Press release

The Global Biometric Payment Card Market is projected to reach a market size of 9.36 billion by 2030.

According to the report published by Virtue Market Research In 2024, the Global Biometric Payment Card Market was valued at $0.3 billion, and is projected to reach a market size of 9.36 billion by 2030. Over the forecast period of 2025-2030, market is projected to grow at a CAGR of 77.3%.Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/biometric-payment-card-market/request-sample

Biometric payment cards are changing the way people handle money by making transactions safer and faster. One long-term factor driving the growth of this market is the increasing focus on security in financial transactions. Traditional cards that rely only on PIN codes or signatures are prone to fraud and theft, which has made banks and financial institutions look for more secure alternatives. The integration of fingerprint sensors directly onto cards ensures that only the authorized cardholder can complete a payment, which builds trust among users. During the COVID-19 pandemic, this security-focused approach gained even more importance. With people avoiding cash and contact-based payments to prevent the spread of the virus, the demand for touch-free and highly secure payment methods surged. This created a significant boost in adoption, encouraging more banks and payment service providers to explore biometric solutions for safer financial interactions.

In the short term, convenience is a strong driver for the biometric payment card market. Customers want quick and easy payment options without the hassle of remembering PINs or signatures. The ability to authenticate payments using just a fingerprint reduces transaction time and enhances the overall shopping experience. This convenience appeals not only to individual consumers but also to retailers, who benefit from faster checkout processes and lower chances of fraudulent transactions. Alongside this, there is a clear opportunity for biometric payment cards to expand in regions where digital payment adoption is still in early stages. Countries with large unbanked populations or where mobile banking penetration is limited can benefit from biometric cards as they provide a secure, standalone solution for digital payments. This opens doors for financial institutions to attract new customers and increase financial inclusion by offering safer, user-friendly payment options.

A trend currently shaping the industry is the growing collaboration between technology companies and financial institutions. These partnerships focus on developing advanced card designs, integrating robust fingerprint sensors, and enhancing data protection measures. Additionally, innovations such as multi-factor authentication using biometrics combined with mobile apps are becoming more common. This trend reflects a broader move toward highly personalized and technologically sophisticated payment systems that are still easy for consumers to use. It also indicates that the market is not just growing in numbers but evolving in quality, with companies prioritizing secure and seamless experiences for their users.

As biometric payment cards become more popular, the market is seeing a rise in awareness campaigns highlighting their benefits. Consumers are gradually learning that these cards reduce fraud risks, simplify payments, and provide a higher level of convenience compared to traditional methods. Governments and regulatory bodies are also encouraging digital payment adoption, which indirectly supports the expansion of biometric solutions. Moreover, as the technology becomes more affordable and easier to integrate into existing payment systems, more banks and financial institutions are expected to issue these cards to their customers. This creates a ripple effect, accelerating adoption and driving the market forward.

Segmentation Analysis:

By Authentication Type: Fingerprint Recognition, Iris Recognition, Facial Recognition, Others

The Biometric Payment Card Market is seeing different kinds of authentication types that help people pay safely. Among these, fingerprint recognition is the largest in this segment because it is easy to use and works quickly for most people. Fingerprint sensors are small and can fit directly on cards, making them very convenient for daily payments. On the other hand, facial recognition is the fastest growing during the forecast period. Many new banks and card providers are introducing facial recognition to attract tech-savvy users who like modern ways to pay. Iris recognition and other types are also used, but they are smaller in share because they need extra devices or cameras to work properly.

The growth of facial recognition is supported by mobile apps and digital wallets that combine card security with phone technology. As people get used to seeing their face as a key to pay, more card makers are investing in these solutions. This makes the authentication market dynamic, with fingerprint leading now and facial recognition catching up fast, shaping the future of how payments are made.

