Press release

UAV Satellite Communication Market Key Players - Share Consolidation Trends & Capital Growth Signals

The UAV satellite communication market is emerging as a critical component of modern unmanned aerial operations, enabling long-range connectivity, real-time data transmission, and mission reliability across defense, commercial, and scientific applications. As UAV deployment accelerates across border surveillance, disaster response, logistics, and environmental monitoring, satellite communication (SATCOM) has evolved into the backbone supporting persistent command-and-control (C2) and high-bandwidth payload communication. This article provides a strategic assessment of major companies, competitive positioning, SWOT analysis, and investment opportunities shaping the UAV satellite communication market.➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-6610

Top Companies & Their Strategies

1. Viasat Inc.

Viasat remains one of the most influential players with its high-capacity satellite networks and advanced airborne SATCOM terminals. The company leverages strong defense partnerships and extensive global coverage to support beyond-line-of-sight (BLOS) missions. Its strategic advantage lies in vertically integrated SATCOM solutions-from satellites to modems-which reinforces reliability and reduces dependency on third-party ecosystem providers.

2. Thales Group

Thales has positioned itself as a leader through ruggedized communication systems designed for both military and commercial UAV operations. Its strength lies in cybersecurity-embedded communication platforms, making it a preferred partner for defense agencies. Thales focuses on modular SATCOM payloads and global partnerships to expand its UAV-ready communication portfolio.

3. Inmarsat (now part of Viasat)

Inmarsat's long-standing reputation for resilient, global L-band connectivity gives it an edge in mission-critical UAV operations. Its services support C2 links for medium and large UAVs across challenging terrains and maritime environments. The company's focus on managed services instead of hardware diversification enhances scalability for operators requiring guaranteed service levels.

4. Honeywell Aerospace

Honeywell offers compact SATCOM terminals optimized for small and medium UAVs, a segment gaining rapid traction. Its Ka-band and Ku-band systems are widely adopted in commercial UAV applications, including inspection, mapping, and cargo. Honeywell's strength lies in miniaturized avionics and its ability to integrate SATCOM with advanced flight management systems.

➤ Get deeper insights into competitive positioning and strategic benchmarking: Download our sample UAV Satellite Communication Market report here → https://www.researchnester.com/sample-request-6610

5. Cobham Satcom (now part of Space & Defense entities)

Cobham provides robust airborne SATCOM equipment designed for harsh environments, giving it a strong position in specialized UAV missions. Its advantage comes from decades of experience in tactical communication technologies. The company emphasizes low-SWaP (size, weight, and power) terminals that enhance endurance and operational range for UAV fleets.

6. Iridium Communications

Iridium's global low-earth-orbit (LEO) network is a competitive differentiator, offering low-latency communication ideal for small UAVs and real-time telemetry. Its cost-effective narrowband solutions make it attractive for industrial and agricultural UAV applications. The company continues to expand partnerships with drone manufacturers to embed Iridium chipsets directly into airframes.

7. Gilat Satellite Networks

Gilat stands out with its flexible SATCOM platforms built around software-defined modems, supporting both GEO and NGSO constellations. Its UAV solutions prioritize dynamic bandwidth allocation and high-throughput uplinks-key for surveillance and data-intensive missions. The company's success stems from strong collaboration with defense integrators across Asia and Latin America.

8. SES Space & Defense

SES leverages a multi-orbit network - combining GEO and MEO satellites - to deliver seamless UAV connectivity. This hybrid-orbit strategy helps reduce latency and ensures consistent coverage across continents. SES invests heavily in government and defense programs, positioning itself as a trusted provider of resilient UAV SATCOM services.

➤ View our UAV Satellite Communication Market Report Overview here: https://www.researchnester.com/reports/uav-satellite-communication-market/6610

SWOT Analysis

Strengths

Leading companies in the UAV satellite communication market benefit from global satellite footprints, established defense partnerships, and advanced terminal technology. Their expertise in multi-band communication systems ensures robust connectivity across diverse UAV platforms. Additionally, strong R&D investments support the development of miniaturized, low-latency, and high-throughput solutions, enhancing competitive advantage.

Weaknesses

Despite technical leadership, many companies face challenges in reducing cost structures for mass-market UAV adoption, especially in commercial sectors. Integration complexities between SATCOM equipment and various UAV airframes can slow deployment cycles. Regulatory barriers and certification requirements also create friction, limiting rapid adoption across civilian applications and emerging markets.

Opportunities

Expanding use of UAVs in logistics, agriculture, environmental monitoring, and disaster response opens new avenues for SATCOM integration. Multi-orbit constellations, software-defined payloads, and AI-assisted network management present major opportunities for differentiation. Collaborations with drone manufacturers, 5G NTN (Non-Terrestrial Networks), and cloud-based mission platforms can further strengthen market positioning.

