Press release

Lithium Iron Phosphate (LFP) Batteries Market Soars at 12.5% CAGR | Asia-Pacific Dominates (45%) | Powered by CATL, BYD, Lithium Werks & Relion

The Global Lithium Iron Phosphate (LFP) Batteries Market was valued at USD 12.2 billion in 2022 and is projected to reach USD 31.3 billion by 2030, growing at a CAGR of 12.5 percent during the forecast period. Lithium iron phosphate batteries are increasingly adopted for their high thermal stability, long cycle life, safety advantages, and cost-effectiveness compared to other lithium-ion chemistries. These batteries are widely used across electric vehicles, energy storage systems, consumer electronics and industrial power applications, enabling reliable and efficient energy delivery.Market expansion is driven by the rapid acceleration of electric mobility, rising investments in renewable energy storage and growing demand for safer, longer-lasting battery solutions. Additional momentum comes from technological advancements in LFP cathode materials, declining battery production costs and the shift toward sustainable, cobalt-free battery chemistries. Asia-Pacific dominates the market, supported by strong EV manufacturing ecosystems, increasing domestic production of LFP cells and expanding exports by major Chinese and regional battery suppliers. Meanwhile, North America and Europe are witnessing rising adoption as automakers diversify chemistries and utilities expand large-scale energy storage deployments.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/lithium-iron-phosphate-batteries-market?sai-v

The Lithium Iron Phosphate (LFP) Batteries Market encompasses energy-storage technologies that utilize LFP chemistry to deliver safe, long-life, thermally stable battery solutions for electric vehicles, renewable energy systems and industrial applications.

Key Developments

United States

✅ October 2025: U.S. EV manufacturers expanded the adoption of next-generation LFP battery packs with improved thermal stability and longer cycle life to enhance safety and reduce total battery costs.

✅ August 2025: American energy storage developers deployed high-capacity LFP battery systems for grid-scale applications to support renewable energy integration and peak load management.

✅ May 2025: U.S.-based battery tech firms introduced cobalt-free LFP chemistries with higher energy density, targeting commercial vehicles and industrial equipment.

Japan

✅ September 2025: Japanese automakers integrated advanced LFP battery modules into hybrid and fully electric vehicle platforms to increase vehicle range and lower production costs.

✅ June 2025: Japan's stationary storage providers installed LFP-based BESS solutions for industrial power backup and renewable energy smoothing.

✅ March 2025: Japanese battery manufacturers launched fast-charging LFP cells optimized for e-two-wheelers and light EV applications.

Mergers & Acquisitions

United States

✅ July 2025: A leading U.S. battery technology company acquired a domestic LFP cathode materials startup to strengthen its supply chain and accelerate localized manufacturing.

Japan

✅ February 2025: A Japanese materials manufacturer partnered with a local automotive battery firm to co-develop high-performance LFP cathode formulations for EV applications.

✅ January 2025: A Japan-based battery systems provider formed a strategic alliance with a U.S. energy storage company to expand LFP-based grid and commercial storage solutions across Asia and North America.

Key Players

BYD | K2 Energy | Relion | A123 Systems | Pihsiang Energy Technology | Lithium Werks | Optimumnano Energy | Taico | Victron Energy | CATL

Key Highlights

• CATL - Holds 36% share of the global LFP battery market, supported by massive production capacity, cell-to-pack (CTP) innovations, and strong supply partnerships with leading EV manufacturers.

• BYD - Accounts for 24% share of the global LFP battery market, driven by its patented Blade Battery technology, high-volume EV production, and vertically integrated manufacturing ecosystem.

• A123 Systems - Estimated to contribute around 3-4% share, supported by its Nanophosphate® technology, strong demand in automotive, grid storage, and industrial high-power applications.

• Lithium Werks - Holds an estimated 2-3% share, recognized for its cobalt-free LFP chemistry and strong presence in industrial, robotics, and commercial energy storage markets.

