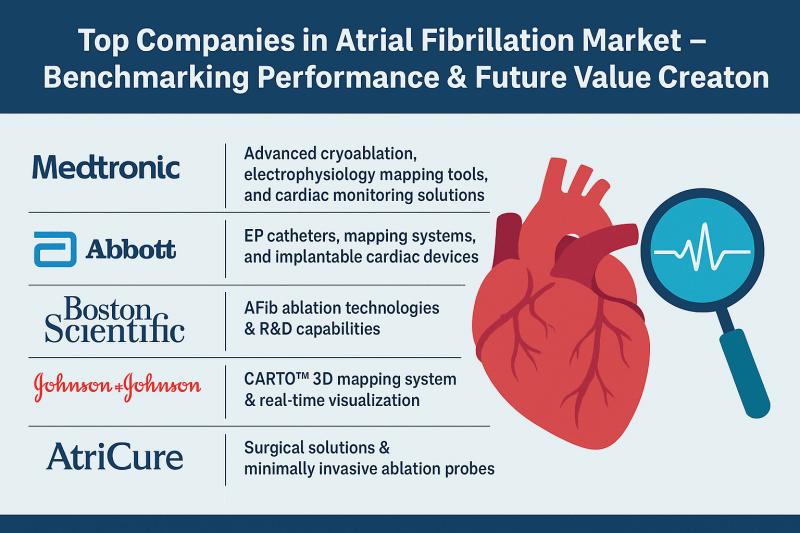

Top Companies in Atrial Fibrillation Market - Benchmarking Performance & Future …

The atrial fibrillation market is undergoing a period of rapid transformation as diagnostic technologies, catheter-based therapies, and antiarrhythmic solutions continue to advance. Atrial fibrillation (AFib) is one of the most prevalent cardiac arrhythmias globally, prompting significant demand for improved detection, early intervention, and minimally invasive treatment. The shift toward advanced ablation systems, AI-enabled diagnostics, wearable monitoring, and next-generation electro-mapping tools has strengthened competition across the market. Companies are expanding their…

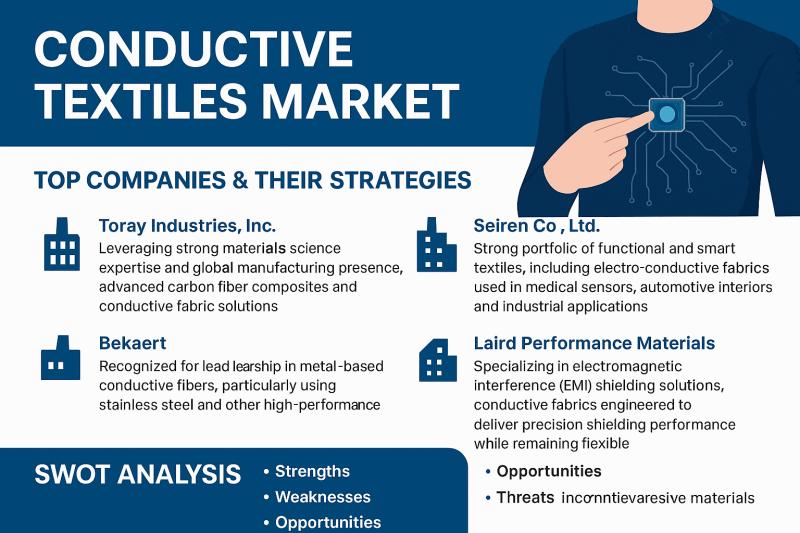

Conductive Textiles Market - Top Companies, SWOT Deep Dive & Capital Flow Trends

The conductive textiles market is undergoing a rapid transformation as wearable electronics, smart apparel, and advanced sensor-integrated fabrics move from niche applications to mainstream adoption. Conductive textiles-engineered using conductive polymers, metal-coated fibers, or intrinsically conductive yarns-have become integral to next-generation healthcare wearables, military gear, automotive interiors, and consumer smart devices. As industries push for lighter, flexible, and more energy-efficient electronic systems, conductive materials embedded within fabrics are emerging as a…

Global Osteosynthesis Devices Market: Top Companies, Market Share Rankings & Inv …

The osteosynthesis devices market continues to evolve as orthopedic care moves toward minimally invasive procedures, biologically compatible materials, and technology-enabled implants. These devices-ranging from plates and screws to intramedullary nails and fixation systems-are essential for treating fractures, deformities, and complex bone injuries. Companies operating in this space are adopting strategies centered around product innovation, clinical efficacy, and expansion into fast-growing regions. As trauma care volumes rise in both developed and…

More Releases for MRO

Aircraft MRO Market Accelerates Toward 2031

New York, US - October 22, 2025 - The global aircraft MRO (maintenance, repair, and operations) market is on the cusp of remarkable change. Leading aviation stakeholders, from service providers to airlines, are responding rapidly to post-pandemic recovery, technological innovations, and growth in global aviation traffic. As air travel surges and regulatory demands intensify, the Aircraft MRO Market emerges as an indispensable backbone for sustainable, safe, and efficient aviation.

Download Sample…

Global Commercial Aero Engine MRO Market Size by Application, Type, and Geograph …

According to Market Research Intellect, the global Commercial Aero Engine MRO market under the Aerospace and Defense category is expected to register notable growth from 2025 to 2032. Key drivers such as advancing technologies, changing consumer behavior, and evolving market dynamics are poised to shape the trajectory of this market throughout the forecast period.

The global recovery of air travel and the increasing number of commercial aircraft in operation are the…

Digital MRO :- Strategic Developments & Key Insights

The Digital MRO Market is expected to register a CAGR of 10.5% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Technology (AR and VR, Big Data and IoT, Blockchain, Digital Twin, Robotics and Drones, Others), Application (Inspection, Maintenance, Monitoring, Training, Others), End User (Commercial Airline Operator, MRO Service Provider, Others). The global analysis…

Emerging Trends Influencing The Growth Of The Air Transport MRO Market:Technolog …

The Air Transport MRO Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

How Big Is the Air Transport MRO Market Size Expected to Be by 2034?

Recently, there has been significant growth in the air transport MRO market. It is projected to increase from $88.11 billion…

Aircraft Engine MRO Market : An Overview

Introduction:

Aircraft Engine Maintenance, Repair, and Overhaul (MRO) is a vital segment of the aviation industry, ensuring the safety, reliability, and performance of aircraft engines. This sector supports commercial, military, and general aviation fleets by offering regular maintenance, advanced diagnostics, and complete overhauls. With the global aviation industry continuously expanding, the demand for MRO services is witnessing substantial growth. Aircraft engine MRO involves activities like routine checks, component replacement, and engine…

Air Transport MRO Market Report 2024 - Air Transport MRO Market Size, Share And …

"The Business Research Company recently released a comprehensive report on the Global Air Transport MRO Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

According to The Business Research Company's, The air transport mro…