Threats

Competition from alternative communication technologies - including terrestrial 5G, mesh networking, and edge-based systems - may challenge SATCOM's dominance in certain UAV segments. Geopolitical tensions and spectrum-related disputes pose potential risks to satellite operators. Emerging LEO constellations could disrupt pricing models, intensifying competitive pressure among established players.

➤ Interested in a customized SWOT for your target competitor? Request your tailored assessment → https://www.researchnester.com/sample-request-6610

Investment Opportunities & Trends

Key Investment Themes

• M&A and strategic partnerships - Given the complexity of the UAV satcom ecosystem, consolidation through mergers and acquisitions or strategic alliances between satellite operators, UAV OEMs, and hardware providers is a key trend. These collaborations enable integrated offerings and reduce time-to-market for fully interoperable UAV-satcom solutions. For instance, partnerships between satellite operators and UAV manufacturers can accelerate deployment.

• Funding and growth of niche hardware and terminal startups - As demand rises for small, lightweight, affordable satcom terminals for commercial UAVs, emerging companies and startups focusing on SWaP-optimized satcom hardware are attracting attention and investment. This supports wider adoption beyond defence, especially in commercial, agricultural, and remote-monitoring use-cases.

• Technology integration: HTS, LEO/NGSO, and multi-orbit satellite networks - Investment is flowing into expanding HTS capabilities, and gradually LEO/NGSO constellations are being considered for UAV connectivity, promising lower latency, global coverage, and scalable bandwidth. Companies that adapt to multi-orbit, multi-band strategies are likely to capture more of the evolving UAV satcom demand.

• Regional expansion / emerging markets focus - Regions such as Asia-Pacific, Middle East & Africa, and other emerging economies present large growth potential, especially for commercial UAV applications (agritech, disaster management, remote mapping). Providers that tailor solutions to these markets - perhaps with lower-cost terminals or region-specific service offerings - present attractive investment opportunities.

Recent Developments in Past 12 Months

• In January 2023, Inmarsat and ESA signed a contract to co-develop a tiny satellite terminal for UAVs - a significant milestone toward integrating UAVs safely into commercial airspace, reflecting growing regulatory and technological readiness.

• In late 2022, Inmarsat teamed with a UAV/robotics industry player to advance BVLOS services (notably via a solution called "Velaris"), underlining commercial UAV operations' accelerating adoption.

• In November 2022, Gilat Satellite Networks secured a multi-year agreement with a UAV manufacturer to supply next-gen satellite terminals (BRP60) for high/medium-altitude long-endurance UAVs - showcasing demand for high-performance, long-range UAV satcom connectivity.

• In April 2022, a contract between a satcom service provider (SKYTRAC Systems Ltd.) and a UAV manufacturer was signed to install mid-band terminal solutions (e.g., Iridium Certus) on HALE UAV platforms - indicating increasing adoption of SATCOM even in very long-endurance UAV categories.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-6610

Related News:

https://www.linkedin.com/pulse/how-satellite-antennas-powering-next-wave-global-connectivity-oedhf/

https://www.linkedin.com/pulse/can-markerless-motion-capture-replace-traditional-tracking-y76uf/

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release UAV Satellite Communication Market Key Players - Share Consolidation Trends & Capital Growth Signals here

News-ID: 4298868 • Views: …

More Releases from Research Nester Pvt Ltd

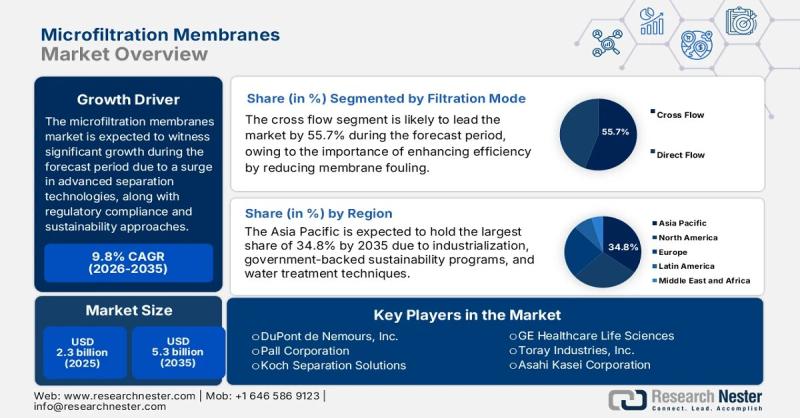

Microfiltration Membranes Market size to reach $5.3Billion by 2035 | Key players …

Market Outlook and Forecast

The microfiltration membranes market size reached USD 2.3 billion in 2025 and is projected to expand to USD 5.3 billion by 2035, reflecting strong industry fundamentals and sustained adoption across diverse end-use industries. The market is expected to grow at a compound annual growth rate (CAGR) of 9.8% between 2026 and 2035, driven by industrial modernization, environmental regulations, and technological innovation.