• Relion - Represents approximately 1-2% share, known for lightweight LFP batteries widely used in renewable energy systems, marine applications, and off-grid power solutions.

• K2 Energy - Estimated to hold 1% share, driven by specialized LFP solutions for defense, medical equipment, and industrial-grade applications.

• Optimumnano Energy - Holds an estimated 2% share, supported by its role as a supplier of high-capacity LFP packs for electric vehicles and commercial fleet applications.

• Pihsiang Energy Technology - Represents about 1% share, driven by its strong presence in electric scooters, mobility devices, and light EV battery systems.

• Taico - Estimated to hold below 1% share, providing cost-effective LFP batteries mainly for consumer electronics, small-scale energy storage, and light EV applications.

• Victron Energy - Holds below 1% share, recognized for premium LFP solutions in renewable energy, off-grid systems, and integrated power management setups.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=lithium-iron-phosphate-batteries-market?sai-v

Market Drivers

- Rising demand for electric vehicles (EVs) due to their longer lifecycle, improved safety, and cost-efficient performance enabled by LFP chemistry.

- Increasing adoption of LFP batteries in energy storage systems (ESS) for grid stabilization, renewable integration, and backup power applications.

- Growing preference for LFP over NMC/NCA batteries due to enhanced thermal stability, lower fire risk, and longer charge cycles.

- Expansion of solar-plus-storage installations driving demand for durable and safe battery technologies.

- Rising investments in gigafactories and localized battery production to reduce supply chain dependency and lower costs.

- Increasing use of LFP batteries in consumer electronics, power tools, and industrial equipment due to improved energy density and affordability.

- Technological advancements improving LFP battery efficiency, charging speed, and overall performance, boosting market competitiveness.

Industry Developments

- Launch of next-generation LFP battery chemistries offering higher energy density and enhanced fast-charging capabilities.

- Major EV manufacturers shifting from NMC/NCA to LFP batteries for entry-level and mid-range electric vehicles.

- Rapid expansion of battery gigafactories across China, Europe, and the U.S. with increased production capacity for LFP cells.

- Integration of LFP batteries in grid-scale energy storage projects to support renewable energy deployment.

- Strategic partnerships between battery manufacturers and automotive OEMs to secure long-term LFP supply agreements.

- Growing investment in lithium refinement and phosphate processing facilities to strengthen upstream supply chains.

- Emergence of advanced battery recycling technologies to recover lithium, iron, and phosphate from spent LFP batteries.

Regional Insights

North America - 22% driven by "growing EV adoption, government incentives for clean energy storage, and expansion of domestic LFP manufacturing capacity."

Europe - 27% supported by "increasing deployment of renewable energy storage, strong EV penetration, and rising investments in localized LFP gigafactories."

Asia Pacific - 45% fueled by "China's dominant battery manufacturing ecosystem, high EV production, and large-scale deployment of grid energy storage systems."

Latin America - 4% driven by "growing investments in solar-plus-storage projects, rising demand for electric buses, and increasing grid modernization efforts."

Middle East & Africa - 2% supported by "expansion of renewable energy programs, adoption of utility-scale storage projects, and growing interest in safe and durable battery chemistries."

Key Segments

➥ By Type

Portable LFP batteries are lightweight, compact, and designed for mobile applications such as consumer electronics, portable energy storage systems, and lightweight EVs, providing high safety, long cycle life, and fast charging capability.

Stationary LFP batteries are used in fixed installations like solar energy storage, grid stabilization systems, and industrial backup power, offering excellent thermal stability, durability, and cost-efficient long-duration energy storage.

➥ By Capacity

0-16,250 mAh batteries are commonly used in small electronics, handheld devices, and compact backup systems, offering reliable performance, fast recharge cycles, and safety for low-power applications.

16,251-50,000 mAh batteries power medium-sized devices and portable energy storage systems, striking a balance between energy density, mobility, and extended runtime requirements.