By Card Type: Credit Cards, Debit Cards, Prepaid Cards

In the Biometric Payment Card Market, cards come in many forms, such as credit, debit, and prepaid cards. Credit cards are the largest in this segment because most adults already use them for shopping, travel, and bills. People like credit cards with biometric features because they add an extra layer of safety without changing how the card is used. Prepaid cards are the fastest growing during the forecast period. They are popular among younger users, students, and people who want to control their spending. Prepaid cards with biometric technology allow safe payments without needing a bank account, which is why new companies are focusing on them.

Debit cards are still important, but their growth is slower because banks already have millions in circulation, and the market is more stable. The mix of credit, debit, and prepaid cards with biometric sensors gives consumers multiple choices, and companies are creating options to suit different needs. This makes the card type segment lively, with credit cards holding the largest share now and prepaid cards rising quickly.

Read More @https://virtuemarketresearch.com/report/biometric-payment-card-market

Regional Analysis:

The Biometric Payment Card Market is expanding in many regions, with North America being the largest in this segment. Banks and financial institutions in the United States and Canada have been early adopters of biometric cards because security and convenience are very important to customers there. North America has advanced infrastructure that supports easy integration of fingerprint, facial, and iris recognition into payment systems. Meanwhile, Asia-Pacific is the fastest growing during the forecast period. Countries like India, China, and Australia are seeing more people using digital payments, and banks are issuing biometric cards to meet rising demand. Europe, South America, and the Middle East & Africa are also growing, but at a slower pace compared to Asia-Pacific. The combination of new technology adoption, increasing smartphone users, and expanding e-commerce in Asia-Pacific is driving this rapid growth. Regional differences show that while North America currently dominates, other regions are quickly catching up by introducing innovative biometric card solutions.

Latest Industry Developments:

• Strategic Partnerships to Accelerate Market Penetration: Companies in the biometric payment card market are increasingly forming strategic partnerships to enhance their market presence and accelerate adoption. For instance, collaborations between biometric card manufacturers and financial institutions enable the rapid deployment of biometric payment solutions across various regions. These partnerships facilitate the integration of biometric technologies into existing payment infrastructures, ensuring seamless user experiences and broad acceptance among consumers. By leveraging each other's strengths, such as technological expertise and extensive customer bases, these alliances help companies expand their reach and solidify their position in the competitive market landscape.

• Investment in Research and Development for Technological Advancements: To stay ahead in the rapidly evolving biometric payment card market, companies are heavily investing in research and development (R&D) to innovate and improve biometric authentication technologies. This focus on R&D leads to the development of more secure, efficient, and user-friendly biometric solutions, such as advanced fingerprint sensors and facial recognition systems. By continually enhancing the performance and reliability of biometric payment cards, companies aim to meet the growing consumer demand for secure and convenient payment methods. These technological advancements not only improve user satisfaction but also help companies differentiate their products in a crowded marketplace.

• Expansion into Emerging Markets to Capture New Customer Segments: Recognizing the untapped potential in emerging markets, companies are expanding their operations to regions with growing digital payment adoption. By introducing biometric payment cards in these markets, companies aim to provide secure and convenient payment solutions to a broader customer base. This expansion strategy involves tailoring products to meet local needs and preferences, ensuring cultural and regulatory compliance. Additionally, partnerships with local financial institutions and retailers facilitate the integration of biometric payment solutions into existing payment ecosystems, fostering trust and encouraging widespread adoption among consumers.

customize the Full Report Based on Your Requirements @https://virtuemarketresearch.com/report/biometric-payment-card-market/customization

CONTACT US :

Virtue Market Research

Kumar Plaza, #103, SRPF Rd, Ramtekadi, Pune, Maharashtra 411013, India

E-mail: megha@virtuemarketresearch.com

Phone: +1-917 436 1025

ABOUT US :

"Virtue Market Research stands at the forefront of strategic analysis, empowering businesses to navigate complex market landscapes with precision and confidence. Specializing in both syndicated and bespoke consulting services, we offer in-depth insights into the ever-evolving interplay between global demand and supply dynamics. Leveraging our expertise, businesses can identify emerging opportunities, discern critical trends, and make decisions that pave the way for future success."