➤ Request Free Sample PDF Report @…

Top Companies in Food Grade Alcohol Market - Benchmarking Performance & Future V …

The food grade alcohol market is shaped by multinational ingredient producers, regional distillation leaders, and specialized ethanol processors. Competitive positioning is largely determined by feedstock access, regulatory compliance, supply chain resilience, and product customization for food and beverage applications.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8307

Top Companies & Their Strategies

Archer Daniels Midland Company (ADM)

ADM remains one of the most influential players in the Food Grade Alcohol Market due to…

Energy Harvesting System Market Dominance: Top Companies Strengthening Share & I …

The energy harvesting system market is rapidly evolving as industries seek sustainable, maintenance-free power solutions for IoT devices, wireless sensor networks, industrial automation, healthcare wearables, and smart infrastructure. Energy harvesting systems convert ambient energy sources - including solar, thermal, vibration, and radio frequency (RF) - into usable electrical power.

As the global transition toward energy efficiency and decentralized power accelerates, the competitive landscape within the energy harvesting system market is intensifying.…

Luxury Hotel Market Players - Competitive Positioning, Strategic Strengths & Inv …

The Luxury Hotel Market is undergoing structural transformation as global travelers increasingly prioritize curated experiences, sustainability, and digital-first service models. No longer defined solely by opulence, the luxury hotel market now revolves around personalization, wellness integration, brand storytelling, and technological innovation. Leading hospitality companies are repositioning portfolios, expanding into high-growth destinations, and investing in asset-light models to strengthen competitive positioning.

This strategic analysis explores the top companies shaping the luxury hotel…

More Releases for UAV

Uav Autopilot Market

According to Market Research Intellect, the global Uav Autopilot market under the Aerospace and Defense category is expected to register notable growth from 2025 to 2032. Key drivers such as advancing technologies, changing consumer behavior, and evolving market dynamics are poised to shape the trajectory of this market throughout the forecast period.

The UAV autopilot market is experiencing robust growth, driven by increasing demand for autonomous drones across commercial, defense, and…

Tactile UAV Market

How Big Is the Tactile UAV Market?

The global tactical UAV market size reached US$ 3.4 Billion in 2022. Looking forward, IMARC Group expects the market to reach US$ 7.0 Billion by 2028, exhibiting a growth rate (CAGR) of 12.5% during 2023-2028.

What is Tactile UAV?

Tactile unmanned aerial vehicles (UAVs) represent heavier protective devices that are used to detect tanks and armored personnel carriers and mitigate risks. Short, close, long, medium-range, endurance,…

UAV Propulsion System Market Survey Report 2023 Along with Statistics, Forecasts …

The report is designed to provide a holistic view of the UAV Propulsion System Market market 2023 to 2030. Several vital aspects are discussed in this UAV Propulsion System Market report in terms of growing business and resulting market revenues. These aspects include the financial status of major companies, trending advancements, and the entire market scenario. Business players can easily make a gainful decision by understanding the data provided in…

Modular Type Electric Helicopter UAV and Hexacopter UAV | PRENEU

PRENEU Co., Ltd. is a leading drone manufacturer in Korea that provides innovative drone systems and services through the convergence of H/W manufacturing technology and S/W development technology for drones and aviation with key IT technology.

PRENEW's Modular Type Electric Helicopter UAV/RUEPEL

PRENEW's UAV Helicopter with the name of RUEPEL provides special mission services such as search and rescue using UAV functions in areas with harsh environmental conditions, such…

Counter-UAV (C-UAV) Systems Market 2021 | Detailed Report

The Counter-UAV (C-UAV) Systems research report undoubtedly meets the strategic and specific needs of the businesses and companies. The report acts as a perfect window that provides an explanation of market classification, market definition, applications, market trends, and engagement. The competitive landscape is studied here in terms of product range, strategies, and prospects of the market’s key players. Furthermore, the report offers insightful market data and information about the Counter-UAV…

New Visiongain Report: Counter-UAV (C-UAV) Market Report 2019-2029

• Do you need definitive counter UAV market data?

• Succinct counter UAV market analysis?

• Technological insight?

• Clear competitor analysis?

• Actionable business recommendations?

Read on to discover how this definitive report can transform your own research and save you time.

Purchase full report or download free sample pages: https://www.visiongain.com/report/counter-uav-c-uav-market-report-2019-2029/

The recent developments in counter UAV systems by type, platform and technology has led Visiongain to publish this timely report. The $ 1.3 billion counter…