50,001-100,000 mAh batteries support larger portable power stations, industrial tools, drones, and backup units, providing robust capacity, long cycle durability, and enhanced thermal safety.

100,001-540,000 mAh batteries are suited for large-scale energy storage, EVs, industrial machinery, and off-grid systems, delivering high endurance, stable discharge rates, and long operational life for heavy-duty applications.

➥ By Application

Automotive leverages LFP batteries for electric vehicles, electric buses, and hybrid systems due to their long life cycles, stability, and cost-effectiveness, making them ideal for mass-market EV adoption.

Power applications include solar energy systems, home energy storage units, microgrids, and utility-scale storage, where LFP batteries deliver high thermal stability, deep discharge capability, and low maintenance needs.

Industrial sectors use LFP batteries for robotics, material-handling equipment, forklifts, telecom towers, and backup systems, benefiting from their durability, safety profile, and efficiency under rigorous operations.

Others include marine, defense, aerospace support equipment, and consumer electronics, where LFP batteries provide a safer, longer-lasting, and environmentally friendly energy solution.

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/lithium-iron-phosphate-batteries-market?sai-v

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Lithium Iron Phosphate (LFP) Batteries Market Soars at 12.5% CAGR | Asia-Pacific Dominates (45%) | Powered by CATL, BYD, Lithium Werks & Relion here

News-ID: 4295938 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

U.S. Alzheimer Drugs Market Set for Explosive Growth to USD 8.84 Billion by 2031 …

Leander Texas -

The Alzheimer Drugs Market reached US$ 4.46 billion in 2023 and is expected to reach US$ 18.33 billion by 2031, growing at a CAGR of 19.4% during the forecast period 2024-2031.

The Alzheimer's drugs market growth is driven by key US-Japan collaborations and approvals, including the JCR Pharma-Acumen Pharmaceuticals partnership to develop a novel blood-brain barrier Alzheimer therapy and expanded use of Eisai/Biogen's lecanemab with new subcutaneous application and…

Micro Nuclear Reactors (MNRs) Market to Reach US$ 4,865.85 Million by 2032 at 18 …

The Micro Nuclear Reactors (MNRs) Market reached US$ 1,434.55 million in 2024 and is projected to reach US$ 4,865.85 million by 2032, growing at a CAGR of 18.26 percent during the forecast period 2025 to 2032.

Market growth is driven by increasing demand for reliable, low-carbon energy solutions, supportive government policies promoting clean power generation, and the need for decentralized power in remote and industrial applications. Micro nuclear reactors offer scalable,…

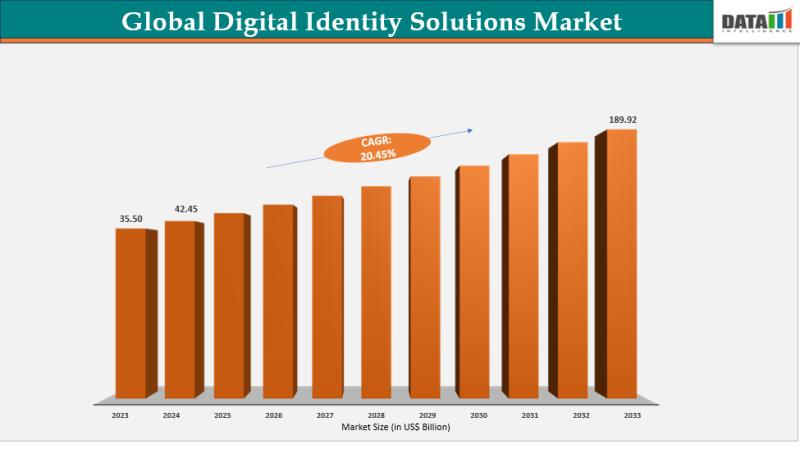

Digital Identity Solutions Market Set for Explosive Growth to US$189.92 Billion …

The Global Digital Identity Solutions Market reached US$35.50 billion in 2023, with a rise to US$42.45 billion in 2024, and is expected to reach US$189.92 billion by 2033, growing at a CAGR of 20.45% during the forecast period 2025-2033.