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The Global Biometric Payment Card Market is projected to reach a market size of 9.36 billion by 2030. here

News-ID: 4298182 • Views: …

More Releases from Virtue Market Research

The Global Vodka Seltzer Market is projected to reach a market size of USD 16.22 …

The Vodka Seltzer Market was valued at USD 9.4 billion in 2024 and is projected to reach a market size of USD 16.21 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.1%.

Request Sample @ https://virtuemarketresearch.com/report/vodka-seltzer-market/request-sample

The vodka seltzer market has grown from a niche beverage choice into a mainstream favorite, supported by shifting consumer lifestyles and evolving…

The Global Telehealth Services Market and is projected to reach a market size of …

The Global Telehealth Services Market was valued at USD 126.1 billion and is projected to reach a market size of USD 302.49 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 15.7%.

Request Sample @ https://virtuemarketresearch.com/report/telehealth-services-market/request-sample

The perennial shift towards patient-centric healthcare has been a pivotal long-term market driver for telehealth services. Over the years, the industry has witnessed…

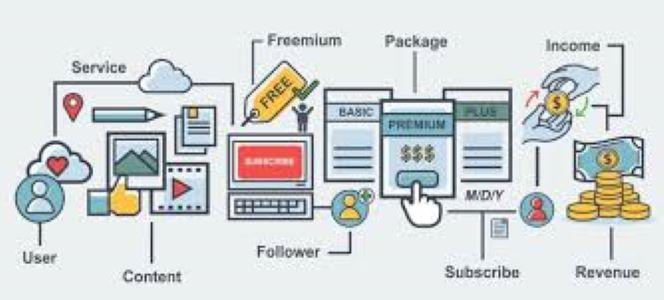

The Subscription Box/Subscription E-Commerce Market is projected to reach a mark …

The Subscription Box/Subscription E-Commerce Market is valued at USD 47.19 billion in 2024 and is projected to reach a market size of USD 97.73 billion by the end of 2030. Over the outlook period of 2025-2030, the market is anticipated to grow at a CAGR of 12.9%.

Request Sample @ https://virtuemarketresearch.com/report/subscription-e-commerce-market/request-sample

The subscription e-commerce market has grown into one of the most dynamic parts of the digital economy. It began as a…

The Global Aramid Fibre Reinforced Polymer Composites Market is projected to rea …

According to the report published by Virtue Market Research in Aramid Fibre Reinforced Polymer Composites Market was valued at USD 5.55 billion and is projected to reach a market size of USD 8.57 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.5%.

Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/aramid-fibre-reinforced-polymer-composites-market/request-sample

The Aramid Fibre Reinforced Polymer Composites…

More Releases for Card

Gift Card and Incentive Card Market Set for Explosive Growth | National Gift Car …

A new business intelligence report released by AMA with title "Gift Card and Incentive Card Market" has abilities to raise as the most significant market worldwide as it has remained playing a remarkable role in establishing progressive impacts on the universal economy. The Global Gift Card and Incentive Card Market Report offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through…

IC Card/Smart Card Market 2022 | Detailed Report

The IC Card/Smart Card research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the IC Card/Smart Card research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope, market overview, and driving force.

Download FREE Sample Report…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future.

A new report published by Allied Market Research, titled, Prepaid Card Market…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future

Prepaid Card Market is projected to grow at a CAGR of 22.7%…

Card Intelligent Lock Market Report 2018: Segmentation by Type (Magnetic card Lo …

Global Card Intelligent Lock market research report provides company profile for Tri-circle, Dessmann, Royalwand, Bangpai, ZKTeco, Schlage, KEYLOCK, Yale, Tenon, KAADAS, BE-TECH and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also…

Prepaid Card Market Report 2018: Segmentation by Card Type (Single-purpose prepa …

Global Prepaid Card market research report provides company profile for Green Dot Corporation, NetSpend Holdings, Inc., H&R Block Inc., American Express Company, JPMorgan Chase & Co., PayPal Holdings, Inc., BBVA Compass Bancshares, Inc. and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and…