Market growth is driven by escalating cybersecurity threats, surging demand for secure authentication in remote work and e-commerce, and widespread adoption of biometric and blockchain-based verification. Advancements in AI-powered fraud detection, expanding…

Iron Ore Mining Market Set for Strong Growth to USD 620.7 Billion by 2031, Led b …

Leander Texas -

Iron Ore Mining Market reached US$ 330.2 billion in 2022 and is expected to reach US$ 620.7 billion by 2031, growing with a CAGR of 8.2% during the forecast period 2024-2031.

The Iron Ore Mining Market's strong growth is boosted by rising infrastructure and steel demand in the U.S. and Japan, coupled with strategic developments like Japanese firms acquiring stakes in global iron ore assets and collaborations with U.S.…

More Releases for LFP

LFP Battery Market Size, Share, Trends, and Forecast: 2024-2030

QY Research Inc. (Global Market Report Research Publisher) announces the release of 2024 latest report "LFP Battery- Global Market Share and Ranking, Overall Sales and Demand Forecast 2024-2030". Based on current situation and impact historical analysis (2019-2023) and forecast calculations (2024-2030), this report provides a comprehensive analysis of the global Wire Drawing Dies market, including market size, share, demand, industry development status, and forecasts for the next few years.

The lithium iron phosphate battery…

LFP Solar Battery Market to Witness Exponential Growth by 2032

In 2024, the WiseGuy Reports latest published research report on "Lfp Solar Battery market growth is growing steadily with exponential rate and a rising adoption of strategies by top industry players, over the projected horizon 2024 to 2032". The high adoption of advanced technology and the presence of large players in this region are likely to create ample growth opportunities for the Lfp Solar Battery market. Technological innovation and advancement…

How to Choose a Lithium Iron Phosphate (LFP) Battery Pack

Lithium Iron Phosphate (LFP) [https://www.kelannrg.com/] batteries are the preferred choice for RV, marine or home energy storage systems due to their high safety, long life, and cost-effectiveness. However, the quality of LFP battery packs on the market varies greatly, and selecting a reliable battery pack is crucial for ensuring performance and safety. Here are some key factors to help you make an informed decision.

1. Safety Certifications: UL and CE

When selecting…

LFP Battery Market Size 2024 to 2031.

Market Overview and Report Coverage

The LFP Battery Market refers to the market for lithium iron phosphate batteries, a type of rechargeable battery known for its long cycle life, enhanced safety features, and stable performance. These batteries are widely used in electric vehicles, energy storage systems, and consumer electronics due to their superior characteristics.

The current outlook for the LFP Battery Market is optimistic, with a projected CAGR of 9.89%…

Global LFP Battery Market Research Report 2022(Status and Outlook)

The global LFP battery market size is projected to reach US$ 61.91 Billion by 2028, from US$ 15.36 Billion in 2021, at a CAGR of 54.68% during 2022-2028.- Bossonresearch.com

The lithium iron phosphate battery (LiFePO4 battery) or LFP battery (lithium ferrophosphate) is a type of lithium-ion battery using lithium iron phosphate (LiFePO4) as the cathode material and a graphitic carbon electrode with a metallic backing as the anode. Because of their…

LFP Battery Market Analysis Growth Factors and Competitive

lithium battery market size was valued at USD 10.45 billion in 2021 and is foreseen to surpass around USD 52.7 billion by 2030, poised to grow at a compound annual growth rate (CAGR) of 19.7% during the forecast period 2022 to 2030.

In order to reduce operating costs and increase output, lithium-iron-phosphate battery manufacturers are now focusing mostly on organisational improvement to certain criteria and technical advancement. Such devices have…